Paperwork

Tax Paperwork Needed

Understanding the Tax Paperwork Requirements

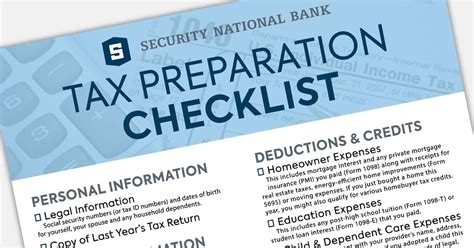

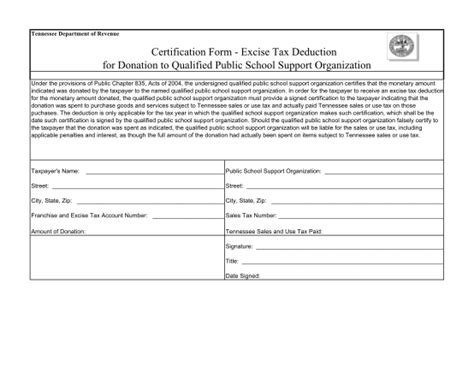

When it comes to managing your finances, one of the most critical aspects is handling tax paperwork. The process can be overwhelming, especially for those who are new to filing taxes or have complex financial situations. Tax paperwork is essential for individuals and businesses to report their income, claim deductions, and pay the appropriate amount of taxes. In this article, we will delve into the world of tax paperwork, exploring the necessary documents, forms, and requirements for a smooth tax filing experience.

