5 Bankruptcy Papers

Understanding the Bankruptcy Process: 5 Essential Bankruptcy Papers

When an individual or a business is unable to pay their debts, they may consider filing for bankruptcy as a last resort. The bankruptcy process involves submitting various documents to the court, which can be overwhelming for those who are not familiar with the procedure. In this article, we will discuss the 5 essential bankruptcy papers that are typically required in a bankruptcy case.

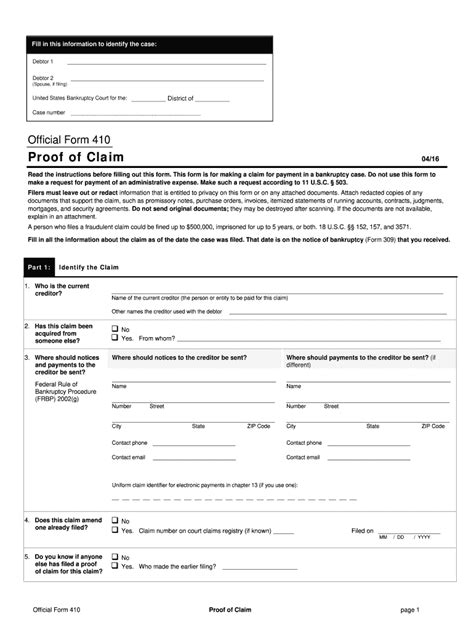

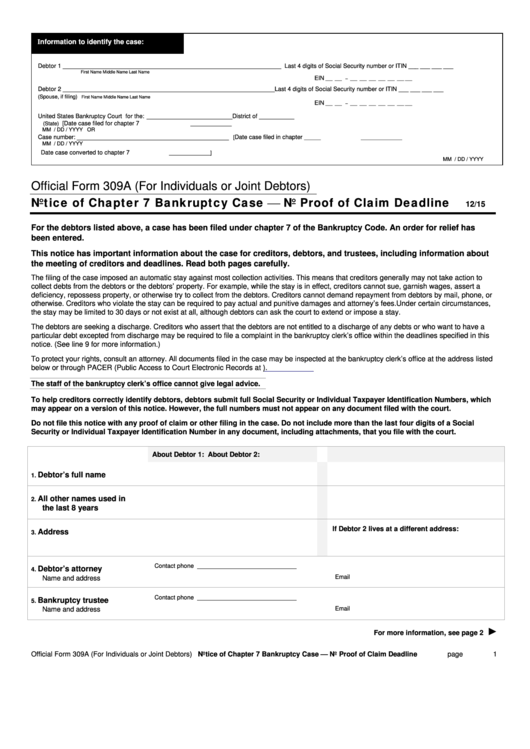

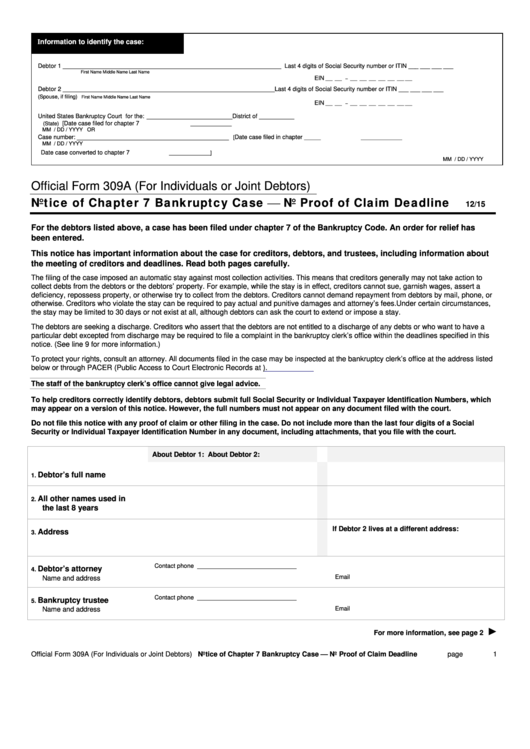

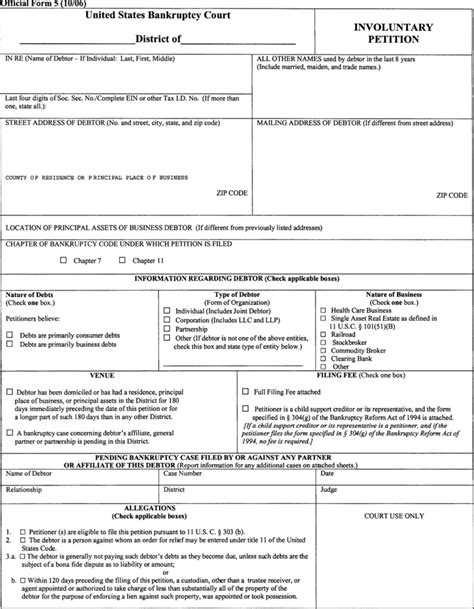

