Closing Papers Needed for House

Introduction to Closing Papers

When purchasing a house, one of the most critical steps in the process is the closing. This is where the buyer and seller sign the final documents, and the ownership of the property is transferred. To ensure a smooth transaction, various closing papers are required. These documents serve as proof of the sale and outline the terms of the agreement. In this article, we will delve into the world of closing papers, exploring their significance, types, and the information they contain.

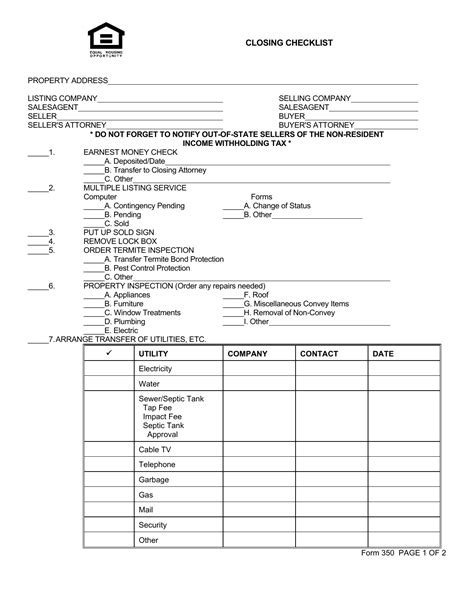

Types of Closing Papers

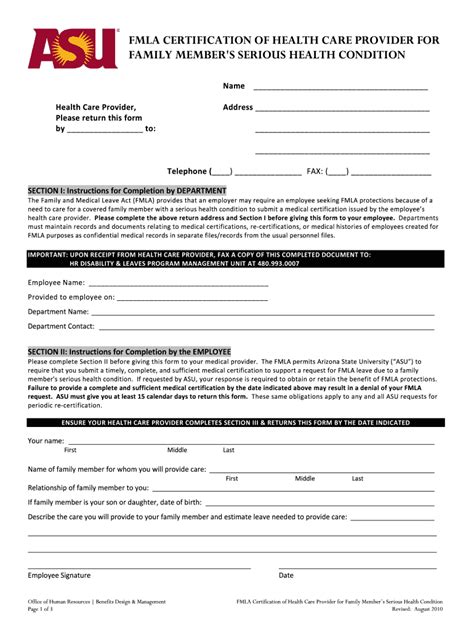

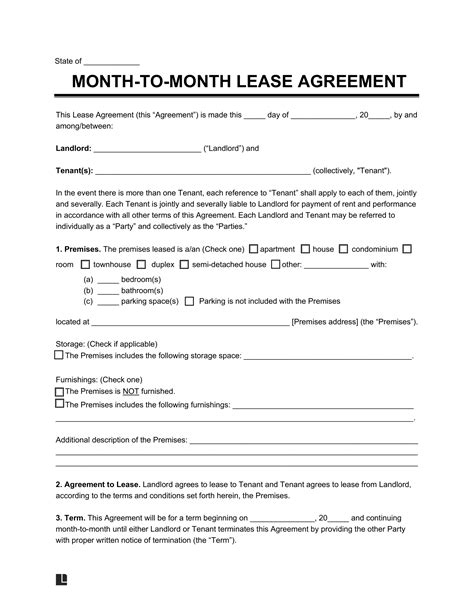

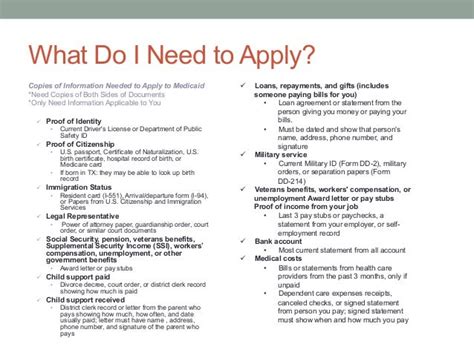

There are several types of closing papers involved in a real estate transaction. Some of the most common include: * Deed: This document transfers the ownership of the property from the seller to the buyer. It must be signed, notarized, and recorded in the public records. * Title: The title report verifies the seller’s ownership of the property and ensures there are no unexpected liens or encumbrances. * Mortgage: If the buyer is financing the purchase, a mortgage document will be required. This outlines the terms of the loan, including the interest rate, payment schedule, and consequences of default. * Property Survey: A property survey verifies the boundaries and dimensions of the property. It may also identify any easements or encroachments. * Insurance Policies: The buyer will need to secure insurance policies, such as homeowner’s insurance and title insurance, to protect against unforeseen events.

