Paperwork

LLC Tax Filing Paperwork Requirements

Understanding the Tax Filing Requirements for LLCs

When it comes to taxes, Limited Liability Companies (LLCs) have a unique set of requirements that must be met to avoid penalties and ensure compliance with the law. As an LLC owner, it’s essential to understand the tax filing paperwork requirements to navigate the complex world of business taxation. In this article, we’ll delve into the details of LLC tax filing, exploring the various forms, deadlines, and regulations that apply to these business entities.

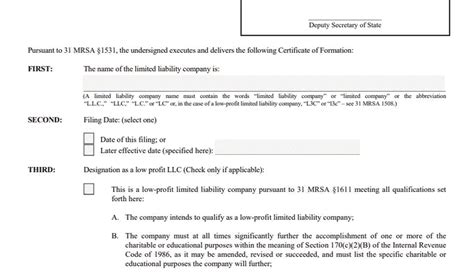

Tax Classification of LLCs

Before we dive into the tax filing requirements, it’s crucial to understand how LLCs are classified for tax purposes. By default, the Internal Revenue Service (IRS) treats LLCs as pass-through entities, meaning that the business income is only taxed at the individual level, not at the business level. However, LLCs can also elect to be taxed as corporations (C-corps or S-corps) by filing Form 8832, Entity Classification Election. This classification determines the tax forms and schedules that must be filed.

Annual Tax Filings for LLCs

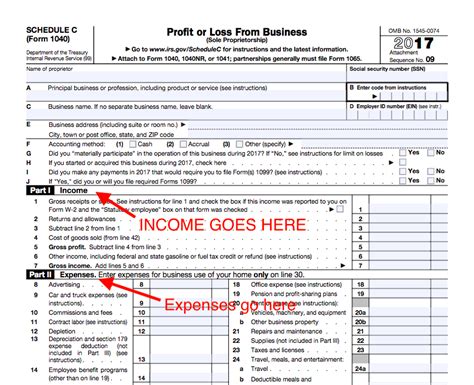

LLCs must file annual tax returns with the IRS, reporting their income, deductions, and credits. The type of tax return filed depends on the tax classification of the LLC: * Single-member LLCs (disregarded entities): File Form 1040, U.S. Individual Income Tax Return, and attach Schedule C (Form 1040), Profit or Loss from Business. * Multi-member LLCs (partnerships): File Form 1065, U.S. Return of Partnership Income, and provide each partner with a Schedule K-1 (Form 1065), Partner’s Share of Income, Deductions, Credits, etc. * LLCs taxed as corporations (C-corps or S-corps): File Form 1120, U.S. Corporation Income Tax Return (for C-corps), or Form 1120S, U.S. Income Tax Return for an S Corporation (for S-corps).

Additional Tax Forms and Schedules

In addition to the primary tax return, LLCs may need to file other forms and schedules, such as: * Form W-2, Wage and Tax Statement, for employees * Form 1099-MISC, Miscellaneous Income, for independent contractors * Schedule SE (Form 1040), Self-Employment Tax, for self-employment income * Form 4562, Depreciation and Amortization, for depreciation and amortization deductions * Form 8829, Expenses for Business Use of Your Home, for home office deductions

Tax Deadlines and Extensions

It’s essential to meet the tax filing deadlines to avoid penalties and interest: * Partnerships (Form 1065): March 15th (or September 15th with an extension) * Corporations (Form 1120 or Form 1120S): April 15th (or October 15th with an extension) * Individuals (Form 1040): April 15th (or October 15th with an extension)

💡 Note: LLCs can request an automatic six-month extension by filing Form 7004, Application for Automatic Extension of Time to File Certain Business Income Tax, Information, and Other Returns.

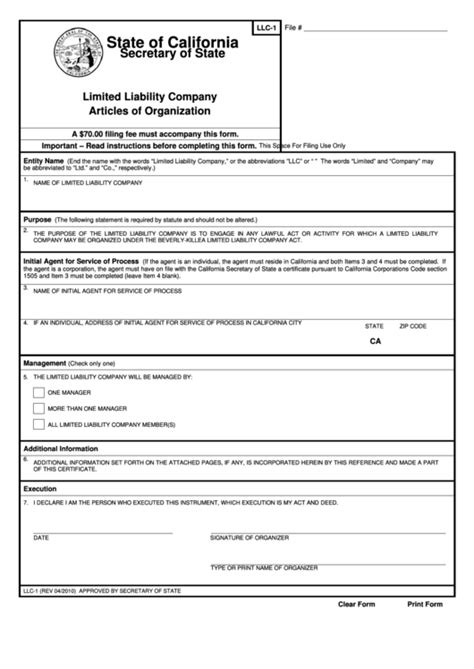

Record-Keeping and Audit Preparation

To ensure compliance with tax laws and regulations, LLCs must maintain accurate and detailed records, including: * Financial statements (balance sheets, income statements, etc.) * Business ledgers (accounts payable, accounts receivable, etc.) * Invoices and receipts * Tax-related documents ( Forms W-2, 1099-MISC, etc.)

In the event of an audit, LLCs must be prepared to provide these records to support their tax filings.

Conclusion and Final Thoughts

In conclusion, LLC tax filing paperwork requirements can be complex and time-consuming. However, by understanding the tax classification, annual tax filings, additional forms and schedules, tax deadlines, and record-keeping requirements, LLC owners can ensure compliance with the law and avoid penalties. It’s crucial to consult with a tax professional or accountant to navigate the intricacies of LLC taxation and ensure that all tax obligations are met.

What is the default tax classification for LLCs?

+

By default, the IRS treats LLCs as pass-through entities, meaning that the business income is only taxed at the individual level, not at the business level.

What tax form do single-member LLCs file?

+

Single-member LLCs file Form 1040, U.S. Individual Income Tax Return, and attach Schedule C (Form 1040), Profit or Loss from Business.

What is the deadline for filing Form 1065 for partnerships?

+

The deadline for filing Form 1065 for partnerships is March 15th (or September 15th with an extension).