Paperwork

All Cash Home Purchase Paperwork Needed

Introduction to All Cash Home Purchase

When it comes to purchasing a home, there are several options available to buyers. One of these options is an all-cash home purchase, where the buyer pays the full amount of the purchase price in cash, without the need for a mortgage or other financing. This type of purchase can be beneficial for both the buyer and the seller, as it eliminates the risk of financing contingencies and can often result in a faster closing process. However, it’s essential to understand the paperwork involved in an all-cash home purchase to ensure a smooth transaction.

Benefits of All Cash Home Purchase

There are several benefits to an all-cash home purchase, including: * Faster Closing: All-cash purchases can often close faster than traditional purchases, as there is no need to wait for mortgage approval. * No Financing Contingencies: The risk of financing contingencies is eliminated, as the buyer is not relying on a lender to secure funding. * More Attractive Offer: All-cash offers can be more attractive to sellers, as they often result in a faster and more secure sale. * No Mortgage Costs: The buyer avoids mortgage costs, such as interest payments and closing costs.

Paperwork Needed for All Cash Home Purchase

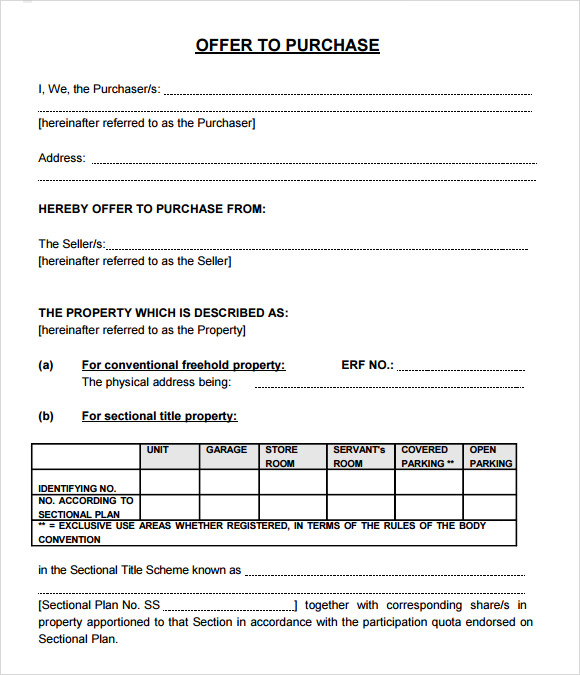

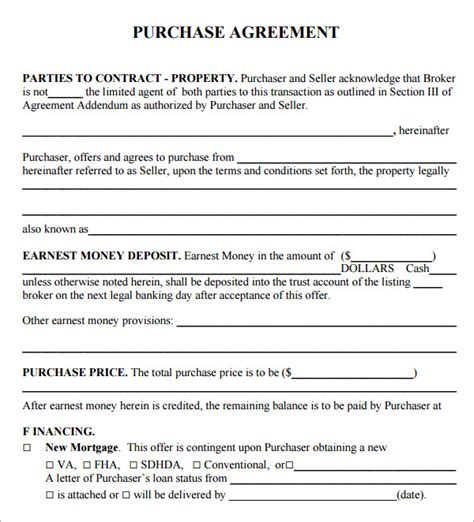

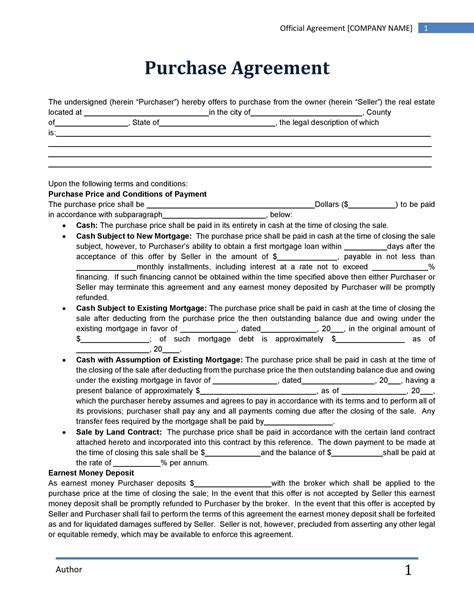

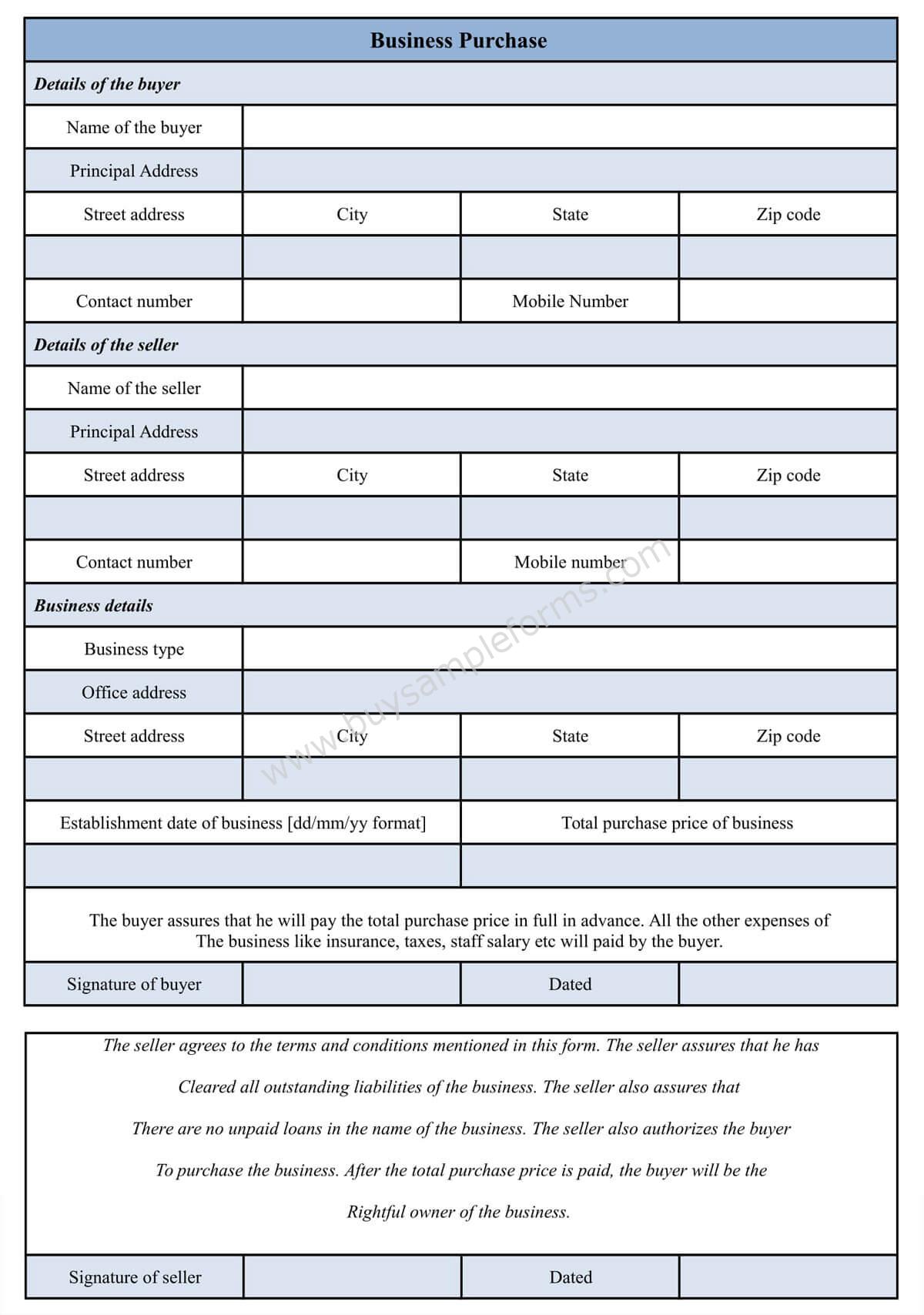

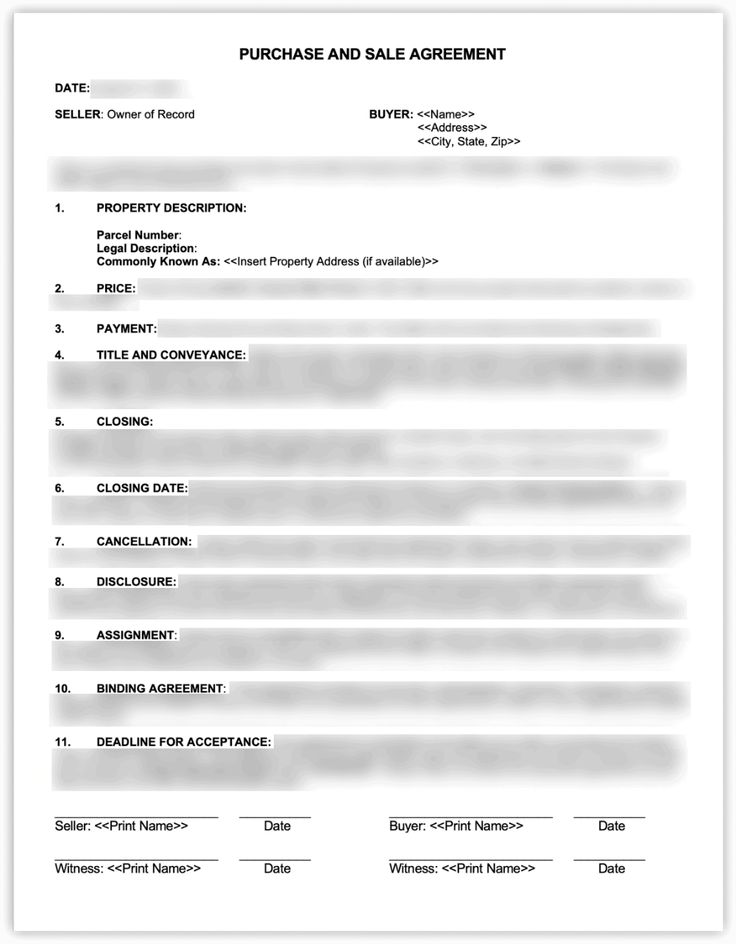

