File Taxes 2022 Paperwork Needed

Introduction to Filing Taxes in 2022

Filing taxes can be a daunting task, especially when it comes to gathering all the necessary paperwork. As the tax season approaches, it’s essential to understand what documents you need to file your taxes accurately and efficiently. In this article, we will guide you through the paperwork needed to file your taxes in 2022.

Personal Identification Documents

To start the tax filing process, you will need to provide personal identification documents. These include: * Social Security number or Individual Taxpayer Identification Number (ITIN): This is a unique identifier assigned to you by the Social Security Administration or the Internal Revenue Service (IRS). * Driver’s license or state ID: This is used to verify your identity and address. * Birth certificate: This may be required for dependents or to claim certain tax credits.

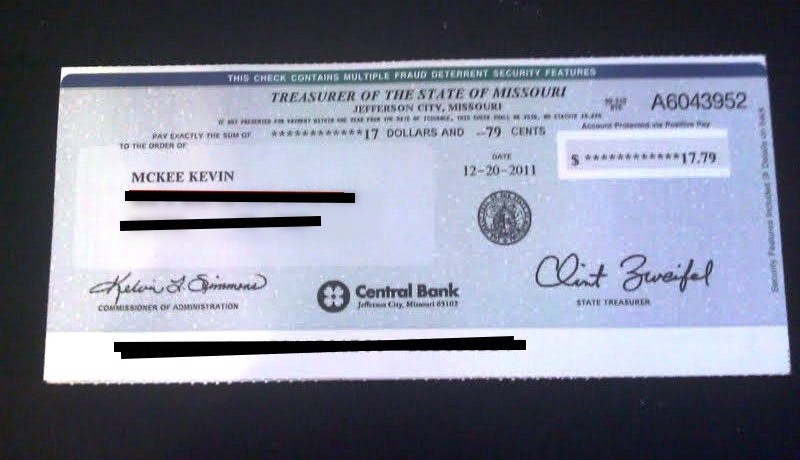

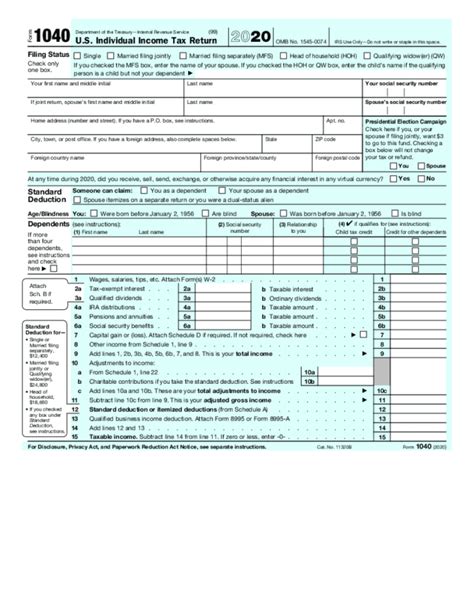

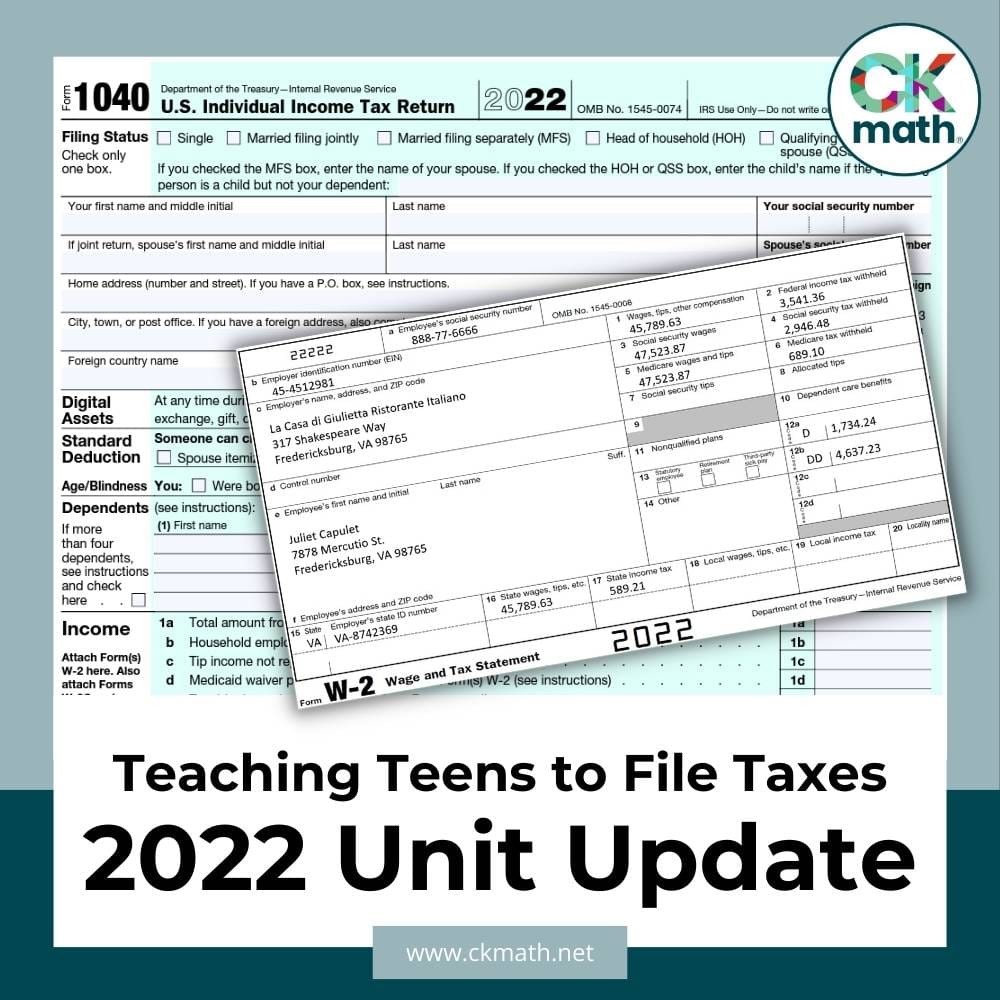

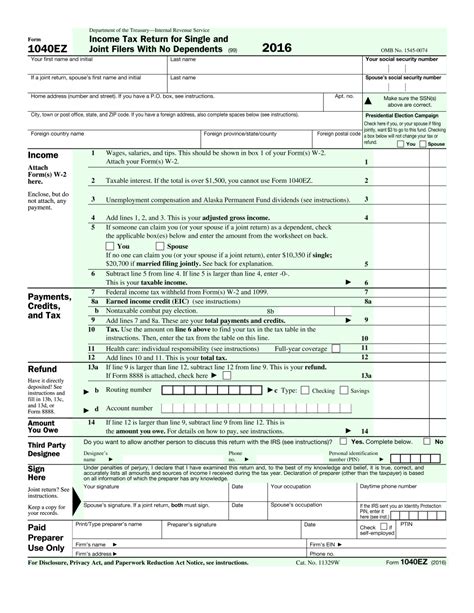

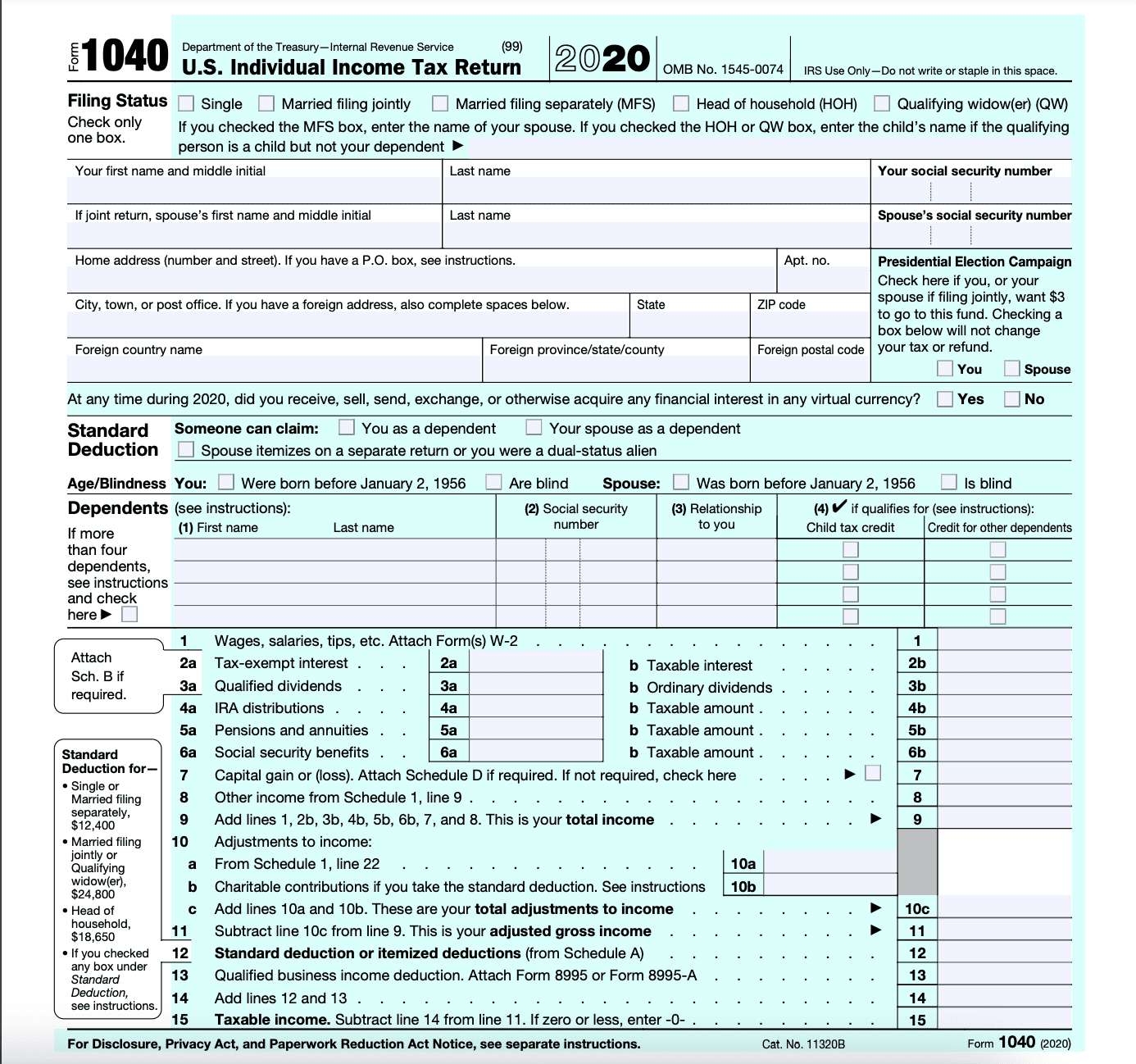

Income-Related Documents

