5 Documents Needed

Introduction to Essential Documents

When it comes to legal, financial, and personal matters, having the right documents in order can make a significant difference. These documents not only help in times of need but also ensure that your wishes are respected and your loved ones are protected. In this article, we will explore five essential documents that everyone should have, and why they are crucial for a secure and organized life.

1. Last Will and Testament

A Last Will and Testament is a document that outlines how you want your assets to be distributed after you pass away. It is a way to ensure that your wishes are carried out and that your loved ones are taken care of. This document should include: - Executor: The person responsible for carrying out the instructions in the will. - Beneficiaries: The individuals or organizations that will inherit your assets. - Assets: A list of your properties, investments, and personal belongings. - Guardians: If you have minor children, you should appoint guardians for them in your will.

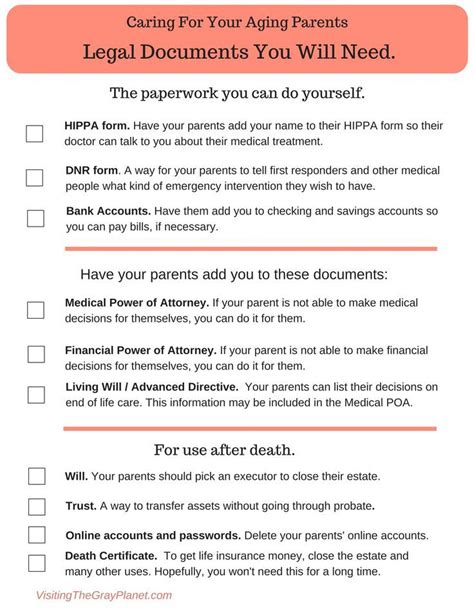

2. Power of Attorney

A Power of Attorney (POA) is a document that gives someone you trust the authority to make decisions on your behalf. This can be useful if you become incapacitated or unable to make decisions for yourself. There are different types of POA, including: - General POA: Gives broad powers to the agent, including managing finances and making business decisions. - Special POA: Limits the agent’s powers to specific areas, such as managing a particular business or property. - Healthcare POA: Allows the agent to make medical decisions on your behalf.

3. Advance Directive

An Advance Directive, also known as a Living Will, is a document that outlines your wishes for end-of-life medical care. This document should include: - Life-sustaining treatments: Your preferences for treatments such as CPR, ventilators, and dialysis. - Palliative care: Your wishes for pain management and comfort care. - Organ donation: Your decision to donate your organs or not.

4. Insurance Policies

Insurance Policies provide financial protection for you and your loved ones in case of unexpected events. Essential insurance policies include: - Life insurance: Provides a death benefit to your beneficiaries. - Health insurance: Covers medical expenses and provides access to healthcare services. - Disability insurance: Replaces your income if you become unable to work due to illness or injury. - Long-term care insurance: Covers the costs of long-term care, such as nursing home care or home health care.

5. Trust

A Trust is a document that allows you to transfer assets to a trustee, who manages them for the benefit of your beneficiaries. Trusts can be used to: - Avoid probate: Transfer assets without going through the probate process. - Minimize taxes: Reduce estate taxes and income taxes. - Protect assets: Shield your assets from creditors and lawsuits.

💡 Note: It's essential to review and update your documents regularly to ensure they reflect your current wishes and circumstances.

In summary, having these five essential documents in order can provide peace of mind and ensure that your wishes are respected. It’s crucial to consult with an attorney or financial advisor to create and update these documents, as laws and regulations can vary depending on your location and circumstances.

What is the purpose of a Last Will and Testament?

+

The purpose of a Last Will and Testament is to outline how you want your assets to be distributed after you pass away, ensuring that your wishes are carried out and your loved ones are taken care of.

What is the difference between a Power of Attorney and an Advance Directive?

+

A Power of Attorney gives someone you trust the authority to make decisions on your behalf, while an Advance Directive outlines your wishes for end-of-life medical care.

Why is it important to review and update my documents regularly?

+

Reviewing and updating your documents regularly ensures that they reflect your current wishes and circumstances, and that you are prepared for any unexpected events that may arise.