Contractor Paperwork Requirements

Introduction to Contractor Paperwork Requirements

As a contractor, navigating the complex world of paperwork requirements can be overwhelming. From licenses and permits to insurance and contracts, understanding what is needed to operate legally and efficiently is crucial. This guide will walk through the essential paperwork requirements for contractors, highlighting key documents, and providing insights into how to manage them effectively.

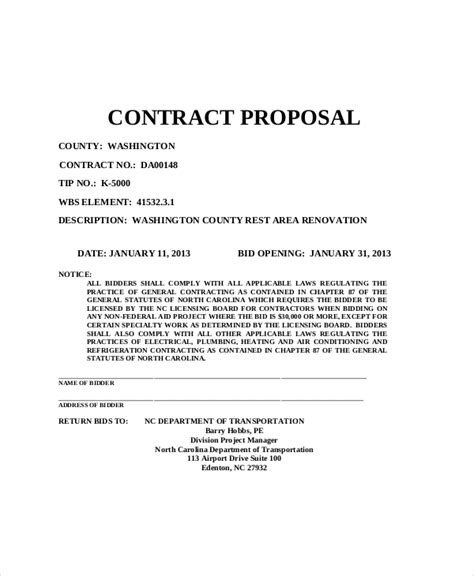

Licenses and Permits

Before starting any project, contractors must ensure they have the necessary licenses and permits. These vary by state and locality but typically include: - Business License: Required for operating a business in a specific state or locality. - Contractor’s License: Mandatory for contractors to work on projects, ensuring they have the requisite skills and knowledge. - Permits: Needed for specific types of work, such as electrical, plumbing, or construction projects.

📝 Note: The specific licenses and permits required can depend greatly on the nature of the work and the location, so it's essential to check with local authorities.

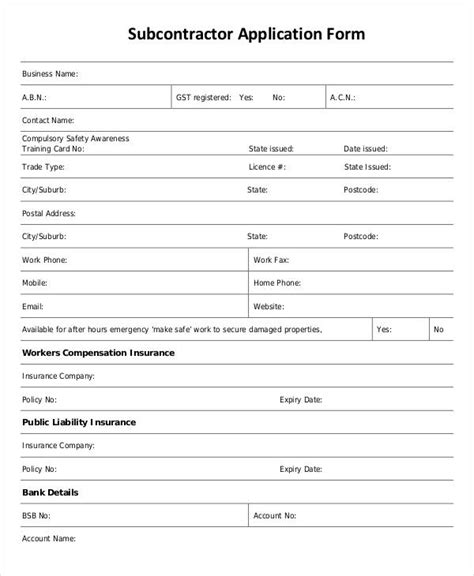

Insurance Requirements

Insurance is a critical aspect of contractor paperwork, protecting both the contractor and the client in case of accidents or work dissatisfaction. Key insurance types include: - Liability Insurance: Covers damages or injuries caused during the work. - Workers’ Compensation Insurance: Mandatory in most states for contractors with employees, covering work-related injuries. - Property Damage Insurance: Protects against damages to the client’s property.

