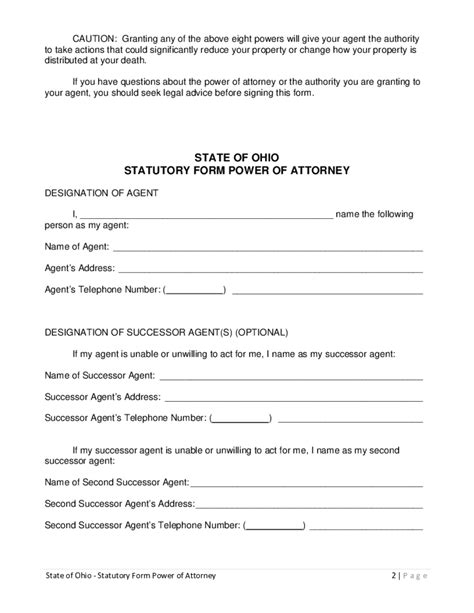

Paperwork

5 Forms Statutory Employees Must Fill

Introduction to Statutory Employee Forms

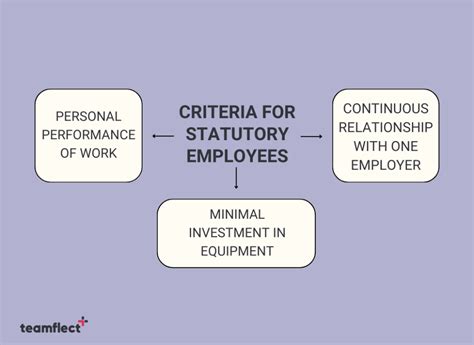

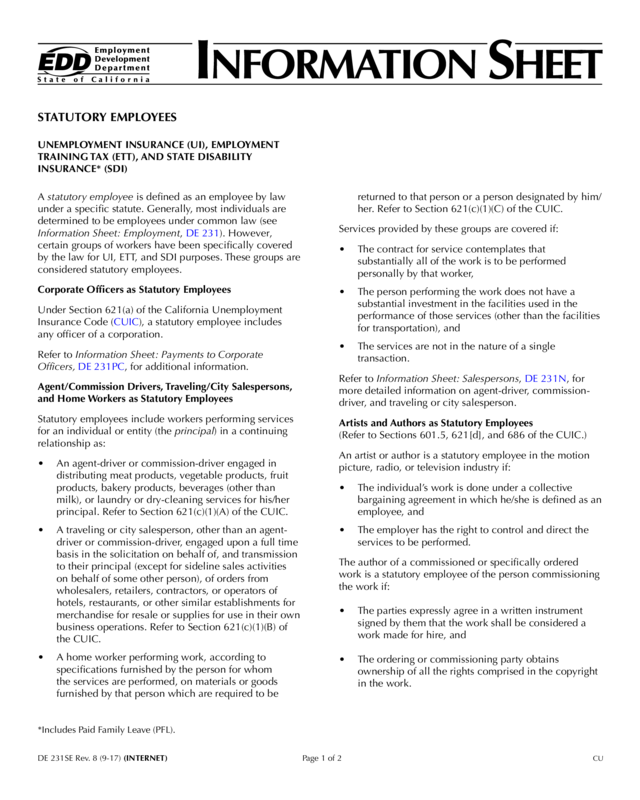

As a statutory employee, it is essential to understand the various forms that must be filled out to comply with tax laws and regulations. Statutory employees are individuals who are considered employees for tax purposes but are not subject to the same tax withholding rules as regular employees. They are typically independent contractors or self-employed individuals who work in specific industries, such as construction, transportation, or agriculture. In this article, we will discuss the five forms that statutory employees must fill out, including the W-2, 1099-MISC, Form 1040, Schedule C, and Form 8919.

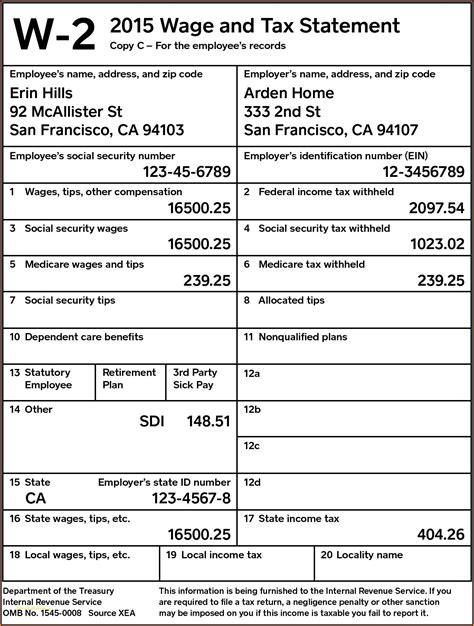

Form 1: W-2 - Wage and Tax Statement

The W-2 form is used to report an employee’s income and taxes withheld to the Internal Revenue Service (IRS). As a statutory employee, you will receive a W-2 form from your employer at the end of each tax year, showing your wages, tips, and other compensation, as well as the taxes withheld from your income. You will use this form to complete your tax return.

