Car Finance Paperwork Requirements

Introduction to Car Finance Paperwork

When considering the purchase of a new or used vehicle, understanding the car finance paperwork requirements is essential to ensure a smooth and hassle-free process. The paperwork involved in car finance can be complex and may vary depending on the lender, the type of vehicle, and the buyer’s financial situation. In this article, we will delve into the various documents and information required for car finance, providing a comprehensive guide to help navigate this process.

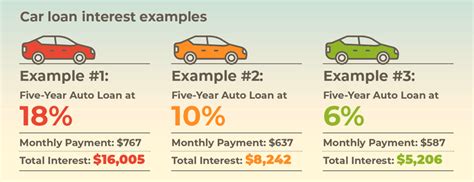

Types of Car Finance

Before diving into the paperwork requirements, it’s crucial to understand the different types of car finance available. These include: * Personal Contract Purchase (PCP): A popular form of car finance that allows buyers to pay a monthly installment for a set period, typically 2-4 years, with the option to return the vehicle or make a final payment to own it. * Hire Purchase (HP): A type of finance where the buyer pays a deposit and then makes monthly payments over a set period, usually 2-5 years, until the full amount is paid, and the vehicle is owned. * Personal Loan: An unsecured loan from a bank or lender that can be used to purchase a vehicle, with monthly repayments over a set period. * Lease: A contract where the buyer pays a monthly fee to use the vehicle for a set period, usually 2-3 years, with no option to own the vehicle.

