Paperwork

5 Guarantor Paperwork Essentials

Understanding the Role of a Guarantor

Being a guarantor is a significant financial responsibility that should not be taken lightly. A guarantor is someone who agrees to take on the debt obligations of another person if they are unable to pay. This can be a family member, friend, or colleague. Before signing any guarantor paperwork, it’s essential to understand the implications and the key elements involved in the process. Guarantor agreements can be complex, and it’s crucial to have all the necessary information before making a decision.

Key Components of Guarantor Paperwork

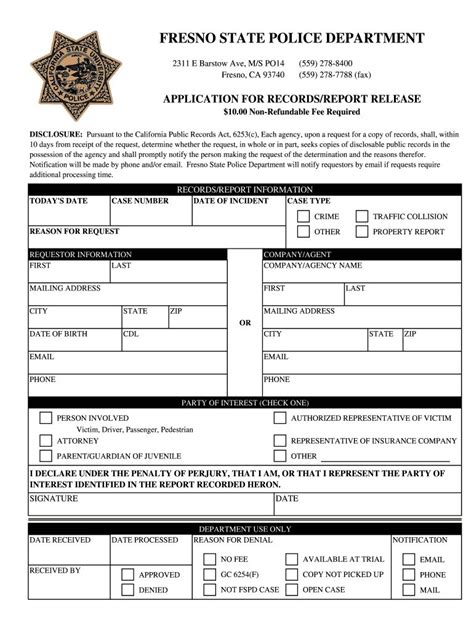

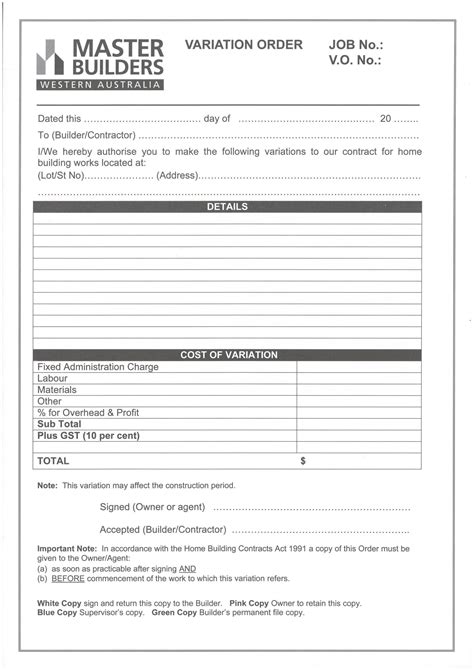

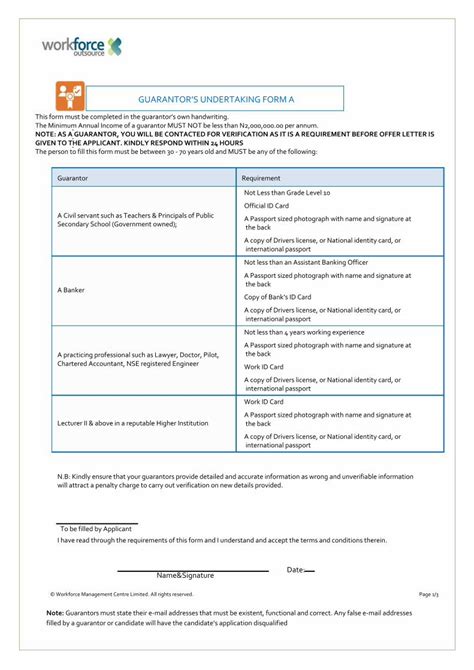

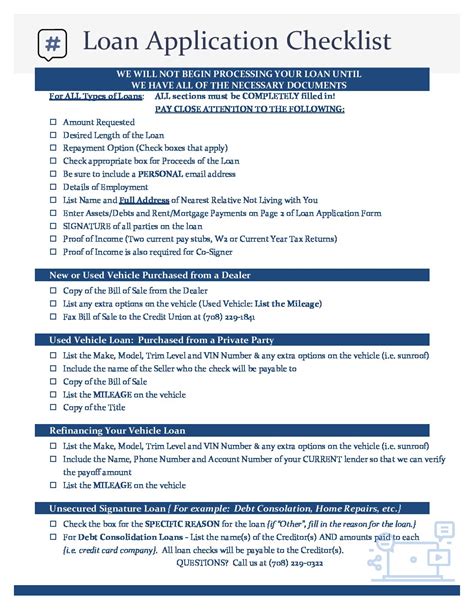

When it comes to guarantor paperwork, there are several essential components that must be included to ensure the agreement is legally binding and clear to all parties involved. These components include: * Guarantor’s personal and financial information: This includes the guarantor’s name, address, employment details, and financial status. * Principal debtor’s information: The principal debtor is the person or entity who is receiving the loan or credit. Their personal and financial information must also be included. * Loan or credit details: The type of loan or credit, the amount, interest rate, and repayment terms must be clearly stated. * Guarantor’s obligations: The guarantor’s responsibilities and obligations must be outlined, including what happens if the principal debtor defaults on the loan. * Termination or cancellation clauses: The conditions under which the guarantor agreement can be terminated or canceled must be specified.

Key Considerations for Guarantors

Before signing any guarantor paperwork, it’s essential to consider the following: * Financial risk: As a guarantor, you are taking on a significant financial risk. If the principal debtor defaults, you will be responsible for paying the debt. * Credit score impact: If the principal debtor misses payments or defaults, it can negatively impact your credit score. * Relationship impact: Guarantor agreements can affect relationships, especially if the principal debtor defaults and you are left to deal with the consequences. * Alternative options: Consider whether there are alternative options available, such as co-signing a loan or providing a different type of financial support.

