Used Vehicle Purchase Tax Paperwork

Introduction to Used Vehicle Purchase Tax Paperwork

When purchasing a used vehicle, there are several factors to consider, including the price, condition, and history of the vehicle. However, one aspect that is often overlooked is the tax implications of the purchase. In this blog post, we will delve into the world of used vehicle purchase tax paperwork, exploring the various forms and documents required to ensure a smooth and compliant transaction.

Understanding the Tax Implications of Used Vehicle Purchases

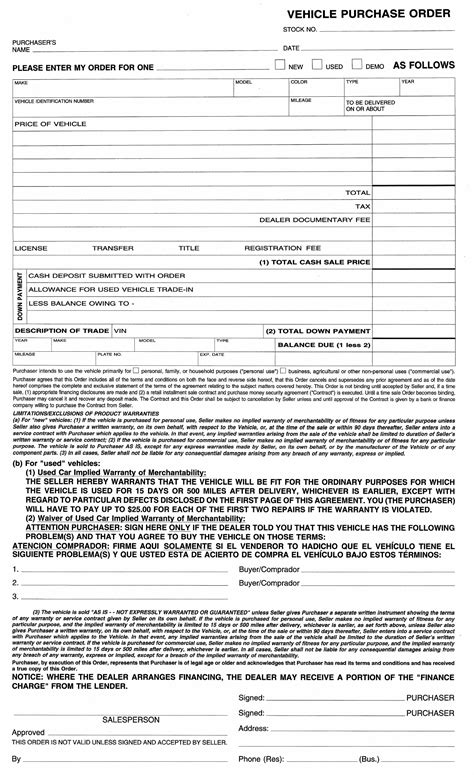

The tax implications of purchasing a used vehicle can be complex and vary depending on the jurisdiction. In general, the buyer is responsible for paying sales tax on the purchase price of the vehicle, which can range from 2-8% of the total cost. Additionally, there may be other fees and taxes associated with the purchase, such as title fees, registration fees, and documentary fees. It is essential to understand these tax implications to avoid any unexpected surprises or penalties.

