Foreign Tax Withholding Form

Understanding Foreign Tax Withholding Forms

When dealing with international transactions, individuals and businesses often encounter the concept of foreign tax withholding. This process involves deducting a certain amount of tax from income earned in a foreign country, which is then submitted to the government of that country. To facilitate this process, various forms are used, including the foreign tax withholding form. In this article, we will delve into the details of these forms, their purposes, and how to navigate them efficiently.

Purpose of Foreign Tax Withholding Forms

The primary purpose of foreign tax withholding forms is to ensure that individuals and businesses comply with the tax laws of the countries in which they operate. These forms are used to report income earned from foreign sources, such as dividends, interest, rents, and royalties, and to claim any tax withheld in the foreign country. By using these forms, taxpayers can provide the necessary documentation to support their tax claims and avoid potential penalties.

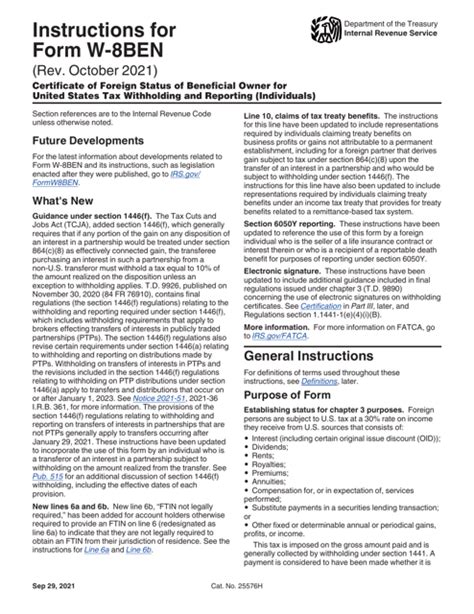

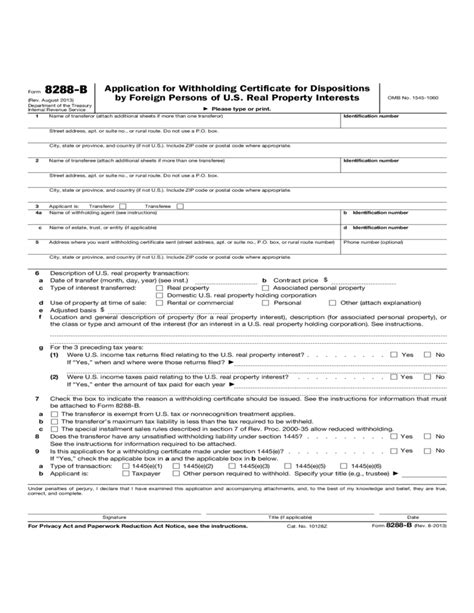

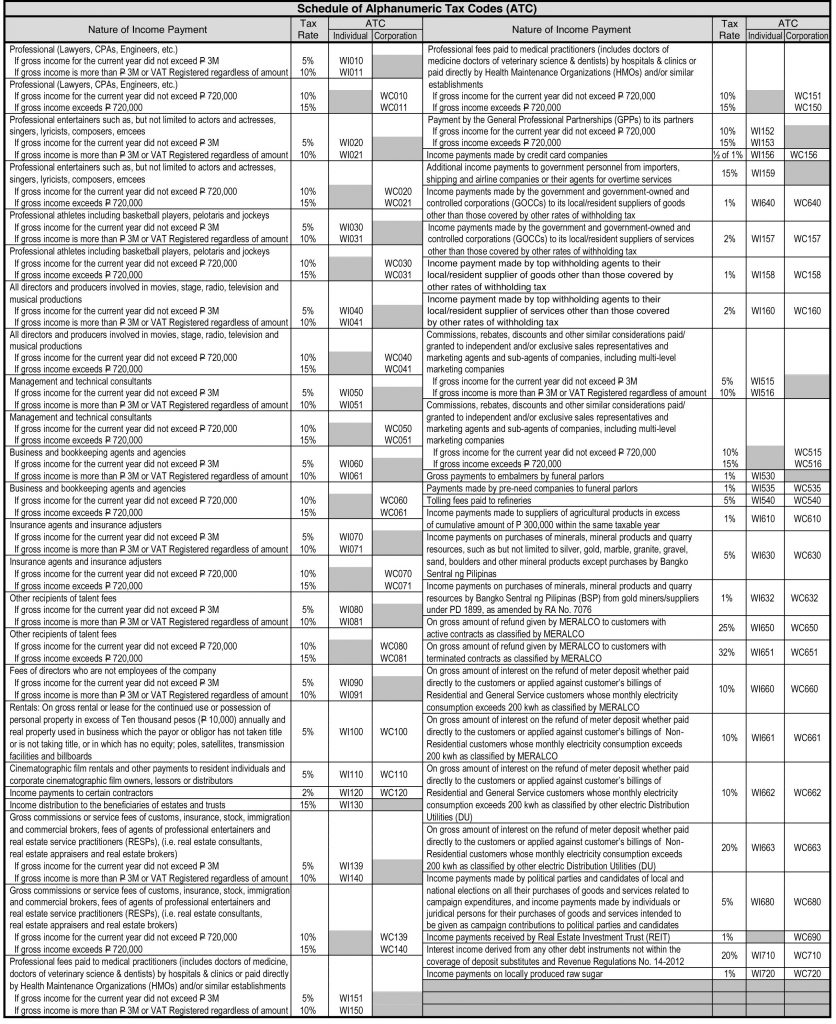

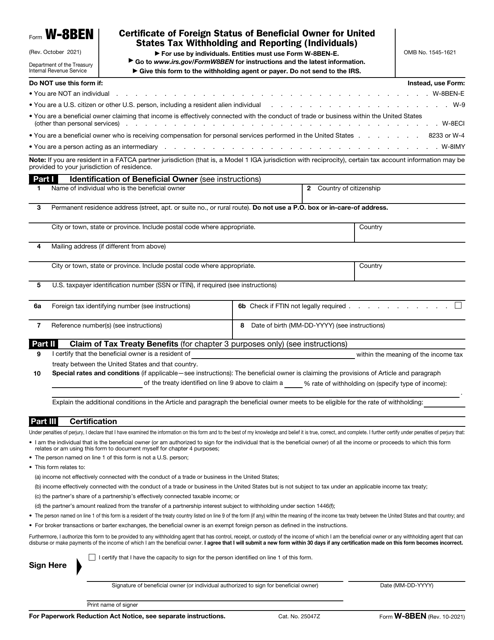

