Paperwork

Estate Administrator Paperwork Requirements

Introduction to Estate Administration

Estate administration is the process of managing and distributing the assets of a deceased person, also known as the decedent. This process can be complex and time-consuming, involving a range of tasks and responsibilities. One of the key aspects of estate administration is the paperwork requirements, which can be overwhelming for those who are not familiar with the process. In this article, we will explore the various paperwork requirements involved in estate administration, including the types of documents that need to be prepared, the information that needs to be gathered, and the deadlines that need to be met.

Types of Documents Required

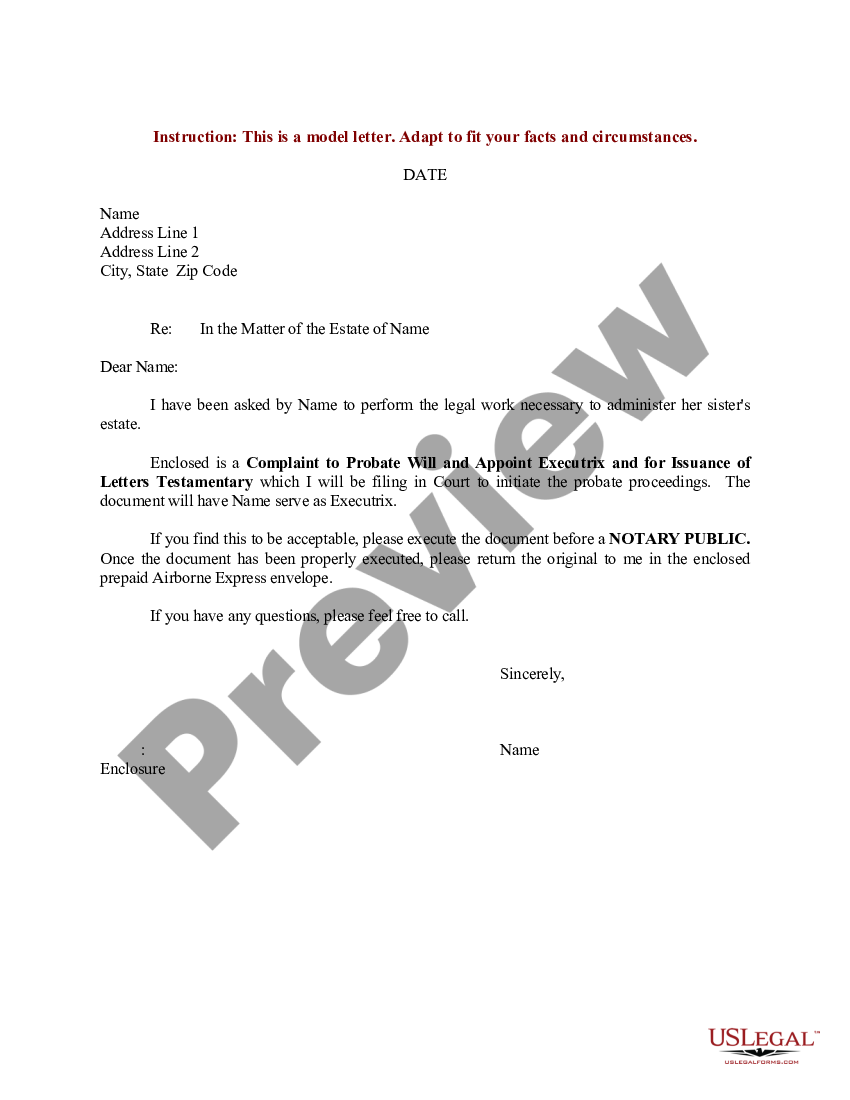

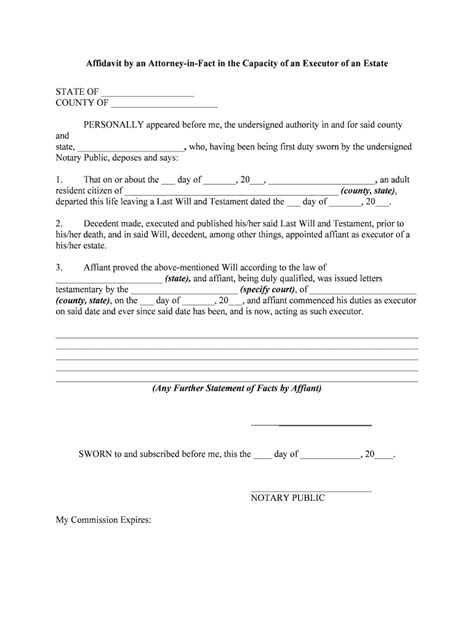

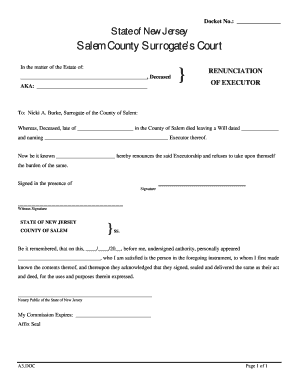

There are several types of documents that are typically required in estate administration, including: * Will: The will is the document that outlines the decedent’s wishes for the distribution of their assets. It is typically prepared by an attorney and must be signed and witnessed in accordance with the laws of the state. * Letters of Administration: If the decedent did not leave a will, or if the will is deemed invalid, the court may appoint an administrator to manage the estate. The administrator will need to obtain letters of administration, which are documents that authorize them to act on behalf of the estate. * Inventory: An inventory is a list of the decedent’s assets, including their value and location. This document is typically prepared by the executor or administrator and must be filed with the court. * Tax Returns: The estate may need to file tax returns, including income tax returns and estate tax returns. These returns must be prepared and filed in accordance with the laws of the state and the federal government. * Accounting: The executor or administrator will need to prepare an accounting of the estate’s assets and expenses. This document must be filed with the court and provides a detailed record of the estate’s financial activities.

