5 Tips Gap Insurance Florida

Introduction to Gap Insurance in Florida

When purchasing a new vehicle, many car owners in Florida are often faced with the decision of whether or not to purchase gap insurance. Gap insurance is a type of insurance that covers the difference between the actual cash value of a vehicle and the amount still owed on the loan or lease if the vehicle is totaled or stolen. In Florida, gap insurance can be a valuable addition to a car owner’s insurance policy, providing financial protection in the event of a loss. In this article, we will discuss the benefits of gap insurance in Florida and provide 5 tips for car owners considering purchasing this type of coverage.

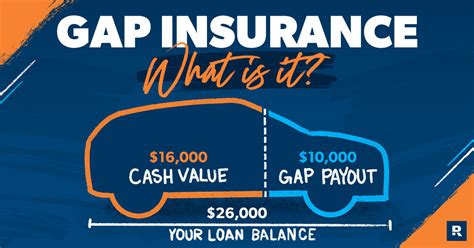

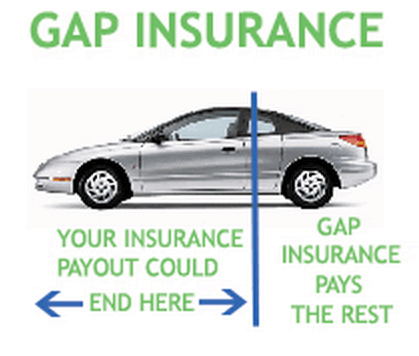

What is Gap Insurance and How Does it Work?

Gap insurance is designed to bridge the gap between the actual cash value of a vehicle and the amount still owed on the loan or lease. If a vehicle is totaled or stolen, the insurance company will typically pay out the actual cash value of the vehicle, which may be less than the amount still owed on the loan or lease. This can leave the car owner with a significant financial burden, as they will still be responsible for paying off the loan or lease. Gap insurance helps to alleviate this burden by covering the difference between the actual cash value of the vehicle and the amount still owed.

Benefits of Gap Insurance in Florida

There are several benefits to purchasing gap insurance in Florida. Some of the key benefits include: * Financial protection: Gap insurance provides financial protection in the event of a loss, helping to ensure that car owners are not left with a significant financial burden. * Peace of mind: Knowing that you have gap insurance can provide peace of mind, as you will be protected in the event of a loss. * Flexibility: Gap insurance can be purchased as a standalone policy or added to an existing insurance policy, providing flexibility for car owners.

5 Tips for Purchasing Gap Insurance in Florida

If you are considering purchasing gap insurance in Florida, here are 5 tips to keep in mind: * Research different providers: It’s essential to research different insurance providers to find the best rate and coverage for your needs. * Read the policy carefully: Before purchasing a gap insurance policy, make sure to read the policy carefully and understand what is covered and what is not. * Consider the cost: Gap insurance can be expensive, so it’s essential to consider the cost and whether it fits within your budget. * Check with your lender: If you are leasing or financing a vehicle, check with your lender to see if they offer gap insurance or require it as part of the loan or lease agreement. * Review and update your policy regularly: It’s essential to review and update your gap insurance policy regularly to ensure that it continues to meet your needs.

📝 Note: When purchasing gap insurance, make sure to carefully review the policy and understand what is covered and what is not.

Types of Gap Insurance in Florida

There are several types of gap insurance available in Florida, including: * Loan/lease gap insurance: This type of insurance covers the difference between the actual cash value of a vehicle and the amount still owed on the loan or lease. * Replacement gap insurance: This type of insurance covers the cost of replacing a vehicle with a new one of similar make and model. * Return gap insurance: This type of insurance covers the cost of returning a leased vehicle and paying off any remaining balance.

| Type of Gap Insurance | Description |

|---|---|

| Loan/Lease Gap Insurance | Covers the difference between the actual cash value of a vehicle and the amount still owed on the loan or lease. |

| Replacement Gap Insurance | Covers the cost of replacing a vehicle with a new one of similar make and model. |

| Return Gap Insurance | Covers the cost of returning a leased vehicle and paying off any remaining balance. |

In summary, gap insurance can be a valuable addition to a car owner’s insurance policy in Florida, providing financial protection in the event of a loss. By researching different providers, reading the policy carefully, considering the cost, checking with your lender, and reviewing and updating your policy regularly, you can ensure that you have the right coverage for your needs.

As we summarize the key points, it’s essential to remember that gap insurance is not mandatory in Florida, but it can be a worthwhile investment for car owners who want to protect themselves from financial loss. With the right coverage, car owners can drive away with confidence, knowing that they are protected in the event of a loss.

What is gap insurance and how does it work?

+

Gap insurance is a type of insurance that covers the difference between the actual cash value of a vehicle and the amount still owed on the loan or lease if the vehicle is totaled or stolen.

Do I need gap insurance in Florida?

+

Gap insurance is not mandatory in Florida, but it can be a worthwhile investment for car owners who want to protect themselves from financial loss.

How much does gap insurance cost in Florida?

+

The cost of gap insurance in Florida varies depending on the provider, the type of coverage, and the vehicle being insured.