Commercial Car Loan Paperwork

Introduction to Commercial Car Loan Paperwork

When it comes to acquiring a vehicle for business purposes, commercial car loans are often the most viable option. However, the process of securing such a loan involves a significant amount of paperwork. Understanding the various documents and requirements involved in commercial car loan paperwork is crucial for a smooth and successful loan application process. In this article, we will delve into the world of commercial car loan paperwork, exploring the key documents, the application process, and the importance of thorough preparation.

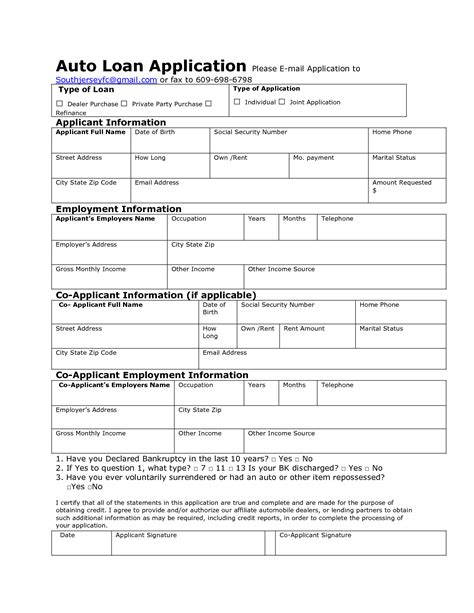

Key Documents Required for Commercial Car Loan Paperwork

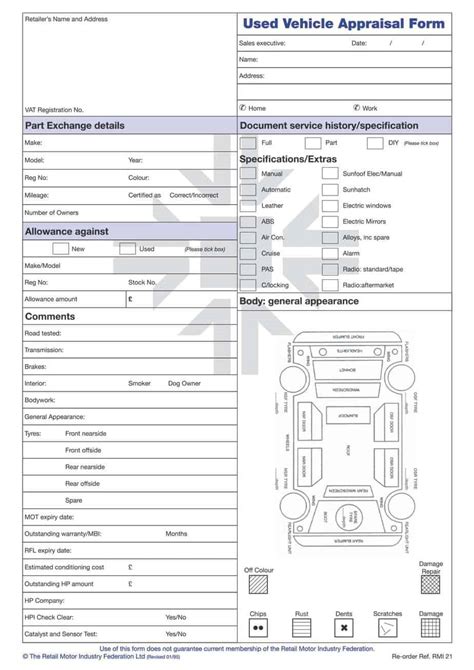

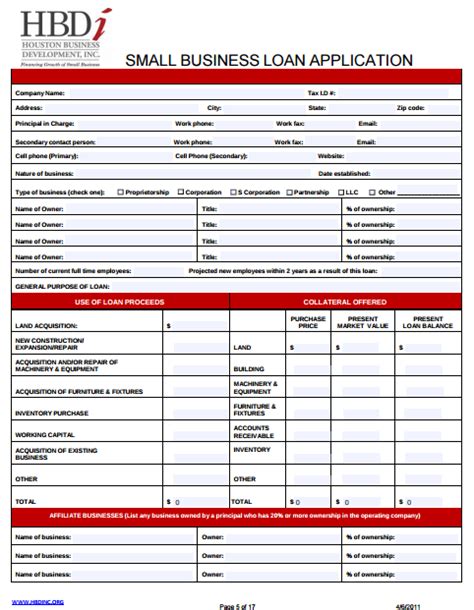

The paperwork for a commercial car loan typically includes a variety of documents that provide lenders with a comprehensive overview of the borrower’s financial situation and business operations. Some of the key documents required include: - Business License: A valid business license is essential to prove the existence and legitimacy of the business. - Financial Statements: This includes balance sheets, income statements, and cash flow statements that demonstrate the business’s financial health and ability to repay the loan. - Tax Returns: Personal and business tax returns are required to assess the borrower’s income and tax obligations. - Vehicle Details: Specifications of the vehicle to be purchased, including make, model, year, and Vehicle Identification Number (VIN). - Insurance Information: Proof of insurance that covers the vehicle against various risks. - Identification Documents: Personal identification of the business owner(s) or authorized signatories, such as passports or driver’s licenses.