Required Documents for Used Vehicle Purchase Tax Paperwork

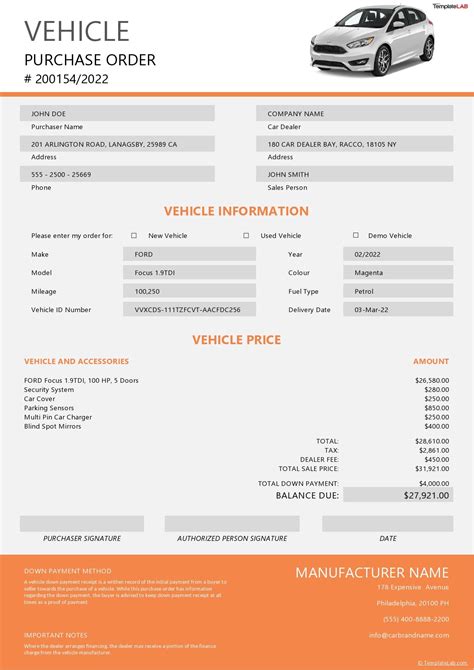

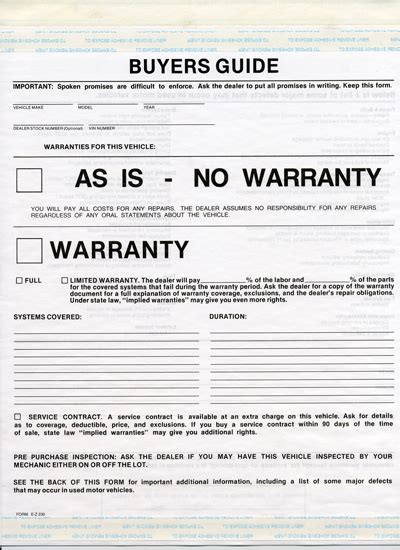

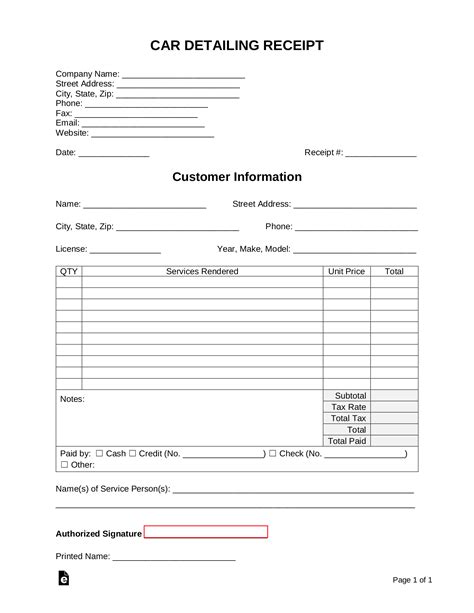

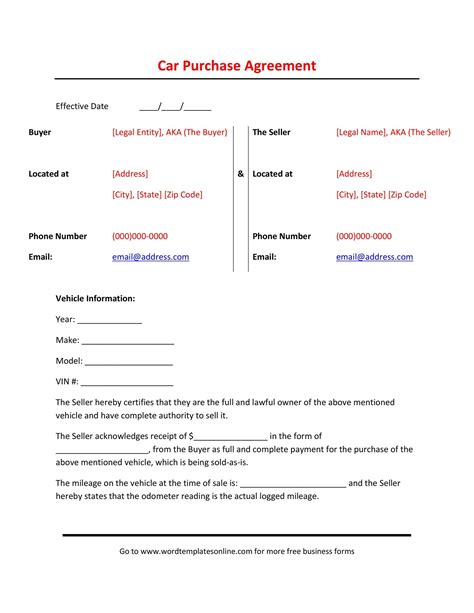

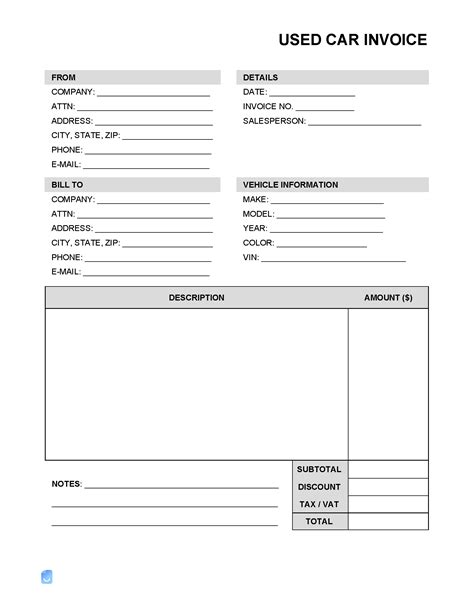

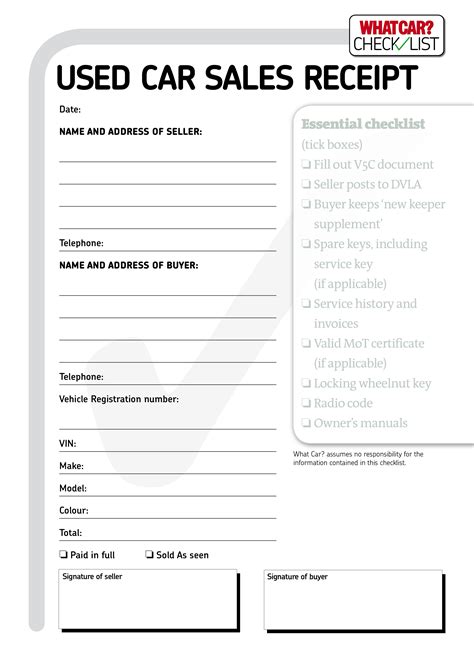

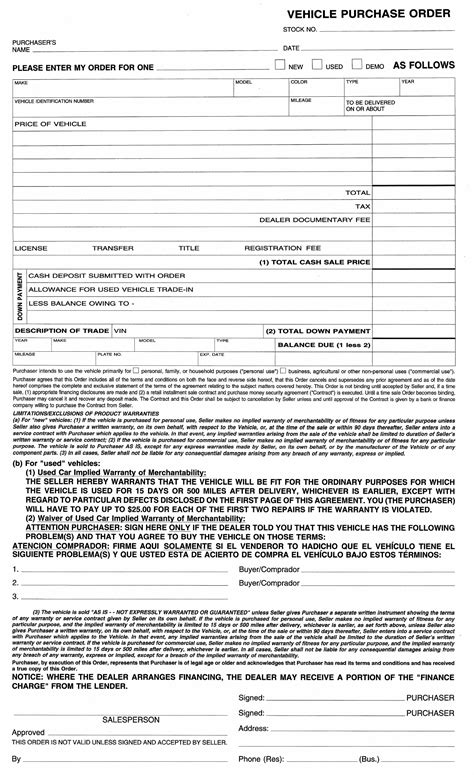

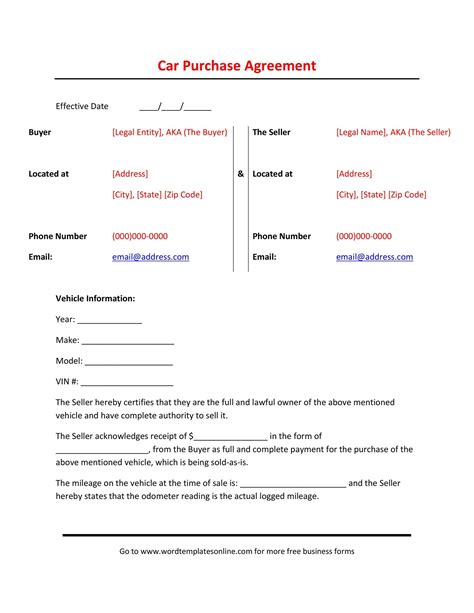

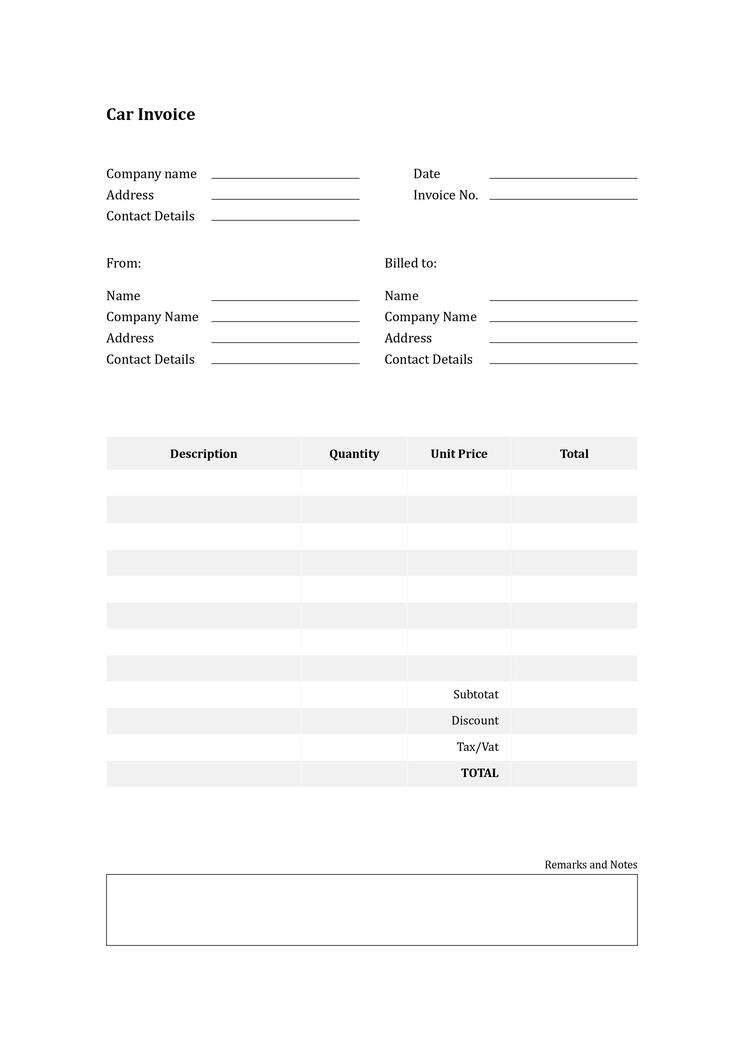

To complete the tax paperwork for a used vehicle purchase, the following documents are typically required: * Bill of Sale: A document that outlines the terms of the sale, including the purchase price, vehicle details, and buyer and seller information. * Title: The vehicle’s title, which proves ownership and is usually signed over to the buyer. * Registration: The vehicle’s registration, which is typically transferred to the buyer. * Sales Tax Form: A form that calculates the sales tax owed on the purchase price of the vehicle. * VIN Verification: A document that verifies the vehicle’s VIN (Vehicle Identification Number) and ensures it matches the title and registration.