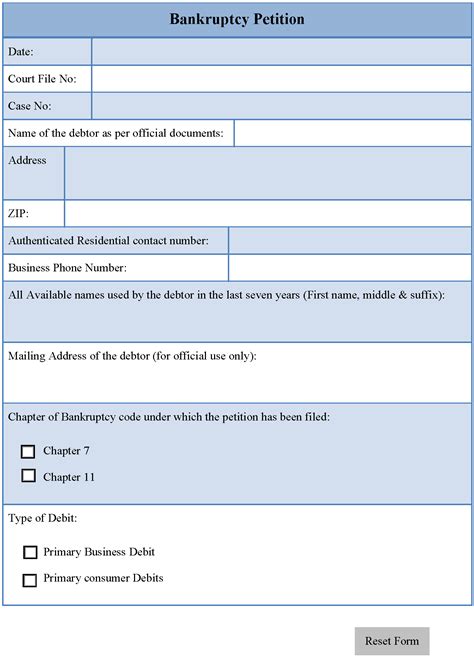

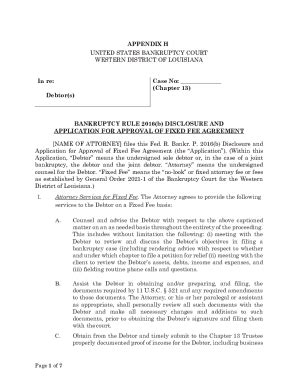

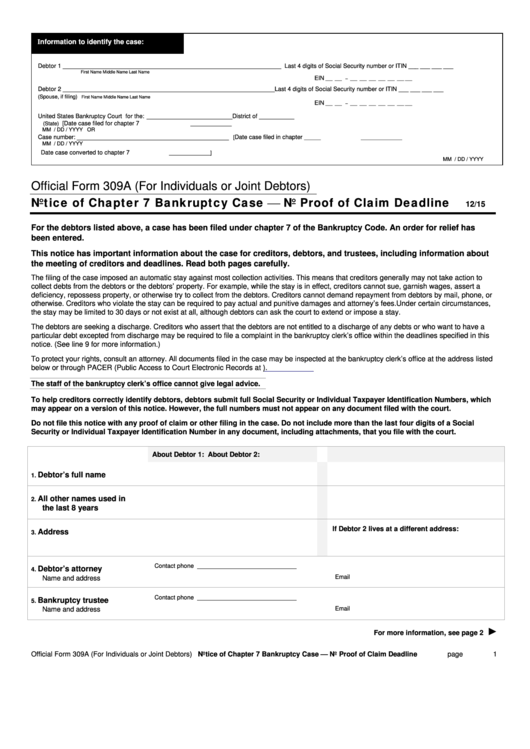

1. Voluntary Petition

The voluntary petition is the first document that initiates the bankruptcy process. It is a formal request to the court to declare the individual or business bankrupt. The petition includes basic information about the debtor, such as their name, address, and social security number. It also requires the debtor to specify the type of bankruptcy they are filing for, either Chapter 7 or Chapter 13. The voluntary petition is a critical document, as it sets the tone for the entire bankruptcy process.