While an all-cash home purchase may seem straightforward, there is still a significant amount of paperwork involved. The following documents are typically required: * Purchase Agreement: A contract between the buyer and seller that outlines the terms of the sale, including the purchase price, closing date, and any contingencies. * Proof of Funds: Documentation that shows the buyer has the necessary funds to complete the purchase, such as a bank statement or letter from a financial institution. * Identification: The buyer’s identification, such as a driver’s license or passport, to verify their identity. * Title Report: A report that shows the current ownership of the property and any liens or encumbrances. * Property Survey: A survey of the property to verify its boundaries and any potential issues. * Inspection Reports: Reports from inspections of the property, such as a termite inspection or home inspection. * Closing Statement: A document that outlines the final terms of the sale, including the purchase price, closing costs, and any prorations.

📝 Note: The specific paperwork required may vary depending on the location and type of property being purchased.

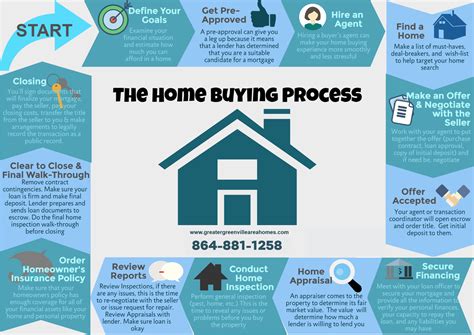

Steps Involved in All Cash Home Purchase

The steps involved in an all-cash home purchase are similar to those of a traditional purchase, with a few key differences: * Find a Property: The buyer finds a property they are interested in purchasing and makes an offer. * Inspect and Appraise: The buyer inspects and appraises the property to ensure it is in good condition and worth the purchase price. * Review and Sign Documents: The buyer reviews and signs the purchase agreement and other documents. * Close the Sale: The buyer and seller meet to sign the final documents and transfer ownership of the property.

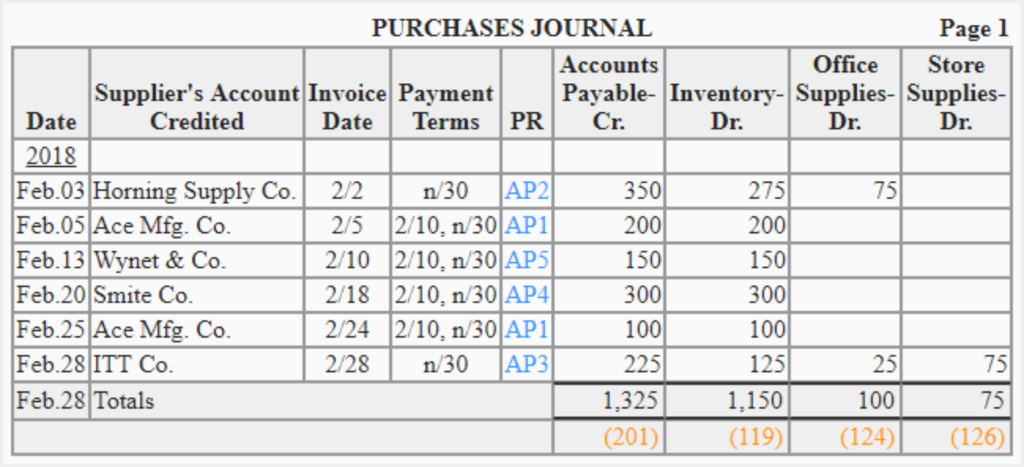

Table of Paperwork Needed

