Home Loan Paperwork Requirements

Introduction to Home Loan Paperwork

When applying for a home loan, it’s essential to understand the paperwork requirements involved in the process. The amount of paperwork needed can be overwhelming, but being prepared and knowing what to expect can make the experience less daunting. In this article, we will guide you through the necessary documents and paperwork required for a home loan application, helping you to navigate the process with ease.

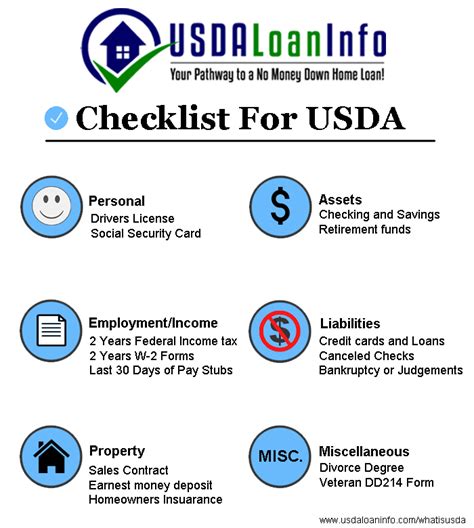

Pre-Approval Paperwork

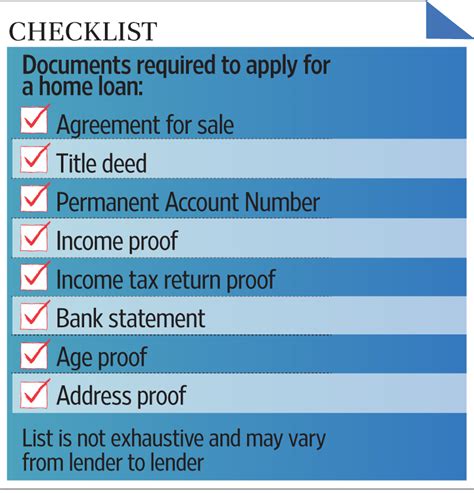

Before starting your home search, it’s recommended to get pre-approved for a home loan. This involves submitting some initial paperwork to your lender, which typically includes:

- Identification documents: Such as a driver’s license, passport, or state ID

- Income verification: Pay stubs, W-2 forms, or tax returns

- Bank statements: To verify your savings and assets

- Credit report: To check your credit score and history

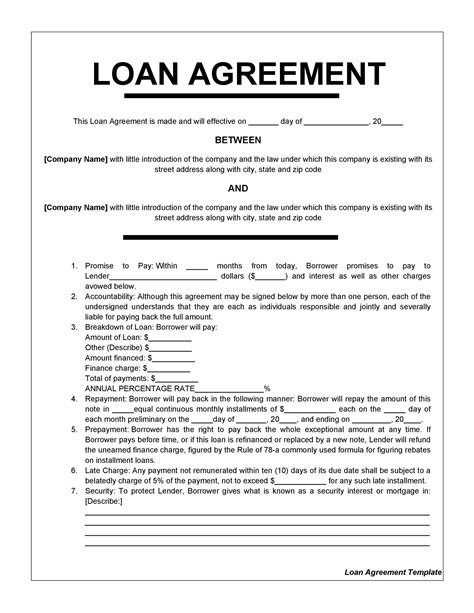

Full Loan Application Paperwork

Once you’ve found a property and are ready to proceed with the full loan application, you’ll need to provide more detailed paperwork. This typically includes:

- Loan application form: This will require personal and financial information

- Property details: Including the address, purchase price, and property type

- Appraisal report: To verify the value of the property

- Inspection reports: To identify any potential issues with the property

| Document | Description |

|---|---|

| Gift letter | If you’re using a gift from a family member or friend towards the down payment |

| Divorce or separation documents | If you’re recently divorced or separated |

| Bankruptcy or foreclosure documents | If you’ve experienced financial difficulties in the past |

Submission and Review Process

After submitting your paperwork, your lender will review your application and verify the information provided. This process can take several days to several weeks, depending on the complexity of your application. It’s essential to ensure that all paperwork is complete and accurate to avoid delays or even rejection of your application.

📝 Note: It’s crucial to respond promptly to any requests for additional information or clarification to keep the process moving forward.

Final Approval and Settlement

Once your application has been approved, you’ll receive a loan commitment letter outlining the terms of your loan. This is usually followed by a settlement meeting, where you’ll sign the final loan documents and transfer the ownership of the property. It’s essential to review these documents carefully and ask questions if you’re unsure about any aspect of the loan.

In the end, understanding the home loan paperwork requirements and being prepared can make a significant difference in the success of your application. By knowing what to expect and having all the necessary documents ready, you can navigate the process with confidence and achieve your goal of becoming a homeowner.

What is the typical timeframe for a home loan application?

+

The timeframe for a home loan application can vary depending on the lender and the complexity of the application. However, it typically takes between 2-6 weeks to complete the process.

Can I apply for a home loan online?

+

Yes, many lenders offer online applications for home loans. This can be a convenient option, but it’s essential to ensure that you’re working with a reputable lender and that you understand the terms of your loan.

What is the difference between pre-approval and final approval?

+

Pre-approval is an initial assessment of your borrowing capacity, while final approval is the formal approval of your loan application. Pre-approval is usually provided after a preliminary review of your financial situation, while final approval is given after a thorough review of your application and supporting documentation.