Paperwork

NH Employee Paperwork Requirements

New Hire Employee Paperwork Requirements

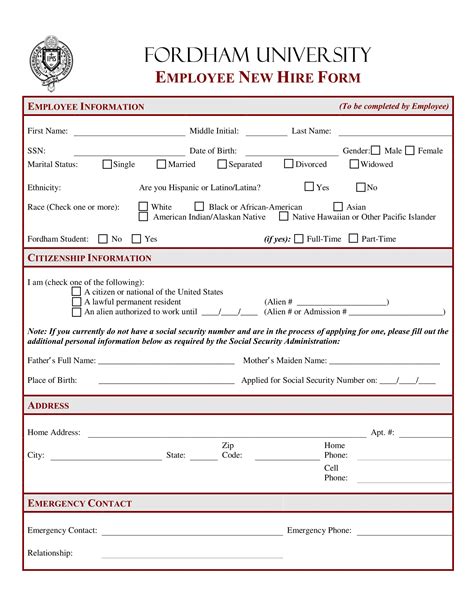

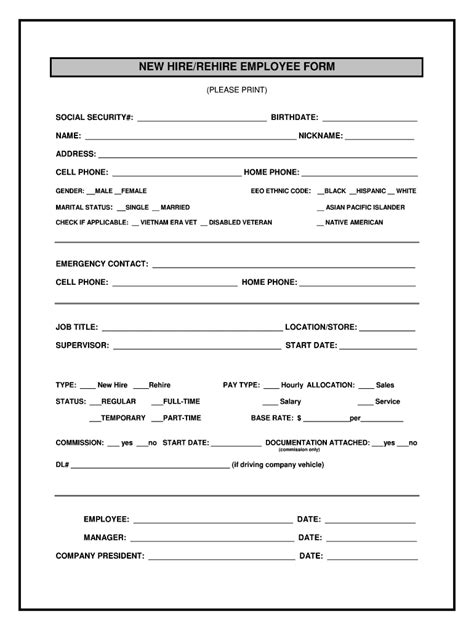

When a new employee is hired, there are several paperwork requirements that must be completed to ensure compliance with federal, state, and local laws. These requirements can vary depending on the location and type of business, but there are some common forms and documents that are typically required. In this article, we will discuss the new hire employee paperwork requirements in the state of New Hampshire (NH).

Federal Requirements

Before discussing the specific requirements for New Hampshire, it’s essential to understand the federal requirements that apply to all employers in the United States. These include:

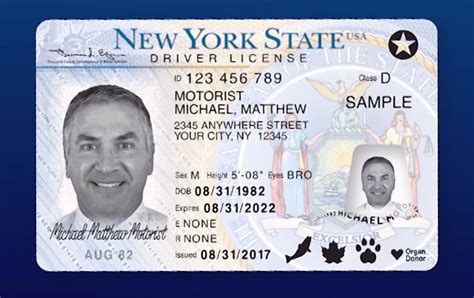

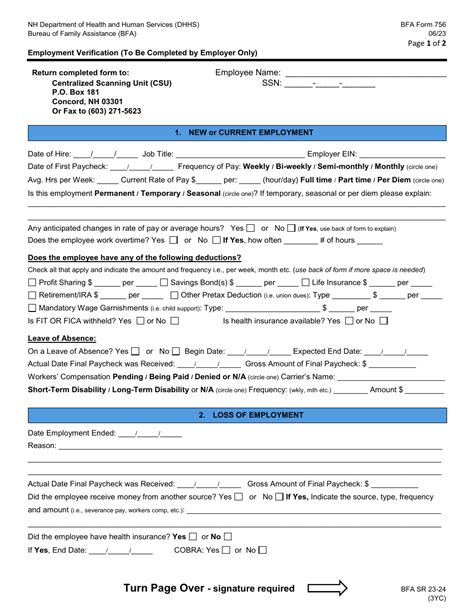

- Form I-9: This form is used to verify the identity and employment authorization of new hires. Employers must complete Section 2 of the form within three business days of the employee’s first day of work.

