5 Tips for Echeck Paperwork

Introduction to Echeck Paperwork

When it comes to managing financial transactions, electronic checks (echecks) have become a popular method for making payments. Echecks are a type of electronic payment that allows individuals and businesses to make payments online by transferring funds directly from their checking account. However, to ensure a smooth and secure transaction, it’s essential to handle echeck paperwork correctly. In this article, we’ll explore five tips for managing echeck paperwork efficiently.

Understanding Echeck Paperwork

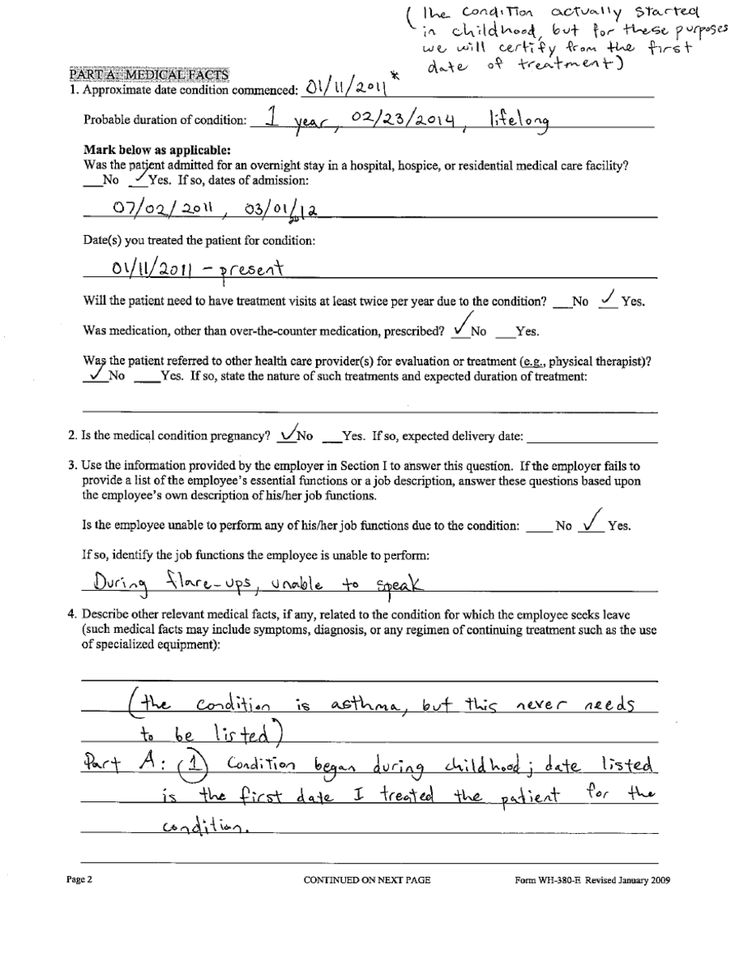

Echeck paperwork typically involves the exchange of sensitive financial information, such as bank account numbers and routing numbers. To protect this information and prevent potential fraud, it’s crucial to handle echeck paperwork with care. This includes verifying the identity of the payer, ensuring the accuracy of the payment information, and maintaining secure records of all transactions.

