Paperwork

New Job Paperwork Requirements

Introduction to New Job Paperwork Requirements

When starting a new job, there are numerous paperwork requirements that must be completed to ensure a smooth transition into the company. These requirements vary depending on the country, state, or industry, but they generally include tax forms, benefit enrollments, and contract agreements. In this article, we will delve into the specifics of new job paperwork requirements, highlighting the key documents and procedures involved.

Pre-Employment Paperwork

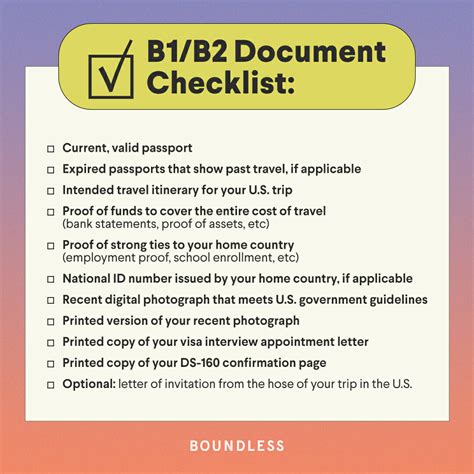

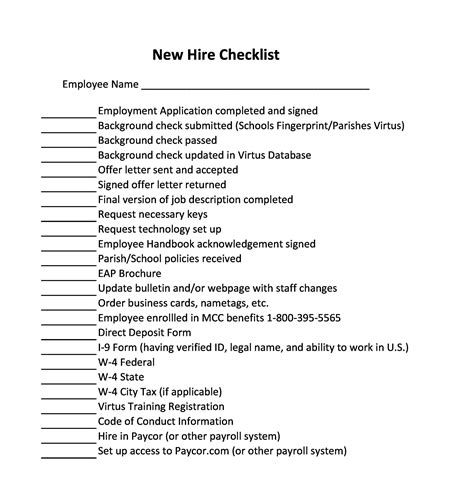

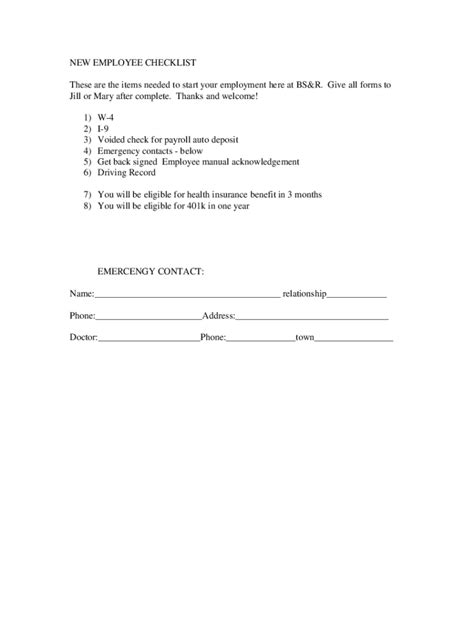

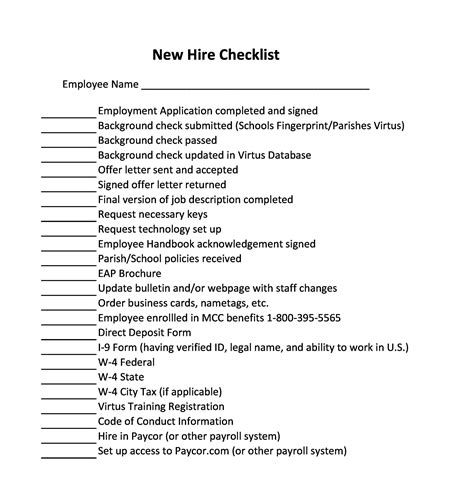

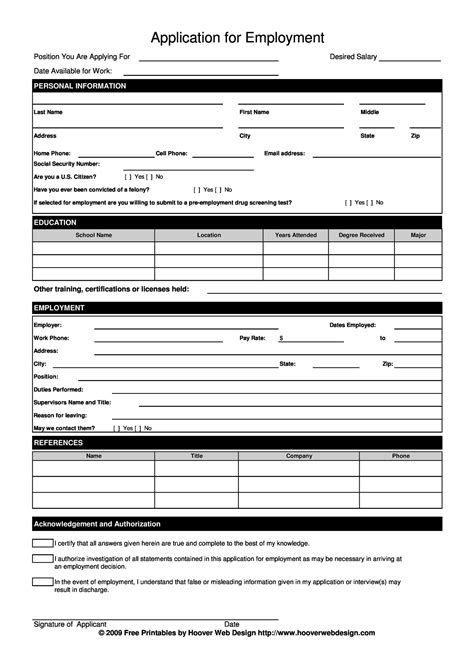