- Form W-4: This form is used to determine the amount of federal income tax to withhold from an employee’s wages. Employers must provide a copy of the form to the employee and retain a copy for their records.

- New Hire Reporting: Employers are required to report new hires to the state’s new hire reporting agency within 20 days of the employee’s first day of work.

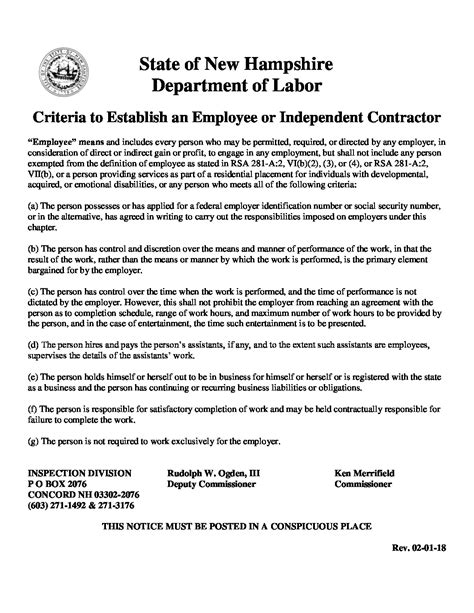

New Hampshire State Requirements

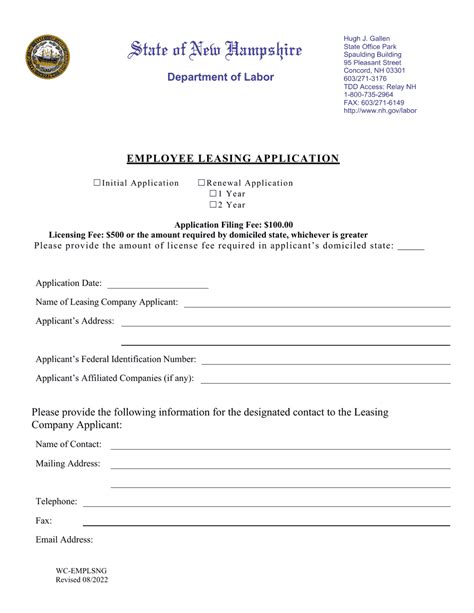

In addition to the federal requirements, New Hampshire has its own set of paperwork requirements for new hires. These include:

- NH New Hire Reporting Form: This form is used to report new hires to the New Hampshire Department of Employment Security.

- NH Employee Withholding Certificate: This form is used to determine the amount of state income tax to withhold from an employee’s wages.

- Workers’ Compensation Notice: Employers are required to provide a notice to new hires explaining their rights and obligations under the New Hampshire Workers’ Compensation Law.

Other Requirements

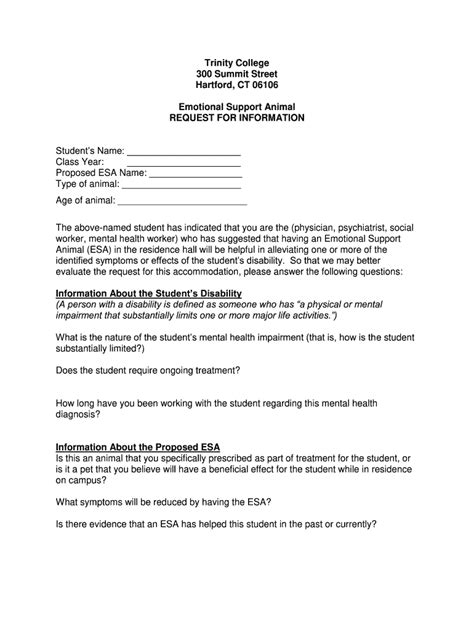

Depending on the type of business and the location, there may be additional paperwork requirements for new hires. These can include:

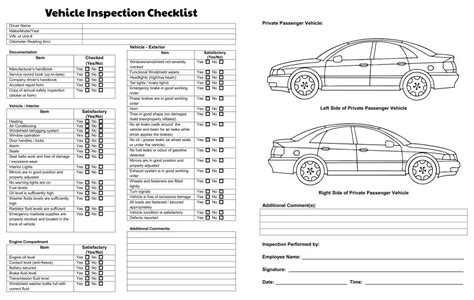

- OSHA Forms: Employers may be required to complete OSHA forms, such as the OSHA Form 300, to report workplace injuries and illnesses.

