Bankruptcy Paperwork Needed

Introduction to Bankruptcy Paperwork

When considering filing for bankruptcy, it’s essential to understand the complexity and detail required in the paperwork involved. Bankruptcy is a legal process that allows individuals or businesses to reorganize or eliminate debts under the protection of the federal bankruptcy court. The process involves submitting extensive documentation to the court, which includes financial information, debt details, and other relevant data. The accuracy and completeness of these documents are crucial for a successful bankruptcy filing.

Types of Bankruptcy

There are several types of bankruptcy, each with its unique requirements and paperwork. The most common types for individuals are Chapter 7 and Chapter 13. - Chapter 7 Bankruptcy involves the liquidation of assets to pay off debts. It’s often referred to as “straight bankruptcy” and is typically used by individuals who have few assets and a lot of unsecured debt. - Chapter 13 Bankruptcy involves creating a repayment plan to pay off a portion or all of the debts over time, usually three to five years. This type is often used by individuals who have a regular income and want to keep certain assets, like a house.

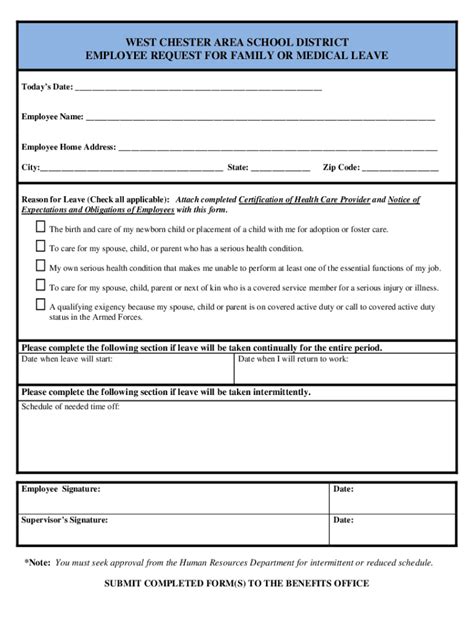

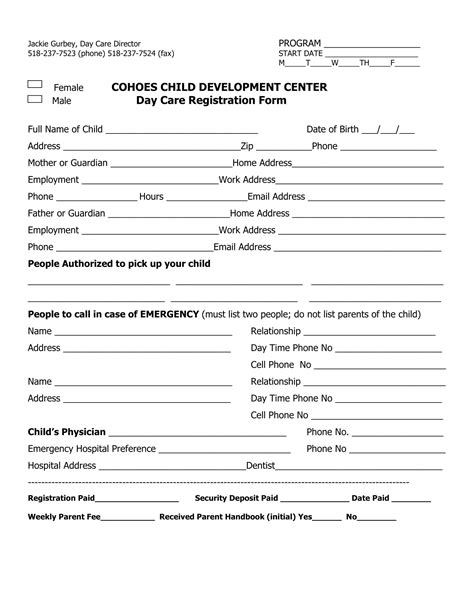

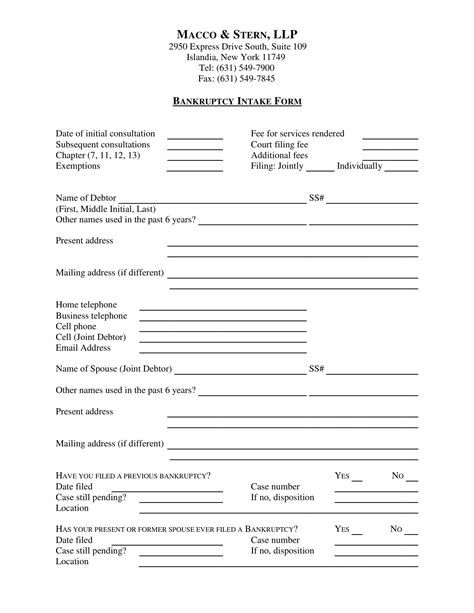

Necessary Documents for Bankruptcy Filing

The paperwork required for bankruptcy can be overwhelming. Here are some key documents and information needed for the filing process: - Financial Records: Detailed lists of all assets, debts, income, and expenses. - Identification: Valid government-issued ID and social security number or tax ID number. - Income Records: Pay stubs, tax returns, and any other proof of income for the last 60 days. - Debt Information: A comprehensive list of all creditors, including addresses and account numbers. - Asset Valuations: Appraisals or valuations of significant assets like real estate or vehicles.