Information Required

To prepare the necessary documents, the executor or administrator will need to gather a range of information, including: * Asset Information: This includes the value, location, and ownership of the decedent’s assets, such as real estate, bank accounts, investments, and personal property. * Creditor Information: The executor or administrator will need to identify the decedent’s creditors and notify them of the estate’s administration. * Beneficiary Information: The executor or administrator will need to identify the beneficiaries of the estate, including their names, addresses, and relationship to the decedent. * Tax Information: The executor or administrator will need to gather tax information, including the decedent’s tax returns and any outstanding tax liabilities.

Deadlines

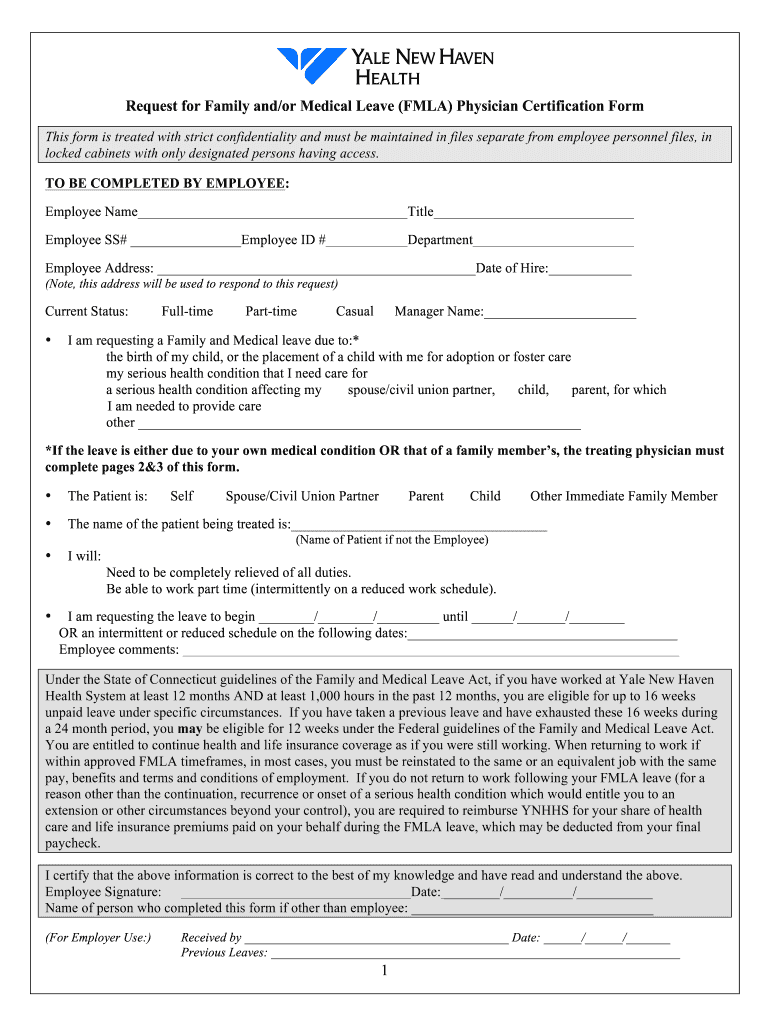

There are several deadlines that must be met in estate administration, including: * Filing the Will: The will must be filed with the court within a certain timeframe, typically 30 days after the decedent’s death. * Notifying Creditors: The executor or administrator must notify the decedent’s creditors within a certain timeframe, typically 30 days after the decedent’s death. * Filing Tax Returns: The estate’s tax returns must be filed within a certain timeframe, typically 9 months after the decedent’s death. * Distributing Assets: The executor or administrator must distribute the estate’s assets in accordance with the will or the laws of the state, typically within 12 months after the decedent’s death.

Additional Requirements

In addition to the paperwork requirements, there may be other requirements that must be met in estate administration, including: * Appraising Assets: The executor or administrator may need to appraise the estate’s assets, including real estate and personal property. * Paying Expenses: The executor or administrator must pay the estate’s expenses, including funeral expenses, taxes, and creditor claims. * Managing Assets: The executor or administrator must manage the estate’s assets, including investing and distributing them in accordance with the will or the laws of the state.

📝 Note: The specific requirements for estate administration can vary depending on the state and the complexity of the estate. It is recommended that the executor or administrator seek the advice of an attorney to ensure that all requirements are met.

Conclusion and Final Thoughts

In conclusion, estate administration involves a range of paperwork requirements, including preparing and filing various documents, gathering information, and meeting deadlines. The executor or administrator must be organized and detail-oriented to ensure that all requirements are met and that the estate is administered in accordance with the decedent’s wishes and the laws of the state. By understanding the paperwork requirements and seeking the advice of an attorney, the executor or administrator can ensure that the estate is administered efficiently and effectively.

What is the purpose of estate administration?

+

The purpose of estate administration is to manage and distribute the assets of a deceased person in accordance with their wishes and the laws of the state.

What documents are required in estate administration?

+

The documents required in estate administration include the will, letters of administration, inventory, tax returns, and accounting.

What is the role of the executor or administrator in estate administration?

+

The executor or administrator is responsible for managing the estate’s assets, paying expenses, and distributing assets in accordance with the will or the laws of the state.