- Benefits Enrollment Forms: Employers may be required to provide benefits enrollment forms to new hires, such as health insurance, retirement plans, or life insurance.

- Company Policies: Employers may be required to provide new hires with a copy of the company’s policies and procedures, such as the employee handbook.

Best Practices

To ensure compliance with federal and state laws, employers should follow these best practices:

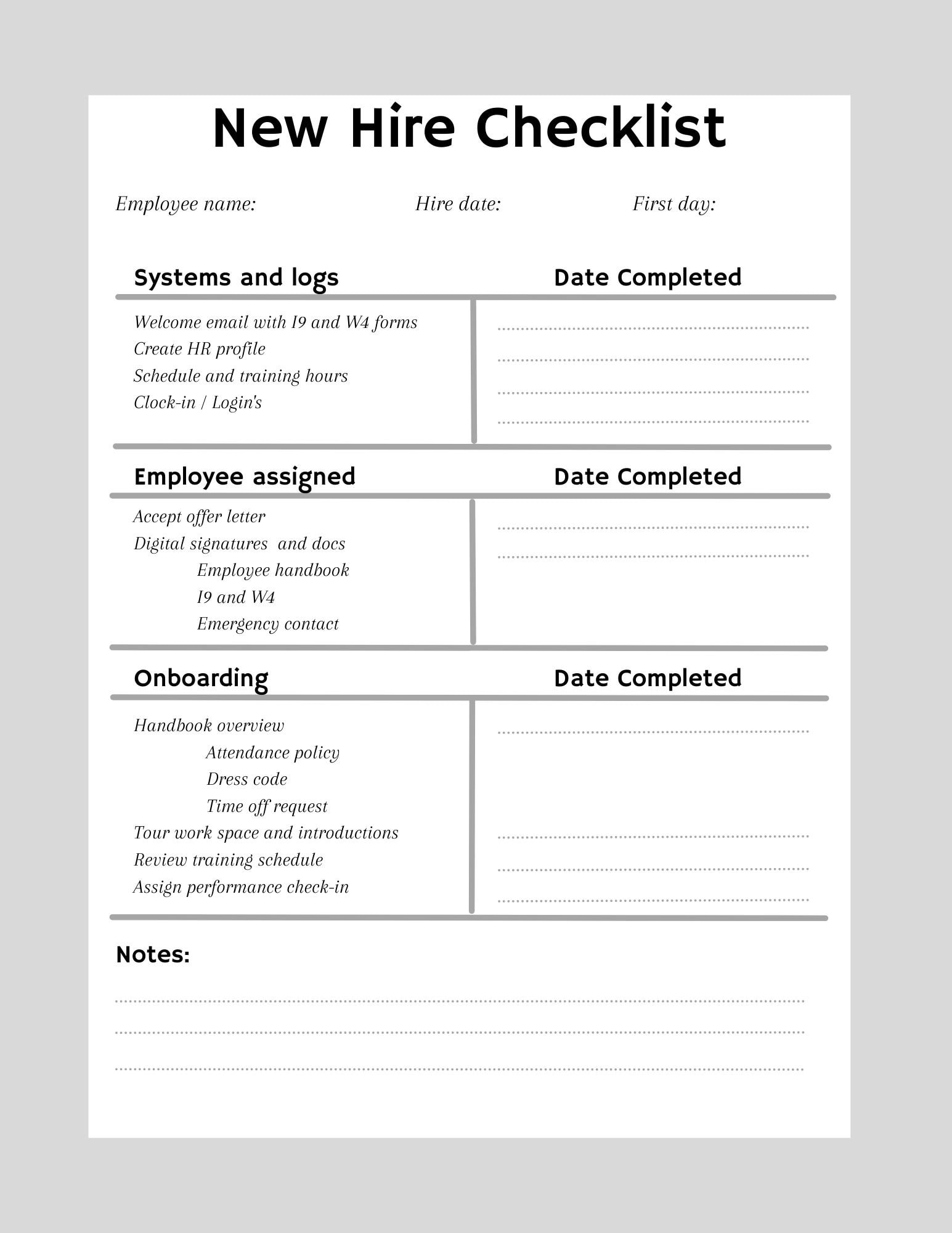

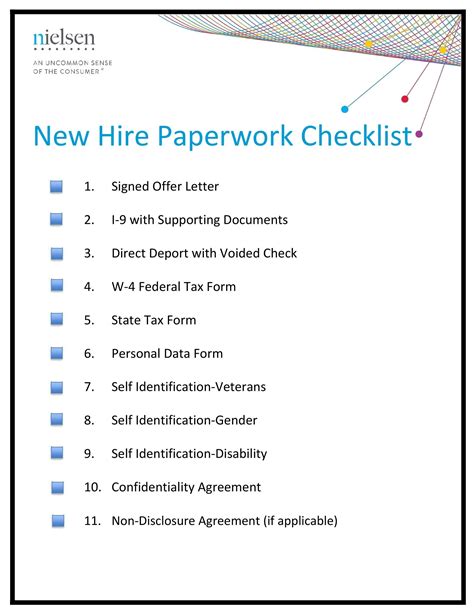

- Use a new hire checklist: Create a checklist to ensure that all necessary paperwork is completed for each new hire.

- Provide clear instructions: Provide clear instructions to new hires on how to complete the necessary paperwork.

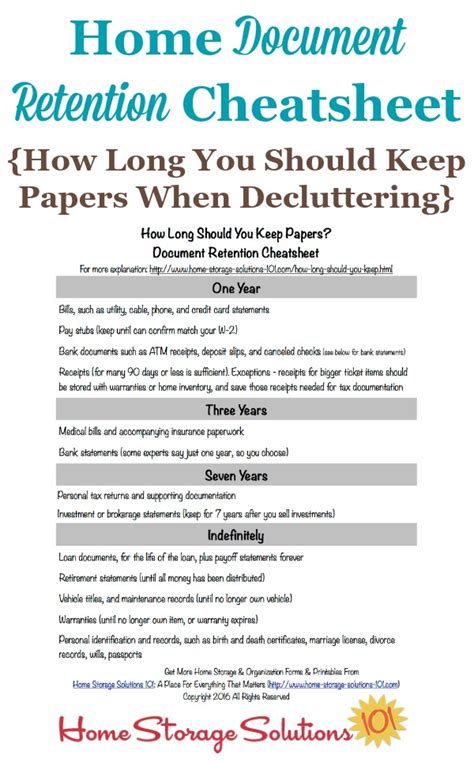

- Retain accurate records: Retain accurate and complete records of all new hire paperwork, including the date and time the paperwork was completed.

- Conduct regular audits: Conduct regular audits to ensure that all new hire paperwork is complete and accurate.

📝 Note: Employers should consult with an attorney or HR professional to ensure compliance with all applicable laws and regulations.

Conclusion Summary

In summary, new hire employee paperwork requirements in New Hampshire include federal requirements, such as Form I-9 and Form W-4, as well as state requirements, such as the NH New Hire Reporting Form and NH Employee Withholding Certificate. Employers must also comply with other requirements, such as OSHA forms and benefits enrollment forms. By following best practices, such as using a new hire checklist and retaining accurate records, employers can ensure compliance with federal and state laws.

What is the purpose of Form I-9?

+

Form I-9 is used to verify the identity and employment authorization of new hires.

What is the deadline for reporting new hires to the state of New Hampshire?

+

Employers must report new hires to the state of New Hampshire within 20 days of the employee’s first day of work.

What is the purpose of the NH Employee Withholding Certificate?

+

The NH Employee Withholding Certificate is used to determine the amount of state income tax to withhold from an employee’s wages.