Paperwork

Mortgage Application Paperwork Needed

Introduction to Mortgage Application Process

When applying for a mortgage, it’s essential to be prepared with the necessary paperwork to ensure a smooth and efficient process. The mortgage application process can be complex and time-consuming, but having all the required documents in order can help to avoid delays and reduce stress. In this article, we will guide you through the mortgage application paperwork needed and provide tips on how to prepare.

Types of Mortgage Applications

There are various types of mortgage applications, including conventional loans, FHA loans, VA loans, and USDA loans. Each type of loan has its own set of requirements, but there are some common documents that are required for all mortgage applications. It’s crucial to understand the specific requirements for your loan type to ensure you have all the necessary paperwork.

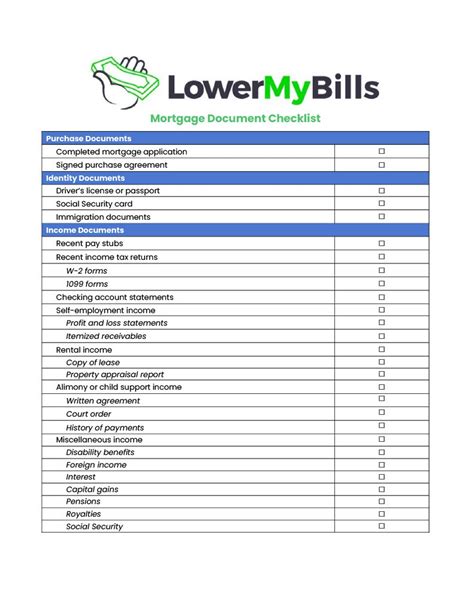

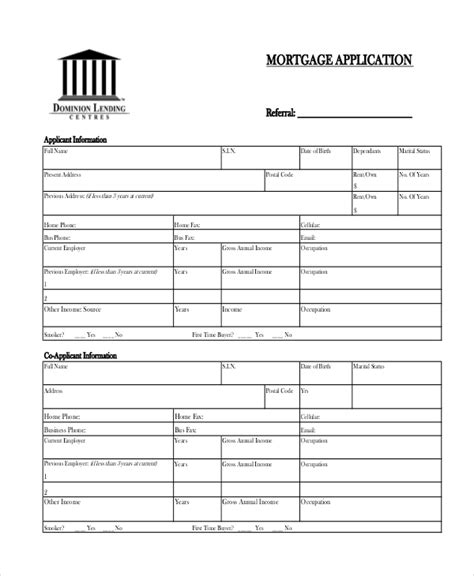

Personal Identification Documents

To start the mortgage application process, you will need to provide personal identification documents, including:

- Government-issued ID: Such as a driver’s license, state ID, or passport

- Social Security number: To verify your identity and creditworthiness

- Birth certificate: To confirm your age and identity

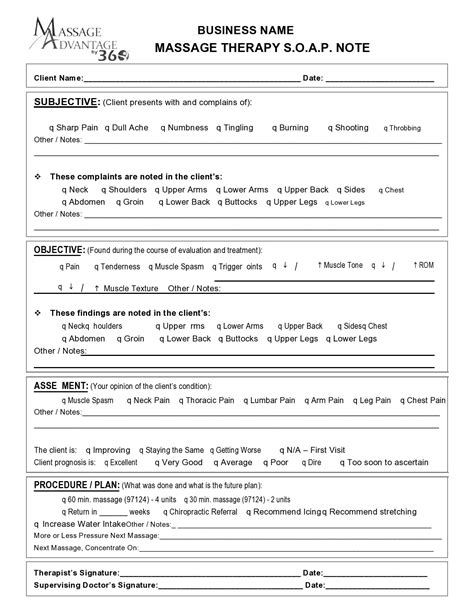

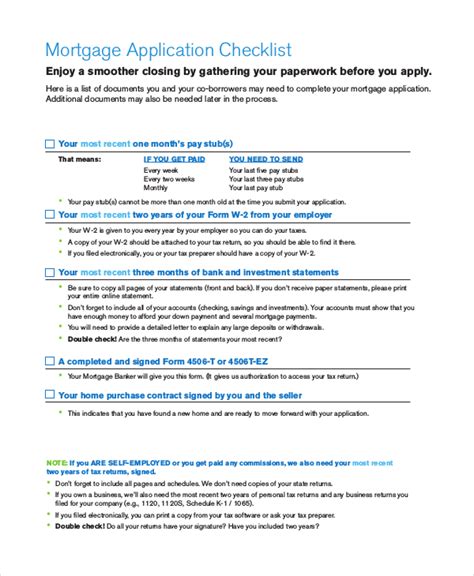

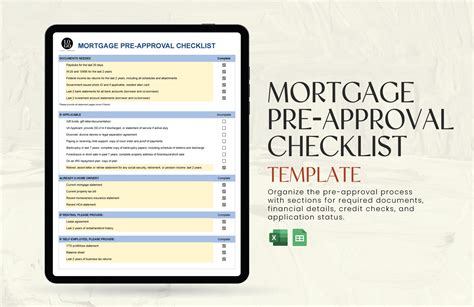

Income and Employment Documents

Lenders need to assess your income and employment stability to determine your ability to repay the loan. You will need to provide:

- Pay stubs: Recent pay stubs to show your current income

- W-2 forms: Previous year’s W-2 forms to verify your income history

- Tax returns: Recent tax returns to confirm your income and employment status

- Letter from employer: A letter from your employer to verify your employment and income

Asset and Credit Documents

To complete the mortgage application process, you will need to provide documents related to your assets and credit history, including:

- Bank statements: Recent bank statements to show your savings and asset history

- Investment accounts: Statements from investment accounts, such as 401(k) or IRA

- Credit report: A copy of your credit report to evaluate your credit history and score

- Debt obligations: Documents related to your debt obligations, such as car loans or student loans

Property-Related Documents

If you are purchasing a property, you will need to provide documents related to the property, including:

- Purchase agreement: A copy of the purchase agreement to confirm the sale price and terms

- Property appraisal: A property appraisal to determine the value of the property

- Title report: A title report to confirm the ownership and any liens on the property

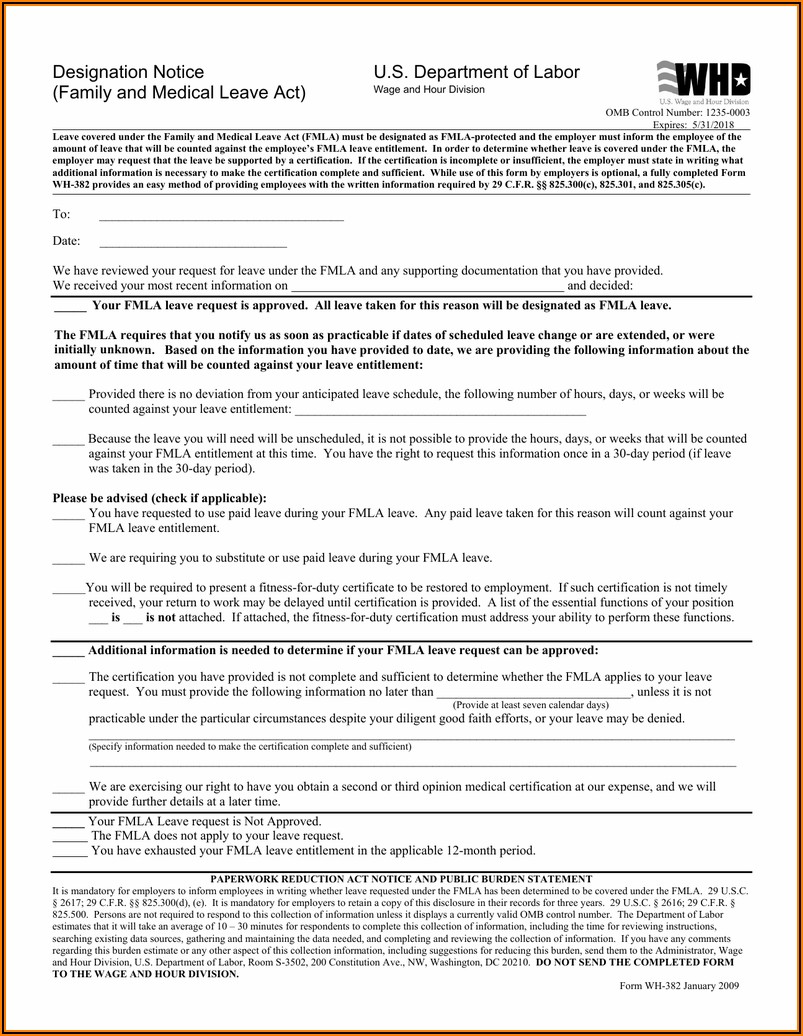

Additional Documents

Depending on your individual circumstances, you may need to provide additional documents, such as:

- Divorce or separation documents: If you are divorced or separated, you may need to provide documents related to your divorce or separation

- Child support or alimony documents: If you receive child support or alimony, you may need to provide documents related to these payments

- Gift letter: If you are receiving a gift from a family member or friend to help with the down payment, you may need to provide a gift letter

Organizing Your Documents

To ensure a smooth mortgage application process, it’s essential to organize your documents in a logical and accessible way. You can use a folder or binder to keep all your documents in one place. Make sure to label each document clearly and keep them in a secure location.

📝 Note: It's crucial to keep your documents up to date and accurate, as any discrepancies or errors can delay the mortgage application process.

Conclusion and Final Thoughts

In conclusion, the mortgage application process requires a significant amount of paperwork, but being prepared and organized can help to simplify the process. By understanding the types of documents required and keeping them in order, you can ensure a smooth and efficient mortgage application process. Remember to stay informed and ask questions if you are unsure about any aspect of the process.

What is the most important document required for a mortgage application?

+

The most important document required for a mortgage application is your credit report, as it provides a comprehensive overview of your credit history and score.

How long does the mortgage application process typically take?

+

The mortgage application process can take anywhere from 30 to 60 days, depending on the complexity of the application and the efficiency of the lender.

Can I apply for a mortgage online?

+

Yes, many lenders offer online mortgage applications, which can be a convenient and time-saving option. However, it’s essential to ensure that you are working with a reputable lender and that you understand the terms and conditions of the loan.