5 Tax Papers Needed

Introduction to Tax Papers

When it comes to managing your finances, one of the most critical aspects is dealing with tax papers. Tax papers are essential documents that you need to have in order to file your taxes, claim deductions, and take advantage of tax credits. In this blog post, we will discuss the 5 tax papers that you need to have in order to ensure that you are complying with tax laws and regulations.

Understanding the Importance of Tax Papers

Tax papers are not just random documents; they are crucial for your financial well-being. Having the right tax papers can help you to avoid penalties, fines, and even audits. Moreover, tax papers can help you to claim deductions and credits that you are eligible for, which can result in a significant reduction in your tax liability. In this section, we will explore the importance of tax papers and why you need to have them.

The 5 Tax Papers You Need

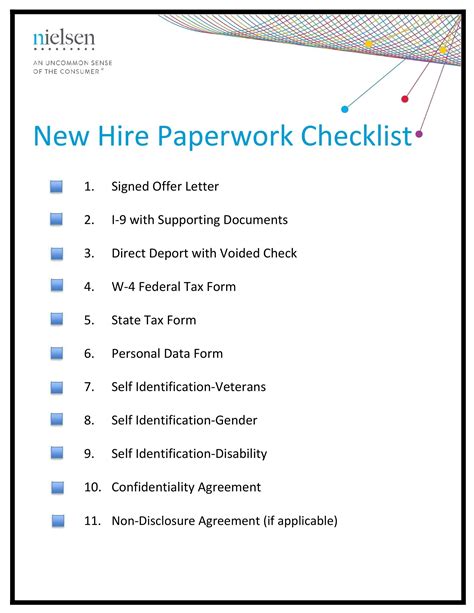

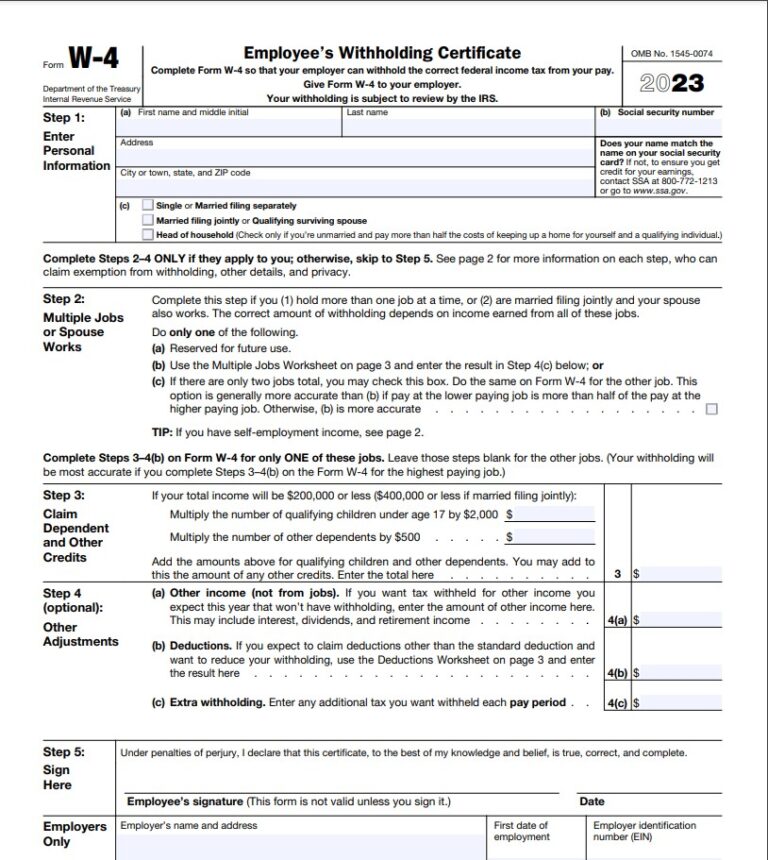

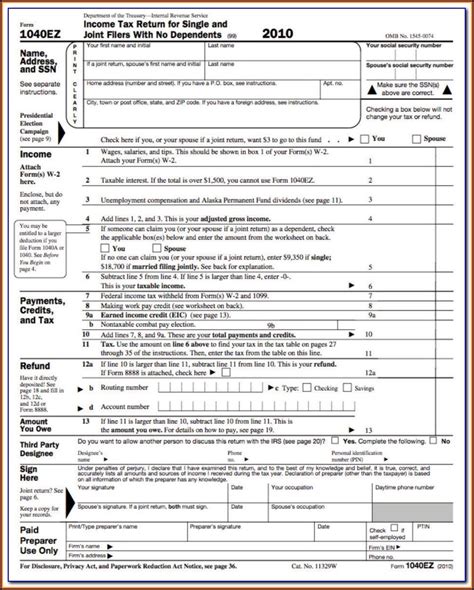

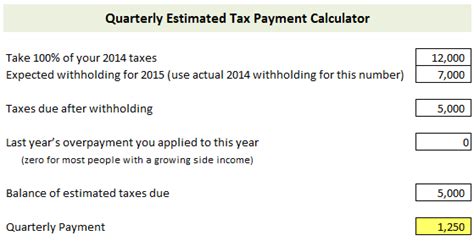

Here are the 5 tax papers that you need to have: * W-2 Form: This is the most common tax paper that you need to have. The W-2 form shows your income and the taxes that have been withheld from your paycheck. * 1099 Form: If you are self-employed or have income from freelance work, you will need to have a 1099 form. This form shows your income and the taxes that you have paid. * Interest Statements: If you have a savings account or investments, you will need to have interest statements. These statements show the interest that you have earned and the taxes that you have paid. * Charitable Donation Receipts: If you have made charitable donations, you will need to have receipts to claim deductions. These receipts show the amount that you have donated and the organization that you donated to. * Medical Expense Receipts: If you have medical expenses, you will need to have receipts to claim deductions. These receipts show the amount that you have spent on medical expenses and the date that you incurred the expenses.

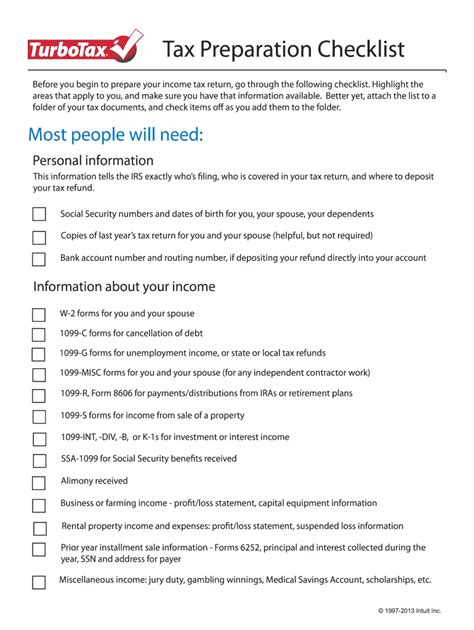

How to Obtain Tax Papers

Obtaining tax papers is not as difficult as you think. Here are some ways to obtain tax papers: * Request from your employer: If you need a W-2 form, you can request it from your employer. * Download from the IRS website: You can download tax forms and instructions from the IRS website. * Contact your bank or financial institution: If you need interest statements or other financial documents, you can contact your bank or financial institution. * Keep receipts and records: It is essential to keep receipts and records of your charitable donations and medical expenses.