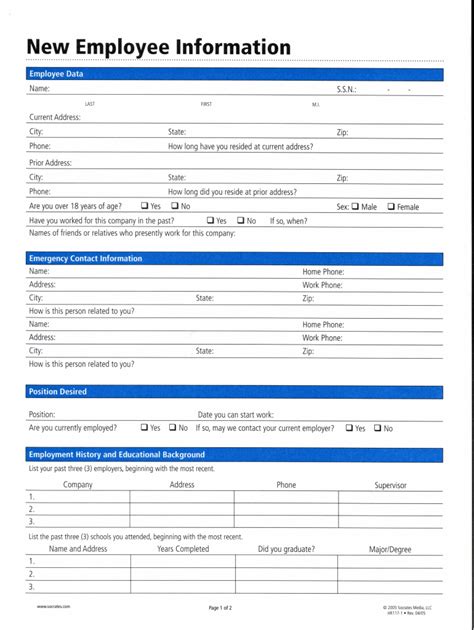

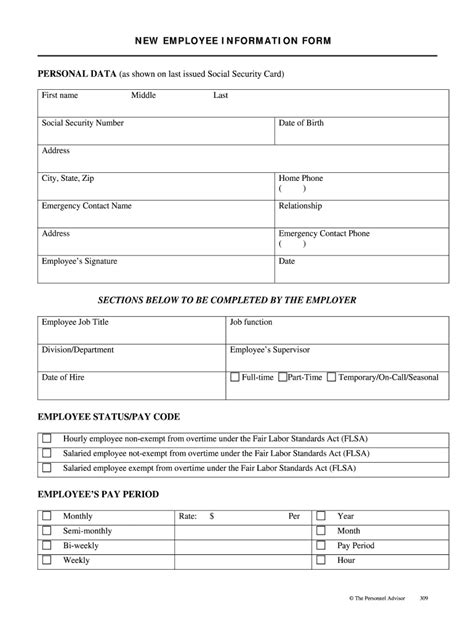

Before the first day of work, employees are typically required to complete pre-employment paperwork. This may include: * Job application forms: Providing personal and professional details to the employer. * Resume and cover letter: Submitting a resume and cover letter to highlight relevant skills and experience. * References: Providing professional references to verify previous work experience. * Background checks: Undergoing background checks to ensure a clean record. * Drug tests: Participating in drug tests to ensure a safe working environment.

📝 Note: The pre-employment paperwork requirements may vary depending on the company and industry.

