5 Steps to Rollover 401k

Introduction to 401k Rollover

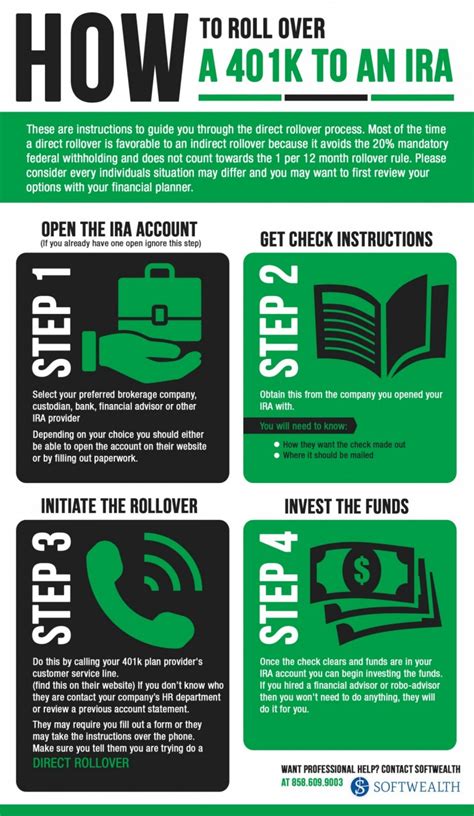

When changing jobs or retiring, individuals often face the decision of what to do with their 401k retirement plan. One option is to rollover the 401k into another qualified retirement account, such as an Individual Retirement Account (IRA) or a new 401k plan. This process can help consolidate retirement savings, reduce fees, and increase investment options. In this article, we will discuss the 5 steps to rollover 401k and provide guidance on how to navigate this process.

Step 1: Determine Eligibility and Choose a Rollover Option

The first step in rolling over a 401k is to determine eligibility and choose a rollover option. Most 401k plans allow participants to rollover their funds when they leave their job, retire, or reach age 59 1⁄2. There are two main types of rollovers: direct rollover and indirect rollover. A direct rollover involves transferring funds directly from the 401k plan to the new retirement account, while an indirect rollover involves receiving a check from the 401k plan and depositing it into the new account within 60 days.

Step 2: Select a New Retirement Account

The next step is to select a new retirement account to receive the 401k funds. This could be an IRA, a new 401k plan, or an annuity. When choosing a new account, consider factors such as fees, investment options, and customer service. It’s essential to research and compares different options to find the best fit for your retirement goals.

Step 3: Gather Required Documents and Information

To initiate the rollover process, you’ll need to gather required documents and information. This may include:

- 401k plan statements and contact information

- New retirement account application and paperwork

- Identification and social security number

- Beneficiary information (if applicable)

Step 4: Complete the Rollover Process

Once you’ve selected a new retirement account and gathered the required documents, it’s time to complete the rollover process. This typically involves:

- Notifying the 401k plan administrator of your intention to rollover your funds

- Completing the new retirement account application and paperwork

- Providing required documents and information

- Verifying the rollover amount and ensuring a smooth transfer of funds

Step 5: Monitor and Manage Your New Retirement Account

After completing the rollover process, it’s essential to monitor and manage your new retirement account. This includes:

- Reviewing and adjusting your investment portfolio as needed

- Monitoring account fees and expenses

- Updating beneficiary information and other account details

- Considering professional advice from a financial advisor or investment expert

📝 Note: It's essential to carefully review and understand the terms and conditions of your new retirement account, including any fees, investment options, and withdrawal rules, before completing the rollover process.

In summary, rolling over a 401k requires careful planning and attention to detail. By following these 5 steps, you can ensure a smooth and successful transfer of your retirement funds. Remember to research and compares different options, gather required documents, and monitor and manage your new retirement account to achieve your long-term retirement goals.

What is the difference between a direct and indirect rollover?

+

A direct rollover involves transferring funds directly from the 401k plan to the new retirement account, while an indirect rollover involves receiving a check from the 401k plan and depositing it into the new account within 60 days.

Can I rollover my 401k into an IRA at any time?

+

Most 401k plans allow participants to rollover their funds when they leave their job, retire, or reach age 59 1⁄2. However, it’s essential to review your 401k plan documents and consult with a financial advisor to determine the best time to rollover your funds.

How long does the rollover process typically take?

+

The rollover process typically takes 2-4 weeks, depending on the complexity of the transfer and the efficiency of the 401k plan administrator and the new retirement account provider. It’s essential to plan ahead and allow sufficient time for the rollover process to complete.