7 Tax Papers Needed

Introduction to Tax Papers

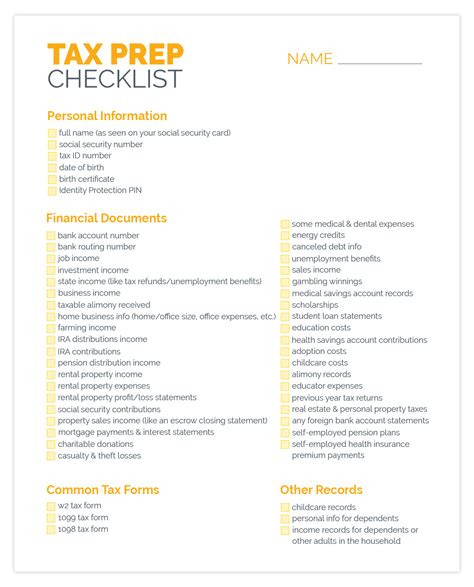

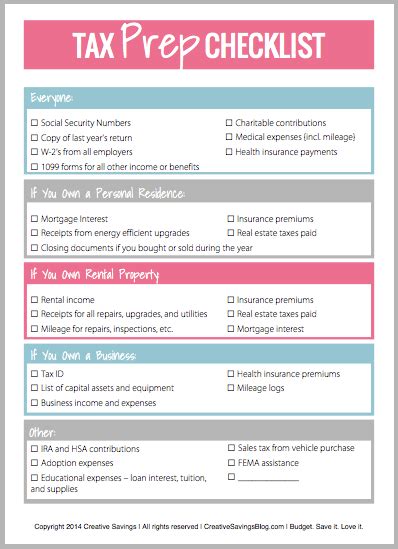

When it comes to filing taxes, having the right documents is crucial. The process can be overwhelming, especially for those who are new to it. Understanding what tax papers are needed can make a significant difference in ensuring that your tax filing is accurate and efficient. In this article, we will delve into the seven essential tax papers that you should be aware of.

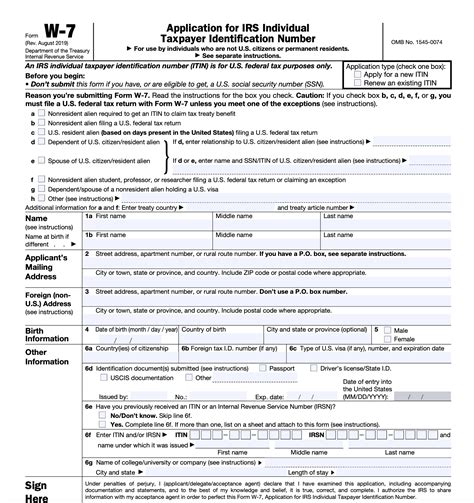

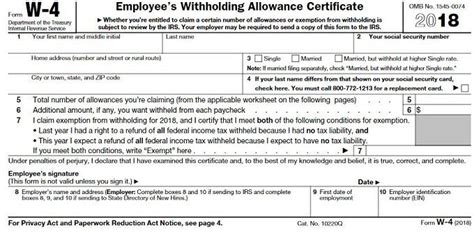

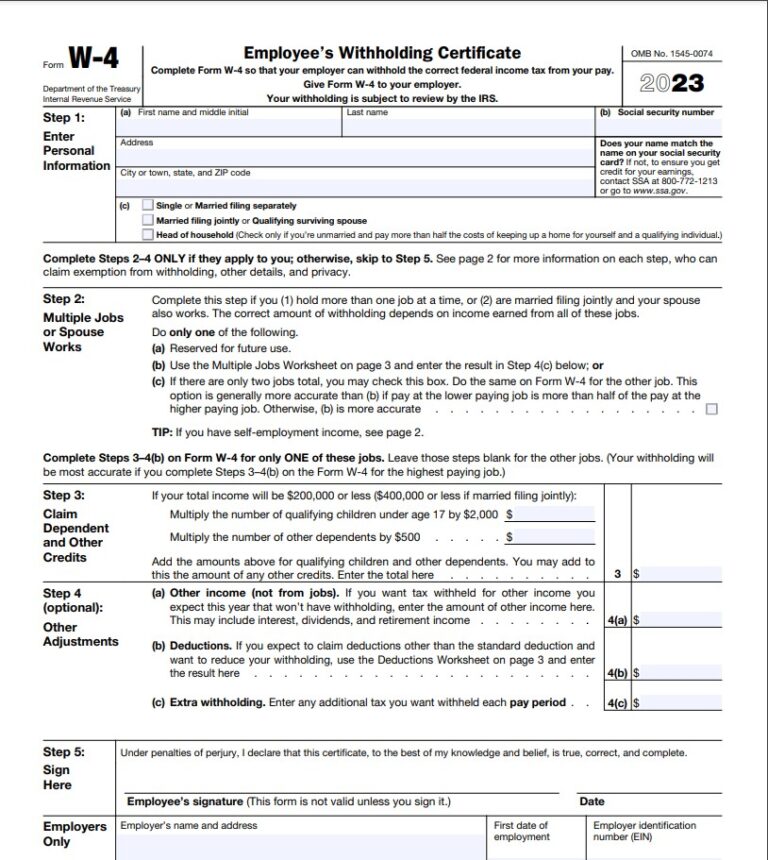

1. W-2 Forms

The W-2 form is one of the most critical tax papers you will need. It is provided by your employer and outlines your income and the taxes withheld from your paycheck. You should receive a W-2 form from each of your employers by January 31st of each year. This form is essential for reporting your income and calculating your tax refund or liability.

