Selling Apartment in Colombia Paperwork

Introduction to Selling an Apartment in Colombia

Selling an apartment in Colombia can be a complex process, involving various legal and administrative steps. The country’s real estate market has experienced significant growth in recent years, attracting both local and foreign investors. However, navigating the paperwork and regulations involved in selling a property can be daunting, especially for those unfamiliar with the Colombian legal system. In this article, we will guide you through the necessary steps and documents required to sell an apartment in Colombia, ensuring a smooth and successful transaction.

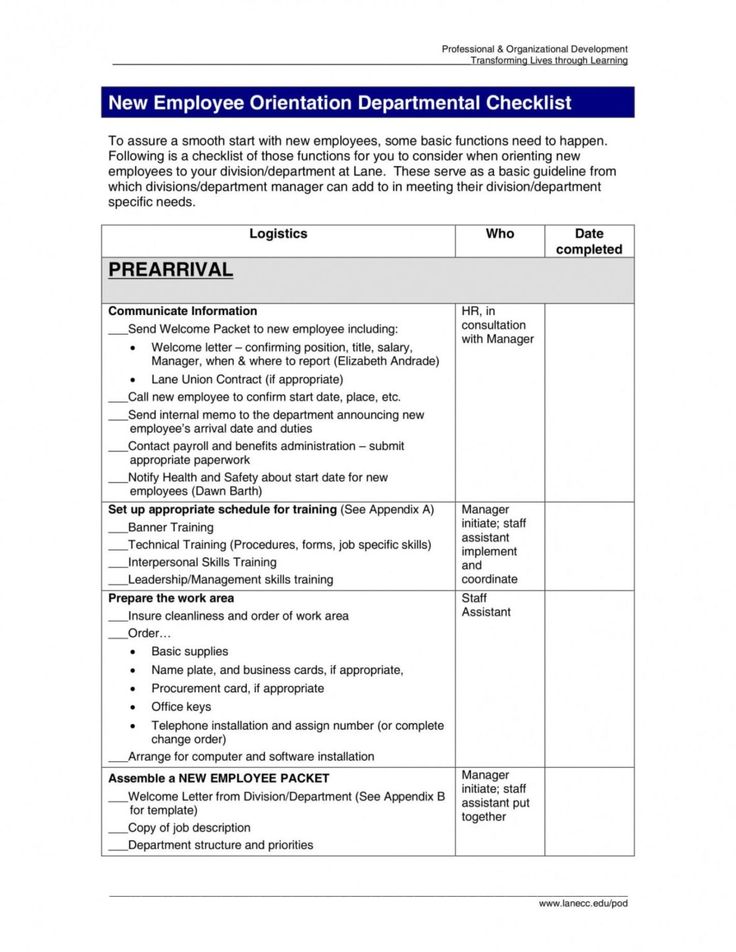

Pre-Sale Preparations

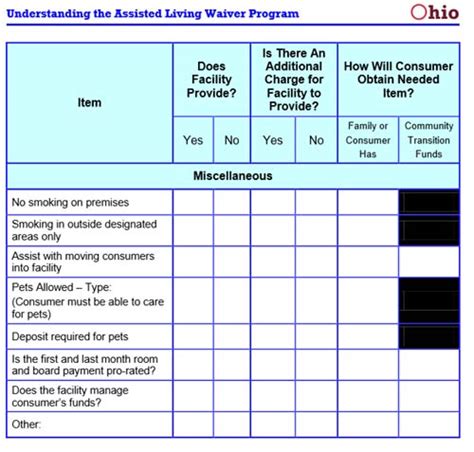

Before putting your apartment on the market, it’s essential to gather all the necessary documents and prepare your property for sale. This includes: * Obtaining a Registro de Propiedad (Property Registry) to confirm your ownership of the apartment * Gathering certificados de libertad (certificates of freedom) to ensure there are no outstanding debts or liens on the property * Obtaining a certificado de tradición y registro (certificate of tradition and registry) to verify the property’s history and ownership * Preparing a ficha técnica (technical sheet) with detailed information about the apartment, including its size, location, and amenities * Taking high-quality photos and videos of the apartment to showcase its condition and features

