5 Loan Papers Needed

Understanding the Loan Process

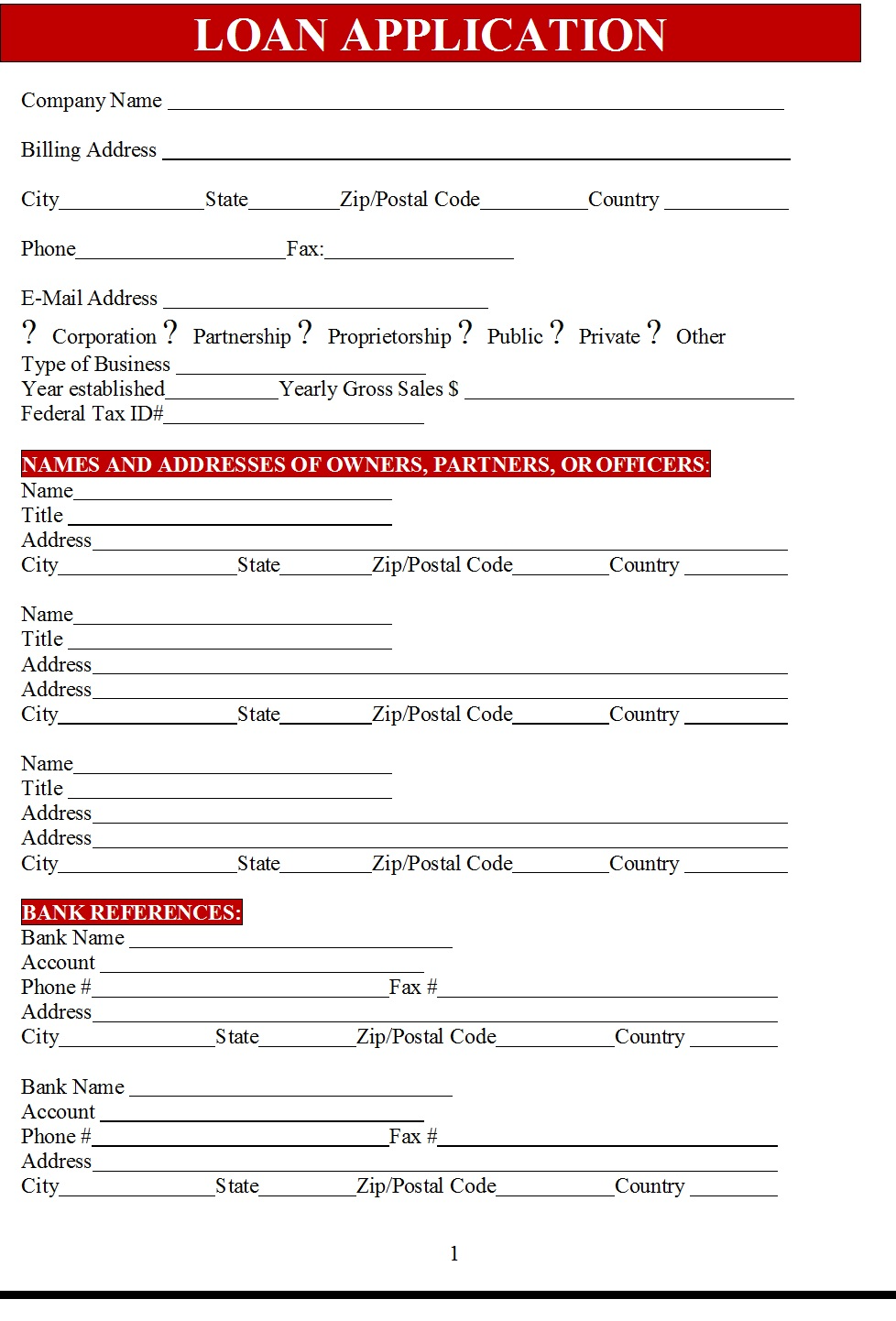

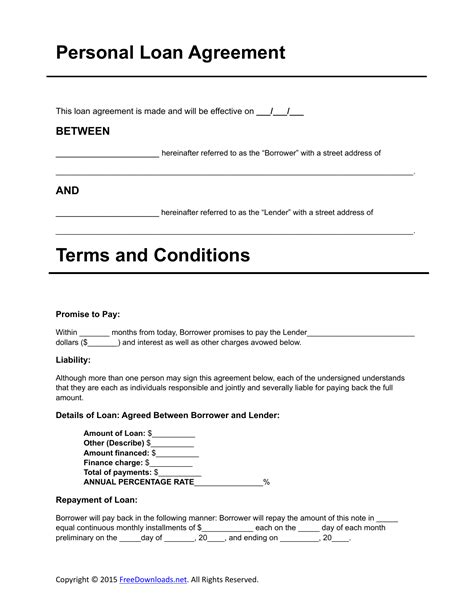

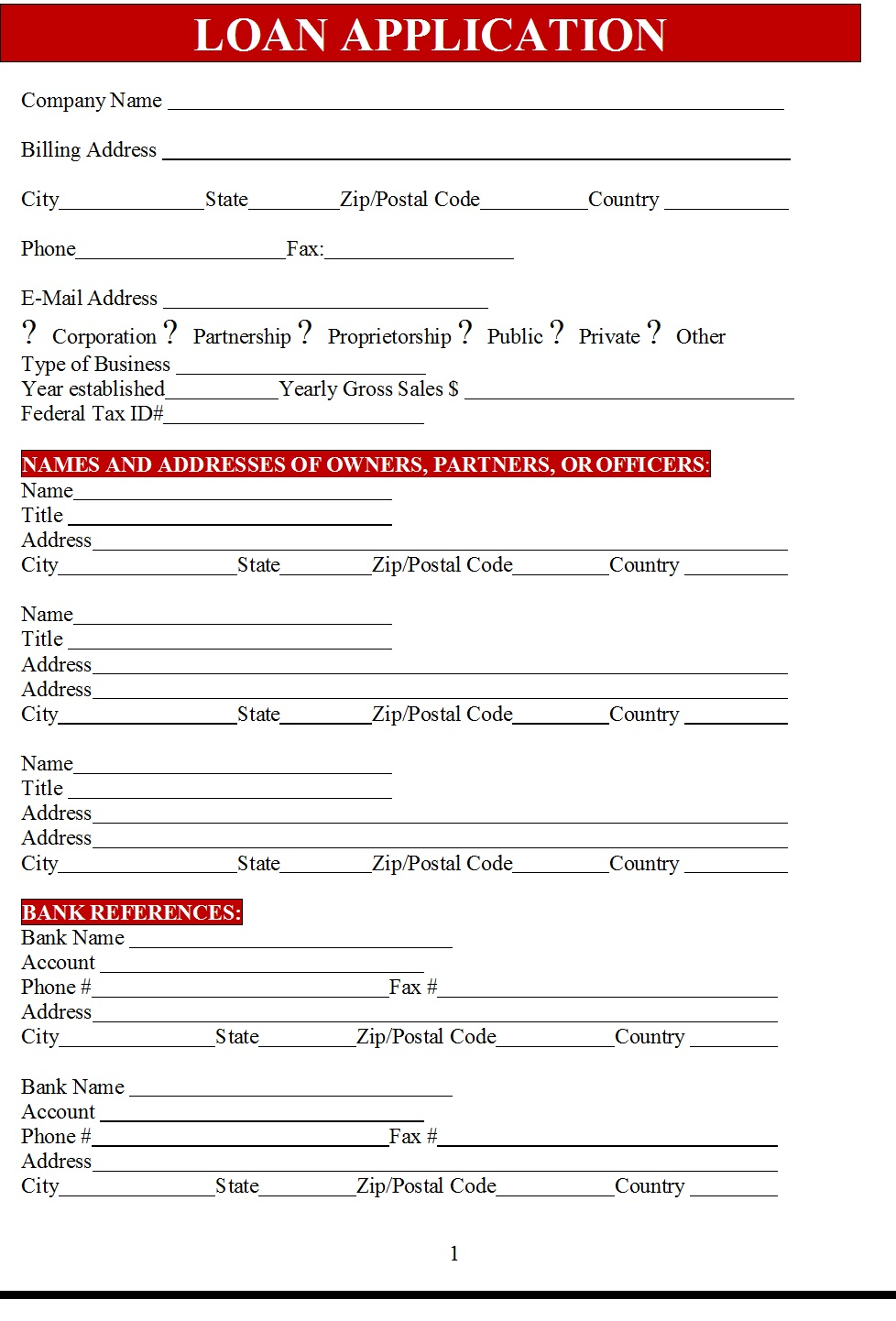

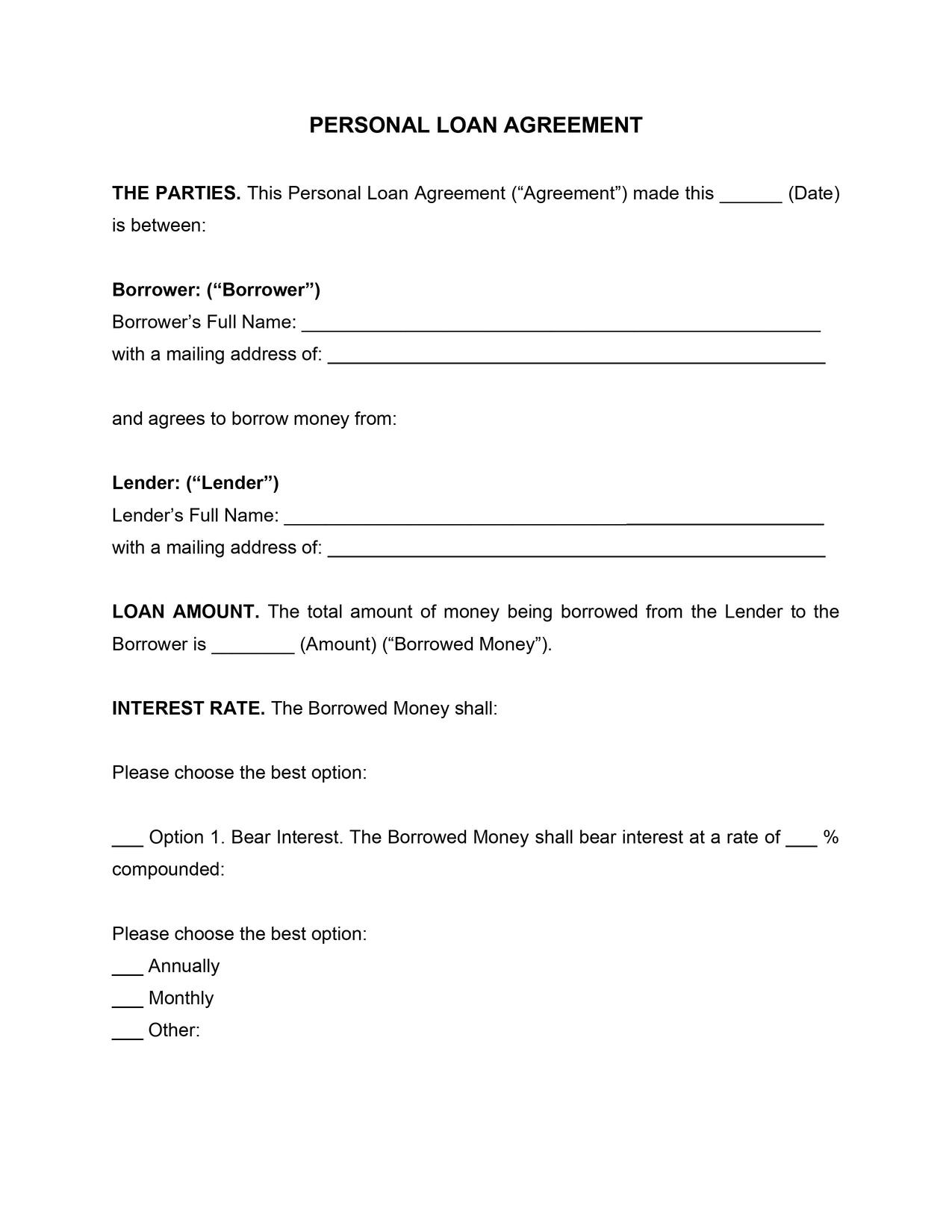

When applying for a loan, it’s essential to understand the various documents required to complete the process. These documents, often referred to as loan papers, are critical for lenders to assess your creditworthiness and verify the information provided in your loan application. In this blog post, we’ll delve into the five key loan papers needed for a loan application, exploring their significance and the role they play in the loan approval process.