2. 1099 Forms

If you are self-employed or have earned income from freelance work, 1099 forms are what you will need. These forms report your income from various sources, such as freelance work, interest, dividends, and capital gains. Like the W-2, you should receive 1099 forms by January 31st. There are different types of 1099 forms, including: - 1099-MISC for miscellaneous income - 1099-INT for interest income - 1099-DIV for dividend income - 1099-B for proceeds from broker and barter exchange transactions

3. Interest Statements (1099-INT)

Your bank will provide you with a 1099-INT form if you have earned more than $10 in interest from your accounts. This includes interest from savings accounts, certificates of deposit (CDs), and bonds. You will need this form to report your interest income on your tax return.

4. Dividend Statements (1099-DIV)

If you have investments in stocks or mutual funds, you will receive a 1099-DIV form from your brokerage firm. This form reports the dividends you have earned from your investments. Like interest income, dividend income is subject to taxation and must be reported on your tax return.

5. Capital Gains Statements (1099-B)

When you sell stocks, bonds, or other investments, you will receive a 1099-B form from your brokerage firm. This form reports the proceeds from the sale of your investments. You will use this information to calculate your capital gains or losses on your tax return.

6. Charitable Donation Receipts

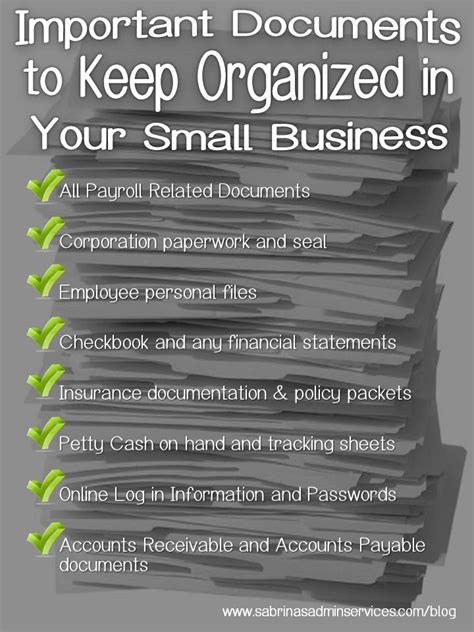

If you have made charitable donations throughout the year, you can deduct these on your tax return. You will need receipts from the charitable organizations to support your deductions. Make sure to keep these receipts organized, as you will need to report the total amount of your donations on your tax return.

7. Mortgage Interest Statements (1098)

If you are a homeowner, you can deduct the mortgage interest you paid on your tax return. Your lender will provide you with a 1098 form that reports the amount of interest you paid on your mortgage. This can be a significant deduction, so make sure to keep this form handy when filing your taxes.

📝 Note: Always verify the accuracy of the information on your tax papers and keep them organized to ensure a smooth tax-filing process.

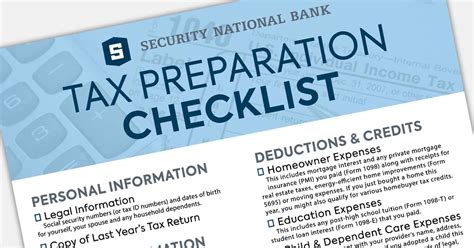

To further illustrate the importance of these tax papers, consider the following benefits: - Accurate Reporting: Having the right tax papers ensures that you report your income and deductions accurately, reducing the risk of errors or audits. - Maximized Refunds: With all the necessary tax papers, you can claim all the deductions and credits you are eligible for, potentially increasing your refund. - Efficient Filing: Being organized with your tax papers saves time and reduces stress during the tax-filing process.

In summary, having the right tax papers is essential for a smooth and accurate tax-filing experience. By understanding what tax papers you need and keeping them organized, you can ensure that you take advantage of all the deductions and credits available to you, potentially maximizing your refund. With the seven essential tax papers outlined in this article, you will be well-prepared to tackle your tax filing with confidence.

What is the deadline for receiving tax papers from employers and financial institutions?

+

Typically, you should receive your tax papers, such as W-2 and 1099 forms, by January 31st of each year.

Can I file my taxes without all the necessary tax papers?

+

While it’s possible to start the tax-filing process without all your tax papers, it’s highly recommended to wait until you have all the necessary documents to ensure accuracy and avoid potential issues with the IRS.

How do I handle errors or discrepancies on my tax papers?

+

If you notice any errors or discrepancies on your tax papers, contact the issuer (employer, bank, etc.) as soon as possible to request corrections. This will help ensure the accuracy of your tax return and prevent potential audits.