Nonprofit Paperwork Requirements

Introduction to Nonprofit Paperwork Requirements

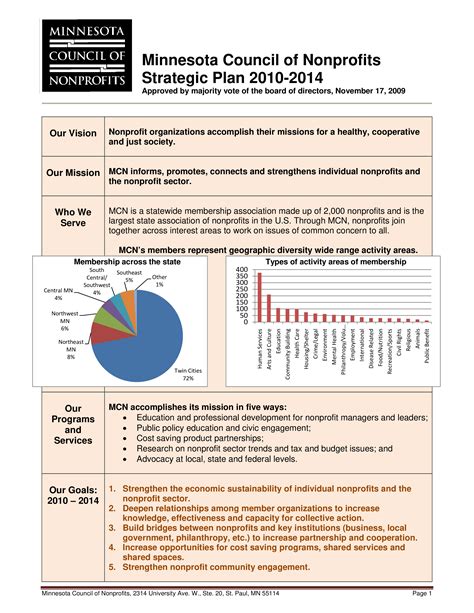

Starting a nonprofit organization can be a daunting task, especially when it comes to navigating the complex world of paperwork requirements. Nonprofit organizations are required to comply with various federal, state, and local regulations, which can be overwhelming for those who are new to the nonprofit sector. In this article, we will provide an overview of the key paperwork requirements for nonprofit organizations, including incorporation documents, tax exemption applications, and annual reporting requirements.

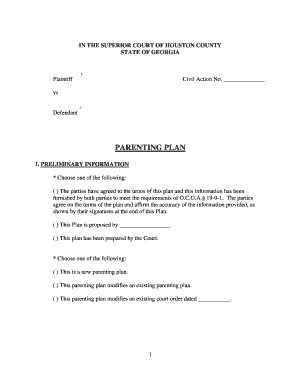

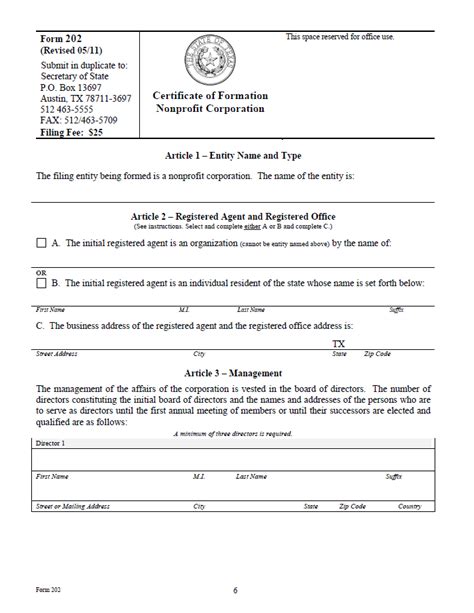

Incorporation Documents

The first step in establishing a nonprofit organization is to incorporate the organization in the state where it will operate. This involves filing articles of incorporation with the state’s business registration office. The articles of incorporation must include certain information, such as the organization’s name, purpose, and address. Additionally, nonprofits must also draft bylaws, which outline the organization’s governance structure, voting procedures, and other key policies.

