Car Loan Paperwork Requirements

Introduction to Car Loan Paperwork

When considering purchasing a vehicle, understanding the car loan paperwork requirements is essential to ensure a smooth and successful transaction. The process involves several steps, from pre-approval to finalizing the loan, each requiring specific documents and information. In this article, we will delve into the details of what you need to know and prepare before applying for a car loan.

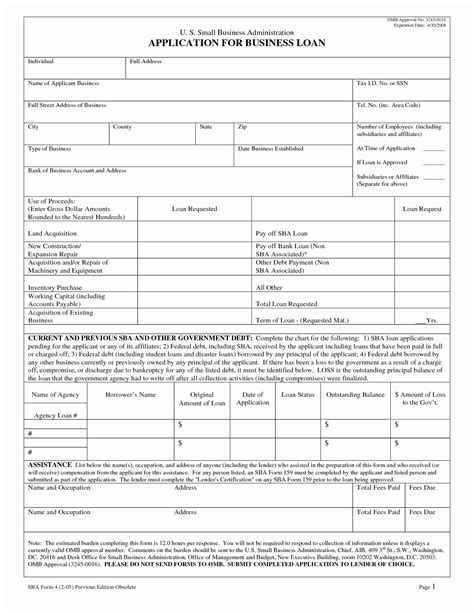

Pre-Approval and Application Process

The journey to securing a car loan begins with pre-approval. This step involves contacting a lender to find out how much you can borrow and what your repayments will be. To get pre-approved, you will typically need to provide: - Identification: A valid government-issued ID, such as a driver’s license or passport. - Proof of Income: Pay stubs, W-2 forms, or tax returns to verify your income. - Proof of Employment: A letter from your employer or recent pay stubs. - Credit Information: Your credit score and history, which can be obtained from the three major credit reporting bureaus (Equifax, Experian, and TransUnion).

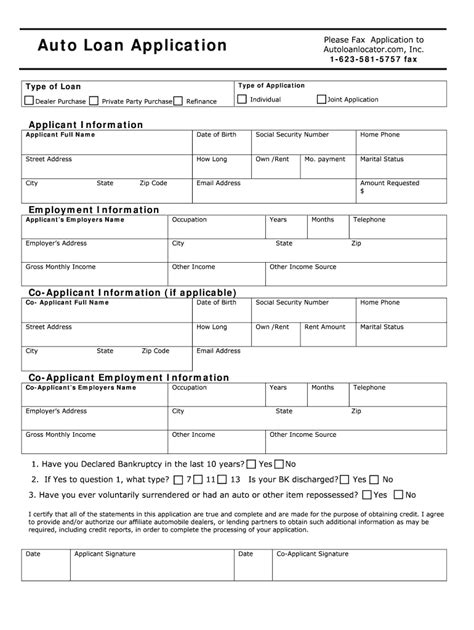

Necessary Documents for Car Loan Application

Once you’re pre-approved, you’ll need to gather specific documents to complete the car loan application. These include: - Personal Documents: - Valid ID - Social Security number or Individual Taxpayer Identification Number - Proof of residency (utility bills, lease agreement) - Financial Documents: - Pay stubs - Bank statements - Tax returns (personal and business, if applicable) - Vehicle Information: - Vehicle identification number (VIN) - Vehicle make, model, and year - Purchase price and any trade-in information

Understanding Credit Scores and Reports

Your credit score plays a significant role in determining the interest rate you’ll qualify for and whether your loan application will be approved. Maintaining a good credit score can help you secure better loan terms. Here are some key points about credit scores: - Range: Credit scores range from 300 to 850. - Good Score: Generally, a score of 700 or higher is considered good. - Impact on Loan: A higher score can lead to lower interest rates and more favorable loan terms.