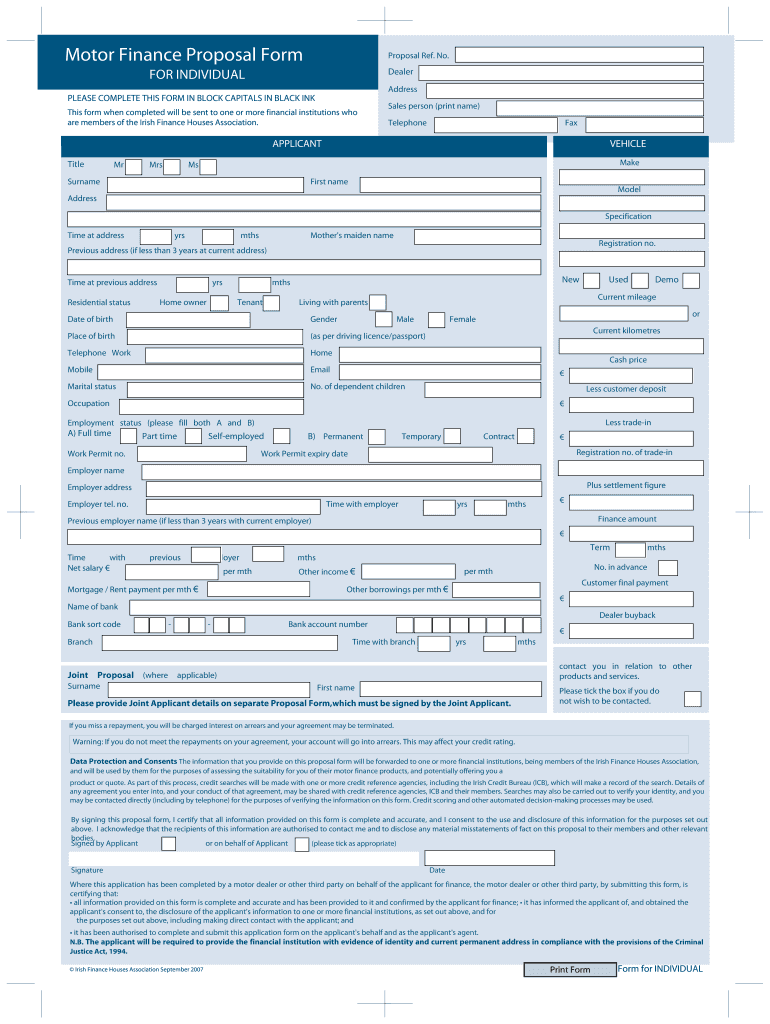

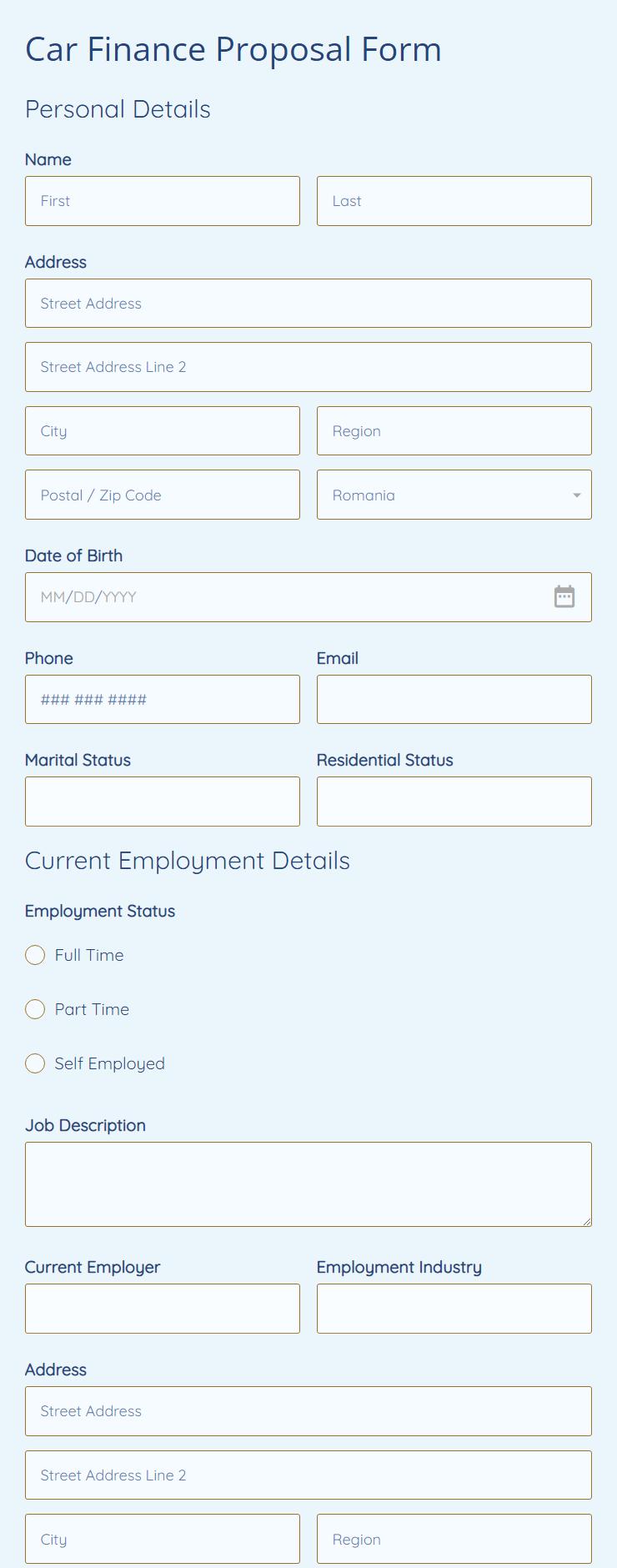

Required Documents

To apply for car finance, buyers will typically need to provide the following documents: * Proof of Identity: A valid passport, driving license, or other government-issued ID. * Proof of Income: Pay slips, bank statements, or tax returns to demonstrate income and employment status. * Proof of Address: Utility bills, bank statements, or council tax bills to confirm the buyer’s address. * Credit Report: Lenders may request a credit report to assess the buyer’s creditworthiness. * Vehicle Details: The vehicle’s make, model, year, and Vehicle Identification Number (VIN) to confirm the vehicle’s identity and value.