Tips for Managing Echeck Paperwork

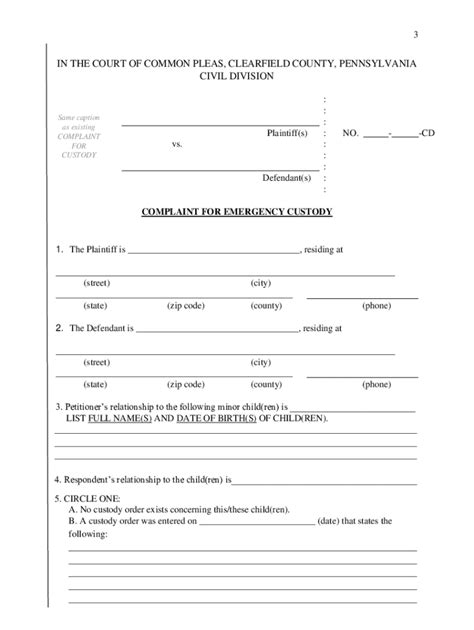

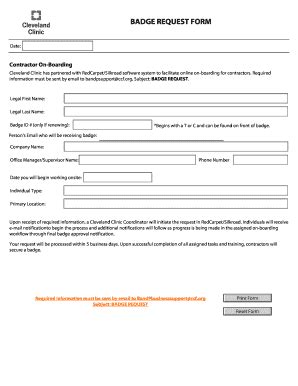

Here are five tips to help you manage echeck paperwork effectively: * Verify Payer Information: Before processing an echeck, verify the payer’s identity and ensure that the payment information is accurate. This includes checking the name, address, and bank account details. * Use Secure Payment Gateways: Use a secure payment gateway to process echecks, such as Authorize.net or PayPal. These gateways provide an additional layer of security and protection against potential fraud. * Maintain Accurate Records: Keep accurate and detailed records of all echeck transactions, including the payment date, amount, and payer information. This will help you track payments and resolve any disputes that may arise. * Implement Fraud Prevention Measures: Implement fraud prevention measures, such as address verification and bank account verification, to prevent potential fraud. * Comply with Regulations: Comply with relevant regulations, such as the Electronic Fund Transfer Act, to ensure that you’re handling echeck paperwork in accordance with the law.

Benefits of Efficient Echeck Paperwork Management

Efficient echeck paperwork management can have numerous benefits, including: * Reduced Risk of Fraud: By verifying payer information and implementing fraud prevention measures, you can reduce the risk of fraud and protect your business from potential losses. * Improved Cash Flow: By processing echecks efficiently, you can improve your cash flow and reduce the time it takes to receive payments. * Enhanced Customer Satisfaction: By providing a secure and efficient payment process, you can enhance customer satisfaction and build trust with your customers.

📝 Note: It's essential to stay up-to-date with the latest regulations and best practices for managing echeck paperwork to ensure compliance and minimize the risk of fraud.

Common Mistakes to Avoid

When managing echeck paperwork, there are several common mistakes to avoid, including: * Inaccurate Payment Information: Failing to verify payer information and ensure the accuracy of payment details can lead to delayed or failed payments. * Insufficient Security Measures: Failing to implement sufficient security measures, such as encryption and secure payment gateways, can leave your business vulnerable to fraud. * Poor Record Keeping: Failing to maintain accurate and detailed records of echeck transactions can make it difficult to track payments and resolve disputes.

| Tip | Benefits |

|---|---|

| Verify Payer Information | Reduces risk of fraud, improves cash flow |

| Use Secure Payment Gateways | Provides additional layer of security, protects against fraud |

| Maintain Accurate Records | Helps track payments, resolves disputes |

| Implement Fraud Prevention Measures | Reduces risk of fraud, protects business |

| Comply with Regulations | Ensures compliance, minimizes risk of fines and penalties |

In summary, managing echeck paperwork efficiently is crucial for businesses that accept electronic checks as a form of payment. By following the tips outlined in this article, you can reduce the risk of fraud, improve cash flow, and enhance customer satisfaction. Remember to verify payer information, use secure payment gateways, maintain accurate records, implement fraud prevention measures, and comply with regulations to ensure efficient echeck paperwork management.

What is an echeck?

+

An echeck is a type of electronic payment that allows individuals and businesses to make payments online by transferring funds directly from their checking account.

How do I verify payer information?

+

To verify payer information, check the name, address, and bank account details to ensure they match the payment information provided.

What are the benefits of using secure payment gateways?

+

Using secure payment gateways provides an additional layer of security and protection against potential fraud, reducing the risk of fraud and protecting your business.