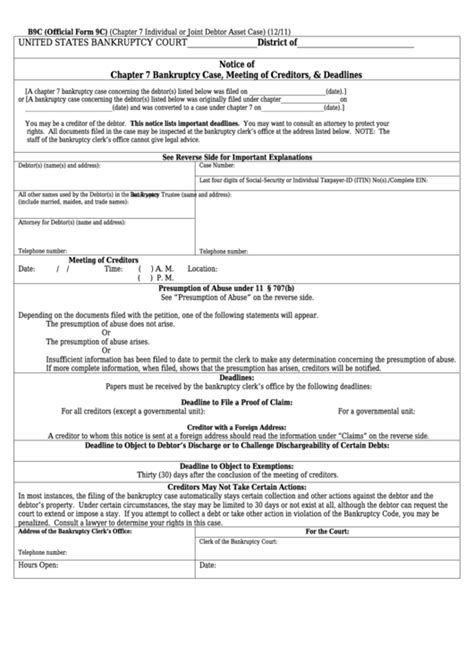

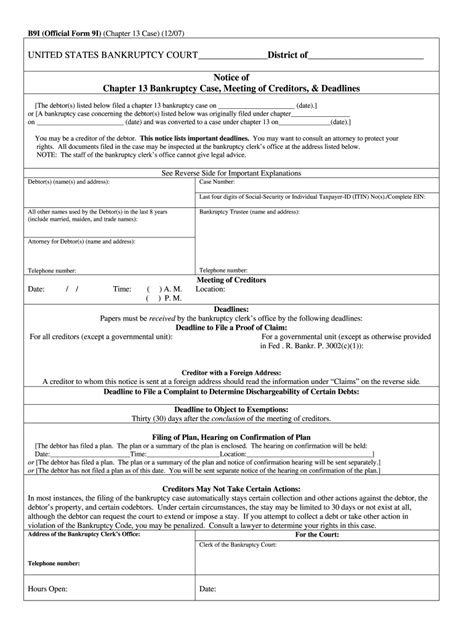

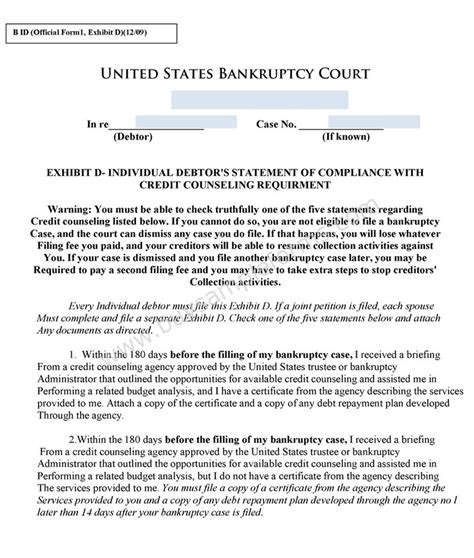

Steps in Preparing Bankruptcy Paperwork

Preparing for bankruptcy involves several steps: 1. Gather All Financial Documents: This includes bank statements, loan documents, credit card statements, and tax returns. 2. Complete the Bankruptcy Forms: These forms are available from the U.S. Courts website and require detailed financial information. 3. Take a Credit Counseling Course: Before filing, individuals must complete a credit counseling course from an approved agency. 4. File the Petition: The bankruptcy petition and supporting documents are filed with the bankruptcy court. 5. Attend the Meeting of Creditors: After filing, there will be a meeting with the trustee and creditors to discuss the bankruptcy plan.

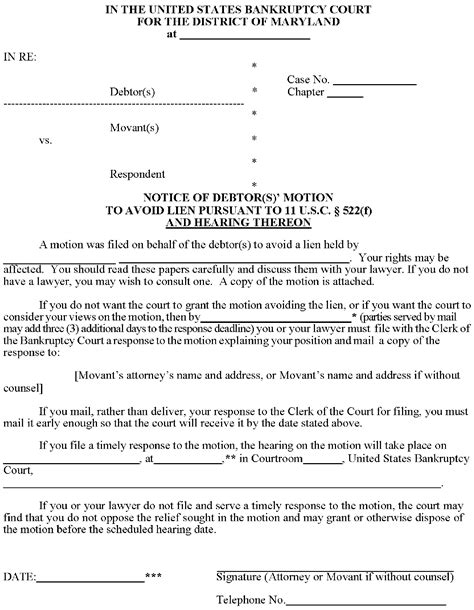

Bankruptcy Forms and Schedules

The official bankruptcy forms, which can be downloaded from the U.S. Courts website, include: - Voluntary Petition: The form that starts the bankruptcy process. - Schedules A/B: Property and Schedules C: The Property You Claim as Exempt: These detail assets and exemptions. - Schedules D: Creditors Who Hold Claims Secured By Property, Schedules E/F: Creditors Who Hold Unsecured Claims, and Schedules G: Executory Contracts and Unexpired Leases: These list secured and unsecured debts. - Schedules H: Your Codebtors: Lists anyone else responsible for your debts. - Schedule J: Your Monthly Expenses: Outlines monthly living expenses.

Electronic Filing and Fees

Most bankruptcy courts require electronic filing (e-filing) for all documents. There is a filing fee for bankruptcy, which varies depending on the chapter filed under. As of my last update, the fee for Chapter 7 is 335, and for Chapter 13, it's 310. There are also fees for converting from one chapter to another or for reopening a case.

📝 Note: Fees are subject to change, so it's essential to check with the bankruptcy court for the most current information.

Seeking Professional Help

Given the complexity of bankruptcy law and the detailed paperwork required, many individuals choose to hire a bankruptcy attorney to guide them through the process. An attorney can help ensure that all necessary documents are correctly prepared and filed, reducing the risk of errors that could lead to the dismissal of the bankruptcy case.

Conclusion of the Bankruptcy Process

In summary, the paperwork for bankruptcy is extensive and requires meticulous attention to detail. Understanding the types of bankruptcy, gathering necessary documents, and following the steps to prepare and file the bankruptcy forms accurately are crucial. While it’s possible to file for bankruptcy without an attorney, the complexity of the process and the potential for significant financial consequences from errors make seeking professional legal advice highly recommended.

What are the main types of bankruptcy for individuals?

+

The two primary types of bankruptcy for individuals are Chapter 7 and Chapter 13. Chapter 7 involves the liquidation of assets to pay off debts, while Chapter 13 involves creating a repayment plan to pay off debts over time.

What are the necessary documents for filing bankruptcy?

+

Necessary documents include financial records, identification, income records, debt information, and asset valuations. Additionally, individuals must complete the official bankruptcy forms and take a credit counseling course.

Can I file for bankruptcy without an attorney?

+

Yes, it’s possible to file for bankruptcy without an attorney, known as filing pro se. However, due to the complexity of the process and the potential for errors, hiring a bankruptcy attorney is highly recommended to ensure all paperwork is correctly prepared and filed.