CA4 Paperwork Requirements

Introduction to CA4 Paperwork Requirements

The CA4 paperwork requirements are a set of documents and forms that must be completed and submitted to the relevant authorities in order to comply with customs regulations. These requirements can vary depending on the country, type of goods being imported or exported, and the mode of transport. In this article, we will explore the different types of CA4 paperwork requirements, their purposes, and the steps involved in completing and submitting them.

Types of CA4 Paperwork Requirements

There are several types of CA4 paperwork requirements, including:

- Commercial Invoice: A document that provides detailed information about the goods being imported or exported, including their value, quantity, and description.

- Bill of Lading: A document that serves as a receipt for the goods being transported and provides information about the shipment, including the shipper, consignee, and route.

- Customs Declaration Form: A document that provides detailed information about the goods being imported or exported, including their classification, value, and quantity.

- Certificate of Origin: A document that certifies the country of origin of the goods being imported or exported.

Purpose of CA4 Paperwork Requirements

The purpose of CA4 paperwork requirements is to ensure that all imports and exports comply with customs regulations and laws. These requirements help to:

- Prevent smuggling and illegal trade: By requiring detailed information about the goods being imported or exported, customs authorities can detect and prevent smuggling and illegal trade.

- Collect revenue: CA4 paperwork requirements help customs authorities to collect revenue from duties and taxes on imported goods.

- Protect public health and safety: By requiring information about the goods being imported or exported, customs authorities can ensure that they comply with health and safety standards.

Steps Involved in Completing and Submitting CA4 Paperwork Requirements

The steps involved in completing and submitting CA4 paperwork requirements are:

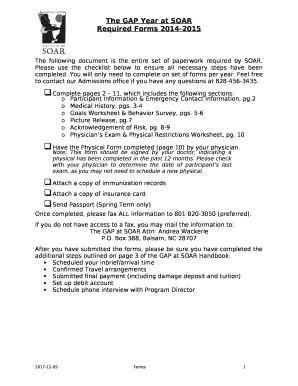

- Obtain the necessary forms and documents: The importer or exporter must obtain the necessary forms and documents, such as the commercial invoice, bill of lading, and customs declaration form.

- Complete the forms and documents: The importer or exporter must complete the forms and documents accurately and in detail, providing all the required information.

- Submit the forms and documents: The completed forms and documents must be submitted to the relevant customs authorities, either electronically or in person.

- Pay any duties or taxes: The importer or exporter must pay any duties or taxes due on the imported goods.

📝 Note: It is essential to ensure that all CA4 paperwork requirements are completed accurately and submitted on time to avoid delays and penalties.

Common Challenges and Solutions

Some common challenges faced by importers and exporters when completing CA4 paperwork requirements include:

- Lack of understanding of customs regulations: Importers and exporters may not be familiar with customs regulations and requirements, leading to errors and delays.

- Inaccurate or incomplete documentation: Inaccurate or incomplete documentation can lead to delays and penalties.

- Delays in submitting documentation: Delays in submitting documentation can lead to delays in the clearance of goods.

- Seek professional advice: Seek advice from customs brokers or freight forwarders who are familiar with customs regulations and requirements.

- Use technology: Use technology, such as automated customs clearance systems, to streamline the documentation process and reduce errors.

- Plan ahead: Plan ahead and allow sufficient time for the completion and submission of CA4 paperwork requirements.

Best Practices for Completing CA4 Paperwork Requirements

Some best practices for completing CA4 paperwork requirements include:

- Ensure accuracy and completeness: Ensure that all documentation is accurate and complete, providing all the required information.

- Use standard formats: Use standard formats for documentation, such as the commercial invoice and customs declaration form.

- Keep records: Keep records of all documentation, including copies of submitted forms and documents.

| Document | Purpose | Requirements |

|---|---|---|

| Commercial Invoice | Provides detailed information about the goods being imported or exported | Must include the value, quantity, and description of the goods |

| Bill of Lading | Serves as a receipt for the goods being transported | Must include the shipper, consignee, and route |

| Customs Declaration Form | Provides detailed information about the goods being imported or exported | Must include the classification, value, and quantity of the goods |

In summary, CA4 paperwork requirements are an essential part of the import and export process, ensuring that all goods comply with customs regulations and laws. By understanding the different types of CA4 paperwork requirements, their purposes, and the steps involved in completing and submitting them, importers and exporters can ensure that their goods are cleared quickly and efficiently. It is also essential to follow best practices, such as ensuring accuracy and completeness, using standard formats, and keeping records, to avoid delays and penalties.

What is the purpose of CA4 paperwork requirements?

+

The purpose of CA4 paperwork requirements is to ensure that all imports and exports comply with customs regulations and laws, preventing smuggling and illegal trade, collecting revenue, and protecting public health and safety.

What are the common challenges faced by importers and exporters when completing CA4 paperwork requirements?

+

Common challenges faced by importers and exporters include lack of understanding of customs regulations, inaccurate or incomplete documentation, and delays in submitting documentation.

How can importers and exporters overcome these challenges?

+

Importers and exporters can overcome these challenges by seeking professional advice, using technology, and planning ahead, ensuring that all documentation is accurate and complete, and keeping records of all submitted forms and documents.