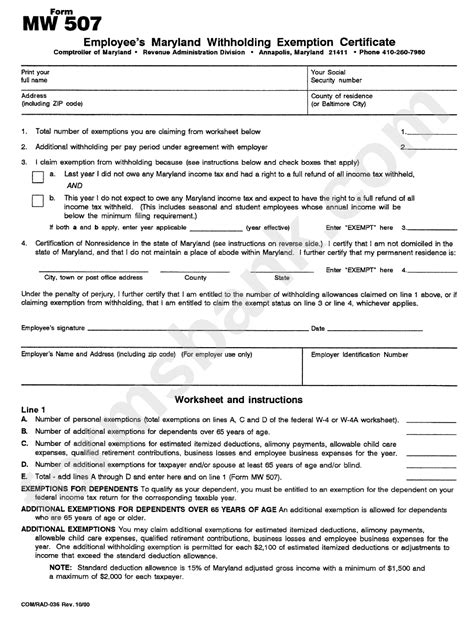

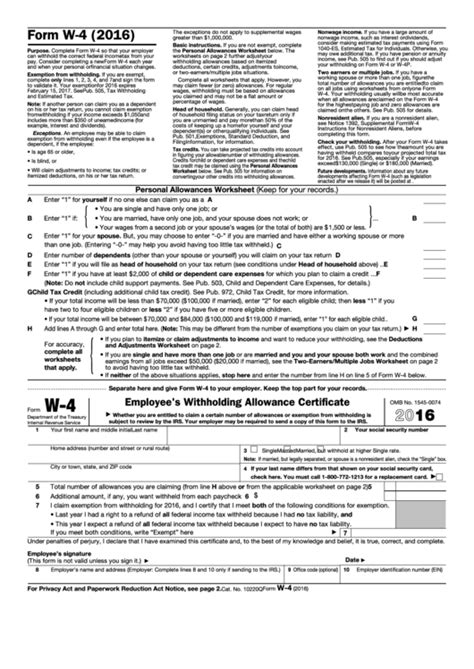

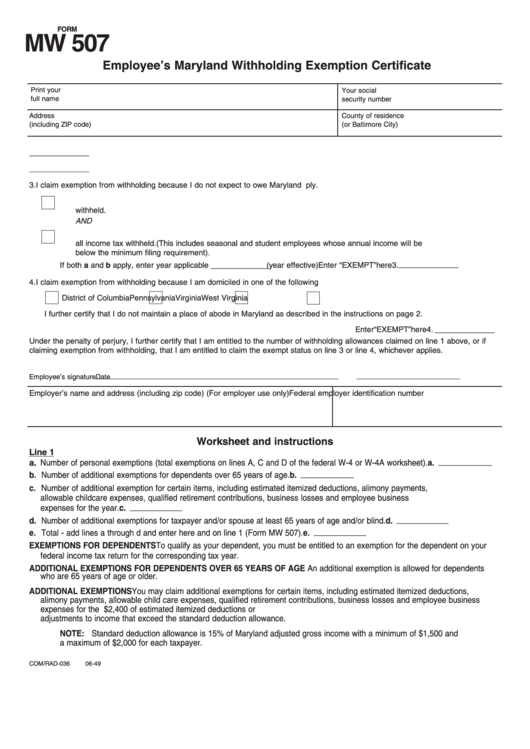

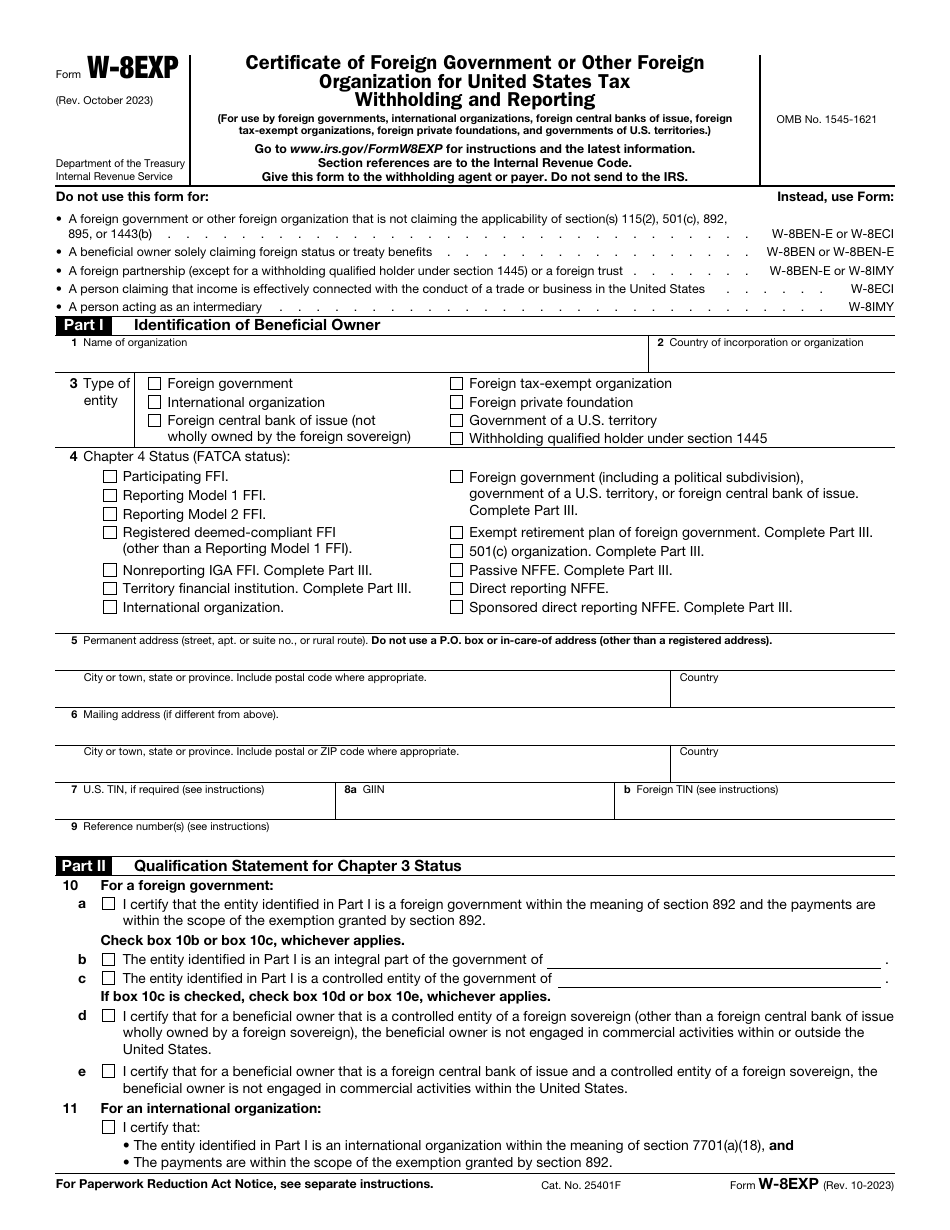

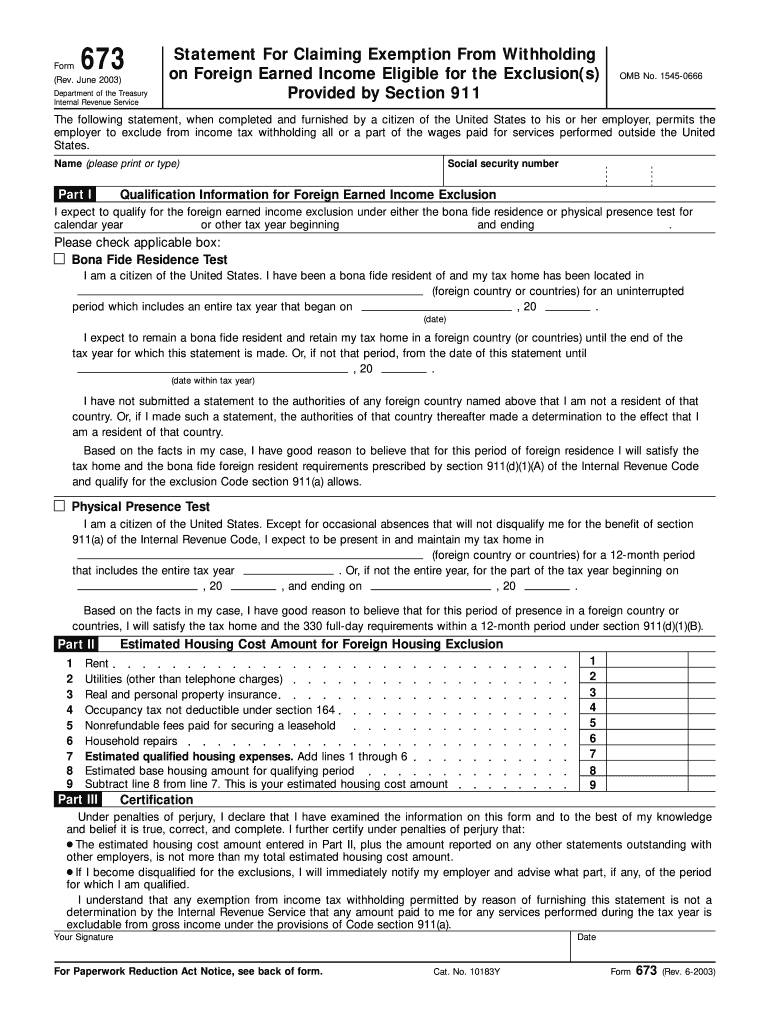

Types of Foreign Tax Withholding Forms

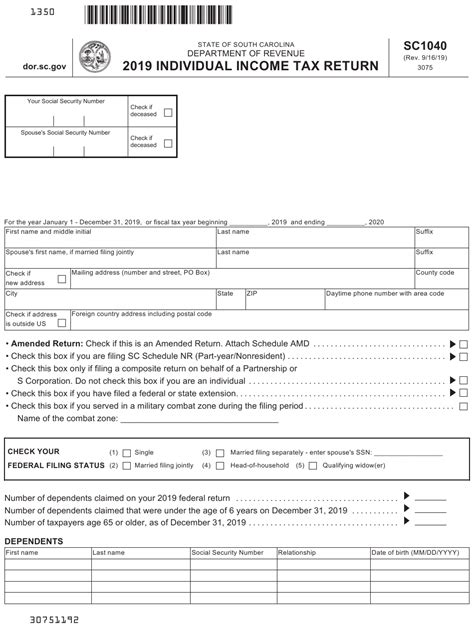

There are several types of foreign tax withholding forms, each serving a specific purpose: - Form W-8BEN: Certificate of Foreign Status of Beneficial Owner for United States Tax Withholding. This form is used by foreign individuals and businesses to certify their foreign status and claim reduced tax withholding rates under an income tax treaty. - Form W-8BEN-E: Certificate of Status of Beneficial Owner for United States Tax Withholding (Entities). Similar to Form W-8BEN, but used by foreign entities rather than individuals. - Form 1040-NR: U.S. Nonresident Alien Income Tax Return. While not exclusively a withholding form, it’s used by nonresident aliens to report their U.S.-sourced income and claim a refund of overwithheld taxes. - Form 8938: Statement of Specified Foreign Financial Assets. This form is used by U.S. taxpayers to report their foreign financial assets if the total value exceeds certain thresholds.