The following table outlines the paperwork typically needed for an all-cash home purchase:

| Document | Description |

|---|---|

| Purchase Agreement | A contract between the buyer and seller |

| Proof of Funds | Documentation of the buyer’s funds |

| Identification | The buyer’s identification |

| Title Report | A report showing the current ownership of the property |

| Property Survey | A survey of the property |

| Inspection Reports | Reports from inspections of the property |

| Closing Statement | A document outlining the final terms of the sale |

Conclusion and Final Thoughts

In conclusion, an all-cash home purchase can be a beneficial option for both buyers and sellers, as it eliminates the risk of financing contingencies and can often result in a faster closing process. However, it’s essential to understand the paperwork involved in this type of purchase to ensure a smooth transaction. By being prepared and knowing what to expect, buyers can navigate the process with confidence and achieve their goal of owning a new home.

What is an all-cash home purchase?

+

An all-cash home purchase is a type of purchase where the buyer pays the full amount of the purchase price in cash, without the need for a mortgage or other financing.

What are the benefits of an all-cash home purchase?

+

The benefits of an all-cash home purchase include a faster closing, no financing contingencies, a more attractive offer, and no mortgage costs.

What paperwork is needed for an all-cash home purchase?

+

The paperwork needed for an all-cash home purchase includes a purchase agreement, proof of funds, identification, title report, property survey, inspection reports, and closing statement.