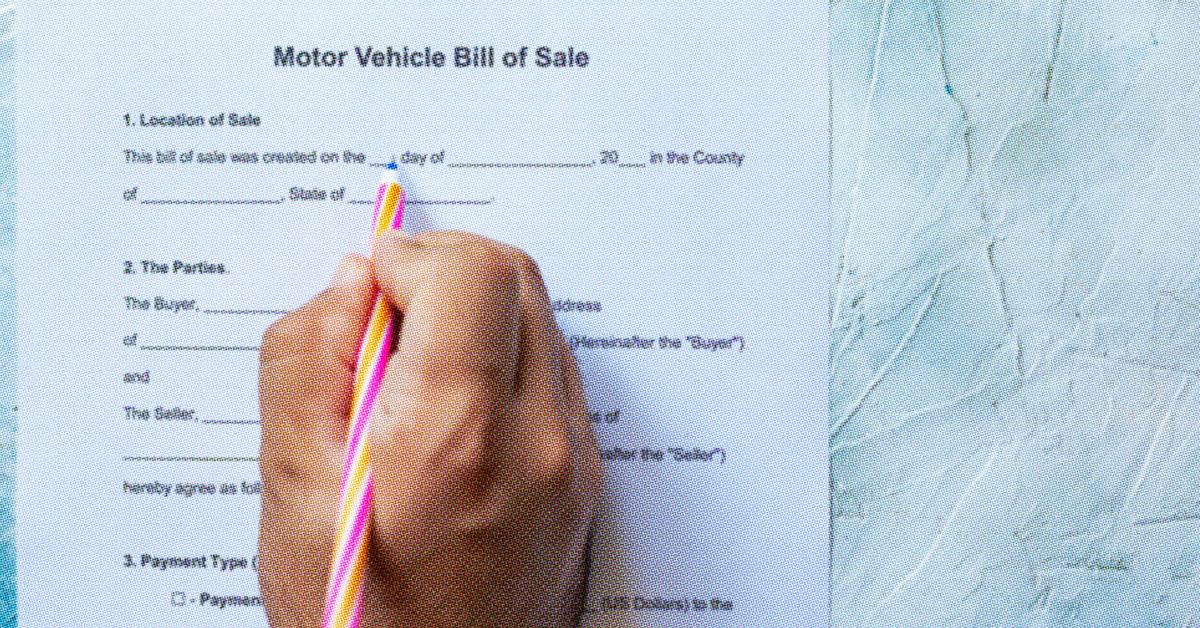

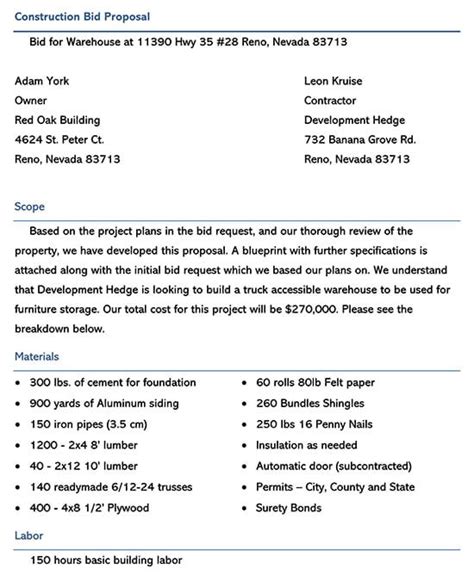

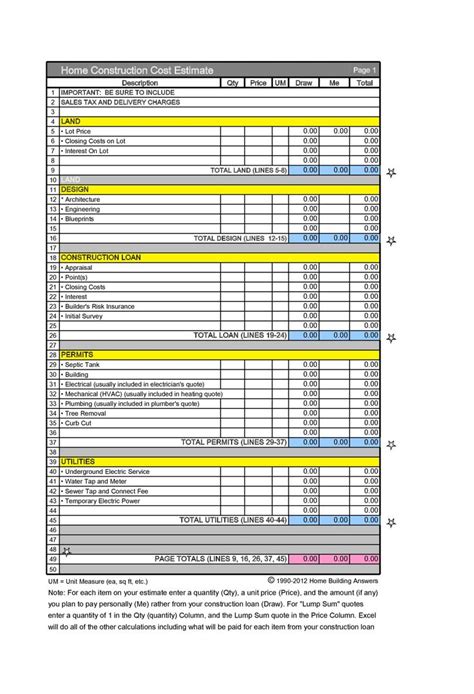

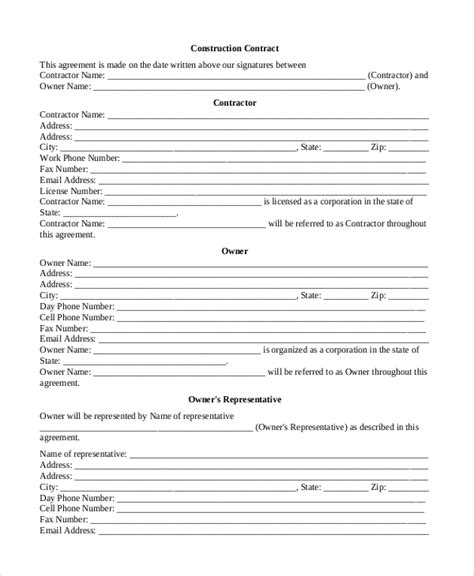

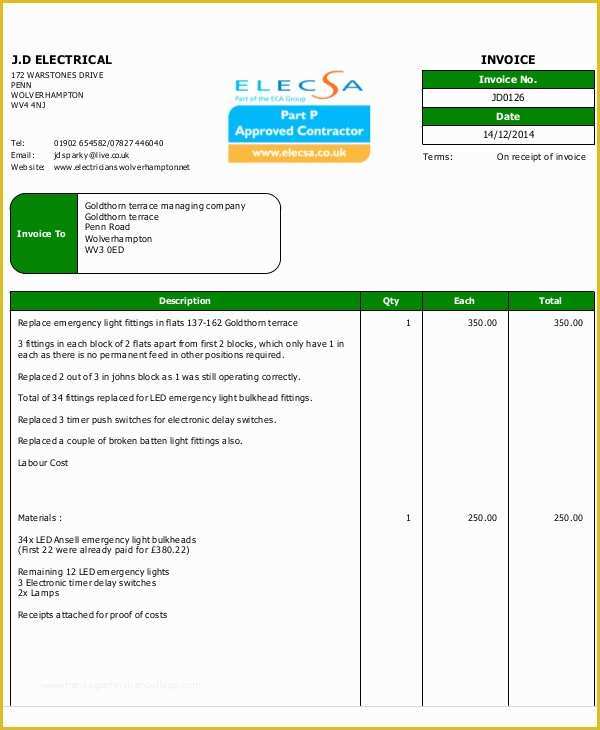

Contract Documents

A well-drafted contract is the backbone of any contractor-client relationship, outlining the scope of work, payment terms, and responsibilities. Essential elements of a contract include: - Scope of Work: A detailed description of the work to be done. - Payment Terms: Specifies how and when the contractor will be paid. - Warranty Information: Outlines any warranties provided for the work.

Employment and Tax Documents

For contractors who hire employees or work as independent contractors, understanding employment and tax laws is vital. This includes: - W-2 and W-9 Forms: For reporting income and taxes for employees and independent contractors. - Payroll Records: Essential for managing employee payments and taxes. - Tax Returns: Contractors must file tax returns annually, reporting their income and expenses.

Health and Safety Regulations

Compliance with health and safety regulations is not only a legal requirement but also crucial for preventing accidents and ensuring a safe working environment. This includes: - OSHA Compliance: Following Occupational Safety and Health Administration guidelines. - Safety Training Records: Documenting that employees have received necessary safety training. - Injury Reports: Keeping records of any work-related injuries or illnesses.

Environmental Regulations

Depending on the type of project, contractors may need to comply with environmental regulations, such as those related to waste disposal, hazardous materials, and environmental impact assessments. Key considerations include: - Permits for Hazardous Materials: Needed for projects involving hazardous substances. - Waste Disposal Plans: Outlining how waste will be managed and disposed of. - Environmental Impact Assessments: For projects that could significantly affect the environment.