Form 2: 1099-MISC - Miscellaneous Income

The 1099-MISC form is used to report miscellaneous income, such as freelance work, consulting fees, and other non-employee compensation. As a statutory employee, you may receive a 1099-MISC form from clients or customers who have paid you for your services. You will use this form to report your income and calculate your self-employment tax.

Form 3: Form 1040 - U.S. Individual Income Tax Return

The Form 1040 is the standard form used for personal income tax returns. As a statutory employee, you will use this form to report your income, deductions, and credits, and to calculate your tax liability. You will also use this form to claim any deductions and credits related to your business expenses.

Form 4: Schedule C - Profit or Loss from Business

The Schedule C form is used to report the profit or loss from your business. As a statutory employee, you will use this form to calculate your business income and expenses, and to determine your net profit or loss. You will also use this form to claim any business-related deductions and credits.

Form 5: Form 8919 - Uncollected Social Security and Medicare Tax on Wages

The Form 8919 is used to report and pay any uncollected Social Security and Medicare taxes on your wages. As a statutory employee, you may be required to pay these taxes if your employer did not withhold them from your income. You will use this form to calculate and pay any uncollected taxes, and to claim any credits related to these taxes.

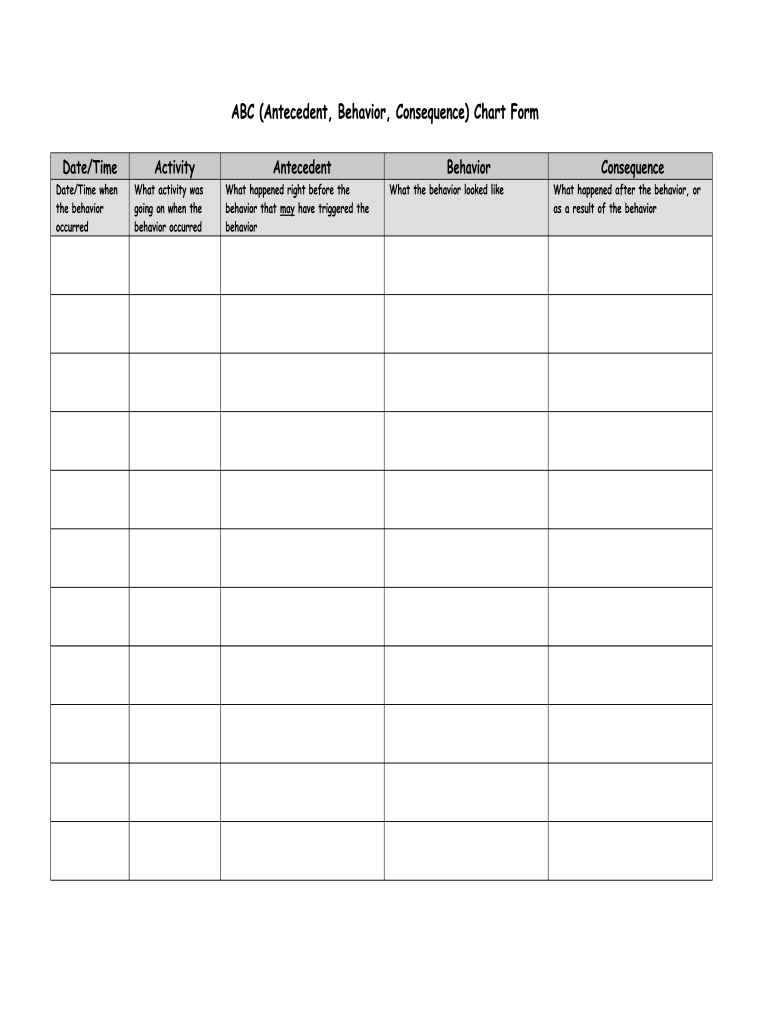

📝 Note: It is essential to keep accurate records of your income and expenses, as well as any forms and documents related to your tax obligations. This will help you to ensure compliance with tax laws and regulations, and to avoid any potential penalties or fines.

Conclusion and Summary

In summary, as a statutory employee, it is crucial to understand the various forms that must be filled out to comply with tax laws and regulations. The five forms discussed in this article, including the W-2, 1099-MISC, Form 1040, Schedule C, and Form 8919, are essential for reporting income, calculating taxes, and claiming deductions and credits. By understanding these forms and completing them accurately, you can ensure compliance with tax laws and regulations, and avoid any potential penalties or fines. It is also important to keep accurate records of your income and expenses, as well as any forms and documents related to your tax obligations.

What is a statutory employee?

+

A statutory employee is an individual who is considered an employee for tax purposes but is not subject to the same tax withholding rules as regular employees.

What forms do statutory employees need to fill out?

+

Statutory employees need to fill out the W-2, 1099-MISC, Form 1040, Schedule C, and Form 8919.

Why is it essential to keep accurate records of income and expenses?

+

Keeping accurate records of income and expenses is essential to ensure compliance with tax laws and regulations, and to avoid any potential penalties or fines.