Guarantor Agreement Templates

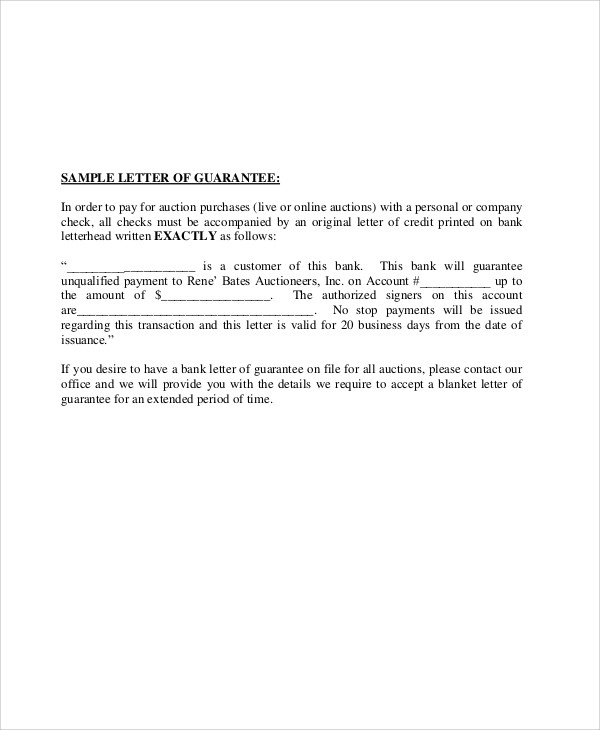

Guarantor agreement templates can be useful in ensuring that all necessary components are included. These templates can be found online or through financial institutions. However, it’s essential to have a lawyer review the agreement to ensure it is legally binding and meets your specific needs.

| Component | Description |

|---|---|

| Guarantor's personal and financial information | Includes the guarantor's name, address, employment details, and financial status |

| Principal debtor's information | Includes the principal debtor's name, address, employment details, and financial status |

| Loan or credit details | Includes the type of loan or credit, the amount, interest rate, and repayment terms |

Conclusion and Final Thoughts

In conclusion, being a guarantor is a significant responsibility that requires careful consideration. It’s essential to understand the key components of guarantor paperwork and the implications of signing such an agreement. By taking the time to review and understand the agreement, guarantors can make informed decisions and avoid potential financial risks. Financial planning and budgeting are crucial in ensuring that guarantors can meet their obligations and avoid default.

📝 Note: It's essential to seek professional advice before signing any guarantor paperwork to ensure you understand the implications and potential risks involved.

What is a guarantor agreement?

+

A guarantor agreement is a contract between a guarantor and a lender, where the guarantor agrees to take on the debt obligations of another person if they are unable to pay.

What are the risks of being a guarantor?

+

The risks of being a guarantor include taking on a significant financial risk, potential impact on credit score, and potential strain on relationships.

Can a guarantor agreement be terminated or canceled?

+

Yes, a guarantor agreement can be terminated or canceled, but the conditions for doing so must be specified in the agreement.