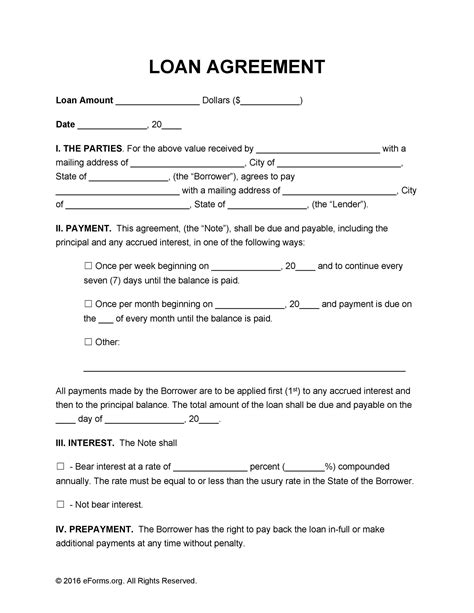

Finalizing the Car Loan

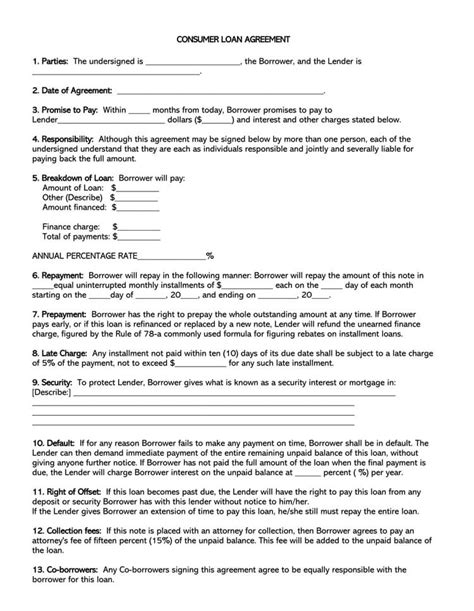

After your application is approved, you’ll move on to finalizing the loan. This involves reviewing and signing the loan contract, which outlines the terms of the loan, including the interest rate, repayment period, and monthly payments. It’s crucial to carefully read through the contract before signing, ensuring you understand all the terms and conditions.

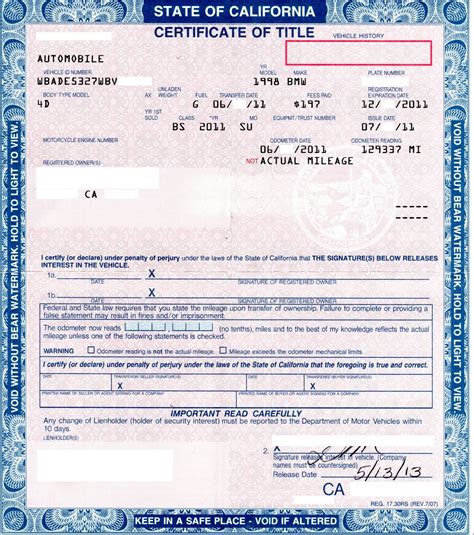

Post-Purchase Considerations

After purchasing your vehicle, there are a few more steps to consider: - Registration and Title: Ensure the vehicle is registered in your name, and you receive the title once the loan is paid off. - Insurance: Secure insurance coverage that meets your state’s minimum requirements and any additional coverage you wish to have. - Loan Repayment: Make timely payments to avoid late fees and negatively affecting your credit score.

📝 Note: Always review the fine print of your loan contract to understand any potential fees associated with the loan, such as origination fees or prepayment penalties.

Conclusion and Next Steps

In conclusion, navigating the car loan paperwork requirements can seem daunting, but being prepared with the necessary documents and understanding the process can make it more manageable. By following these steps and considering your financial situation carefully, you can find a car loan that fits your needs and budget. Remember, your credit score and history play significant roles in the loan application process, so maintaining good credit habits is essential for securing favorable loan terms.

What is the minimum credit score required for a car loan?

+

The minimum credit score required for a car loan can vary significantly depending on the lender and the specific loan product. However, generally, a score of 661 or higher is considered good for auto loans, though some lenders may offer loans to individuals with lower scores at higher interest rates.

How long does the car loan application process typically take?

+

The duration of the car loan application process can vary, but with pre-approval, it can often be completed within a day or two, depending on how quickly you can provide the necessary documentation and the lender’s processing time.

Can I apply for a car loan online?

+

Yes, many lenders offer the option to apply for a car loan online. This can be a convenient way to start the process, especially for pre-approval, as it allows you to compare rates and terms from multiple lenders easily.