The next step is to gather documents related to your income. These include: * W-2 forms: These are provided by your employer and show your income and taxes withheld. * 1099 forms: These are used to report income from freelance work, investments, or other sources. * Interest statements: These show the interest earned on your savings accounts, investments, or other financial assets. * Dividend statements: These show the dividends earned on your investments.

Deduction-Related Documents

To claim deductions, you will need to provide supporting documents. These include: * Receipts for charitable donations: These show the amount donated to qualified charitable organizations. * Medical expense receipts: These show the medical expenses incurred during the tax year. * Mortgage interest statements: These show the interest paid on your mortgage. * Property tax statements: These show the property taxes paid on your primary residence or investment properties.

Credit-Related Documents

To claim tax credits, you will need to provide supporting documents. These include: * Child care expense receipts: These show the amount paid for child care services. * Education expense receipts: These show the amount paid for education-related expenses. * Retirement savings contribution receipts: These show the amount contributed to retirement savings accounts.

Business-Related Documents (if applicable)

If you are self-employed or have a business, you will need to provide additional documents. These include: * Business income statements: These show the income earned from your business. * Business expense receipts: These show the expenses incurred by your business. * Business tax returns: These show the taxes paid on your business income.

Other Documents

Other documents that may be required include: * Divorce or separation agreements: These may be required to claim certain tax credits or deductions. * Alimony payment records: These show the alimony paid or received. * Child support payment records: These show the child support paid or received.

📝 Note: It's essential to keep accurate and detailed records of all your income, expenses, and tax-related documents to ensure you are taking advantage of all the tax credits and deductions available to you.

