5 Car Loan Papers

Introduction to Car Loan Papers

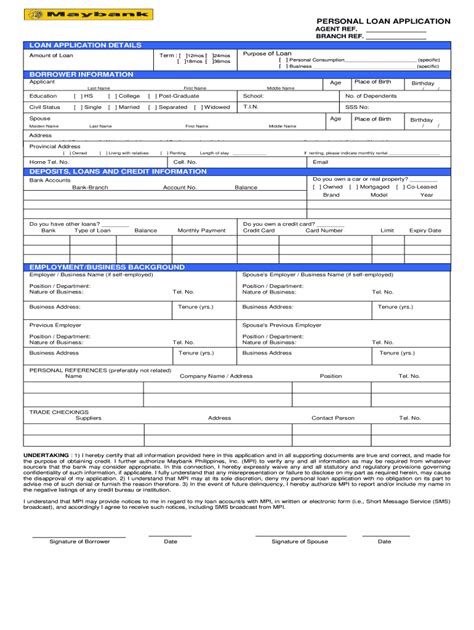

When purchasing a vehicle, most individuals rely on car loans to finance their purchase. The process involves numerous documents and paperwork, which can be overwhelming for first-time buyers. Understanding the different types of car loan papers is essential to ensure a smooth and hassle-free transaction. In this article, we will delve into the world of car loan papers, exploring the various documents required and their significance in the loan process.

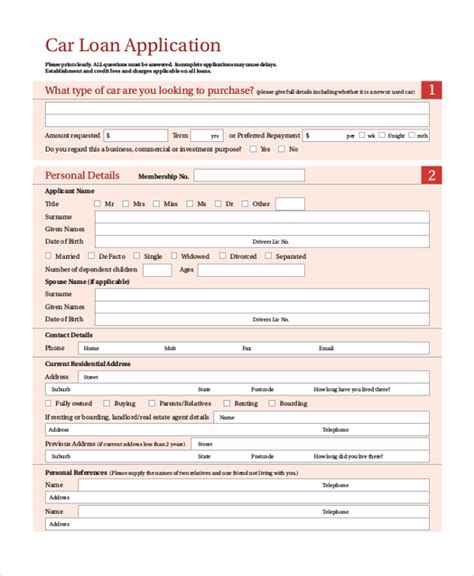

Types of Car Loan Papers

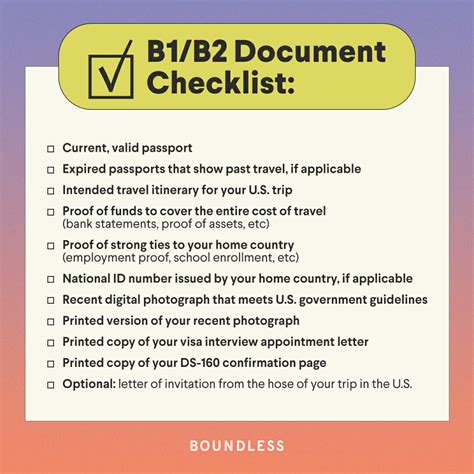

There are several types of car loan papers that borrowers need to be familiar with. These documents serve as proof of the loan agreement, ownership, and other essential details. The following are five key car loan papers:

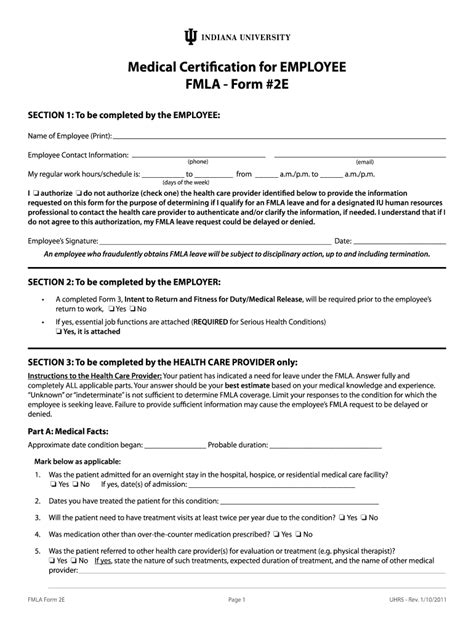

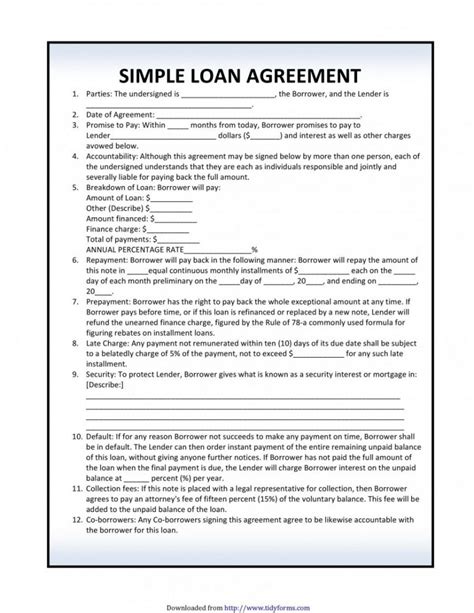

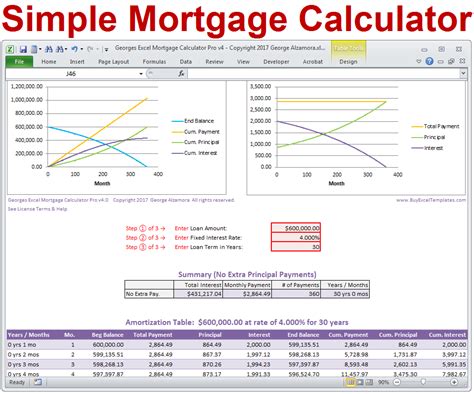

- Loan Agreement: This document outlines the terms and conditions of the loan, including the loan amount, interest rate, repayment period, and monthly installment.

- Promissory Note: A promissory note is a written promise to repay the loan amount, including interest, within the specified timeframe.

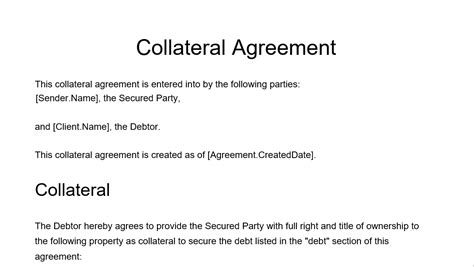

- Security Agreement: This document establishes the vehicle as collateral for the loan, giving the lender the right to repossess the vehicle if the borrower defaults on payments.

- Title Transfer: The title transfer document transfers ownership of the vehicle from the seller to the buyer. It is typically held by the lender until the loan is fully repaid.

- Insurance Proof: Borrowers are required to provide proof of insurance, which ensures that the vehicle is covered against damage or loss.

Importance of Car Loan Papers

Car loan papers play a crucial role in the loan process, as they provide a written record of the agreement between the lender and borrower. These documents help to:

- Establish the terms and conditions of the loan

- Protect the lender’s interests by establishing the vehicle as collateral

- Provide proof of ownership and insurance

- Serve as a reference point in case of disputes or discrepancies

Benefits of Understanding Car Loan Papers

Understanding the different types of car loan papers can benefit borrowers in several ways: * Informed Decision-Making: By knowing what to expect, borrowers can make informed decisions about their loan options. * Avoiding Disputes: Familiarity with car loan papers can help borrowers avoid disputes with lenders or sellers. * Smooth Transaction: Understanding the necessary documents can facilitate a smooth and efficient transaction.

📝 Note: It is essential to carefully review and understand all car loan papers before signing, as they are legally binding documents.

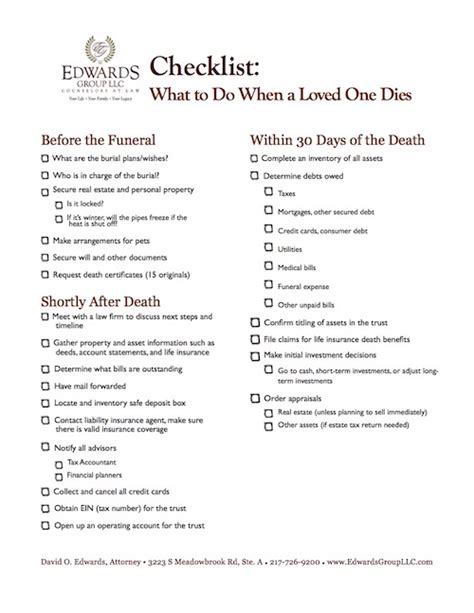

Best Practices for Managing Car Loan Papers

To ensure that car loan papers are managed effectively, borrowers should: * Keep Accurate Records: Maintain a file with all relevant documents, including the loan agreement, promissory note, and insurance proof. * Review Documents Carefully: Take the time to read and understand each document before signing. * Ask Questions: If unsure about any aspect of the loan papers, borrowers should not hesitate to ask the lender or seller for clarification.

| Document | Purpose |

|---|---|

| Loan Agreement | Outlines loan terms and conditions |

| Promissory Note | Written promise to repay loan amount |

| Security Agreement | Establishes vehicle as collateral |

| Title Transfer | Transfers ownership of vehicle |

| Insurance Proof | Provides proof of insurance coverage |

In summary, car loan papers are a crucial aspect of the vehicle purchasing process. By understanding the different types of documents required and their significance, borrowers can navigate the loan process with confidence. It is essential to carefully review and manage these documents to ensure a smooth and hassle-free transaction.

What is the purpose of a loan agreement?

+

The loan agreement outlines the terms and conditions of the loan, including the loan amount, interest rate, repayment period, and monthly installment.

Why is a promissory note required?

+

A promissory note is a written promise to repay the loan amount, including interest, within the specified timeframe.

What happens if I default on my car loan payments?

+

If you default on your car loan payments, the lender may repossess the vehicle, as established in the security agreement.