Estate Planning Paperwork Essentials

Introduction to Estate Planning

Estate planning is a critical process that involves making arrangements for the management and distribution of your assets after you pass away or become incapacitated. It’s a complex and often emotional task, but having a solid plan in place can provide peace of mind for you and your loved ones. At its core, estate planning is about ensuring that your wishes are respected and that your assets are protected and distributed according to your desires. Effective estate planning requires a thorough understanding of the necessary paperwork and documentation.

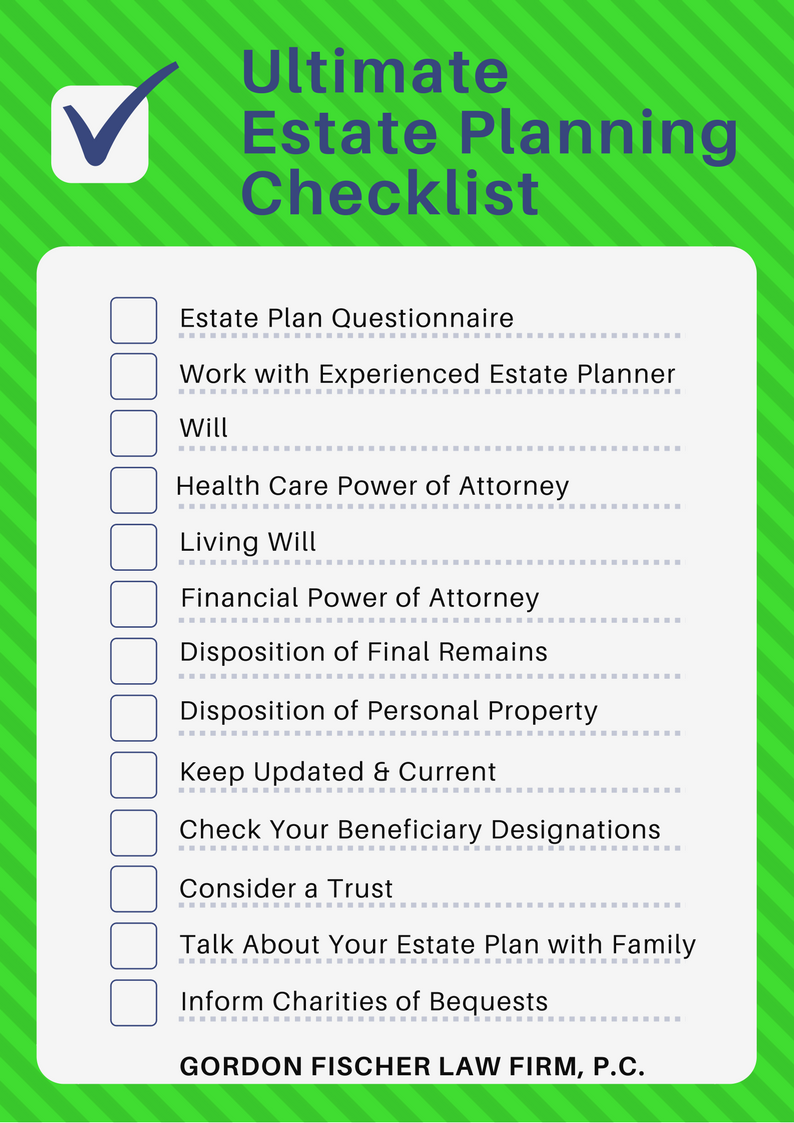

Understanding the Key Documents

There are several essential documents that form the foundation of a comprehensive estate plan. These include: * Last Will and Testament: A legal document that outlines how you want your assets to be distributed after you pass away. * Power of Attorney: A document that grants someone you trust the authority to manage your financial and personal affairs if you become incapacitated. * Living Will: A document that specifies your wishes for end-of-life medical treatment. * Trusts: Legal arrangements that allow you to manage and distribute your assets during your lifetime and after you pass away. * Beneficiary Designations: Documents that specify who will receive certain assets, such as life insurance policies or retirement accounts, after you pass away.

The Role of a Will in Estate Planning

A Last Will and Testament is a fundamental document in estate planning. It allows you to: * Appoint an executor to manage your estate after you pass away * Name guardians for your minor children * Specify how you want your assets to be distributed * Make charitable donations * Include any specific wishes or instructions for your funeral or burial

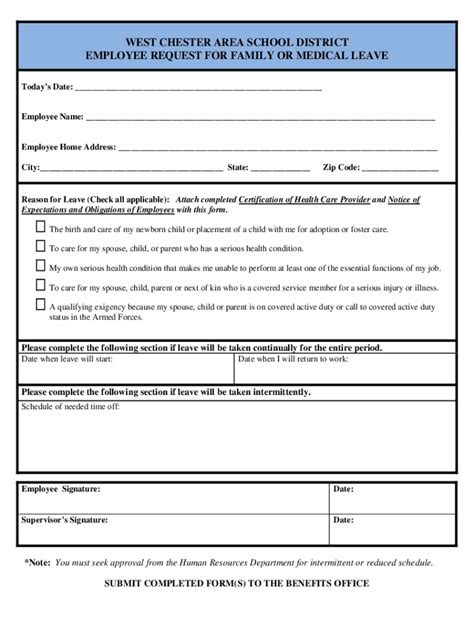

Power of Attorney: Managing Your Affairs

A Power of Attorney is a critical document that grants someone you trust the authority to manage your financial and personal affairs if you become incapacitated. This can include: * Managing your bank accounts and investments * Paying your bills and taxes * Making medical decisions on your behalf * Selling or transferring your assets

