5 Ways to Quit LLC

Introduction to Quitting an LLC

When an individual decides to leave a Limited Liability Company (LLC), it can be a complex process, involving various legal and financial considerations. Whether you’re a member of a multi-member LLC or the sole owner of a single-member LLC, understanding the steps and implications of quitting is crucial. This process might be necessitated by various factors, including disagreements with other members, a desire to pursue other business ventures, or personal reasons. The key to a smooth exit lies in careful planning, adherence to the LLC’s operating agreement, and compliance with state laws.

Reasons for Quitting an LLC

Before diving into the process of quitting an LLC, it’s essential to consider the reasons behind this decision. Common reasons include: - Financial disagreements: Disagreements over the financial management or distribution of profits can lead to a decision to quit. - Lack of control: In a multi-member LLC, some members might feel they have limited control over the business’s direction, leading to dissatisfaction. - Personal reasons: Health issues, family commitments, or a desire to retire can prompt a member to leave the LLC. - New business opportunities: Members might decide to pursue other business ventures that align better with their interests or offer greater potential for growth.

Steps to Quit an LLC

Quitting an LLC involves several steps, each critical to ensuring the process is handled legally and professionally. Here are five ways to approach quitting an LLC:

Review the Operating Agreement: The first step is to review the LLC’s operating agreement. This document outlines the rules and procedures for the operation of the LLC, including how members can leave the company. It may specify notice periods, buyout procedures, and the valuation method for a member’s interest.

Notify Other Members: Formal notification to the other members of the LLC is essential. This can be done through a written letter or email, stating the intention to leave and referencing the relevant sections of the operating agreement. The notice period and any other conditions stipulated in the agreement must be adhered to.

Valuate Your Interest: If the operating agreement includes a provision for buying out a leaving member’s interest, the next step is to valuate this interest. This can be done through an independent appraisal or by using a formula specified in the operating agreement. The valuation will determine the amount that must be paid to the leaving member for their share of the business.

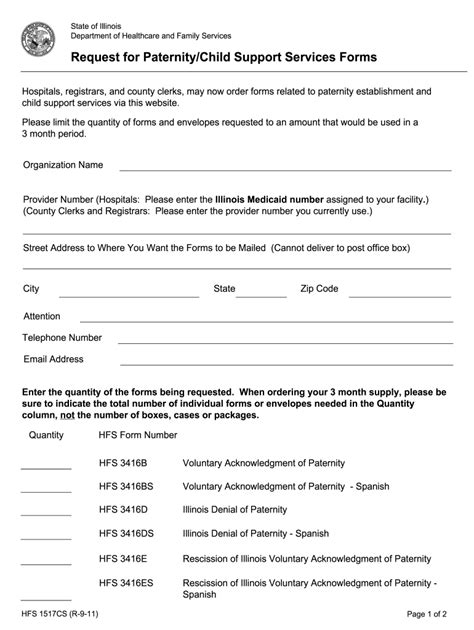

Comply with State Law: State laws govern the dissolution or departure from an LLC. Filing the appropriate documents with the state, such as the Articles of Dissolution if the LLC is being dissolved, or notifying the state of changes in membership, is crucial. Failure to comply with state regulations can result in legal and financial penalties.

Update Business Records: Finally, all business records must be updated to reflect the change in membership. This includes updating the LLC’s operating agreement, if necessary, and ensuring that all financial and legal documents accurately represent the new structure of the business.

Considerations and Implications

Quitting an LLC can have significant implications, both for the leaving member and the remaining members. Some key considerations include: - Tax implications: The sale or buyout of a member’s interest can have tax implications, including potential capital gains tax. - Continuity of the business: The departure of a key member can impact the business’s operations and continuity, especially if that member played a critical role in management or operations. - Legal and financial obligations: Ensuring that all legal and financial obligations are met during the exit process is vital to avoid future liabilities.

📝 Note: It's highly recommended to consult with a legal and financial advisor to ensure that the process of quitting an LLC is handled correctly and that all parties' rights are protected.

Alternatives to Quitting

Before making the final decision to quit, it’s worth considering alternatives that might address the underlying issues without necessitating a complete exit. These can include: - Negotiating changes to the operating agreement: If the issues are related to control or financial distribution, renegotiating the operating agreement might provide a solution. - Seeking mediation: For disputes between members, mediation can be an effective way to resolve issues without the need for a member to leave. - Buying out other members: If the desire is to have more control, buying out other members could be an option, depending on the operating agreement and the financial situation of the LLC.

Embedding Images for Illustration

This image illustrates a basic structure of an LLC, highlighting the importance of understanding the roles and responsibilities of each member.

This image illustrates a basic structure of an LLC, highlighting the importance of understanding the roles and responsibilities of each member.

| Step | Description |

|---|---|

| Review Operating Agreement | Understand the procedures for leaving the LLC as outlined in the operating agreement. |

| Notify Other Members | Formally inform other members of the decision to leave, following the notice period and procedures stipulated in the agreement. |

| Valuate Interest | Determine the value of the leaving member's interest in the LLC, using an independent appraisal or a formula from the operating agreement. |

| Comply with State Law | File necessary documents with the state to formalize the change in membership or the dissolution of the LLC, if applicable. |

| Update Business Records | Reflect the changes in membership by updating the LLC's operating agreement, financial records, and other relevant documents. |

In summary, quitting an LLC is a significant decision that requires careful consideration and planning. By understanding the reasons for quitting, following the necessary steps, and being aware of the implications, individuals can navigate this process effectively. Whether through negotiation, mediation, or a formal exit, finding a resolution that respects the rights and interests of all parties involved is crucial.

What are the primary reasons for quitting an LLC?

+

The primary reasons include financial disagreements, lack of control, personal reasons, and new business opportunities.

How do I valuate my interest in the LLC?

+

Valuation can be done through an independent appraisal or by using a formula specified in the operating agreement.

What are the tax implications of quitting an LLC?

+

The tax implications can include capital gains tax on the sale or buyout of a member’s interest. It’s recommended to consult with a tax advisor to understand the specific implications.