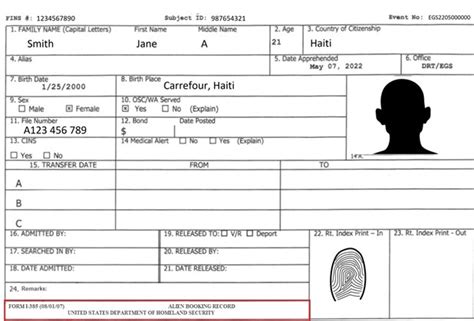

Tax Forms and Benefits

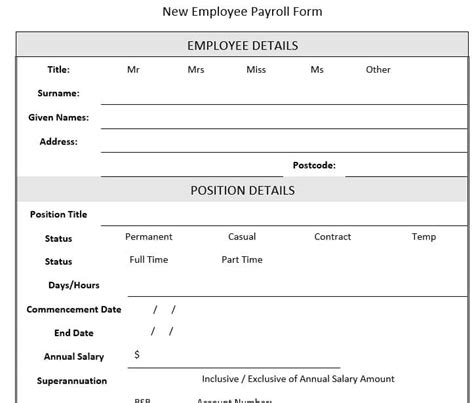

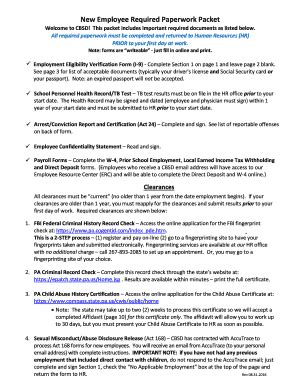

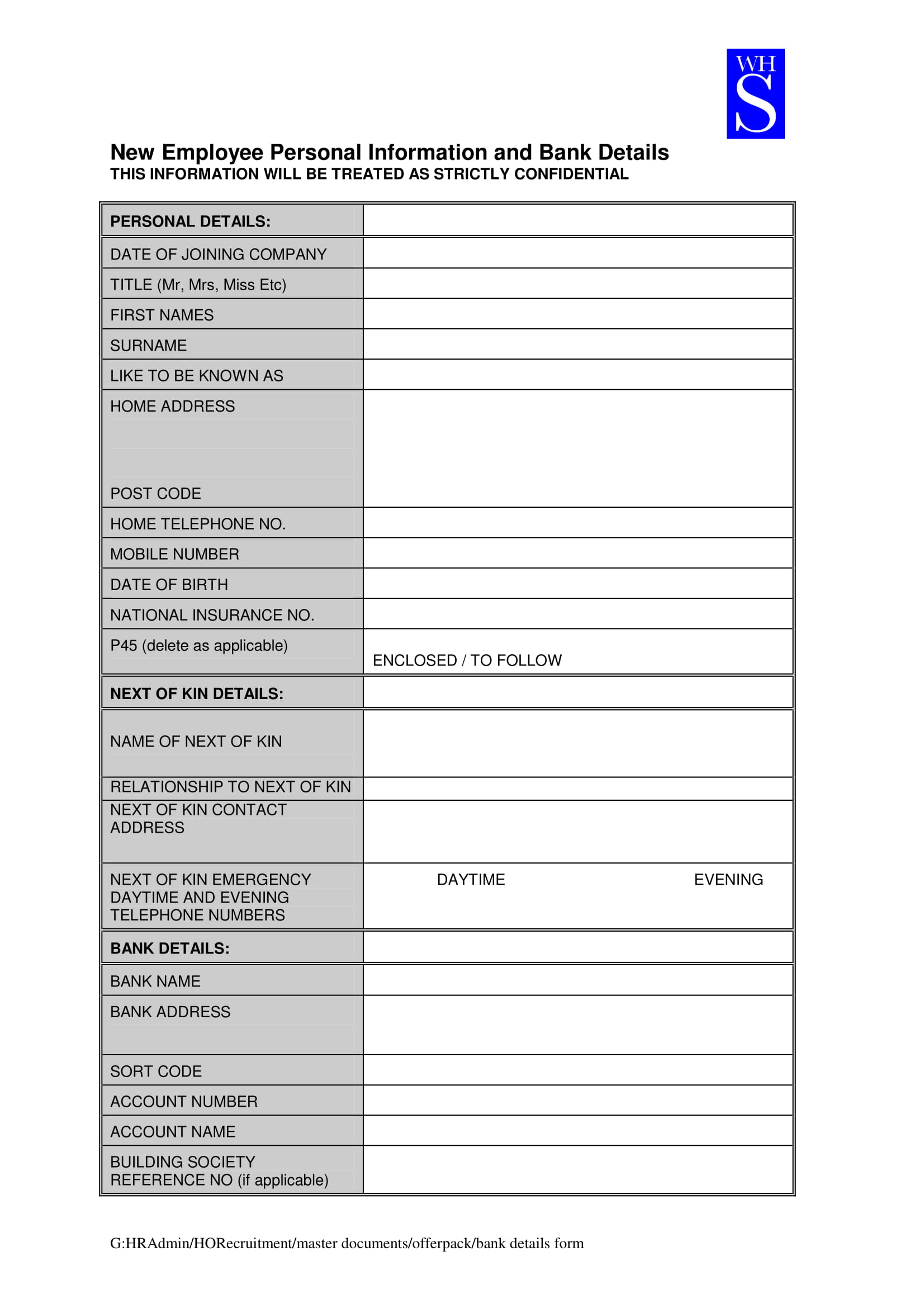

Once hired, employees must complete tax forms and benefit enrollments. This includes: * W-4 forms: Completing W-4 forms to determine tax withholding. * I-9 forms: Completing I-9 forms to verify employment eligibility. * Benefits enrollment: Enrolling in company-sponsored benefits, such as health insurance, retirement plans, and life insurance. * Direct deposit forms: Setting up direct deposit to receive paychecks electronically.

