5 Steps Homestead Exemption

Understanding Homestead Exemption

The concept of homestead exemption is a vital aspect of property tax law in many jurisdictions, designed to provide relief to homeowners by reducing the amount of property taxes they owe. This exemption can vary significantly from one state to another, with each having its own set of rules and eligibility criteria. For homeowners, understanding and applying for homestead exemption can lead to substantial savings on their annual property tax bills. In this article, we will delve into the details of homestead exemption, exploring what it entails, its benefits, and the steps involved in applying for it.

Benefits of Homestead Exemption

Before diving into the application process, it’s essential to grasp the benefits that homestead exemption offers. These benefits can include: - Reduced Property Taxes: The primary advantage is the reduction in property tax liability, which can lead to significant annual savings for homeowners. - Protection from Creditors: In some states, homestead exemptions also provide a level of protection against creditors, safeguarding a portion of the home’s value from being seized to pay off debts. - Increased Affordability: By lowering the property tax burden, homestead exemptions can make homeownership more affordable, especially for low-income families, seniors, and disabled individuals.

5 Steps to Apply for Homestead Exemption

Applying for homestead exemption involves several steps that homeowners must follow carefully to ensure their application is successful. Here are the key steps:

Check Eligibility: The first step is to determine if you are eligible for homestead exemption. Eligibility criteria vary by state but typically include requirements such as:

- The property must be your primary residence.

- You must have owned and occupied the property as of a certain date (usually January 1st of the tax year).

- Income and age requirements may apply, especially for additional exemptions.

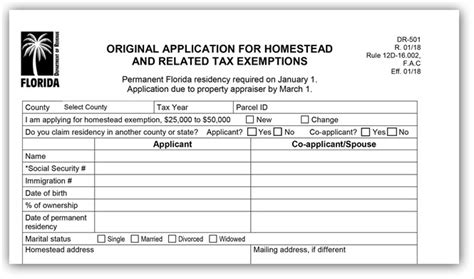

Gather Required Documents: Once you’ve confirmed your eligibility, gather all necessary documents. These may include:

- Proof of ownership (deed or title).

- Proof of residency (driver’s license, utility bills).

- Social Security number or Individual Taxpayer Identification Number.

- Income verification for income-based exemptions.

Complete the Application: Obtain the homestead exemption application form from your local tax assessor’s office or download it from their official website. Fill out the form accurately and completely, as any errors or omissions can delay or invalidate your application.

Submit the Application: Submit your completed application, along with all required documents, to the tax assessor’s office before the deadline. Deadlines vary by state and even by county, so it’s crucial to check with your local tax authority for specific dates.

Review and Follow Up: After submitting your application, review it to ensure everything is in order. If additional information is required, be prepared to provide it promptly. Follow up with the tax assessor’s office if you haven’t received a response within a few weeks to confirm the status of your application.

📝 Note: The specific requirements and deadlines for homestead exemption applications can vary significantly, so it's essential to consult with your local tax authority for the most accurate and up-to-date information.

Common Mistakes to Avoid

When applying for homestead exemption, there are several common mistakes that homeowners should be aware of to avoid delays or rejection of their application: - Failing to meet the deadline: Submit your application on time to ensure it is processed for the current tax year. - Incomplete application: Ensure all sections of the application are filled out accurately and completely. - Insufficient documentation: Verify that you have included all required documents to support your application.

Conclusion

Applying for homestead exemption is a straightforward process that can yield significant savings on property taxes for eligible homeowners. By understanding the eligibility criteria, gathering the necessary documents, completing the application accurately, submitting it on time, and following up as needed, homeowners can successfully apply for this valuable exemption. It’s also important to be aware of common mistakes to avoid and to consult with local tax authorities for specific guidance tailored to their jurisdiction.

What is homestead exemption, and how does it benefit homeowners?

+

Homestead exemption is a reduction in property taxes offered to homeowners who meet specific eligibility criteria, such as using the property as their primary residence. It benefits homeowners by reducing their property tax liability, making homeownership more affordable.

How do I apply for homestead exemption, and what documents do I need?

+

To apply for homestead exemption, you need to obtain the application form from your local tax assessor’s office, fill it out accurately, and submit it along with required documents such as proof of ownership, proof of residency, and possibly income verification. The specific documents needed may vary depending on your state or local jurisdiction.

Are there any common mistakes I should avoid when applying for homestead exemption?

+

Yes, common mistakes to avoid include missing the application deadline, submitting an incomplete application, and failing to provide sufficient documentation to support your eligibility. It’s also important to ensure you meet the eligibility criteria for your state or local jurisdiction.