PPP Loan Paperwork Requirements

Introduction to PPP Loan Paperwork Requirements

The Paycheck Protection Program (PPP) is a federal loan initiative designed to help small businesses and other eligible entities maintain their payroll and cover certain expenses during the COVID-19 pandemic. To apply for a PPP loan, businesses must navigate a complex process involving various paperwork requirements. Understanding these requirements is crucial for a successful application. In this article, we will delve into the details of PPP loan paperwork requirements, providing insights into the necessary documents and steps to follow.

Eligibility Criteria and Required Documents

Before applying for a PPP loan, it is essential to determine if your business meets the eligibility criteria set by the Small Business Administration (SBA). Generally, eligible entities include small businesses, sole proprietors, independent contractors, and self-employed individuals. The primary documents required for eligibility include: * Business license * Articles of incorporation * Payroll records * Tax returns * Identification documents for owners and authorized representatives

These documents serve as the foundation for your loan application, as they verify your business’s identity, size, and operational status.

Calculating PPP Loan Amounts

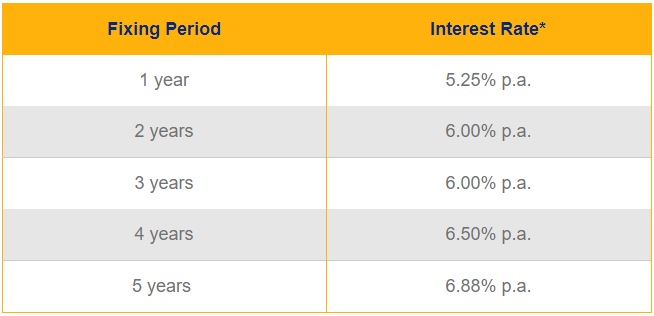

The PPP loan amount is calculated based on your business’s average monthly payroll costs. To calculate this, you will need: * Payroll records for the specified period (usually 2019 or 2020) * Tax forms, such as Form 1040 for sole proprietors or Form 1120 for corporations * Bank statements to verify payroll costs

The calculation involves determining your average monthly payroll costs and then multiplying this figure by 2.5 to obtain the maximum loan amount. Certain caps and exceptions apply, particularly for businesses with high-compensation employees or those in the hospitality and food service industries.

Completing the Loan Application

The PPP loan application, Form 2483, requires detailed information about your business, including: * Business description * Ownership structure * Average monthly payroll costs * Loan amount requested * Use of loan proceeds

Accurate completion of this form is critical, as any errors or omissions can delay or even reject your application.

Additional Requirements for Self-Employed Individuals

Self-employed individuals, including sole proprietors and independent contractors, must provide additional documentation, such as: * Form 1040 Schedule C to verify business income * Form 1099-MISC for freelance or contract work * Bank statements showing business-related transactions

These documents help establish the individual’s business activity and income level, which are essential for determining loan eligibility and amount.

Submission and Review Process

Once all required documents are gathered and the application is completed, it must be submitted to an approved lender. The lender will review your application, verify the information provided, and assess your creditworthiness. This process may involve additional requests for documentation or clarification on specific points.

📝 Note: It is crucial to ensure all documents are accurate and complete to avoid delays in the application process.