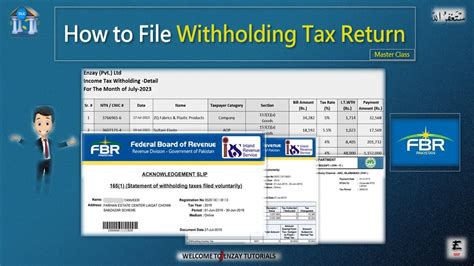

How to Complete Foreign Tax Withholding Forms

Completing foreign tax withholding forms requires careful attention to detail to ensure accuracy and compliance with tax laws. Here are general steps to follow: - Gather Necessary Documents: Before starting, collect all relevant documents, including identification, tax identification numbers, and details of the income earned. - Choose the Correct Form: Select the appropriate form based on your status (individual or entity) and the nature of the income. - Fill Out the Form Accurately: Follow the instructions provided with the form. Ensure all required fields are completed, and calculations are accurate. - Submit the Form: Submit the completed form to the appropriate authority, which could be the withholding agent or the tax authority of the country where the income was earned.

Importance of Compliance

Compliance with foreign tax withholding regulations is crucial to avoid penalties, fines, and potential legal action. Non-compliance can result in overwithholding of taxes, reducing the income available to the taxpayer. Moreover, it can lead to audits and investigations, which can be time-consuming and costly.

Benefits of Accurate Reporting

Accurate and timely reporting using foreign tax withholding forms offers several benefits: - Reduced Tax Liability: By claiming the correct withholding rate under an income tax treaty, taxpayers can reduce their tax liability. - Avoidance of Penalties: Compliance with tax laws and regulations helps avoid penalties and fines associated with late or incorrect filing. - Efficient Refund Process: For overwithheld taxes, accurate reporting facilitates a smoother refund process.

Challenges and Considerations

Navigating foreign tax withholding forms can be challenging due to the complexity of international tax laws and the varying requirements of different countries. Taxpayers must stay updated on tax treaty changes and be aware of the specific forms and deadlines applicable to their situation. Additionally, language barriers and differences in tax year endings can complicate the process.

📝 Note: It is essential to consult with a tax professional or accountant familiar with international tax laws to ensure compliance and maximize benefits.

Technology and Foreign Tax Withholding

The use of technology, such as tax software and digital platforms, has simplified the process of completing and submitting foreign tax withholding forms. These tools can guide taxpayers through the completion process, perform calculations, and even submit the forms electronically. However, it is crucial to choose reputable and compliant software to avoid errors and ensure security.

| Form | Purpose | Who Should File |

|---|---|---|

| W-8BEN | Certify foreign status for U.S. tax withholding | Foreign individuals |

| W-8BEN-E | Certify foreign status for U.S. tax withholding (entities) | Foreign entities |

| 1040-NR | Report U.S.-sourced income and claim refund | Nonresident aliens |

| 8938 | Report specified foreign financial assets | U.S. taxpayers with foreign financial assets |

In summary, foreign tax withholding forms play a critical role in ensuring compliance with international tax laws. By understanding the purpose, types, and completion process of these forms, individuals and businesses can navigate the complexities of foreign tax withholding efficiently. It is also important to leverage technology and seek professional advice when needed to maximize the benefits of accurate reporting and compliance.

As we reflect on the key points discussed, it becomes clear that managing foreign tax withholding effectively requires a combination of knowledge, attention to detail, and the right resources. Whether you are an individual with international income or a business operating globally, understanding and complying with foreign tax withholding regulations is essential for minimizing tax liabilities and avoiding potential issues with tax authorities.

What is the purpose of Form W-8BEN?

+

Form W-8BEN is used by foreign individuals to certify their foreign status and claim reduced tax withholding rates under an income tax treaty.

Who needs to file Form 1040-NR?

+

Nonresident aliens who have U.S.-sourced income need to file Form 1040-NR to report their income and claim a refund of overwithheld taxes.

What is the difference between Form W-8BEN and Form W-8BEN-E?

+

Form W-8BEN is used by foreign individuals, while Form W-8BEN-E is used by foreign entities to certify their foreign status for U.S. tax withholding purposes.