5 VA Loan Papers

Understanding the VA Loan Process: 5 Essential Papers to Know

The VA loan process can seem complex, especially for first-time homebuyers. However, breaking down the requirements into manageable parts can make the journey to homeownership more accessible. One of the critical aspects of the VA loan process is the paperwork involved. In this article, we will delve into the 5 essential papers that play a crucial role in a VA loan application.

1. Certificate of Eligibility (COE)

The Certificate of Eligibility (COE) is perhaps the most critical document in the VA loan process. It confirms for lenders that you are eligible for a VA-backed loan. Eligibility is typically determined by your military service, with requirements varying based on whether you are on active duty, a veteran, a member of the National Guard, or a surviving spouse. To obtain a COE, you can apply online through the VA’s eBenefits portal, by mail, or through your lender.

2. DD Form 214

The DD Form 214, or Certificate of Release or Discharge from Active Duty, is a crucial document for veterans and their families. It outlines the nature and terms of your military service, including your dates of service, rank, and the character of your discharge. This form is essential for determining your eligibility for a VA loan. If you do not have a copy of your DD Form 214, you can request one from the National Archives.

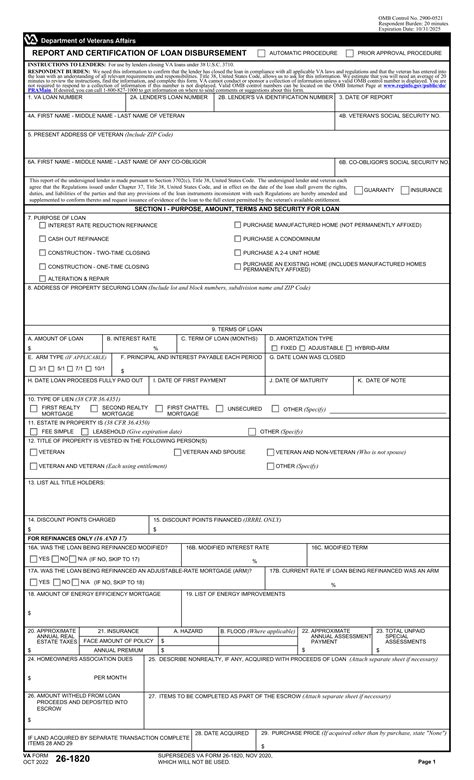

3. VA Loan Application (VA Form 26-1880)

While not all lenders require a VA Form 26-1880 for a VA loan application, it is an essential document for applying for a Certificate of Eligibility directly from the VA. This form provides detailed personal and military service information that the VA uses to determine your eligibility for a home loan guarantee. It’s often submitted along with your DD Form 214 and other supporting documents.

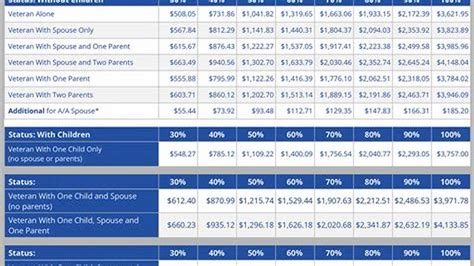

4. Income and Employment Verification

For a VA loan, income and employment verification are critical. Lenders need to confirm your stable income to ensure you can afford the mortgage payments. This typically involves providing:

- Pay stubs from the last 30 days

- W-2 forms from the last two years

- Tax returns (personal and business, if applicable)

5. Appraisal Report

Once your loan is approved, an appraisal report is conducted on the property you wish to purchase. This report is prepared by a licensed appraiser and provides an independent opinion of the property’s value. The VA requires an appraisal to ensure the property’s value is sufficient to secure the loan. The appraisal process involves:

- Physical inspection of the property

- Comparison with similar properties in the area

- Evaluation of the property’s condition and any needed repairs

💡 Note: Understanding and gathering these documents can significantly streamline the VA loan process, making it easier for eligible veterans and their families to achieve homeownership.

To summarize, the VA loan process involves several key documents, each playing a vital role in determining eligibility and facilitating the loan application. By understanding the importance of the Certificate of Eligibility, DD Form 214, VA Loan Application, income and employment verification, and appraisal report, applicants can better navigate the process and move closer to securing their dream home.

What is the purpose of the Certificate of Eligibility in the VA loan process?

+

The Certificate of Eligibility confirms for lenders that you are eligible for a VA-backed loan, based on your military service.

How do I apply for a VA loan if I lost my DD Form 214?

+

You can request a replacement DD Form 214 from the National Archives. This document is crucial for proving your military service and eligibility for a VA loan.

What are the Minimum Property Requirements for a VA loan?

+

The VA’s Minimum Property Requirements ensure the property is safe, sanitary, and secure for the buyer. This includes criteria for the property’s condition, necessary repairs, and environmental factors.