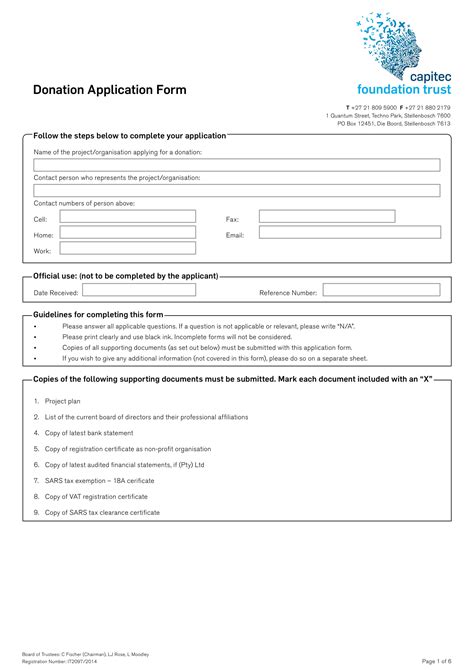

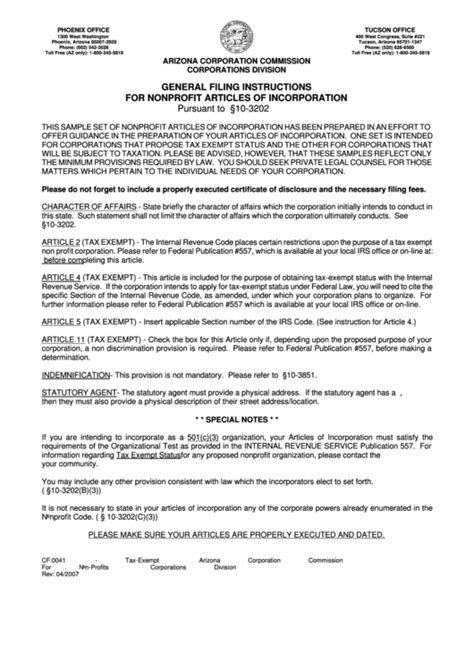

Tax Exemption Applications

To qualify for tax-exempt status, nonprofits must apply for recognition of exemption with the Internal Revenue Service (IRS). This involves filing Form 1023, which requires detailed information about the organization’s mission, activities, and financial projections. The IRS will review the application to ensure that the organization meets the requirements for tax-exempt status, including the public benefit requirement and the non-distribution constraint.

Annual Reporting Requirements

Once a nonprofit organization has obtained tax-exempt status, it must file annual information returns with the IRS. These returns, which are typically filed on Form 990, require nonprofits to report on their financial activities, governance practices, and compliance with federal tax laws. Additionally, nonprofits may also be required to file state and local annual reports, which may include information on the organization’s charitable activities, fundraising practices, and governance structure.

| Type of Filing | Purpose | Frequency |

|---|---|---|

| Articles of Incorporation | To establish the organization's existence and purpose | One-time filing |

| Form 1023 | To apply for recognition of tax-exempt status | One-time filing |

| Form 990 | To report on the organization's financial activities and governance practices | Annual filing |

| State and Local Annual Reports | To report on the organization's charitable activities and compliance with state and local laws | Annual filing |

📝 Note: Nonprofit organizations must ensure that they comply with all applicable federal, state, and local regulations, including those related to fundraising, governance, and financial reporting.

Compliance with State and Local Regulations

In addition to federal regulations, nonprofit organizations must also comply with state and local laws that govern their activities. This may include registering with the state’s charity registration office, obtaining business licenses, and complying with local zoning ordinances. Nonprofits must also ensure that they are in compliance with state and local tax laws, including those related to sales tax, property tax, and employment tax.

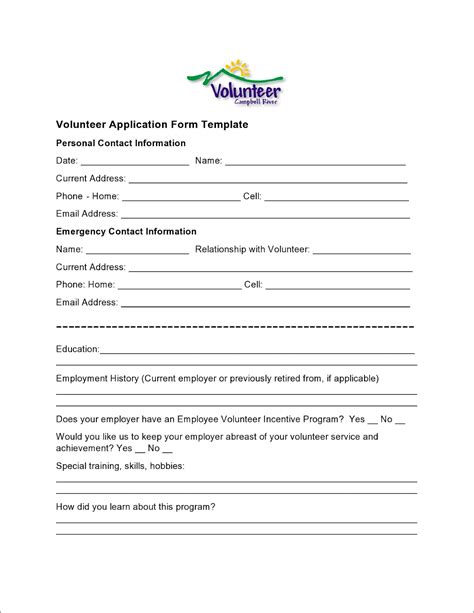

Best Practices for Managing Nonprofit Paperwork

To ensure compliance with all applicable regulations, nonprofit organizations should establish robust record-keeping systems and compliance protocols. This may include designating a compliance officer to oversee the organization’s regulatory affairs, as well as implementing policies and procedures for managing paperwork and reporting requirements. Nonprofits should also stay up-to-date on changes to federal, state, and local regulations that may affect their operations.

In the end, navigating the complex world of nonprofit paperwork requirements requires careful planning, attention to detail, and a commitment to compliance. By understanding the key requirements and best practices outlined in this article, nonprofit organizations can ensure that they are in compliance with all applicable regulations and can focus on their mission to serve the public good.

What is the purpose of the articles of incorporation?

+

The articles of incorporation establish the organization’s existence and purpose, and must include certain information, such as the organization’s name, purpose, and address.

What is the difference between Form 1023 and Form 990?

+

Form 1023 is used to apply for recognition of tax-exempt status, while Form 990 is used to report on the organization’s financial activities and governance practices on an annual basis.

What are the consequences of noncompliance with nonprofit paperwork requirements?

+

Noncompliance with nonprofit paperwork requirements can result in penalties, fines, and even the loss of tax-exempt status. It is essential for nonprofit organizations to ensure compliance with all applicable regulations to avoid these consequences.