Paperwork

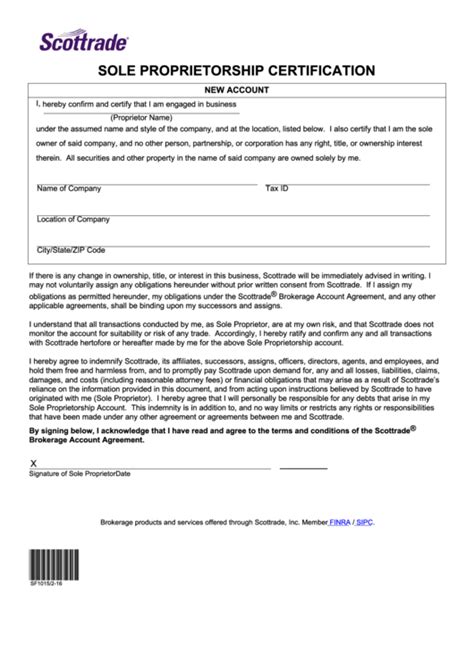

Sole Proprietorship Paperwork Requirements

Introduction to Sole Proprietorship

A sole proprietorship is a type of business structure where one individual owns and operates the business. It is the simplest and most common form of business ownership, requiring minimal paperwork and regulatory compliance. However, it is essential to understand the necessary sole proprietorship paperwork requirements to ensure the business is properly established and operated. In this article, we will delve into the details of the paperwork requirements for a sole proprietorship, providing a comprehensive guide for entrepreneurs and small business owners.

Business Name and Registration

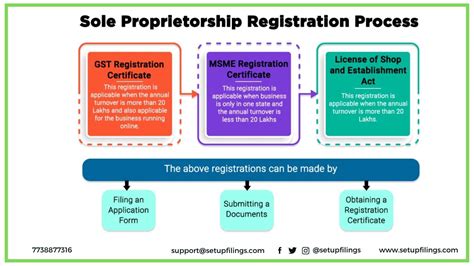

To start a sole proprietorship, the business owner must choose a unique business name that is not already in use by another business in the state. The business name should also comply with the state’s naming requirements, which may include specific words or phrases that must be included or excluded. Once the business name is chosen, the owner must register the business with the state government, typically through the Secretary of State’s office. This registration process involves filing a business registration form and paying a registration fee, which varies by state.

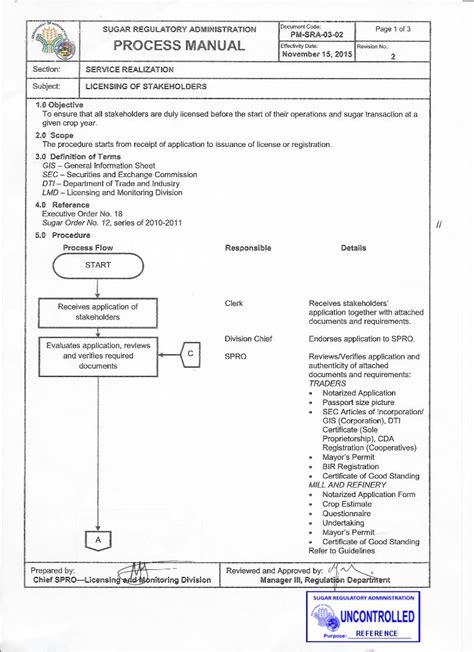

Obtaining Licenses and Permits

Depending on the type of business and its location, the sole proprietorship may require licenses and permits to operate. These licenses and permits may be issued by the state, county, or local government, and may include: * Business license: required for all businesses operating in the state * Sales tax permit: required for businesses that sell taxable goods or services * Employer identification number (EIN): required for businesses that have employees or pay taxes * Health department permit: required for businesses that handle food or provide healthcare services * Zoning permit: required for businesses that operate in a specific location

