5 Documents Needed

Introduction to Essential Documents

When it comes to legal, financial, and personal matters, having the right documents in place is crucial. These documents not only provide a sense of security but also ensure that your wishes are respected and your loved ones are protected. In this article, we will explore five essential documents that everyone should have, highlighting their importance and the role they play in our lives.

1. Last Will and Testament

A Last Will and Testament is a document that outlines how you want your assets to be distributed after your death. It allows you to decide who will inherit your property, belongings, and other possessions. Having a will in place ensures that your wishes are carried out and can help avoid disputes among family members. It’s also an opportunity to name an executor, who will be responsible for managing your estate according to your instructions.

2. Power of Attorney

A Power of Attorney (POA) is a document that grants someone you trust the authority to make decisions on your behalf. This can include financial, medical, or personal decisions, depending on the type of POA you have. There are different types of POAs, such as: - Durable Power of Attorney: Remains in effect even if you become incapacitated. - Non-Durable Power of Attorney: Ends if you become incapacitated. - Springing Power of Attorney: Takes effect only if you become incapacitated.

3. Advance Directive

An Advance Directive is a document that outlines your wishes for medical treatment if you become unable to communicate. It includes a Living Will, which specifies the type of care you want to receive, and a Healthcare Proxy, which appoints someone to make medical decisions on your behalf. Having an Advance Directive in place ensures that your healthcare wishes are respected and can help reduce the burden on your loved ones.

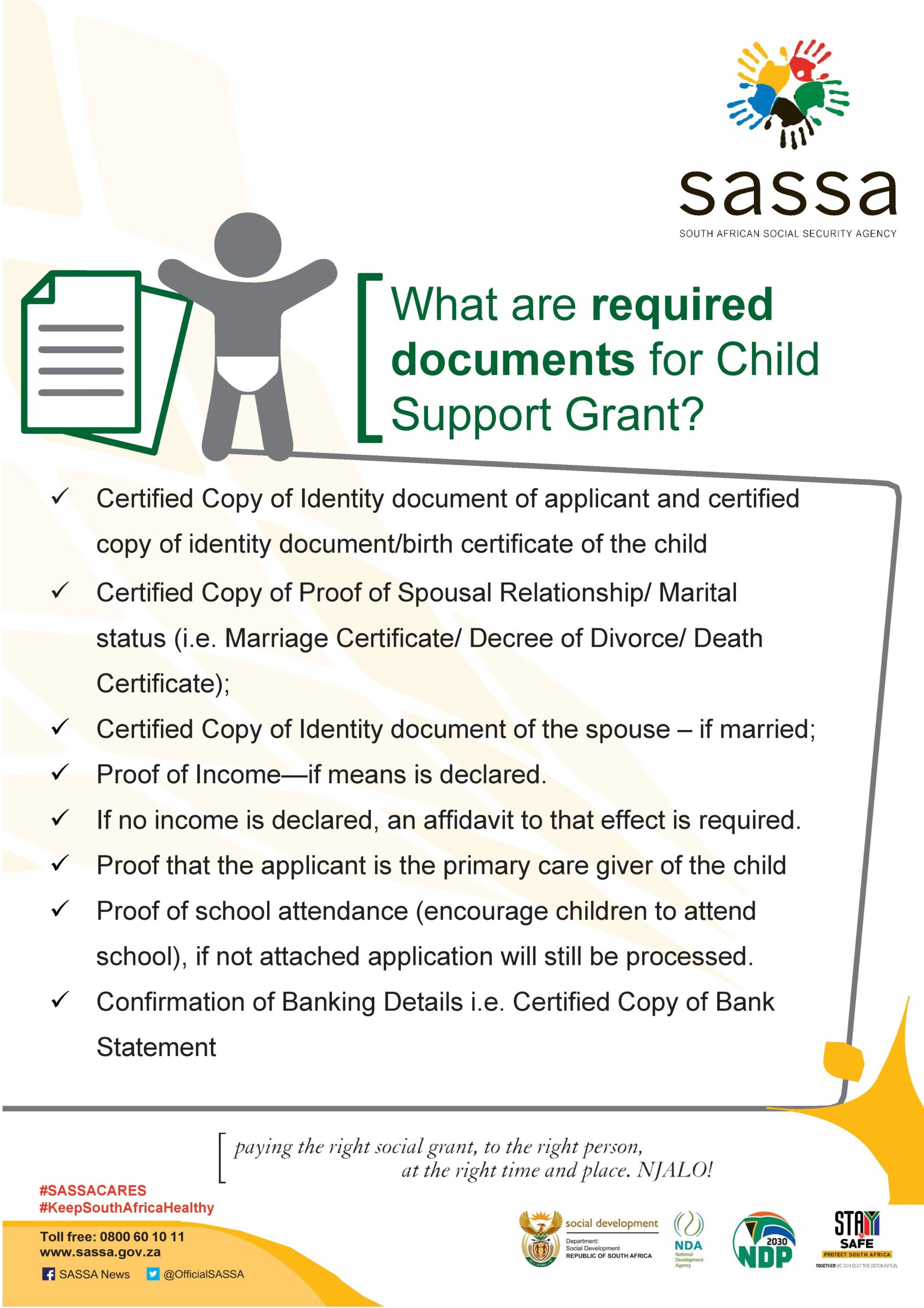

4. Insurance Policies

Insurance Policies provide financial protection against unexpected events, such as illness, injury, or death. Common types of insurance policies include: - Life Insurance: Provides a death benefit to your beneficiaries. - Health Insurance: Covers medical expenses. - Disability Insurance: Replaces income if you become unable to work.

5. Trust

A Trust is a document that allows you to transfer assets to a separate entity, which is managed by a trustee for the benefit of your beneficiaries. Trusts can be used to: - Avoid Probate: Bypass the court process of distributing assets after death. - Minimize Taxes: Reduce tax liabilities for your beneficiaries. - Protect Assets: Safeguard assets from creditors or lawsuits.

💡 Note: It's essential to review and update these documents regularly to ensure they reflect your current wishes and circumstances.

To further illustrate the importance of these documents, consider the following benefits: - Peace of Mind: Knowing that your affairs are in order can provide peace of mind and reduce stress. - Financial Security: Having the right documents in place can help protect your assets and ensure financial security for your loved ones. - Control and Autonomy: These documents allow you to maintain control over your life and make decisions about your care and assets.

| Document | Purpose |

|---|---|

| Last Will and Testament | Outlines asset distribution after death |

| Power of Attorney | Grants decision-making authority to someone |

| Advance Directive | Specifies medical treatment wishes |

| Insurance Policies | Provides financial protection against unexpected events |

| Trust | Transfers assets to a separate entity for beneficiary benefit |

In summary, having the right documents in place is essential for ensuring that your wishes are respected, your loved ones are protected, and your assets are secure. By understanding the importance of these five documents, you can take the first step towards creating a comprehensive estate plan that provides peace of mind and financial security.

What is the purpose of a Last Will and Testament?

+

A Last Will and Testament outlines how you want your assets to be distributed after your death, allowing you to decide who will inherit your property and belongings.

What is the difference between a Durable and Non-Durable Power of Attorney?

+

A Durable Power of Attorney remains in effect even if you become incapacitated, while a Non-Durable Power of Attorney ends if you become incapacitated.

Why is it important to have an Advance Directive?

+

An Advance Directive outlines your wishes for medical treatment if you become unable to communicate, ensuring that your healthcare wishes are respected and reducing the burden on your loved ones.