Additional Requirements

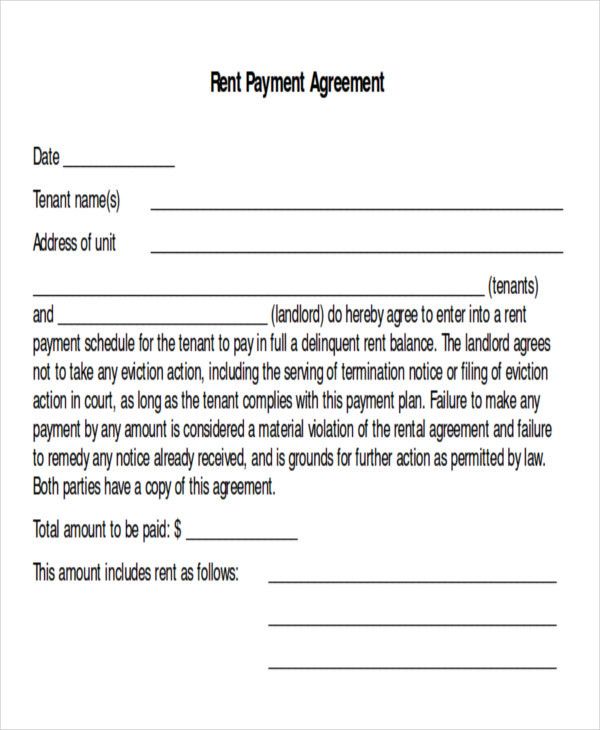

Depending on the lender and the type of finance, additional requirements may include: * A deposit, which can range from 10% to 20% of the vehicle’s purchase price. * A guarantor, who can provide an additional layer of security for the lender. * insurance details, to confirm that the vehicle is fully insured.