Individual Taxpayers

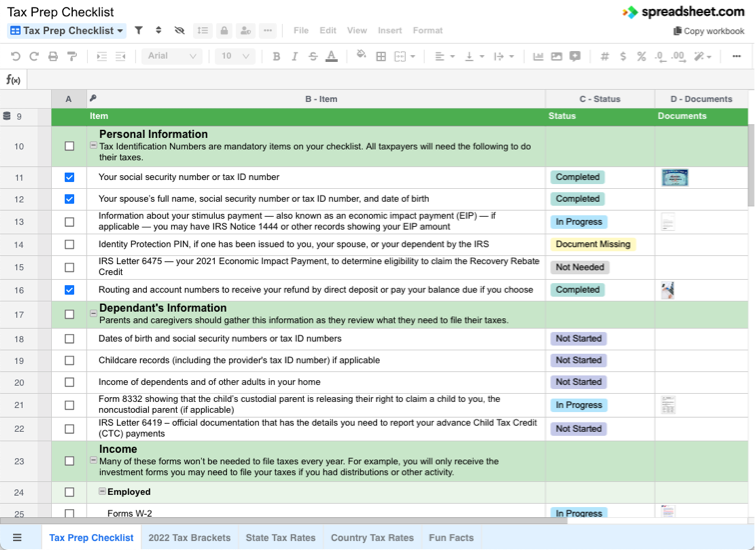

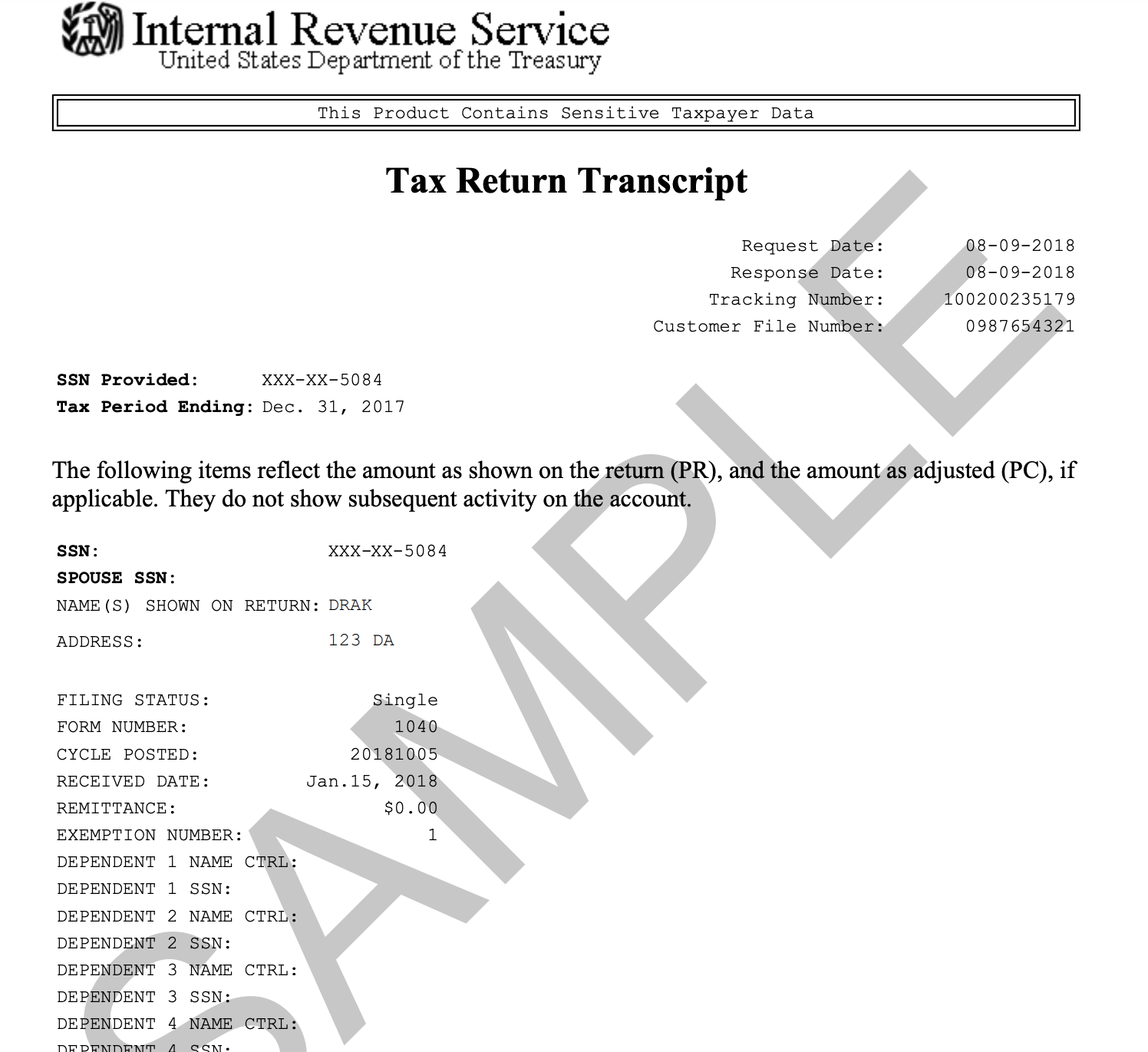

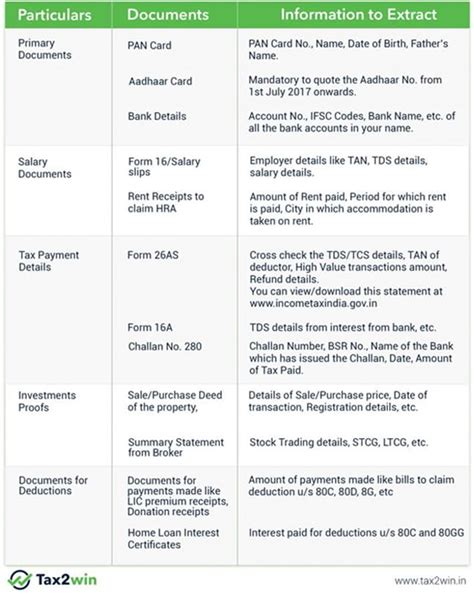

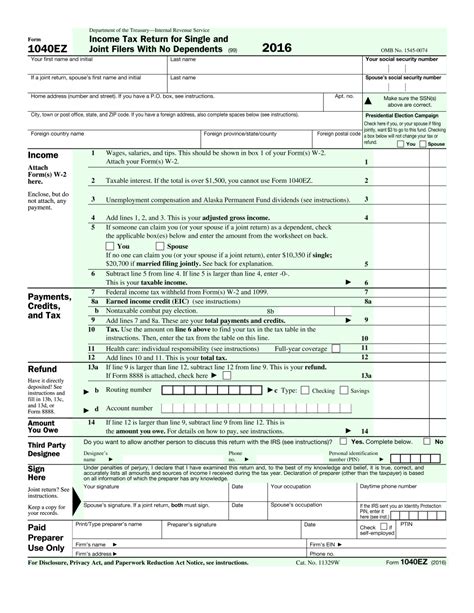

For individual taxpayers, the tax paperwork process begins with gathering the necessary documents. These typically include: * W-2 forms from employers, which show the income earned and taxes withheld * 1099 forms for freelance work, investments, or other sources of income * Interest statements from banks and investment accounts * Charitable donation receipts * Medical expense records * Mortgage interest statements Having these documents ready will make it easier to fill out tax forms and ensure accuracy in reporting income and claiming deductions.