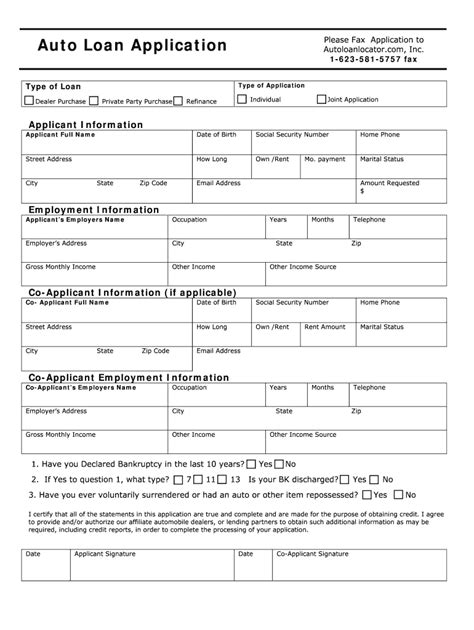

The Application Process for Commercial Car Loans

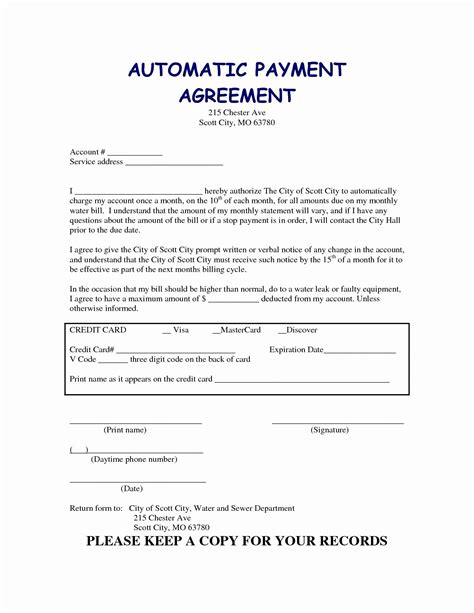

The application process for a commercial car loan involves several steps, each requiring careful attention to detail to ensure a successful outcome. The steps include: - Pre-approval: Before applying, it’s beneficial to get pre-approved for a loan to understand how much you can borrow. - Loan Application: Submitting the loan application along with all required documents. - Credit Check: The lender conducts a credit check on the business and its owners. - Loan Approval: The lender reviews the application and makes a decision on whether to approve the loan. - Loan Agreement: Once approved, the borrower signs a loan agreement that outlines the terms and conditions of the loan.

Importance of Thorough Preparation

Thorough preparation is crucial when dealing with commercial car loan paperwork. This includes: - Understanding Credit Scores: Knowing the business’s credit score and how it impacts loan eligibility and interest rates. - Gathering All Documents: Ensuring all required documents are ready and in order to avoid delays in the application process. - Comparing Loan Offers: Shopping around to compare loan terms from different lenders to find the most favorable deal. - Legal and Financial Advice: Consulting with legal and financial advisors to understand the implications of the loan agreement and to negotiate terms if necessary.

Common Challenges in Commercial Car Loan Paperwork

Despite the best preparations, borrowers may encounter challenges in the commercial car loan paperwork process. These can include: - Complexity of Documents: The sheer volume and complexity of the paperwork can be overwhelming. - Credit Issues: Poor credit scores can lead to higher interest rates or loan rejection. - Lack of Collateral: Businesses without sufficient collateral may find it difficult to secure a loan. - Strict Lender Requirements: Lenders may have strict requirements that not all businesses can meet.

📝 Note: It's essential to address these challenges proactively by seeking professional advice and carefully reviewing all documents before signing.

Best Practices for Managing Commercial Car Loan Paperwork

To manage commercial car loan paperwork effectively, consider the following best practices: - Maintain Organized Records: Keep all financial and business documents well-organized and easily accessible. - Regularly Review Credit Reports: Ensure credit reports are accurate and up-to-date to avoid any surprises during the loan application process. - Build a Strong Business Plan: A solid business plan demonstrates financial stability and growth potential, making the business more attractive to lenders. - Seek Professional Assistance: Utilize the services of financial advisors or attorneys to navigate complex legal and financial aspects of the loan agreement.

| Document | Purpose |

|---|---|

| Business License | Proves business legitimacy |

| Financial Statements | Demonstrates financial health |

| Tax Returns | Assesses income and tax obligations |

| Vehicle Details | Specifies the vehicle for purchase |

| Insurance Information | Covers the vehicle against risks |

In the end, securing a commercial car loan requires meticulous attention to the paperwork involved. By understanding the key documents required, navigating the application process smoothly, and being thoroughly prepared, businesses can overcome challenges and find the right loan to meet their needs. This involves not just completing the necessary paperwork but also making informed decisions about the loan terms and how they will impact the business’s financial future. As such, it’s not just about completing paperwork but about setting the business up for success with the right financing solutions.