Applying for Car Finance

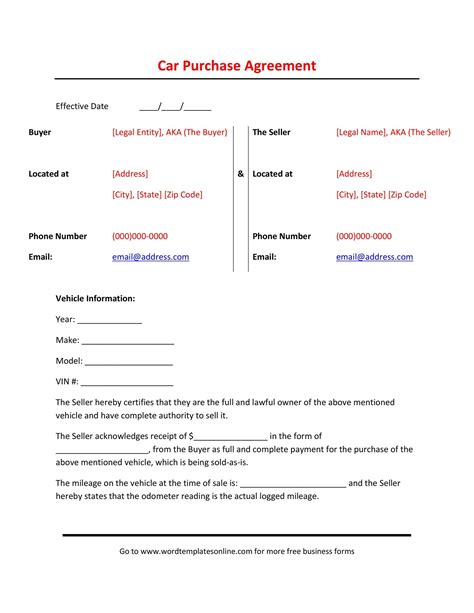

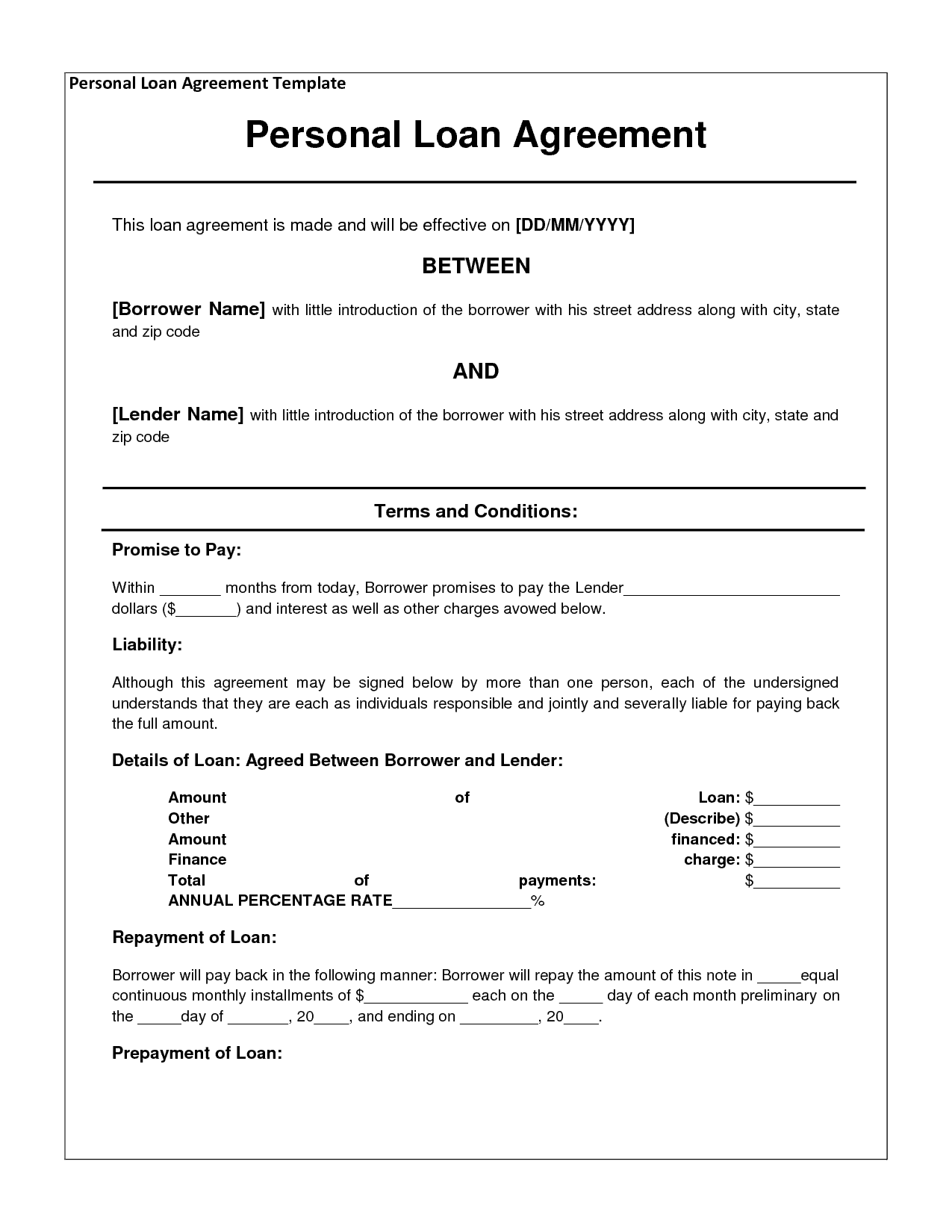

The application process for car finance typically involves the following steps: * Pre-approval: Buyers can apply for pre-approval from a lender to determine how much they can borrow. * Application: The buyer will need to complete a formal application, providing the required documents and information. * Approval: The lender will review the application and make a decision based on the buyer’s creditworthiness and financial situation. * Signing the agreement: Once approved, the buyer will need to sign a finance agreement, which outlines the terms and conditions of the loan.

📝 Note: It's essential to carefully review the finance agreement before signing, to ensure that all terms and conditions are understood.

Table of Required Documents

| Document | Description |

|---|---|

| Proof of Identity | Valid passport, driving license, or other government-issued ID |

| Proof of Income | Pay slips, bank statements, or tax returns |

| Proof of Address | Utility bills, bank statements, or council tax bills |

| Credit Report | Assesses the buyer’s creditworthiness |

| Vehicle Details | Make, model, year, and Vehicle Identification Number (VIN) |

In summary, understanding the car finance paperwork requirements is crucial to ensure a smooth and hassle-free process. By providing the required documents and information, buyers can navigate the application process with confidence. It’s essential to carefully review the finance agreement before signing, to ensure that all terms and conditions are understood. With the right knowledge and preparation, buyers can secure the perfect vehicle and enjoy a stress-free car ownership experience.

What is the typical deposit required for car finance?

+

The typical deposit required for car finance can range from 10% to 20% of the vehicle’s purchase price, depending on the lender and the buyer’s financial situation.

Can I apply for car finance with a poor credit history?

+

Yes, it is possible to apply for car finance with a poor credit history, but the lender may require a larger deposit or offer less favorable terms.

How long does the car finance application process typically take?

+

The car finance application process can typically take anywhere from a few hours to several days, depending on the lender and the complexity of the application.