Paperwork

Bankruptcy Filing Paperwork Needed

Introduction to Bankruptcy Filing

Filing for bankruptcy can be a complex and overwhelming process, especially when it comes to gathering all the necessary paperwork. Bankruptcy laws are in place to help individuals and businesses restructure or eliminate debts, but the process requires careful preparation and attention to detail. In this article, we will guide you through the essential paperwork needed for a bankruptcy filing, helping you understand the requirements and what to expect.

Types of Bankruptcy

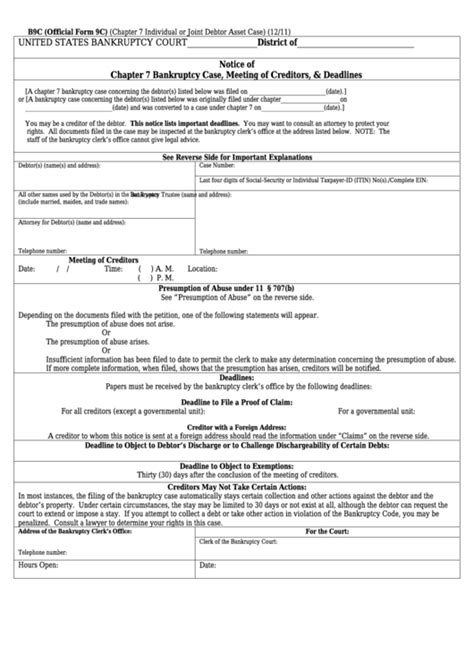

Before diving into the paperwork, it’s essential to understand the different types of bankruptcy filings. The most common types are: * Chapter 7 Bankruptcy: Also known as liquidation bankruptcy, this type involves selling off assets to pay off creditors. * Chapter 13 Bankruptcy: This type involves creating a repayment plan to pay off debts over time. * Chapter 11 Bankruptcy: This type is typically used by businesses to restructure debts and continue operating.

