House Ownership Paperwork Explained

Introduction to House Ownership Paperwork

When it comes to purchasing a house, the process can be complex and overwhelming, especially for first-time buyers. One of the most critical aspects of buying a house is understanding the paperwork involved. House ownership paperwork is a collection of documents that prove ownership of a property and outline the terms of the sale. In this article, we will delve into the world of house ownership paperwork, explaining the different types of documents, their purposes, and what to expect during the buying process.

Types of House Ownership Paperwork

There are several types of documents that make up house ownership paperwork. These include: * Deed: A deed is a document that transfers ownership of a property from the seller to the buyer. It is typically signed by the seller and recorded at the local county recorder’s office. * Title: A title is a document that proves ownership of a property. It is usually issued by a title company and guarantees that the seller has the right to sell the property. * Mortgage: A mortgage is a document that secures a loan for the purchase of a property. It is typically signed by the buyer and recorded at the local county recorder’s office. * Property Survey: A property survey is a document that outlines the boundaries and features of a property. It is usually conducted by a licensed surveyor and provides a detailed map of the property. * Appraisal: An appraisal is a document that estimates the value of a property. It is usually conducted by a licensed appraiser and provides an independent assessment of the property’s value.

The House Buying Process

The house buying process typically involves several steps, including: * Pre-approval: The buyer applies for a mortgage and receives pre-approval from a lender. * Home search: The buyer searches for a property that meets their needs and budget. * Offer: The buyer makes an offer on a property, which is usually contingent on financing and inspections. * Inspections: The buyer conducts inspections on the property, including a home inspection and termite inspection. * Appraisal: The lender conducts an appraisal to estimate the value of the property. * Final approval: The lender provides final approval for the mortgage, and the buyer signs the final documents.

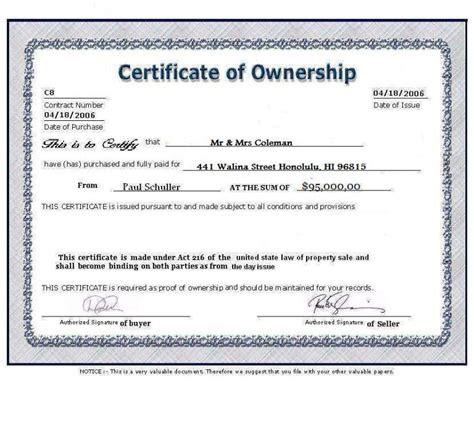

Understanding the Deed

The deed is a critical document in the house ownership paperwork process. It transfers ownership of the property from the seller to the buyer and is typically recorded at the local county recorder’s office. There are several types of deeds, including: * Warranty Deed: A warranty deed guarantees that the seller has clear title to the property and is responsible for any defects in the title. * Quitclaim Deed: A quitclaim deed transfers any interest the seller has in the property to the buyer, but does not guarantee clear title. * Special Warranty Deed: A special warranty deed guarantees that the seller has clear title to the property, but only for the period of time that the seller owned the property.

| Type of Deed | Description |

|---|---|

| Warranty Deed | Guarantees clear title to the property |

| Quitclaim Deed | Transfers any interest in the property |

| Special Warranty Deed | Guarantees clear title for the period of time the seller owned the property |

Important Notes

📝 Note: It is essential to carefully review all documents involved in the house ownership paperwork process to ensure that they are accurate and complete.

📝 Note: Buyers should also consider working with a real estate attorney to review and explain the documents involved in the process.

As we near the end of our journey through the world of house ownership paperwork, it is essential to summarize the key points. Understanding the different types of documents, their purposes, and the house buying process can help buyers navigate the complex world of real estate. By carefully reviewing all documents and working with a real estate attorney, buyers can ensure a smooth and successful transaction.

What is a deed, and why is it important?

+

A deed is a document that transfers ownership of a property from the seller to the buyer. It is essential because it proves ownership of the property and is typically recorded at the local county recorder’s office.

What is the difference between a warranty deed and a quitclaim deed?

+

A warranty deed guarantees that the seller has clear title to the property, while a quitclaim deed transfers any interest the seller has in the property to the buyer, but does not guarantee clear title.

Why is it essential to work with a real estate attorney when buying a house?

+

Working with a real estate attorney can help buyers navigate the complex world of real estate and ensure that all documents are accurate and complete. They can also provide valuable guidance and advice throughout the buying process.