Paperwork

5 Papers Need DLN

Introduction to Digital Loan Numbers (DLN)

In the realm of financial transactions and loan processing, efficiency and accuracy are paramount. One crucial element that ensures the smooth operation of loan applications and their subsequent management is the Digital Loan Number (DLN). The DLN is a unique identifier assigned to each loan application, facilitating easy tracking, retrieval, and management of loan documents. This article delves into the importance of DLNs, especially highlighting five papers that necessitate a DLN for their processing and why this requirement is indispensable in contemporary financial practices.

Understanding Digital Loan Numbers (DLNs)

A Digital Loan Number (DLN) is essentially a barcode or a unique code generated for each loan application. This code contains vital information about the loan, such as the borrower’s details, loan amount, interest rate, and repayment terms. The use of DLNs has revolutionized the loan processing industry by making it more efficient, secure, and less prone to errors. By scanning the DLN, financial institutions can instantly access the loan details, thereby streamlining the application review process, loan disbursal, and subsequent loan management activities.

5 Papers That Need a DLN

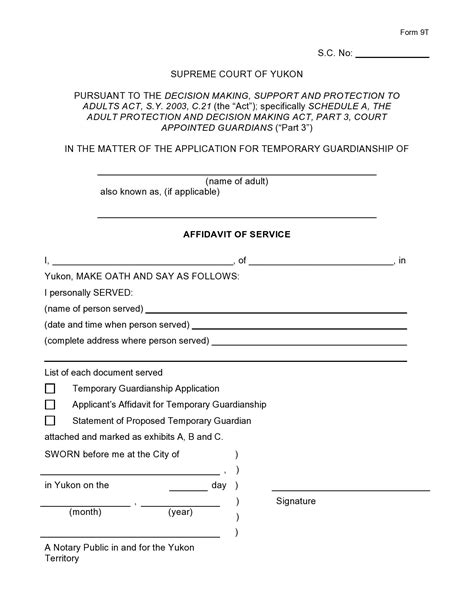

Several documents are critical in the loan application and processing cycle. The following five papers are particularly important and require a DLN for efficient and secure processing:

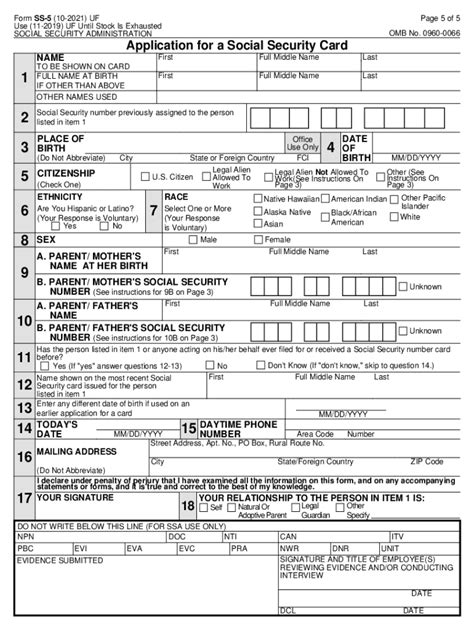

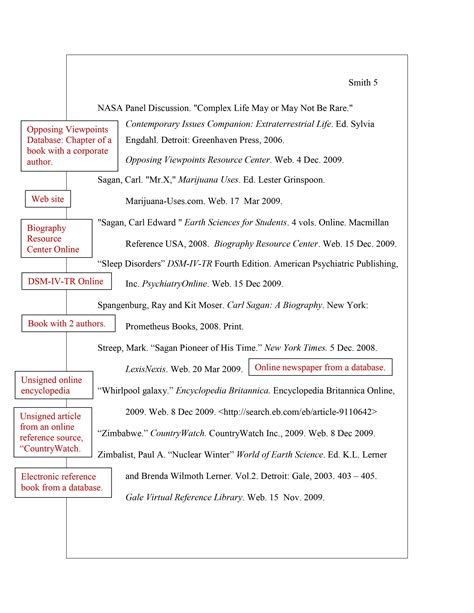

- Loan Application Form: The primary document in any loan process, the loan application form contains detailed information about the borrower and the loan requirements. Assigning a DLN to this form helps in easy identification and tracking of the application.

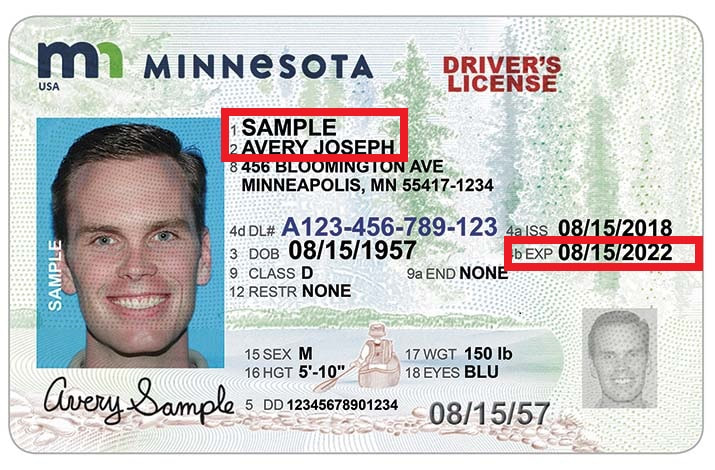

- Identity Proof Documents: Documents such as passports, driver’s licenses, or national IDs are crucial for verifying the borrower’s identity. A DLN on these documents ensures they are linked to the correct loan application and borrower.