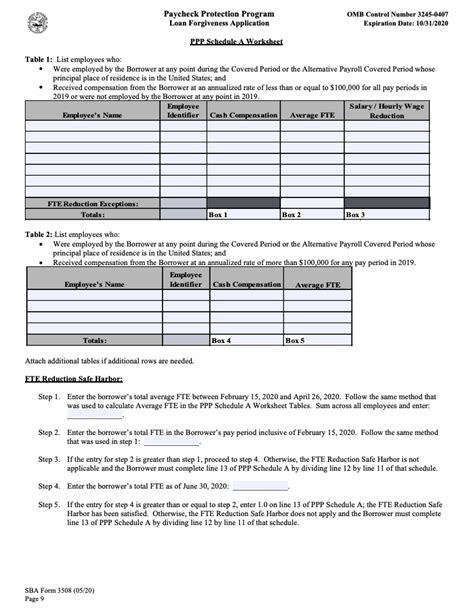

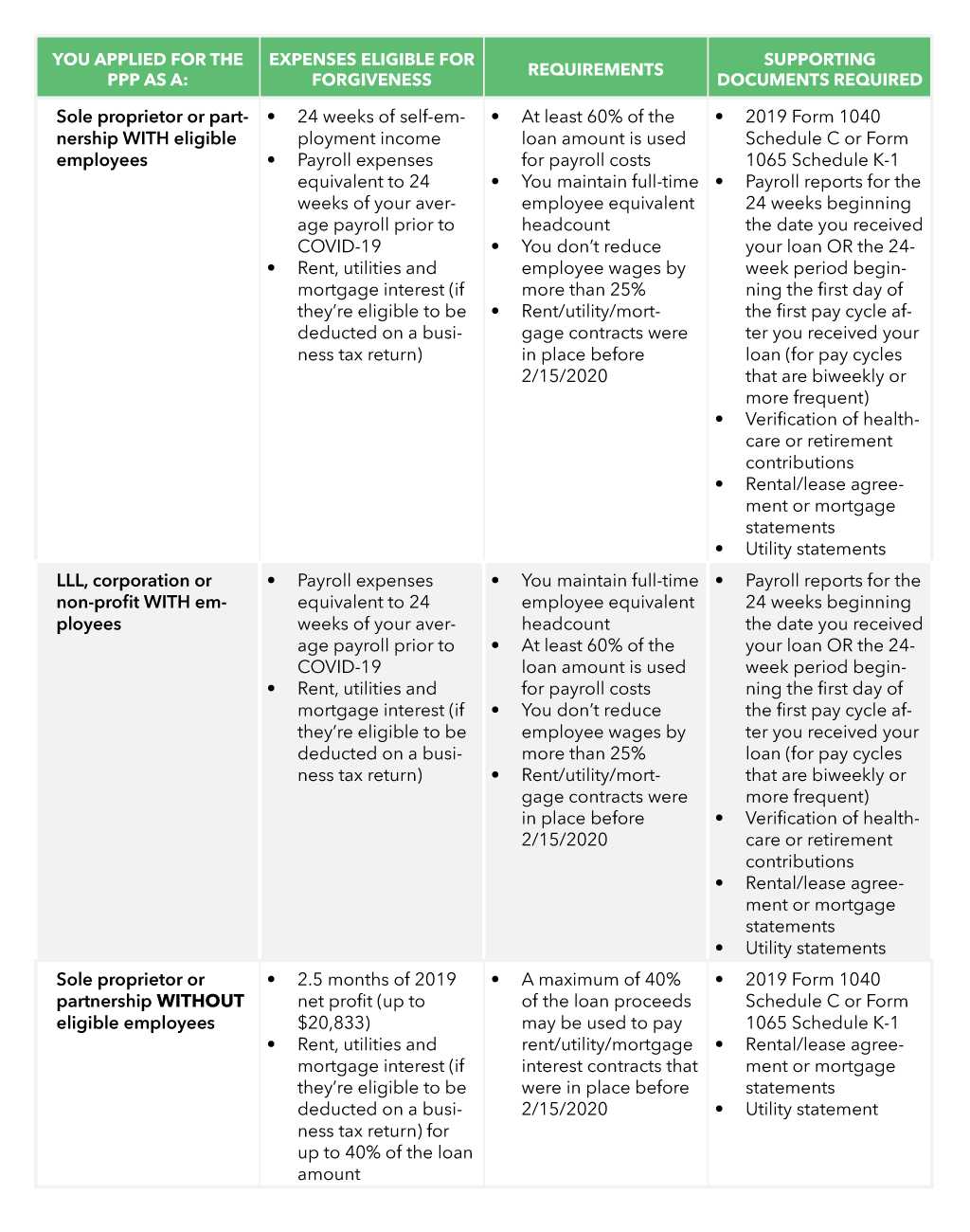

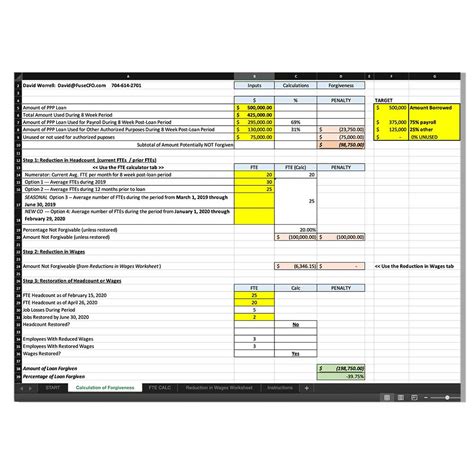

Loan Forgiveness

A significant aspect of PPP loans is the potential for loan forgiveness. To qualify, businesses must use at least 60% of the loan proceeds for payroll costs and the remaining amount for other eligible expenses, such as rent, utilities, and mortgage interest. Documentation required for loan forgiveness includes: * Payroll records showing the use of loan funds for payroll costs * Receipts and invoices for eligible non-payroll expenses * Bank statements verifying the payment of eligible expenses

The loan forgiveness application, which involves submitting Form 3508 or 3508EZ to your lender, must be accompanied by these supporting documents to demonstrate compliance with PPP regulations.

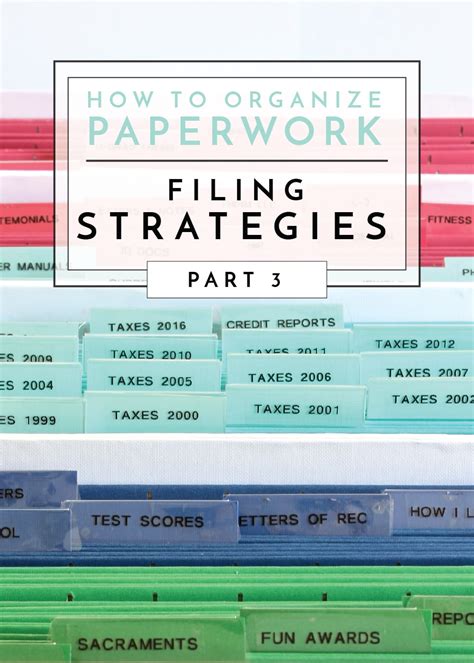

| Document Type | Purpose |

|---|---|

| Business License | Verifies business operation |

| Payroll Records | Determines loan amount and forgiveness eligibility |

| Tax Returns | Confirms business income and eligibility |

In summary, navigating the PPP loan paperwork requirements involves careful preparation and attention to detail. By understanding the necessary documents, calculation processes, and submission procedures, businesses can successfully apply for a PPP loan and potentially achieve loan forgiveness.

To finalize, the key points to consider when applying for a PPP loan include determining eligibility, gathering required documents, accurately completing the loan application, and understanding the loan forgiveness process. Each step requires precision and compliance with SBA regulations to ensure a successful outcome.

What are the primary documents required for a PPP loan application?

+

The primary documents include business license, articles of incorporation, payroll records, tax returns, and identification documents for owners and authorized representatives.

How is the PPP loan amount calculated?

+

The loan amount is calculated based on the business’s average monthly payroll costs, multiplied by 2.5, with certain caps and exceptions applying.

What is required for loan forgiveness?

+

To qualify for loan forgiveness, businesses must use at least 60% of the loan for payroll costs and provide detailed documentation, including payroll records, receipts for eligible expenses, and bank statements.