Paperwork

Chapter 7 Bankruptcy Maryland Paperwork Needed

Introduction to Chapter 7 Bankruptcy in Maryland

Filing for Chapter 7 bankruptcy in Maryland can be a complex and daunting process, especially when it comes to gathering the necessary paperwork. Bankruptcy is a legal proceeding that allows individuals or businesses to reorganize or eliminate debts under the protection of the federal bankruptcy court. In Maryland, Chapter 7 bankruptcy is also known as “liquidation” bankruptcy, where a trustee is appointed to oversee the sale of non-exempt assets to pay off creditors. To navigate this process successfully, it is crucial to understand the required paperwork and steps involved.

Understanding Chapter 7 Bankruptcy

Before diving into the paperwork, it’s essential to understand the basics of Chapter 7 bankruptcy. This type of bankruptcy is typically used by individuals who have limited income and significant debt. The process involves the appointment of a trustee who will review the debtor’s assets and determine which ones are exempt from sale. Exempt assets may include primary residences, vehicles, and personal belongings, depending on their value and the specific laws of Maryland. Non-exempt assets are sold, and the proceeds are distributed among creditors.

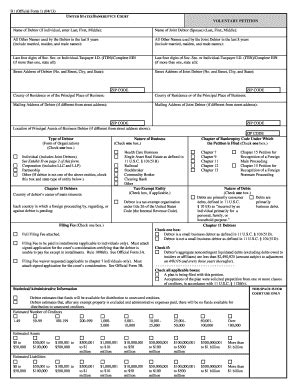

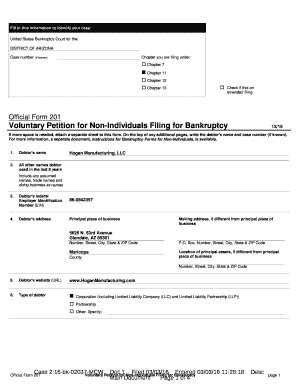

Required Paperwork for Chapter 7 Bankruptcy in Maryland

The paperwork required for filing Chapter 7 bankruptcy in Maryland includes: * Petition for Individuals Filing for Bankruptcy: This is the primary document that initiates the bankruptcy process. It requires detailed information about the debtor’s identity, address, and the reason for filing. * Schedules A-J: These schedules provide a comprehensive overview of the debtor’s assets, liabilities, income, and expenses. They are crucial for determining which assets are exempt and how debts will be addressed. * Statement of Financial Affairs: This document outlines the debtor’s financial transactions and activities over the past two years, including income, expenses, and any significant financial events. * Means Test: The means test is used to determine whether the debtor qualifies for Chapter 7 bankruptcy based on their income and expenses. It involves calculating the debtor’s disposable income to ensure they are not abusing the bankruptcy system. * Credit Counseling Certificate: Before filing for bankruptcy, individuals are required to undergo credit counseling from an approved agency. This certificate serves as proof of completion. * Income Tax Returns: Debtors must provide copies of their income tax returns for the past two years, if applicable. * Pay Stubs and Proof of Income: Recent pay stubs and proof of income are necessary to verify the debtor’s financial situation.

Additional Requirements

In addition to the primary paperwork, there are other requirements and considerations: * Filing Fees: There are costs associated with filing for bankruptcy, including court fees and potentially the cost of hiring a bankruptcy attorney. * Creditors’ Meeting: After filing, the debtor will be required to attend a meeting with creditors, also known as a 341 meeting, where they will be questioned under oath about their financial situation. * Bankruptcy Trustee: A trustee will be appointed to oversee the bankruptcy case, including the sale of non-exempt assets and the distribution of funds to creditors.

Steps to Filing Chapter 7 Bankruptcy in Maryland

The process of filing for Chapter 7 bankruptcy involves several key steps: 1. Determine Eligibility: Use the means test to determine if you qualify for Chapter 7 bankruptcy. 2. Gather Paperwork: Collect all necessary documents, including financial records and identification. 3. Complete Bankruptcy Forms: Fill out the petition, schedules, and statement of financial affairs accurately and thoroughly. 4. File with the Bankruptcy Court: Submit the completed paperwork and pay the required filing fees. 5. Attend the Creditors’ Meeting: Participate in the 341 meeting to answer questions about your bankruptcy case. 6. Receive Discharge: After completing all requirements, you will receive a discharge of your debts, freeing you from legal obligation to pay them.

📝 Note: It is highly recommended to consult with a bankruptcy attorney to ensure all paperwork is correctly filled out and filed, and to guide you through the complex bankruptcy process.

Conclusion and Final Thoughts

Filing for Chapter 7 bankruptcy in Maryland requires meticulous attention to detail and a thorough understanding of the necessary paperwork and legal process. By understanding the requirements and steps involved, individuals can navigate this challenging time more effectively. It’s also important to consider the long-term implications of bankruptcy on credit scores and financial stability. With the right guidance and preparation, individuals can use Chapter 7 bankruptcy as a tool to regain control of their finances and start anew.

What is the primary purpose of Chapter 7 bankruptcy?

+

The primary purpose of Chapter 7 bankruptcy is to provide individuals with a fresh start by liquidating non-exempt assets to pay off debts.

What are exempt assets in Chapter 7 bankruptcy?

+

Exempt assets may include primary residences, vehicles, and personal belongings, depending on their value and the specific laws of Maryland.

Do I need a lawyer to file for Chapter 7 bankruptcy?

+

While it is possible to file for Chapter 7 bankruptcy without a lawyer, it is highly recommended to consult with a bankruptcy attorney to ensure all paperwork is correctly filled out and filed, and to guide you through the complex bankruptcy process.