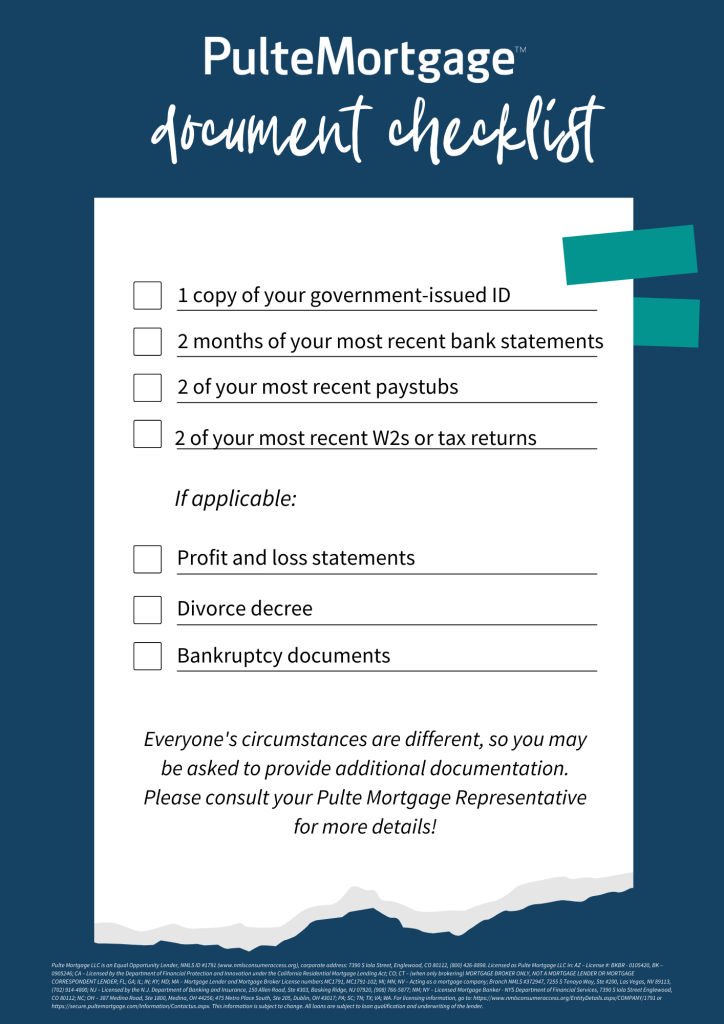

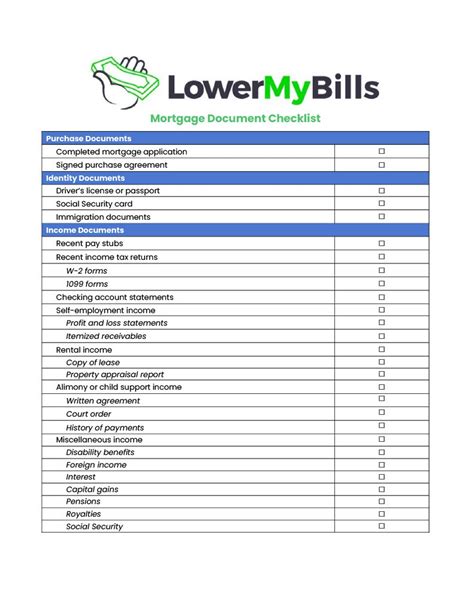

1. Identification Documents

The first and most crucial loan paper is identification documents. These documents are necessary to verify your identity and ensure that you are who you claim to be. Common identification documents include:

- Passport

- Driver’s license

- State ID card

- Birth certificate

2. Income Proof

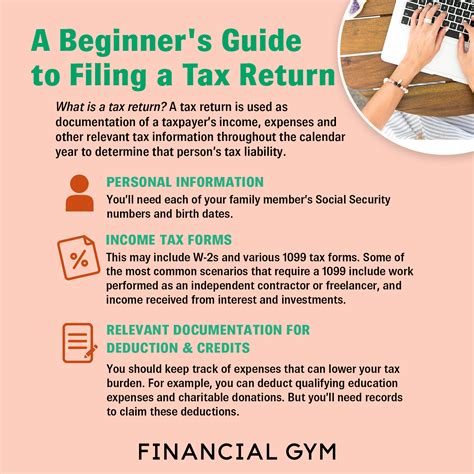

Income proof is another essential loan paper that lenders require to assess your ability to repay the loan. This document helps lenders determine whether you have a stable income source and can afford the monthly loan payments. Common income proof documents include:

- Payslips

- Income tax returns

- Form 16

- Bank statements

3. Address Proof

Address proof is a critical loan paper that helps lenders verify your current and permanent addresses. This document is necessary to prevent fraud and ensure that lenders can contact you if needed. Common address proof documents include:

- Utility bills (electricity, water, gas)

- Rent agreement

- Passport

- Bank statements

4. Employment Proof

Employment proof is another vital loan paper that lenders require to assess your job stability and income security. This document helps lenders determine whether you have a stable employment history and can afford the loan repayments. Common employment proof documents include:

- Appointment letter

- Relieving letter

- Experience certificate

- Job offer letter

5. Bank Statements

Bank statements are the final essential loan paper that lenders require to assess your financial health. This document provides lenders with a detailed picture of your income, expenses, and savings, helping them determine your creditworthiness. Common bank statement documents include:

- 6-month bank statement

- 12-month bank statement

- Passbook

📝 Note: The specific loan papers required may vary depending on the lender, loan type, and individual circumstances. It's essential to check with your lender to confirm the necessary documents.

In summary, the five key loan papers needed for a loan application are identification documents, income proof, address proof, employment proof, and bank statements. These documents play a critical role in the loan approval process, enabling lenders to assess your creditworthiness and verify the information provided in your loan application. By understanding the significance of these loan papers, you can ensure a smooth and efficient loan application process.

What are the common identification documents required for a loan application?

+

Common identification documents include passport, driver’s license, state ID card, and birth certificate.

Why is income proof necessary for a loan application?

+

Income proof is necessary to assess your ability to repay the loan and determine whether you have a stable income source.

What are the consequences of providing false or incomplete loan papers?

+

Providing false or incomplete loan papers can lead to loan rejection, damage to your credit score, and even legal action.