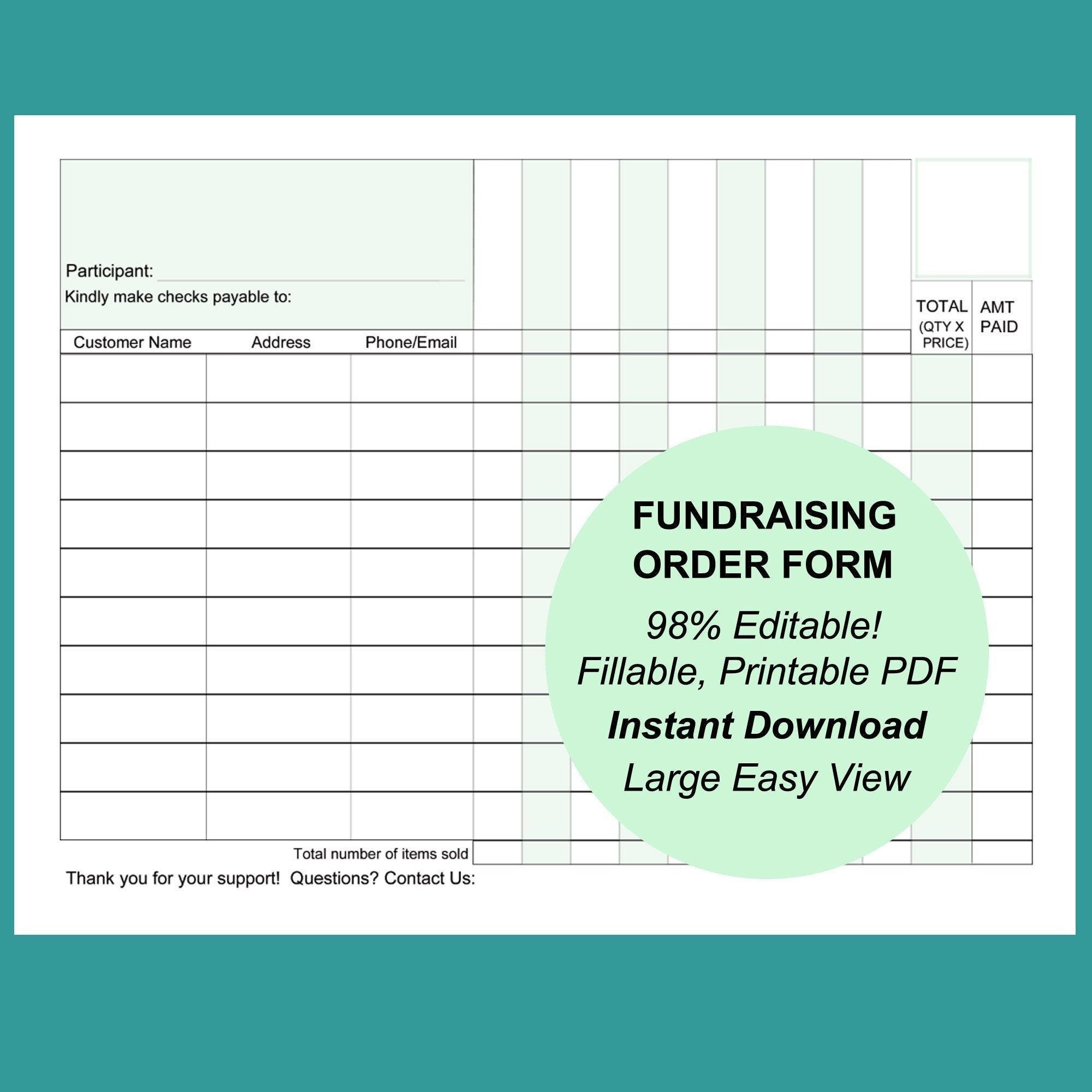

Best Practices for Managing Paperwork

Effective management of paperwork is essential for contractors to avoid legal issues, maintain good client relationships, and ensure the smooth operation of their business. Best practices include: - Digitizing Documents: Using digital tools to store and manage paperwork. - Creating a Filing System: Organizing documents in a logical and accessible way. - Regularly Reviewing and Updating Documents: Ensuring all paperwork is current and compliant with changing regulations.

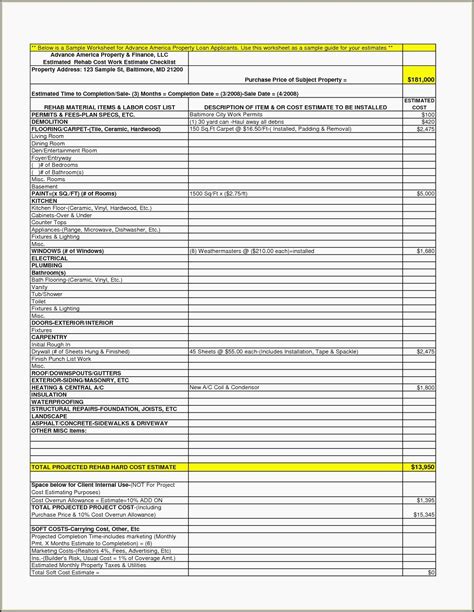

| Document Type | Purpose | Frequency |

|---|---|---|

| Licenses | To operate legally | Annual/Renewal |

| Insurance Policies | To cover risks | Annual/Renewal |

| Contracts | To outline work and payment terms | Per Project |

| Tax Returns | To report income and expenses | Annual |

In wrapping up the discussion on contractor paperwork requirements, it’s clear that managing these documents effectively is crucial for the success and legality of a contractor’s business. By understanding the necessary licenses, permits, insurance, contracts, and regulatory compliance documents, contractors can navigate the complex landscape of their industry with confidence. Moreover, implementing best practices for document management can further streamline operations and reduce the risk of legal or financial repercussions. Whether you’re a seasoned contractor or just starting out, prioritizing paperwork and staying informed about regulatory changes will be key to your long-term success.

What are the primary licenses a contractor needs?

+

The primary licenses include a business license and a contractor’s license, though specific requirements can vary by state and locality.

Why is insurance important for contractors?

+

Insurance protects contractors and clients against damages, injuries, and work dissatisfaction, providing financial security and peace of mind.

How often should a contractor review and update their paperwork?

+

Contractors should regularly review and update their paperwork to ensure compliance with changing regulations and to maintain accurate and current records.