Organizing Your Tax Papers

Once you have obtained your tax papers, it is essential to organize them properly. Here are some tips to help you organize your tax papers: * Create a folder or file: Create a folder or file to store all your tax papers. * Label and date documents: Label and date each document so that you can easily identify them. * Keep receipts and records: Keep receipts and records of your charitable donations and medical expenses. * Review and update regularly: Review and update your tax papers regularly to ensure that you have all the necessary documents.

📝 Note: It is essential to keep your tax papers organized and up-to-date to avoid penalties and fines.

Benefits of Having Tax Papers

Having tax papers can have several benefits, including: * Reduced tax liability: Having tax papers can help you to claim deductions and credits that you are eligible for, which can result in a significant reduction in your tax liability. * Avoid penalties and fines: Having tax papers can help you to avoid penalties and fines that can result from not having the necessary documents. * Improved financial management: Having tax papers can help you to manage your finances better and make informed decisions about your money. * Peace of mind: Having tax papers can give you peace of mind, knowing that you have all the necessary documents to comply with tax laws and regulations.

| Tax Paper | Purpose |

|---|---|

| W-2 Form | Shows income and taxes withheld |

| 1099 Form | Shows income and taxes paid |

| Interest Statements | Shows interest earned and taxes paid |

| Charitable Donation Receipts | Shows charitable donations made |

| Medical Expense Receipts | Shows medical expenses incurred |

In summary, having the right tax papers is essential for managing your finances and complying with tax laws and regulations. The 5 tax papers that you need to have are the W-2 form, 1099 form, interest statements, charitable donation receipts, and medical expense receipts. By obtaining and organizing these tax papers, you can reduce your tax liability, avoid penalties and fines, and improve your financial management.

What is the purpose of a W-2 form?

+

The W-2 form shows your income and the taxes that have been withheld from your paycheck.

How do I obtain a 1099 form?

+

You can obtain a 1099 form from the IRS website or by contacting your employer or financial institution.

What is the importance of keeping charitable donation receipts?

+

Keeping charitable donation receipts is essential to claim deductions on your tax return.