New Employee Paperwork Requirements

Introduction to New Employee Paperwork Requirements

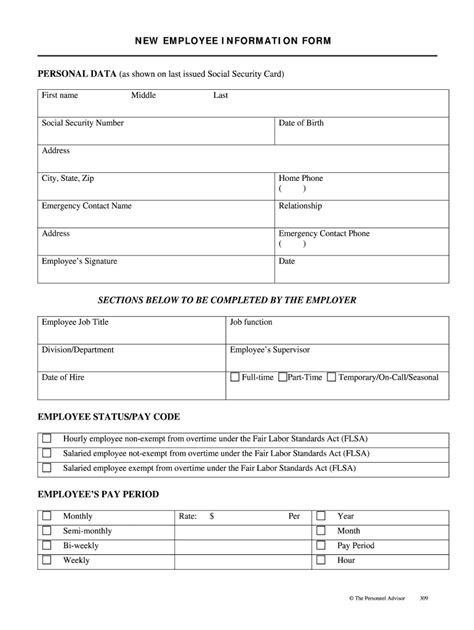

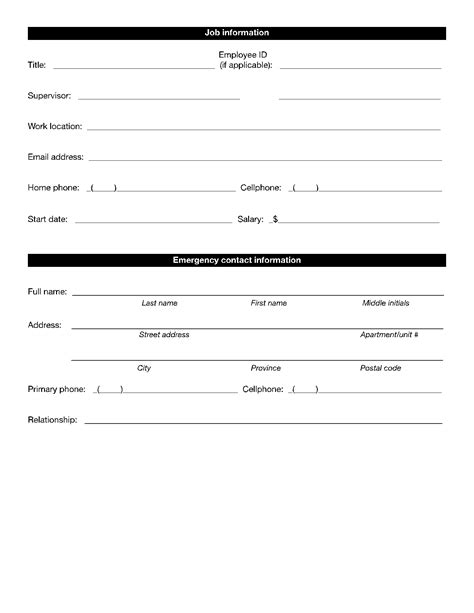

When a new employee joins an organization, there are several paperwork requirements that must be completed to ensure compliance with relevant laws and regulations. These requirements can vary depending on the country, state, or industry, but there are some common documents that are typically required. In this article, we will explore the different types of paperwork that new employees must complete, including tax forms, benefits enrollment, and company policies.