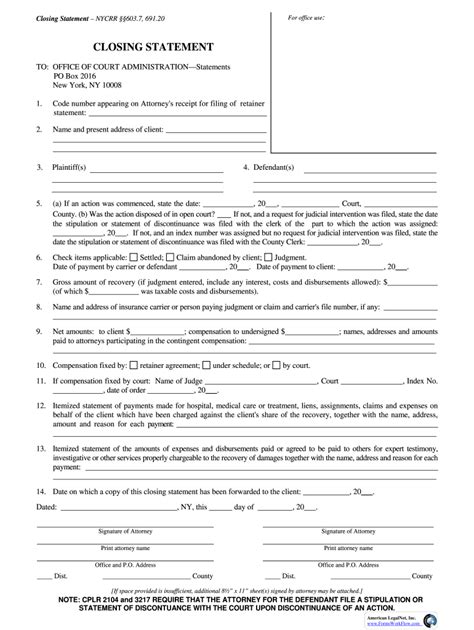

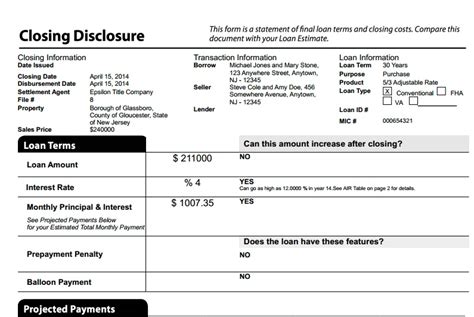

Information Contained in Closing Papers

Closing papers contain a wealth of information, including: * Property Description: A detailed description of the property, including its address, boundaries, and any improvements. * Purchase Price: The total amount paid for the property, including the down payment and financing terms. * Financing Terms: The terms of the loan, including the interest rate, payment schedule, and repayment terms. * Warranties and Representations: Statements made by the seller regarding the condition of the property and any warranties or guarantees. * Prorations: Adjustments made to account for expenses such as property taxes and insurance.

