5 Steps Refinance

Introduction to Refinancing

Refinancing a mortgage can be a great way to save money on interest, lower monthly payments, or tap into home equity. With interest rates at historic lows, many homeowners are considering refinancing their mortgages. However, the process can be complex and overwhelming, especially for those who are new to refinancing. In this article, we will break down the 5 steps to refinance a mortgage, providing a clear and concise guide to help homeowners navigate the process.

Step 1: Check Your Credit Score

Before starting the refinancing process, it’s essential to check your credit score. Your credit score plays a significant role in determining the interest rate you’ll qualify for and whether you’ll be approved for a refinance. A good credit score can help you qualify for better interest rates, which can save you thousands of dollars over the life of the loan. You can check your credit score for free on various websites, such as Credit Karma or Credit Sesame. If your credit score is low, you may want to consider improving your credit before applying for a refinance.

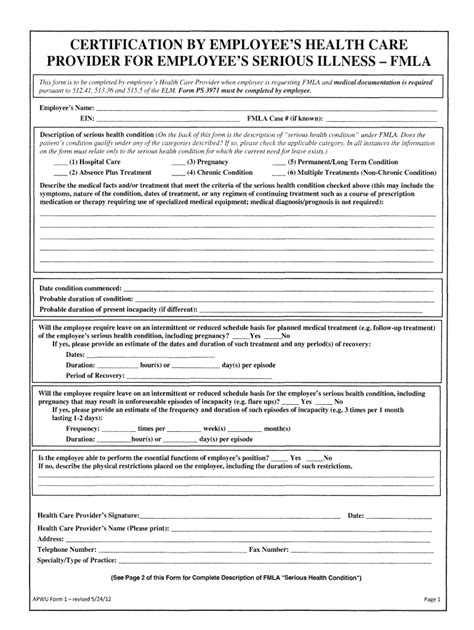

Step 2: Gather Financial Documents

To apply for a refinance, you’ll need to gather various financial documents, including: * Pay stubs * Bank statements * Tax returns * Identification documents * Mortgage statements It’s essential to have all the necessary documents ready to ensure a smooth and efficient process. You may also want to consider organizing your documents digitally to make it easier to access and share them with your lender.

Step 3: Choose a Refinance Option

There are several refinance options available, including: * Rate-and-term refinance: This involves refinancing your existing mortgage with a new loan that has a lower interest rate or more favorable terms. * Cash-out refinance: This involves refinancing your existing mortgage and taking out a new loan that is larger than the existing mortgage, allowing you to tap into your home equity. * Streamline refinance: This involves refinancing an existing government-backed mortgage, such as an FHA or VA loan, with a new loan that has a lower interest rate. It’s crucial to choose the right refinance option for your situation, considering factors such as interest rates, closing costs, and loan terms.

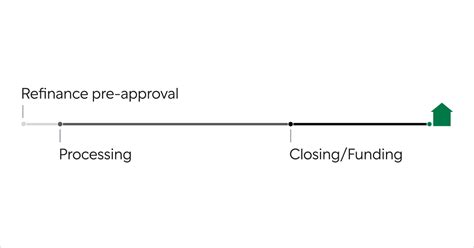

Step 4: Apply for a Refinance

Once you’ve chosen a refinance option, it’s time to apply for a refinance. You can apply through a lender or a mortgage broker. Be prepared to provide all the necessary financial documents and information about your property. The lender will review your application and order an appraisal to determine the value of your property. If your application is approved, you’ll receive a loan estimate that outlines the terms of the loan, including the interest rate, loan amount, and closing costs.

Step 5: Close the Refinance

The final step in the refinancing process is closing the refinance. This involves reviewing and signing the loan documents, which can be done in person or electronically. It’s essential to carefully review the documents to ensure that everything is accurate and complete. After signing the documents, the lender will disburse the funds, and you’ll start making payments on your new loan.

📝 Note: It's essential to carefully review the loan documents and ask questions if you're unsure about anything.

After completing these 5 steps, you’ll have successfully refinanced your mortgage. Refinancing can be a great way to save money, lower monthly payments, or tap into home equity. By following these steps and doing your research, you can make an informed decision and choose the best refinance option for your situation.

In the end, refinancing a mortgage can be a complex process, but by breaking it down into smaller steps, you can make it more manageable. Remember to carefully consider your options, choose the right lender, and review the loan documents carefully to ensure a smooth and successful refinance.

What are the benefits of refinancing a mortgage?

+

The benefits of refinancing a mortgage include saving money on interest, lowering monthly payments, and tapping into home equity.

What is the difference between a rate-and-term refinance and a cash-out refinance?

+

A rate-and-term refinance involves refinancing an existing mortgage with a new loan that has a lower interest rate or more favorable terms, while a cash-out refinance involves refinancing an existing mortgage and taking out a new loan that is larger than the existing mortgage, allowing you to tap into your home equity.

How long does the refinancing process typically take?

+

The refinancing process typically takes 30-60 days, but it can vary depending on the lender and the complexity of the loan.