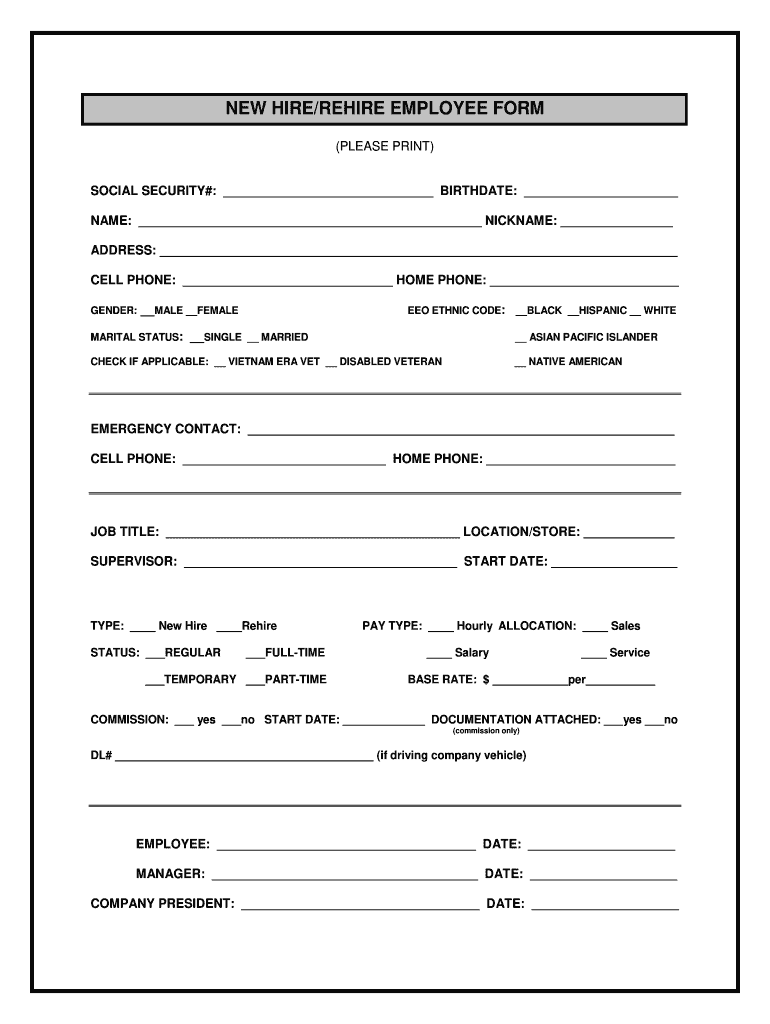

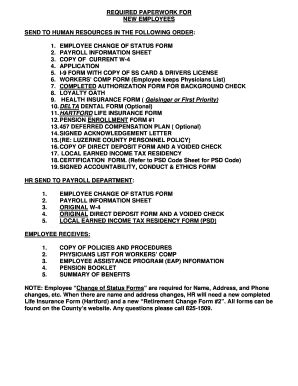

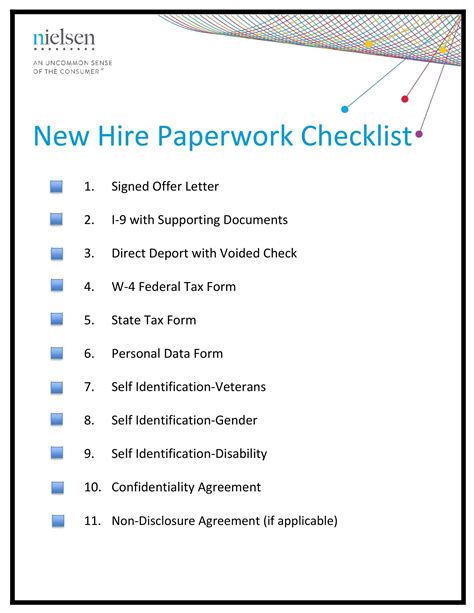

Pre-Employment Paperwork

Before a new employee starts work, there are several documents that must be completed. These include: * Job application: This is the initial document that the employee completes to apply for the job. * Resume and cover letter: These documents provide more information about the employee’s qualifications and experience. * Reference checks: The employer may contact the employee’s previous employers to verify their employment history and check their references. * Background check: Depending on the industry and job requirements, a background check may be necessary to ensure the employee is eligible to work in the position.

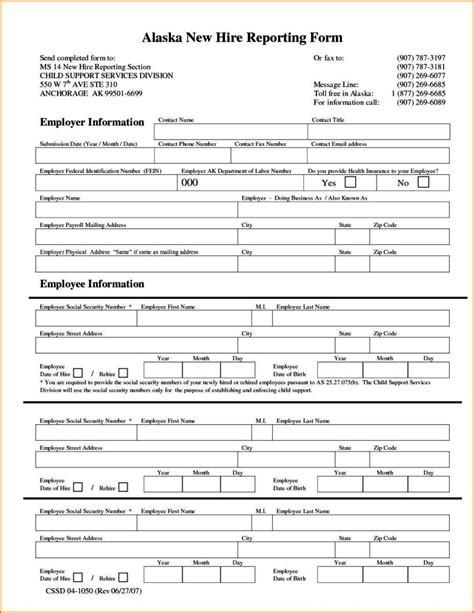

Tax Forms and Withholding

All new employees must complete tax forms to determine their tax withholding. The most common tax forms include: * W-4 form: This form is used to determine the employee’s federal income tax withholding. * State tax form: This form is used to determine the employee’s state income tax withholding. * Other tax forms: Depending on the location, there may be other tax forms that are required, such as local tax forms or forms for other benefits.

Benefits Enrollment

Many employers offer benefits to their employees, such as health insurance, retirement plans, and paid time off. To enroll in these benefits, employees must complete the necessary paperwork, which may include: * Benefits enrollment form: This form is used to select the benefits the employee wants to enroll in. * Dependent information: If the employee has dependents, they may need to provide information about them to enroll them in benefits. * Beneficiary information: The employee may need to provide beneficiary information for life insurance or other benefits.

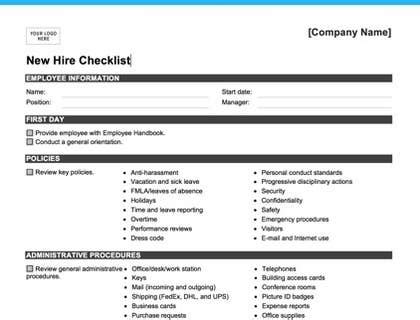

Company Policies and Procedures

All new employees must review and acknowledge the company’s policies and procedures. This may include: * Employee handbook: This document outlines the company’s policies and procedures, including information about benefits, time off, and performance expectations. * Confidentiality agreement: This document requires the employee to maintain the confidentiality of company information. * Non-compete agreement: This document may require the employee to agree not to work for a competitor for a certain period of time after leaving the company.

Other Paperwork Requirements

There may be other paperwork requirements that are specific to the industry or job. For example: * Certifications and licenses: Depending on the job, the employee may need to provide certifications or licenses to perform their job duties. * Physical examination: Some jobs may require a physical examination to ensure the employee is able to perform their job duties safely. * Drug test: Some employers may require a drug test as a condition of employment.

| Document | Purpose |

|---|---|

| W-4 form | |

| State tax form | State income tax withholding |

| Benefits enrollment form | Enroll in company benefits |

| Employee handbook | Company policies and procedures |

📝 Note: The specific paperwork requirements may vary depending on the company and industry, so it's essential to check with the HR department or supervisor to ensure all necessary documents are completed.

To ensure a smooth onboarding process, it’s essential to have all the necessary paperwork completed before the new employee starts work. This includes tax forms, benefits enrollment, company policies, and other paperwork requirements specific to the industry or job. By having all the necessary documents completed, the new employee can focus on learning their job duties and becoming a productive member of the team. In the end, completing all the necessary paperwork requirements is crucial for a successful onboarding process, and it’s essential to prioritize this step to ensure compliance with relevant laws and regulations. The key takeaways from this article include the importance of tax forms, benefits enrollment, and company policies, as well as the need to complete all necessary paperwork requirements before the new employee starts work.

What is the purpose of the W-4 form?

+

The W-4 form is used to determine the employee’s federal income tax withholding.

What is the purpose of the employee handbook?

+

The employee handbook outlines the company’s policies and procedures, including information about benefits, time off, and performance expectations.

What is the purpose of the benefits enrollment form?

+

The benefits enrollment form is used to select the benefits the employee wants to enroll in.