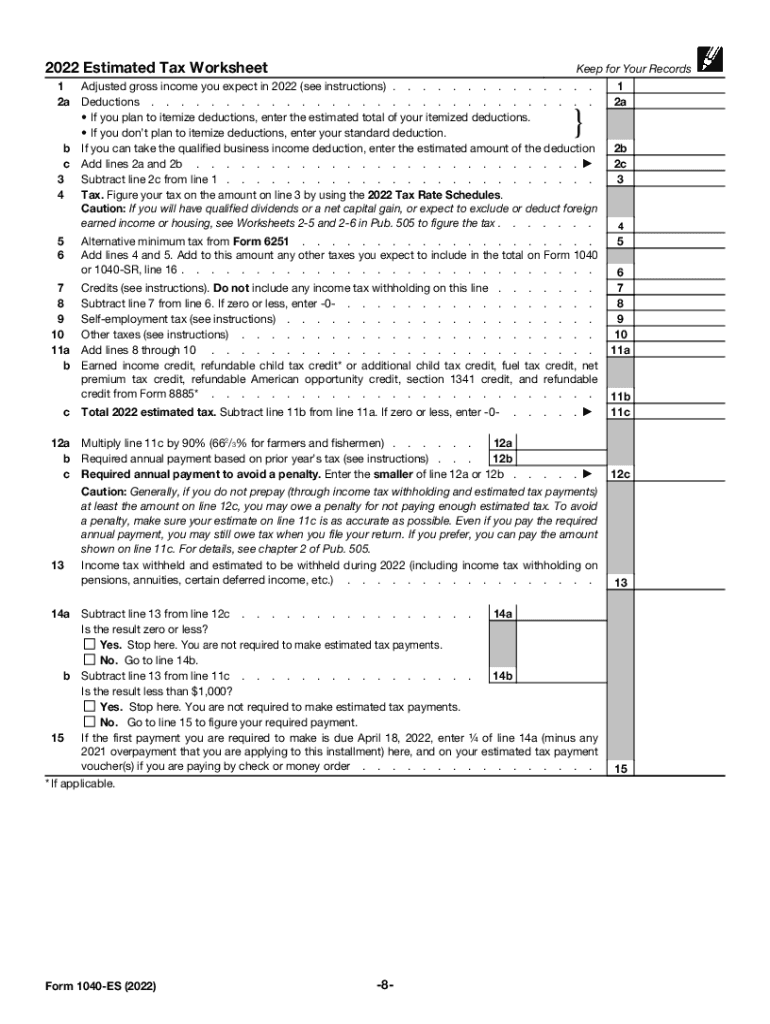

As you gather all the necessary paperwork, you can start the tax filing process. You can choose to file your taxes electronically or by mail. Electronic filing is generally faster and more accurate, but you can also file by mail if you prefer.

To make the process smoother, you can use tax preparation software or consult a tax professional. They can guide you through the process and help you ensure you are taking advantage of all the tax credits and deductions available to you.

In the end, filing taxes requires careful planning and attention to detail. By gathering all the necessary paperwork and seeking professional help when needed, you can ensure you are filing your taxes accurately and efficiently.

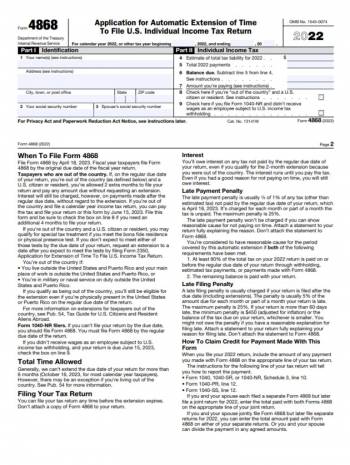

What is the deadline for filing taxes in 2022?

+

The deadline for filing taxes in 2022 is April 18, 2022. However, you can request an extension if you need more time to file your taxes.

Do I need to file taxes if I don’t have any income?

+

You may still need to file taxes even if you don’t have any income. This is because you may be eligible for tax credits or refunds, or you may need to report certain types of income, such as investment income or self-employment income.

Can I file my taxes electronically?

+

Yes, you can file your taxes electronically using tax preparation software or by visiting the IRS website. Electronic filing is generally faster and more accurate than filing by mail.