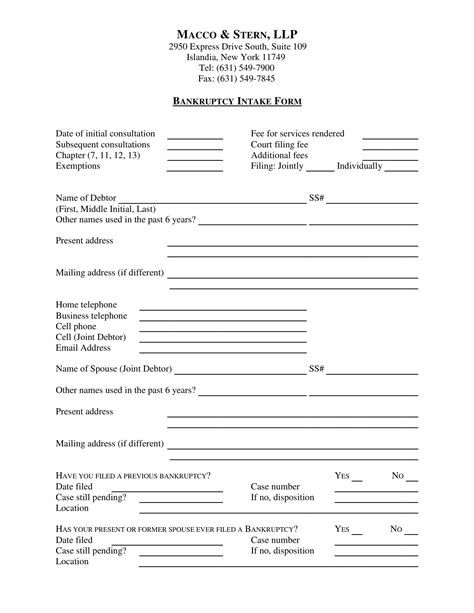

2. Schedules

Schedules are a series of forms that provide detailed information about the debtor’s financial situation. They include:

- Schedule A/B: Real property

- Schedule C: Exemptions

- Schedule D: Secured creditors

- Schedule E/F: Unsecured creditors

- Schedule G: Executory contracts and unexpired leases

- Schedule H: Co-signers

3. Statement of Financial Affairs

The Statement of Financial Affairs is a document that provides a comprehensive overview of the debtor’s financial transactions over the past two years. It includes information about:

- Income and expenses

- Assets and liabilities

- Creditors and debtors

- Business operations, if applicable

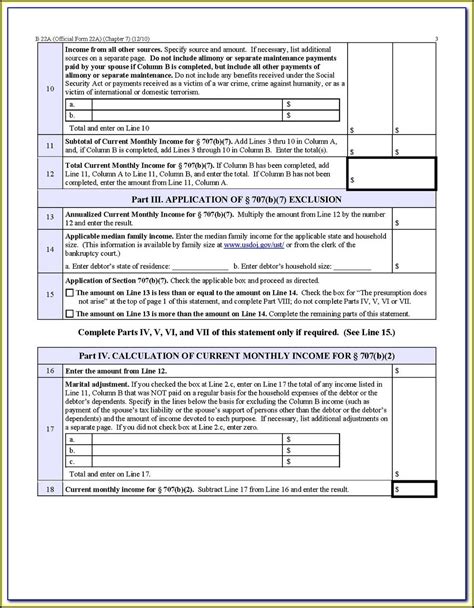

4. Means Test

The Means Test is a document that determines whether the debtor is eligible for Chapter 7 bankruptcy. It assesses the debtor’s income and expenses to determine whether they have sufficient disposable income to repay their debts. The Means Test is typically required for individuals with primarily consumer debts. Failure to complete the Means Test accurately can result in the court converting the case to Chapter 13 or dismissing it altogether.

5. Plan (Chapter 13 only)

In a Chapter 13 bankruptcy case, the debtor is required to submit a Plan that outlines how they intend to repay their debts over time. The Plan typically includes:

- A list of creditors and the amount to be paid to each

- A repayment schedule

- A description of the debtor’s income and expenses

📝 Note: It is essential to consult with a qualified bankruptcy attorney to ensure that all the necessary documents are completed accurately and submitted on time.

| Document | Description |

|---|---|

| Voluntary Petition | Initiates the bankruptcy process |

| Schedules | Provides detailed information about the debtor's financial situation |

| Statement of Financial Affairs | Provides a comprehensive overview of the debtor's financial transactions |

| Means Test | Determines whether the debtor is eligible for Chapter 7 bankruptcy |

| Plan (Chapter 13 only) | Outlines how the debtor intends to repay their debts over time |

In summary, the 5 essential bankruptcy papers are critical documents that play a crucial role in the bankruptcy process. They provide the court and the trustee with the necessary information to determine the debtor’s eligibility for bankruptcy and to develop a plan for repayment. By understanding the purpose and requirements of each document, debtors can navigate the bankruptcy process with confidence and take the first step towards financial recovery.

What is the purpose of the voluntary petition?

+

The voluntary petition is a formal request to the court to declare the individual or business bankrupt. It initiates the bankruptcy process and provides basic information about the debtor.

What is the difference between Chapter 7 and Chapter 13 bankruptcy?

+

Chapter 7 bankruptcy involves the liquidation of assets to repay debts, while Chapter 13 bankruptcy involves the development of a repayment plan to pay off debts over time.

What is the role of the trustee in a bankruptcy case?

+

The trustee is responsible for overseeing the bankruptcy process, reviewing the debtor’s documents, and ensuring that the debtor complies with the terms of the bankruptcy plan.