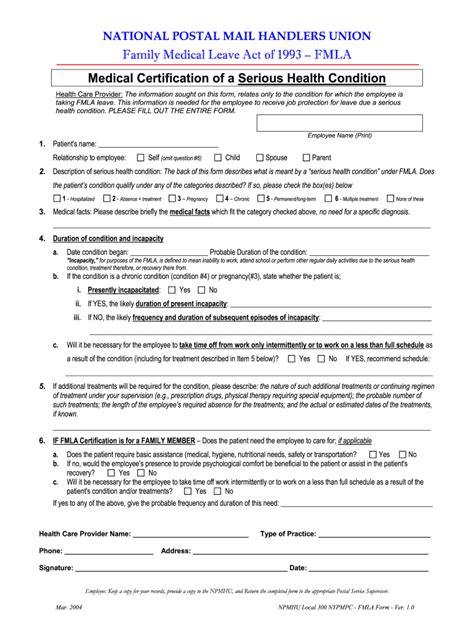

- Income Proof Documents: Pay slips, bank statements, or tax returns are essential for assessing the borrower’s creditworthiness. A DLN on these documents facilitates quick verification and assessment of the borrower’s financial status.

- Collateral Documents: For secured loans, documents related to the collateral (such as property deeds or vehicle registration) are critical. A DLN helps in linking these documents to the loan application, ensuring that the collateral is correctly identified and valued.

- Loan Agreement Contract: The final contract between the lender and borrower outlines the terms and conditions of the loan. Including a DLN in this contract ensures that all parties can easily reference the specific loan details.

Benefits of Using DLNs

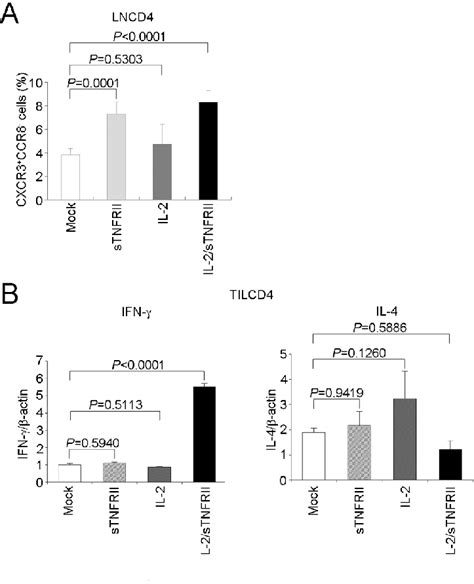

The integration of DLNs in loan processing offers several benefits, including: - Enhanced Efficiency: DLNs enable quick access to loan information, reducing the time spent on manual searches and data entry. - Improved Accuracy: By linking documents directly to the loan application, DLNs minimize the chance of errors or misfiling. - Increased Security: DLNs can be encrypted, providing an additional layer of security against unauthorized access to sensitive loan information. - Better Customer Experience: The efficiency and accuracy provided by DLNs contribute to faster loan processing times, improving customer satisfaction.

Implementing DLNs in Financial Institutions

The implementation of DLNs in financial institutions involves several steps: - Software Integration: Financial institutions need to integrate DLN generation and scanning capabilities into their existing loan management systems. - Staff Training: Employees must be trained to generate, apply, and scan DLNs correctly, as well as understand the benefits and proper use of this technology. - Customer Education: Borrowers should be informed about the purpose and benefits of DLNs to ensure their cooperation and understanding throughout the loan process. - Security Measures: Institutions must implement robust security measures to protect DLNs from unauthorized access or tampering.

📝 Note: The successful implementation of DLNs requires careful planning, thorough training, and ongoing evaluation to ensure that the system operates effectively and securely.

Future of DLNs in Loan Processing

As technology continues to evolve, the role of DLNs in loan processing is likely to expand. Artificial Intelligence (AI) and Machine Learning (ML) can be integrated with DLN systems to further automate loan assessment and decision-making processes. Moreover, the use of Blockchain technology could provide an additional layer of security and transparency in DLN management. The future of loan processing will undoubtedly be shaped by advancements in digital technologies, with DLNs playing a central role in enhancing efficiency, security, and customer experience.

In summary, Digital Loan Numbers are a critical component of modern loan processing, offering numerous benefits in terms of efficiency, accuracy, and security. The five papers that necessitate a DLN - loan application form, identity proof documents, income proof documents, collateral documents, and loan agreement contract - highlight the comprehensive nature of DLNs in loan management. As financial institutions continue to adopt and refine DLN systems, the future of loan processing promises to be more streamlined, secure, and customer-centric than ever before.