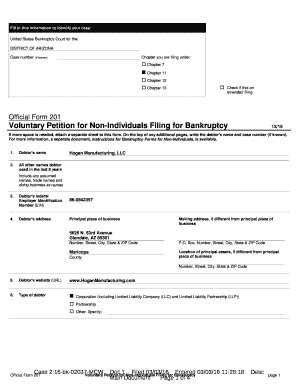

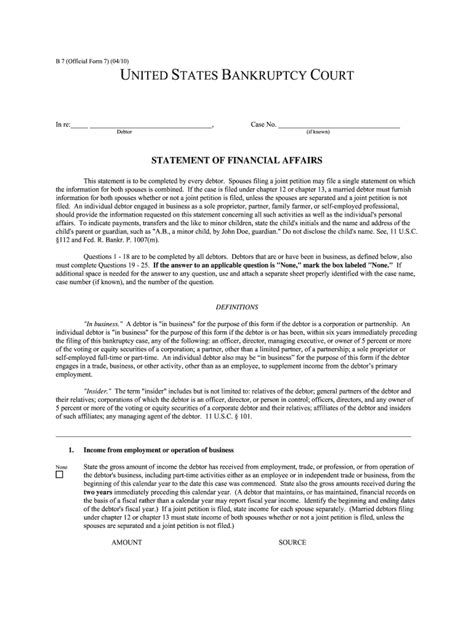

Required Paperwork for Bankruptcy Filing

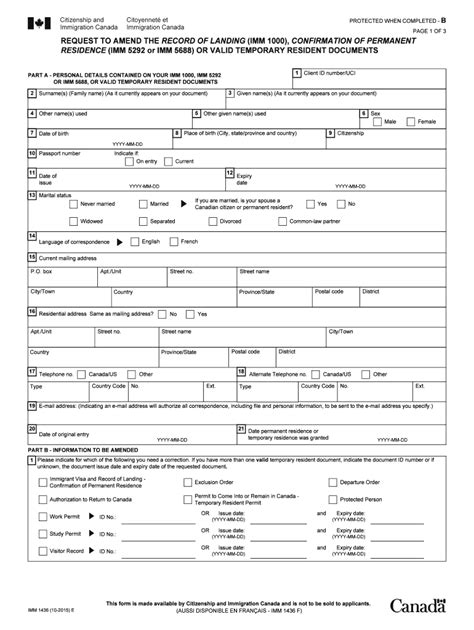

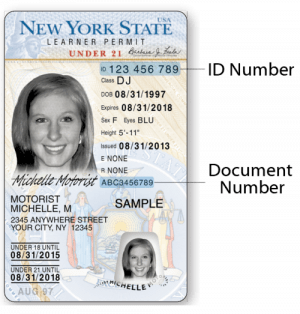

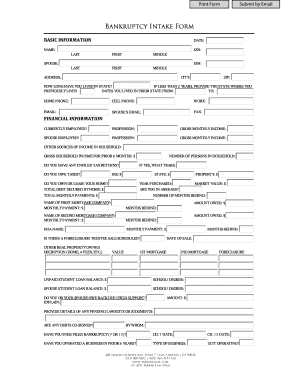

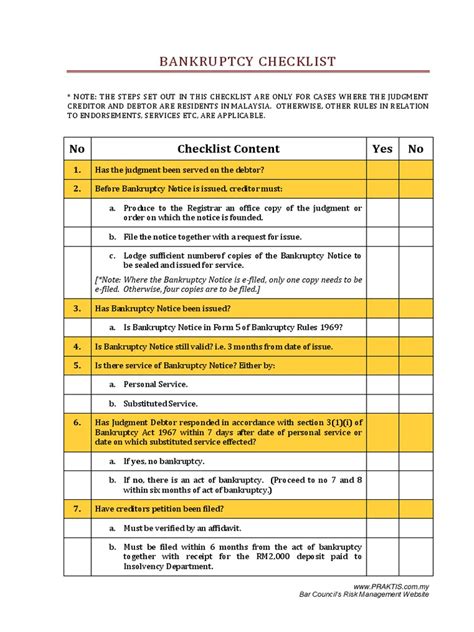

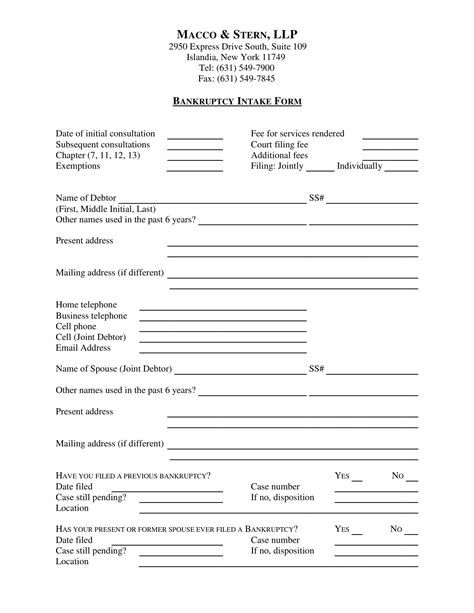

The paperwork required for a bankruptcy filing can be extensive, but here are the essential documents you’ll need to gather: * Voluntary Petition: This is the initial document that starts the bankruptcy process. * Schedules A-J: These schedules provide detailed information about your assets, liabilities, income, and expenses. * Statement of Financial Affairs: This document provides a comprehensive overview of your financial situation, including income, expenses, and debt. * Means Test: This document is used to determine whether you qualify for Chapter 7 bankruptcy or if you need to file for Chapter 13. * Credit Counseling Certificate: You’ll need to complete a credit counseling course and obtain a certificate before filing for bankruptcy. * Identification and Social Security Number: You’ll need to provide a valid government-issued ID and Social Security number.

Additional Paperwork for Chapter 13 Bankruptcy

If you’re filing for Chapter 13 bankruptcy, you’ll need to provide additional paperwork, including: * Chapter 13 Plan: This document outlines your repayment plan and how you intend to pay off debts over time. * Proof of Income: You’ll need to provide proof of income, such as pay stubs or tax returns, to support your repayment plan. * Expense Budget: You’ll need to create a detailed budget that outlines your monthly expenses and how you plan to make payments.

Table of Bankruptcy Filing Fees

The following table outlines the current bankruptcy filing fees:

| Chapter | Filing Fee |

|---|---|

| Chapter 7 | 335</td> </tr> <tr> <td>Chapter 13</td> <td>310 |

| Chapter 11 | $1,717 |

📝 Note: Filing fees are subject to change, so it's essential to check with the court for the most up-to-date information.

Conclusion and Final Thoughts

Filing for bankruptcy requires careful preparation and attention to detail. By gathering all the necessary paperwork and understanding the requirements, you can navigate the process with confidence. Remember to stay organized, and don’t hesitate to seek professional help if you need guidance. With the right approach, you can take the first step towards a fresh financial start.

What is the difference between Chapter 7 and Chapter 13 bankruptcy?

+

Chapter 7 bankruptcy involves selling off assets to pay off creditors, while Chapter 13 bankruptcy involves creating a repayment plan to pay off debts over time.

How long does the bankruptcy process take?

+

The length of the bankruptcy process varies depending on the type of bankruptcy and the complexity of the case. Chapter 7 bankruptcy typically takes 4-6 months, while Chapter 13 bankruptcy can take 3-5 years.

Will filing for bankruptcy affect my credit score?

+

Yes, filing for bankruptcy can significantly affect your credit score. However, the impact will decrease over time, and you can start rebuilding your credit by making on-time payments and keeping credit utilization low.