Trusts: Flexible and Customizable

Trusts are legal arrangements that allow you to manage and distribute your assets during your lifetime and after you pass away. There are several types of trusts, including: * Revocable Trusts: Can be changed or terminated during your lifetime * Irrevocable Trusts: Cannot be changed or terminated once they are created * Special Needs Trusts: Designed to provide for individuals with disabilities * Charitable Trusts: Used to make charitable donations and reduce taxes

Beneficiary Designations: Simplifying Asset Distribution

Beneficiary Designations are documents that specify who will receive certain assets, such as life insurance policies or retirement accounts, after you pass away. These designations can: * Simplify the process of distributing your assets * Avoid probate and reduce taxes * Ensure that your assets are distributed according to your wishes

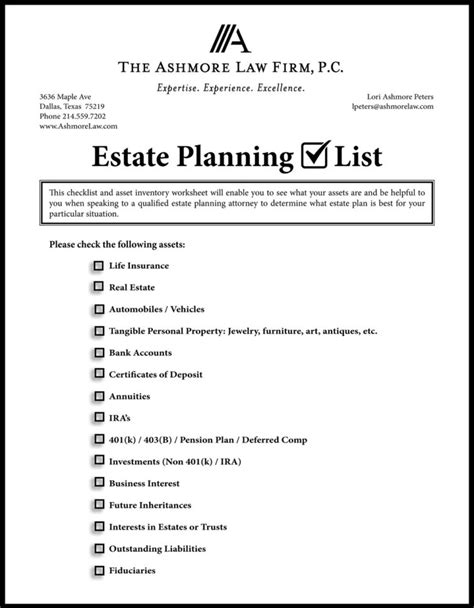

Additional Estate Planning Considerations

In addition to the essential documents, there are several other factors to consider when creating an estate plan. These include: * Tax Planning: Minimizing taxes and ensuring that your assets are distributed in a tax-efficient manner * Insurance: Ensuring that you have adequate life insurance coverage to provide for your loved ones * Business Succession: Planning for the succession of your business, if applicable * Digital Assets: Managing your digital assets, such as social media accounts and online storage

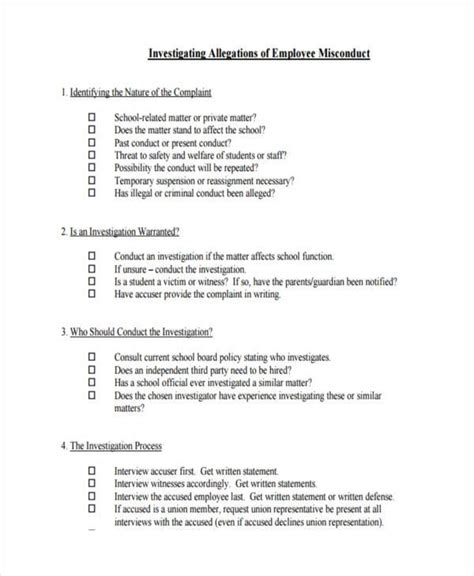

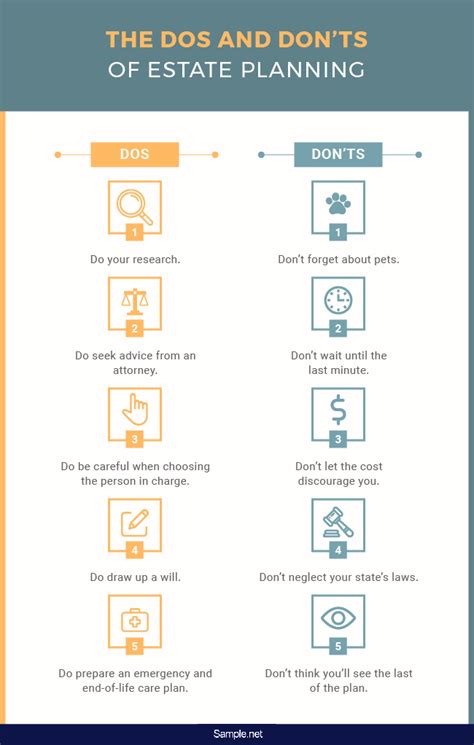

Creating an Estate Plan: Next Steps

Creating an estate plan requires careful consideration and planning. To get started: * Consult with an Attorney: Work with an experienced estate planning attorney to create a customized plan * Gather Information: Gather all necessary documents and information, including asset valuations and beneficiary designations * Review and Update: Regularly review and update your estate plan to ensure that it remains relevant and effective

📝 Note: It's essential to work with an experienced estate planning attorney to ensure that your plan is comprehensive and effective.

In summary, estate planning is a critical process that requires careful consideration and planning. By understanding the essential documents and considerations, you can create a comprehensive plan that protects your assets and ensures that your wishes are respected. With the right guidance and support, you can create a plan that provides peace of mind for you and your loved ones.

What is the purpose of a Last Will and Testament?

+

The purpose of a Last Will and Testament is to outline how you want your assets to be distributed after you pass away, as well as to appoint an executor to manage your estate and name guardians for your minor children.

What is the difference between a Power of Attorney and a Living Will?

+

A Power of Attorney grants someone you trust the authority to manage your financial and personal affairs if you become incapacitated, while a Living Will specifies your wishes for end-of-life medical treatment.

Do I need to work with an attorney to create an estate plan?

+

While it’s possible to create some estate planning documents on your own, it’s highly recommended that you work with an experienced estate planning attorney to ensure that your plan is comprehensive and effective.