📝 Note: The specific documents required may vary depending on the jurisdiction, so it's essential to check with the local DMV or tax authority for specific requirements.

Step-by-Step Guide to Completing Used Vehicle Purchase Tax Paperwork

Completing the tax paperwork for a used vehicle purchase can be a daunting task, but by following these steps, you can ensure a smooth and compliant transaction: * Step 1: Gather all required documents, including the bill of sale, title, registration, and sales tax form. * Step 2: Complete the sales tax form, calculating the sales tax owed on the purchase price of the vehicle. * Step 3: Verify the vehicle’s VIN and ensure it matches the title and registration. * Step 4: Submit the completed paperwork to the local DMV or tax authority. * Step 5: Pay any required fees and taxes, including sales tax, title fees, and registration fees.

Tips for Avoiding Common Mistakes

To avoid common mistakes when completing used vehicle purchase tax paperwork, keep the following tips in mind: * Double-check calculations: Ensure that all calculations, including sales tax and fees, are accurate and complete. * Verify documentation: Verify that all documents, including the title and registration, are accurate and complete. * Check for any outstanding liens: Ensure that there are no outstanding liens on the vehicle, which could affect the transfer of ownership. * Keep records: Keep accurate records of all paperwork and transactions, including receipts and invoices.

Benefits of Accurate Used Vehicle Purchase Tax Paperwork

Accurate and complete used vehicle purchase tax paperwork can have several benefits, including: * Avoiding penalties and fines: Inaccurate or incomplete paperwork can result in penalties and fines, which can be avoided by ensuring that all paperwork is accurate and complete. * Ensuring compliance: Accurate paperwork ensures compliance with all relevant laws and regulations, reducing the risk of legal issues or disputes. * Protecting ownership: Accurate paperwork helps to protect ownership of the vehicle, ensuring that the buyer has clear title and ownership.

Common Challenges and Solutions

Common challenges when completing used vehicle purchase tax paperwork include: * Inaccurate or incomplete documentation: Ensure that all documentation is accurate and complete, and verify all information before submitting paperwork. * Calculating sales tax: Use a sales tax calculator or consult with a tax professional to ensure accurate calculations. * Outstanding liens: Check for any outstanding liens on the vehicle and ensure that they are resolved before transferring ownership.

| Document | Description |

|---|---|

| Bill of Sale | A document that outlines the terms of the sale, including the purchase price, vehicle details, and buyer and seller information. |

| Title | The vehicle's title, which proves ownership and is usually signed over to the buyer. |

| Registration | The vehicle's registration, which is typically transferred to the buyer. |

| Sales Tax Form | A form that calculates the sales tax owed on the purchase price of the vehicle. |

| VIN Verification | A document that verifies the vehicle's VIN (Vehicle Identification Number) and ensures it matches the title and registration. |

In summary, used vehicle purchase tax paperwork can be complex and time-consuming, but by understanding the required documents, following a step-by-step guide, and avoiding common mistakes, you can ensure a smooth and compliant transaction. Accurate and complete paperwork can have several benefits, including avoiding penalties and fines, ensuring compliance, and protecting ownership.

What documents are required for used vehicle purchase tax paperwork?

+

The documents required for used vehicle purchase tax paperwork typically include a bill of sale, title, registration, sales tax form, and VIN verification.

How do I calculate sales tax on a used vehicle purchase?

+

To calculate sales tax on a used vehicle purchase, you can use a sales tax calculator or consult with a tax professional. The sales tax rate will depend on the jurisdiction and the purchase price of the vehicle.

What are the benefits of accurate used vehicle purchase tax paperwork?

+

The benefits of accurate used vehicle purchase tax paperwork include avoiding penalties and fines, ensuring compliance with all relevant laws and regulations, and protecting ownership of the vehicle.