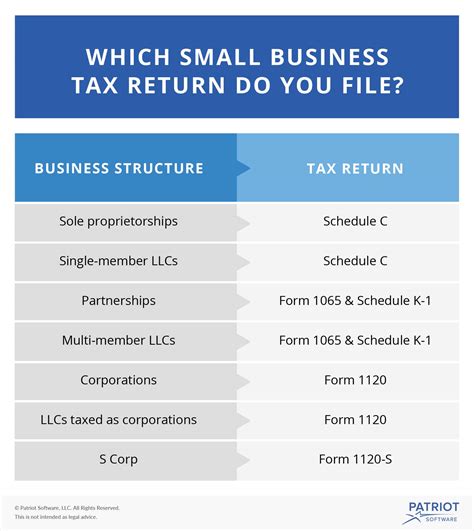

Business Taxpayers

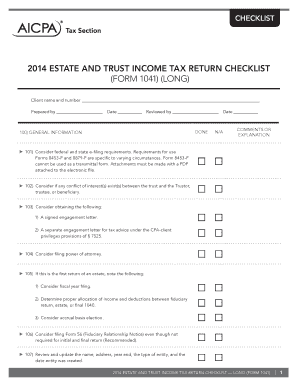

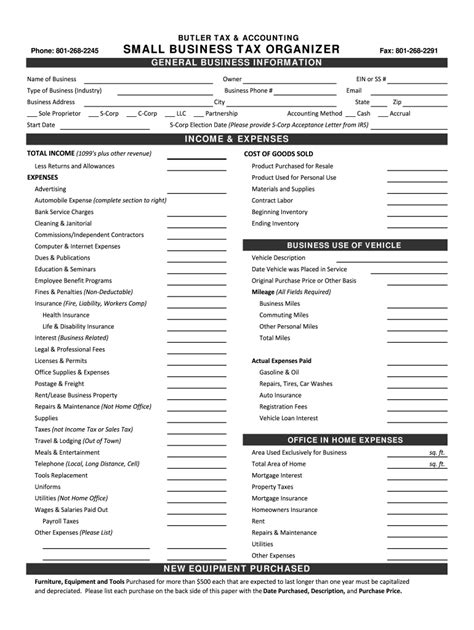

Businesses have additional tax paperwork requirements. These include: * Form 1120 for corporations, which reports the business’s income, deductions, and tax liability * Form 1120S for S corporations, which passes the business’s income, deductions, and tax liability through to shareholders * Form 1065 for partnerships, which reports the business’s income, deductions, and tax liability and allocates these items to partners * Schedule C for sole proprietorships, which reports the business’s income and expenses Businesses must also keep detailed records of income, expenses, and payroll to support their tax filings.

Tax Forms and Schedules

The IRS provides various tax forms and schedules to help individuals and businesses report their income and claim deductions. Some of the most common forms include: * Form 1040, the standard form for personal income tax returns * Schedule A, for itemizing deductions * Schedule B, for reporting interest and dividend income * Schedule C, for business income and expenses * Schedule D, for capital gains and losses Understanding which forms and schedules to use can be challenging, but the IRS website and tax professionals can provide guidance.