Contract Agreements

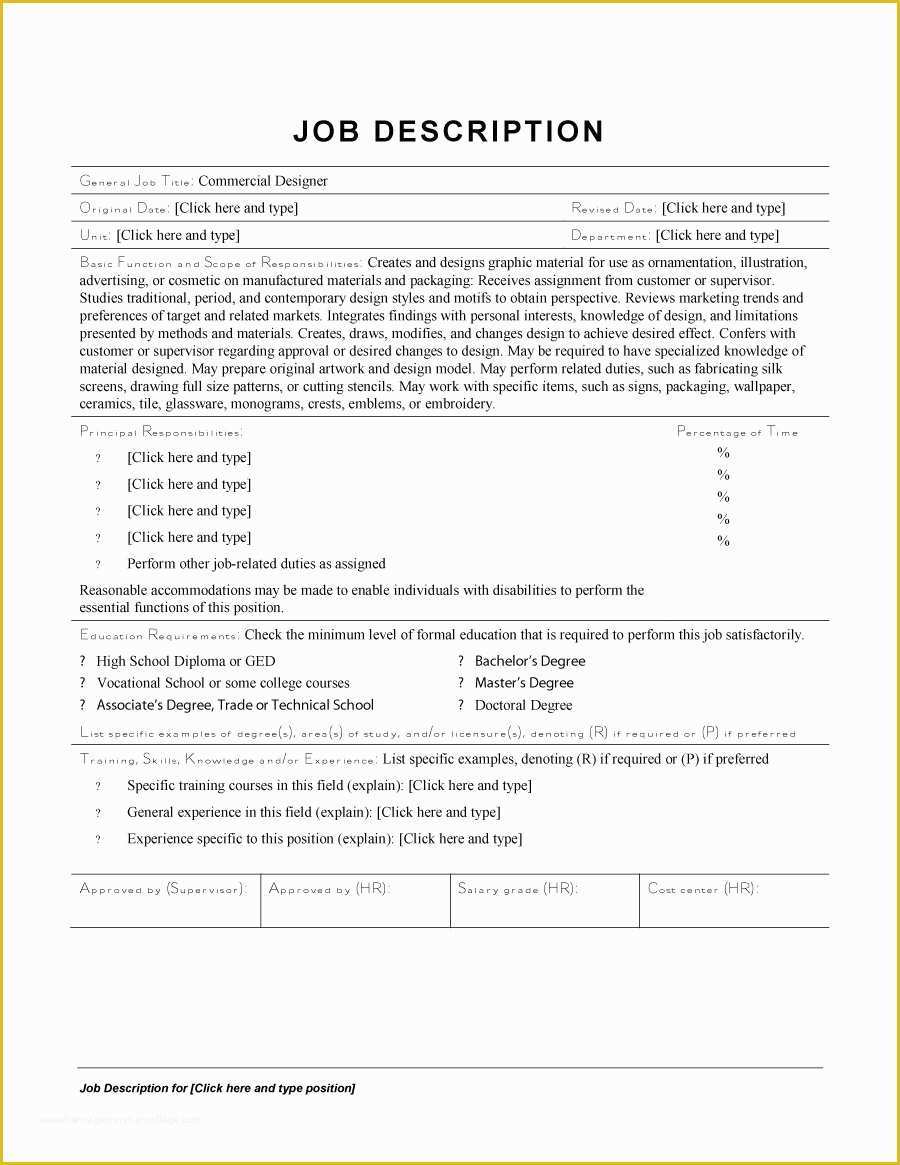

Contract agreements are a crucial part of new job paperwork requirements. These agreements outline the terms and conditions of employment, including: * Employment contracts: Defining the employment relationship, job responsibilities, and compensation. * Non-disclosure agreements: Protecting company confidential information. * Non-compete agreements: Restricting employees from working with competitors. * Intellectual property agreements: Assigning ownership of intellectual property created during employment.

Other Requirements

In addition to the above-mentioned paperwork, employees may need to complete other requirements, such as: * Employee handbooks: Reviewing and acknowledging company policies and procedures. * Training programs: Participating in training programs to develop job-specific skills. * Security clearances: Obtaining security clearances for sensitive or restricted areas.

Importance of Accurate Paperwork

Accurate and timely completion of new job paperwork requirements is essential to avoid delays or complications in the hiring process. Inaccurate or incomplete paperwork can lead to: * Delayed start dates: Postponing the start date due to incomplete paperwork. * Benefits delays: Delaying benefits enrollment, resulting in missed opportunities or penalties. * Tax issues: Encountering tax-related problems due to incorrect or incomplete tax forms.

Best Practices for Completing Paperwork

To ensure a seamless onboarding process, employees should: * Carefully review and complete paperwork: Double-checking forms for accuracy and completeness. * Ask questions: Clarifying any doubts or concerns with the employer or HR representative. * Keep records: Maintaining a copy of completed paperwork for personal records. * Follow up: Verifying that all paperwork has been received and processed by the employer.

Conclusion and Final Thoughts

In conclusion, new job paperwork requirements are an essential part of the hiring process. By understanding the various documents and procedures involved, employees can ensure a smooth transition into their new role. It is crucial to carefully review and complete paperwork, ask questions, and keep records to avoid any potential issues. By following these best practices, employees can focus on their new job and start building a successful career.

What are the most common new job paperwork requirements?

+

The most common new job paperwork requirements include tax forms, benefit enrollments, contract agreements, and pre-employment paperwork, such as job application forms and background checks.

Why is accurate paperwork important for new employees?

+

Accurate paperwork is essential to avoid delays or complications in the hiring process, such as delayed start dates, benefits delays, or tax issues.

What are some best practices for completing new job paperwork?

+

Best practices for completing new job paperwork include carefully reviewing and completing forms, asking questions, keeping records, and following up to ensure all paperwork has been received and processed.