The Sales Process

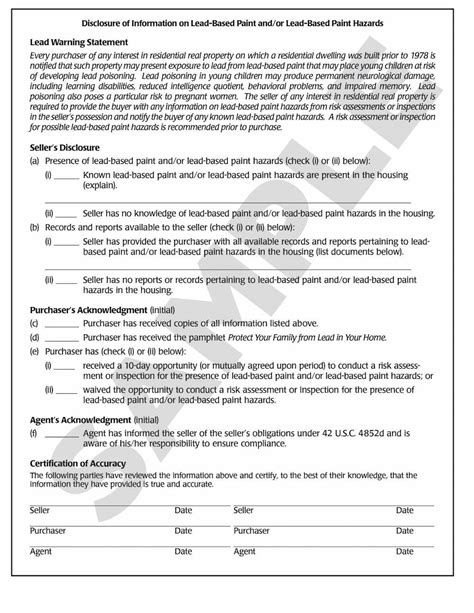

Once you have prepared your apartment for sale, you can start marketing it to potential buyers. This may involve working with a real estate agent or listing your property online. When a buyer is found, the sales process typically involves the following steps: * Negotiating the sale price and terms of the sale * Signing a contrato de promesa de compraventa (promise to purchase agreement) outlining the terms of the sale * Conducting a due diligence review of the property to ensure there are no hidden issues or defects * Obtaining autorización de venta (sale authorization) from the property’s administrator or homeowners’ association, if applicable * Signing the escritura pública de compraventa (public deed of sale) at a notary public’s office, which formalizes the transfer of ownership

Taxes and Fees

Selling an apartment in Colombia involves various taxes and fees, including: * Impuesto de registro (registry tax): 0.5% of the sale price * Impuesto de timbre (stamp tax): 0.5% of the sale price * Impuesto sobre la renta (income tax): 10% to 33% of the capital gain, depending on the seller’s tax status * Honorarios notariales (notary fees): 0.5% to 1% of the sale price * Comisión de corretaje (real estate commission): 2% to 5% of the sale price, depending on the agent’s fee structure

| Tax/Fee | Rate | Payment Responsibility |

|---|---|---|

| Impuesto de registro | 0.5% of sale price | Buyer |

| Impuesto de timbre | 0.5% of sale price | Buyer |

| Impuesto sobre la renta | 10% to 33% of capital gain | Seller |

| Honorarios notariales | 0.5% to 1% of sale price | Buyer |

| Comisión de corretaje | 2% to 5% of sale price | Seller |

📝 Note: The payment responsibility for taxes and fees may vary depending on the specific terms of the sale and the parties involved.

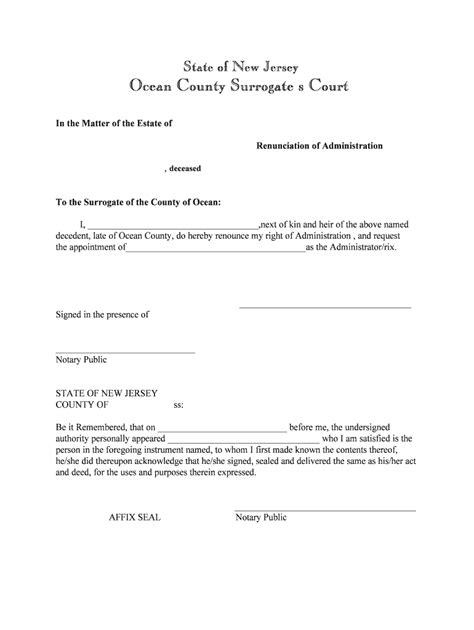

Post-Sale Procedures

After the sale is complete, the buyer and seller must fulfill various post-sale procedures, including: * Registering the property transfer with the Registro de Propiedad (Property Registry) * Obtaining a certificado de tradición y registro (certificate of tradition and registry) to verify the property’s new ownership * Notifying the property’s administrator or homeowners’ association of the change in ownership * Updating the property’s tax records with the Departamento Administrativo Nacional de Estadística (DANE) (National Administrative Department of Statistics)

In the final stages of selling an apartment in Colombia, it is crucial to ensure that all necessary documents are in order and that the transfer of ownership is properly registered. This will help prevent any potential issues or disputes in the future.

To recap, selling an apartment in Colombia requires careful preparation, attention to detail, and a thorough understanding of the country’s real estate laws and regulations. By following the steps outlined in this article, sellers can navigate the complex process with confidence and ensure a successful transaction. With the right guidance and support, selling an apartment in Colombia can be a smooth and profitable experience.