Digital Tax Filing

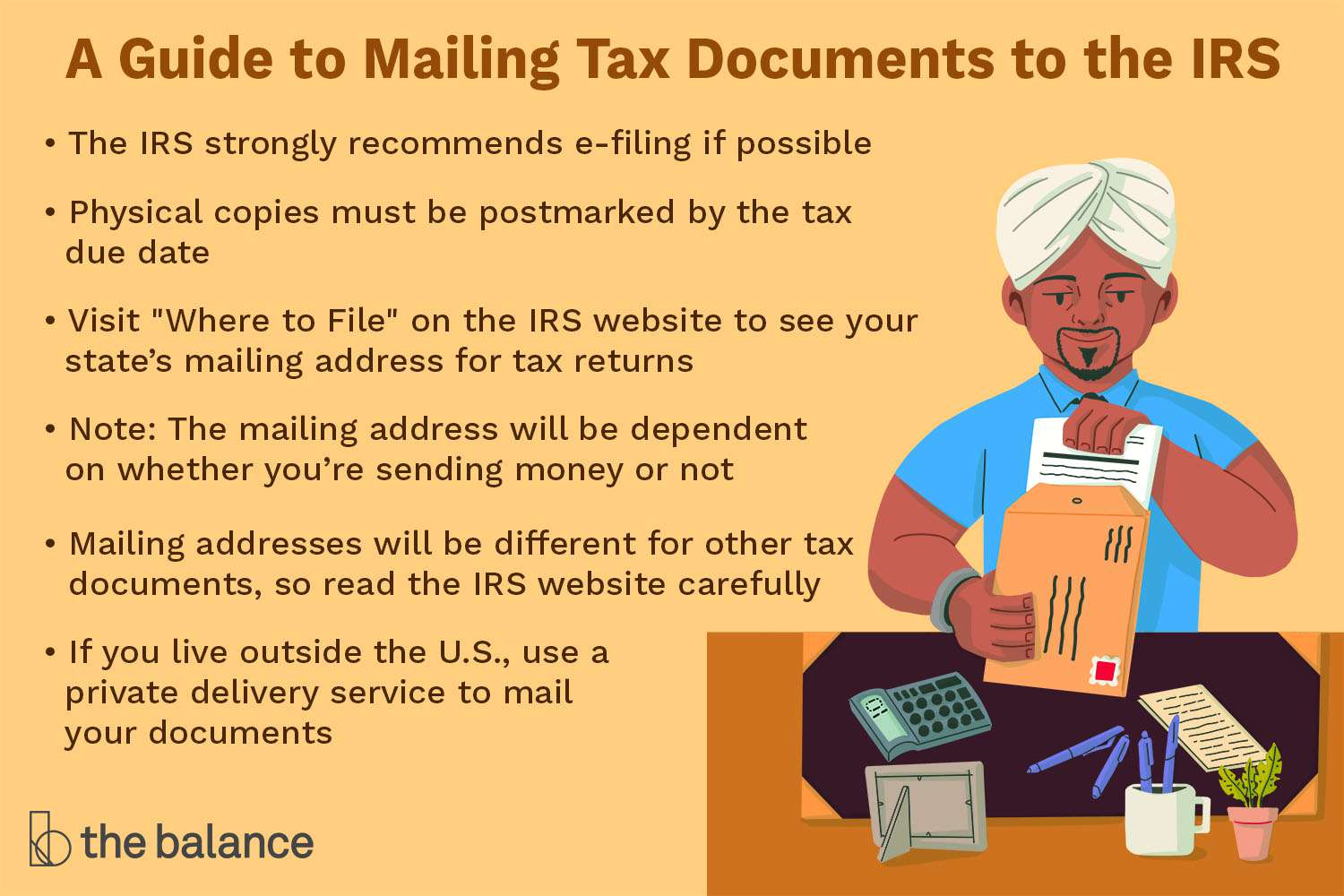

In recent years, digital tax filing has become increasingly popular. Electronic filing offers several benefits, including: * Faster refund processing * Reduced errors * Increased security * Environmentally friendly Taxpayers can use tax software or work with a tax professional to file their taxes electronically.

| Form | Purpose |

|---|---|

| Form 1040 | Personal income tax return |

| Schedule A | Itemized deductions |

| Schedule B | Interest and dividend income |

| Schedule C | Business income and expenses |

| Schedule D | Capital gains and losses |

💡 Note: It's essential to keep accurate and detailed records of income, expenses, and tax-related documents to ensure a smooth tax filing experience.

Tax Paperwork Deadlines

Taxpayers must be aware of the deadlines for filing their tax returns. The standard deadline for personal income tax returns is April 15th, while businesses may have different deadlines depending on their entity type. Extensions can be requested, but taxpayers must still pay any estimated tax liability by the original deadline to avoid penalties.

Conclusion and Final Thoughts

In conclusion, tax paperwork is a critical aspect of managing one’s finances. By understanding the necessary documents, forms, and deadlines, individuals and businesses can ensure a smooth tax filing experience. It’s essential to stay organized, keep accurate records, and seek professional help when needed. Remember, tax compliance is crucial for avoiding penalties and ensuring the integrity of the tax system.

What is the deadline for filing personal income tax returns?

+

The standard deadline for filing personal income tax returns is April 15th.

What are the benefits of digital tax filing?

+

Digital tax filing offers faster refund processing, reduced errors, increased security, and is environmentally friendly.

What forms do businesses need to file for tax purposes?

+

Businesses may need to file Form 1120, Form 1120S, Form 1065, or Schedule C, depending on their entity type and tax situation.