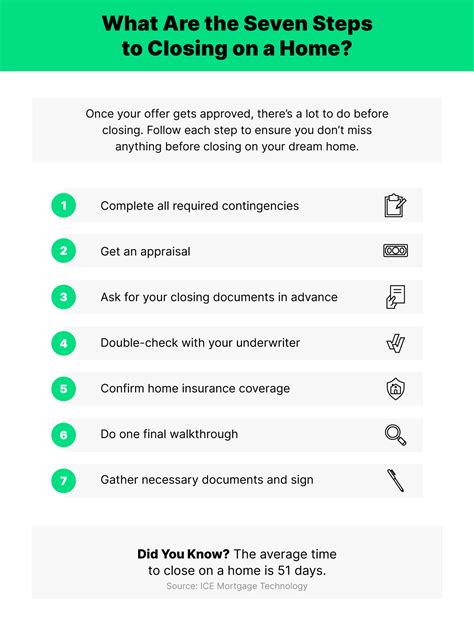

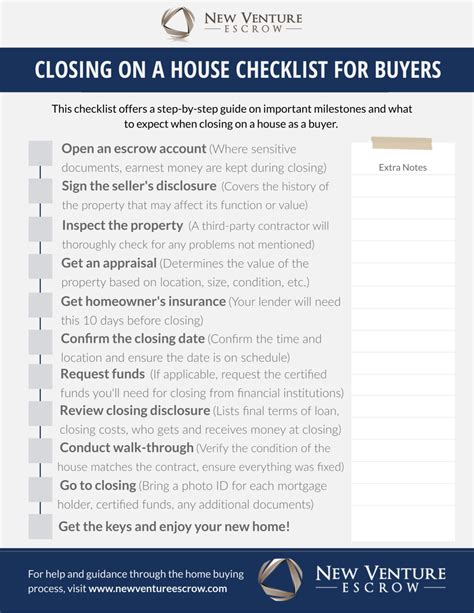

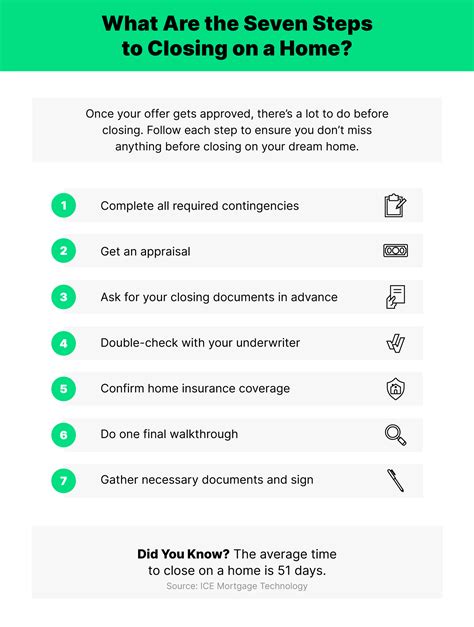

Closing Process

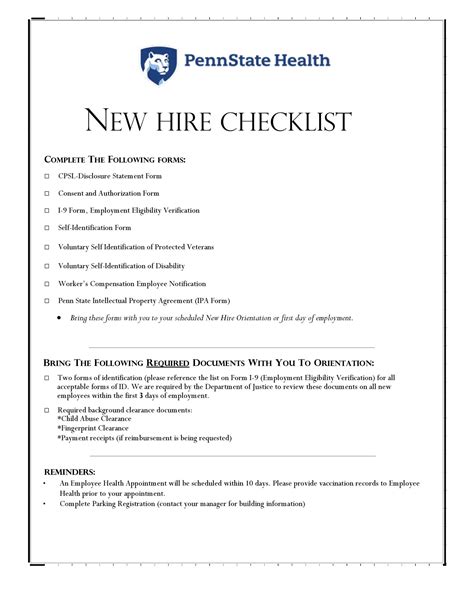

The closing process typically involves the following steps: * Review of Documents: The buyer and seller review the closing papers to ensure accuracy and completeness. * Signing of Documents: The buyer and seller sign the closing papers, transferring ownership of the property. * Exchange of Funds: The buyer pays the purchase price, and the seller receives the payment. * Recording of Documents: The closing papers are recorded in the public records, providing a permanent record of the transaction.

📝 Note: It is essential to carefully review the closing papers before signing to ensure accuracy and completeness.

Importance of Closing Papers

Closing papers play a critical role in the real estate transaction process. They provide a permanent record of the sale, outlining the terms of the agreement and transferring ownership of the property. Without these documents, the transaction would not be valid, and the buyer and seller would be left without proof of the sale.

Common Issues with Closing Papers

While closing papers are essential, they can also be a source of issues. Some common problems include: * Errors or Omissions: Mistakes or missing information can delay the closing process or even invalidate the transaction. * Disputes over Terms: The buyer and seller may disagree on the terms of the sale, leading to delays or even the collapse of the transaction. * Title Issues: Unexpected liens or encumbrances can arise, affecting the seller’s ownership of the property.

| Document | Description |

|---|---|

| Deed | Transfers ownership of the property |

| Title | Verifies the seller's ownership of the property |

| Mortgage | Outlines the terms of the loan |

In summary, closing papers are a crucial aspect of the real estate transaction process. They provide a permanent record of the sale, outlining the terms of the agreement and transferring ownership of the property. It is essential to carefully review these documents to ensure accuracy and completeness, and to address any issues that may arise during the closing process.

The process of purchasing a house involves many complex steps, and the closing papers are a critical component. By understanding the types of closing papers, the information they contain, and the importance of these documents, buyers and sellers can navigate the process with confidence. With the right guidance and attention to detail, the closing process can be a smooth and successful experience for all parties involved.

What is the purpose of closing papers in a real estate transaction?

+

Closing papers provide a permanent record of the sale, outlining the terms of the agreement and transferring ownership of the property.

What types of documents are typically included in closing papers?

+

Closing papers typically include a deed, title report, mortgage document, property survey, and insurance policies.

Why is it essential to carefully review closing papers before signing?

+

Carefully reviewing closing papers ensures accuracy and completeness, preventing potential issues or disputes down the line.