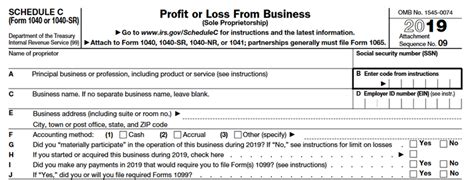

Tax Requirements

As a sole proprietorship, the business owner is responsible for reporting the business’s income and expenses on their personal tax return. The business owner must also pay self-employment taxes on their net earnings from self-employment, which includes the business’s income. The tax requirements for a sole proprietorship include: * Form 1040: the business owner’s personal tax return * Schedule C: the business’s profit and loss statement * Schedule SE: the business owner’s self-employment tax return * Form W-9: the business’s tax identification number

| Form | Purpose |

|---|---|

| Form 1040 | Personal tax return |

| Schedule C | Business profit and loss statement |

| Schedule SE | Self-employment tax return |

| Form W-9 | Tax identification number |

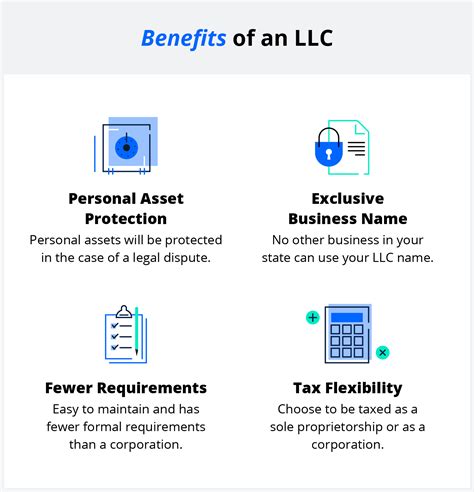

Insurance Requirements

While not mandatory, it is highly recommended that sole proprietors obtain business insurance to protect themselves and their business from potential risks and liabilities. The types of insurance that may be necessary for a sole proprietorship include: * Liability insurance: protects the business from lawsuits and damages * Property insurance: protects the business’s assets and property * Workers’ compensation insurance: required for businesses with employees * Business interruption insurance: protects the business from unexpected events or disasters

📝 Note: The specific insurance requirements for a sole proprietorship will depend on the type of business, its location, and its operations.

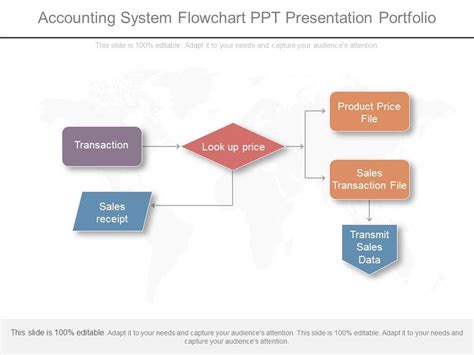

Record-Keeping Requirements

As a sole proprietorship, the business owner is responsible for maintaining accurate and detailed financial records, including: * Income statements: records of the business’s income and expenses * Balance sheets: records of the business’s assets, liabilities, and equity * Cash flow statements: records of the business’s cash inflows and outflows * Tax records: records of the business’s tax returns and payments

Conclusion and Final Thoughts

In conclusion, starting and operating a sole proprietorship requires careful attention to the necessary paperwork and regulatory requirements. By understanding the business name and registration process, obtaining licenses and permits, meeting tax requirements, obtaining insurance, and maintaining accurate records, sole proprietors can ensure their business is properly established and operated. It is essential to stay informed and up-to-date on the specific requirements for your business and location, and to seek professional advice when necessary.

What is the main advantage of a sole proprietorship?

+

The main advantage of a sole proprietorship is its simplicity and ease of formation, as it requires minimal paperwork and regulatory compliance.

Do I need to register my sole proprietorship with the state?

+

Yes, you need to register your sole proprietorship with the state by filing a business registration form and paying a registration fee.

What types of insurance do I need for my sole proprietorship?

+

The types of insurance you need for your sole proprietorship will depend on the type of business, its location, and its operations, but may include liability insurance, property insurance, workers’ compensation insurance, and business interruption insurance.