Mortgage Paperwork Requirements

Introduction to Mortgage Paperwork

When applying for a mortgage, it’s essential to understand the various mortgage paperwork requirements that lenders need to process your loan application. The mortgage application process can be overwhelming, especially for first-time homebuyers. However, being prepared with the necessary documents can help streamline the process and reduce the risk of delays or even loan rejection. In this article, we will delve into the world of mortgage paperwork, exploring the key documents required, the application process, and providing valuable tips to ensure a smooth experience.

Understanding the Mortgage Application Process

The mortgage application process typically begins with pre-approval, where the lender reviews your creditworthiness and provides a preliminary approval for a specific loan amount. This step is crucial as it gives you an idea of how much you can borrow and helps you narrow down your home search. Following pre-approval, you’ll submit a formal application, which involves providing detailed financial information and supporting documentation. The lender will then review your application, order an appraisal of the property (if necessary), and finally, approve or deny your loan application.

Key Mortgage Paperwork Requirements

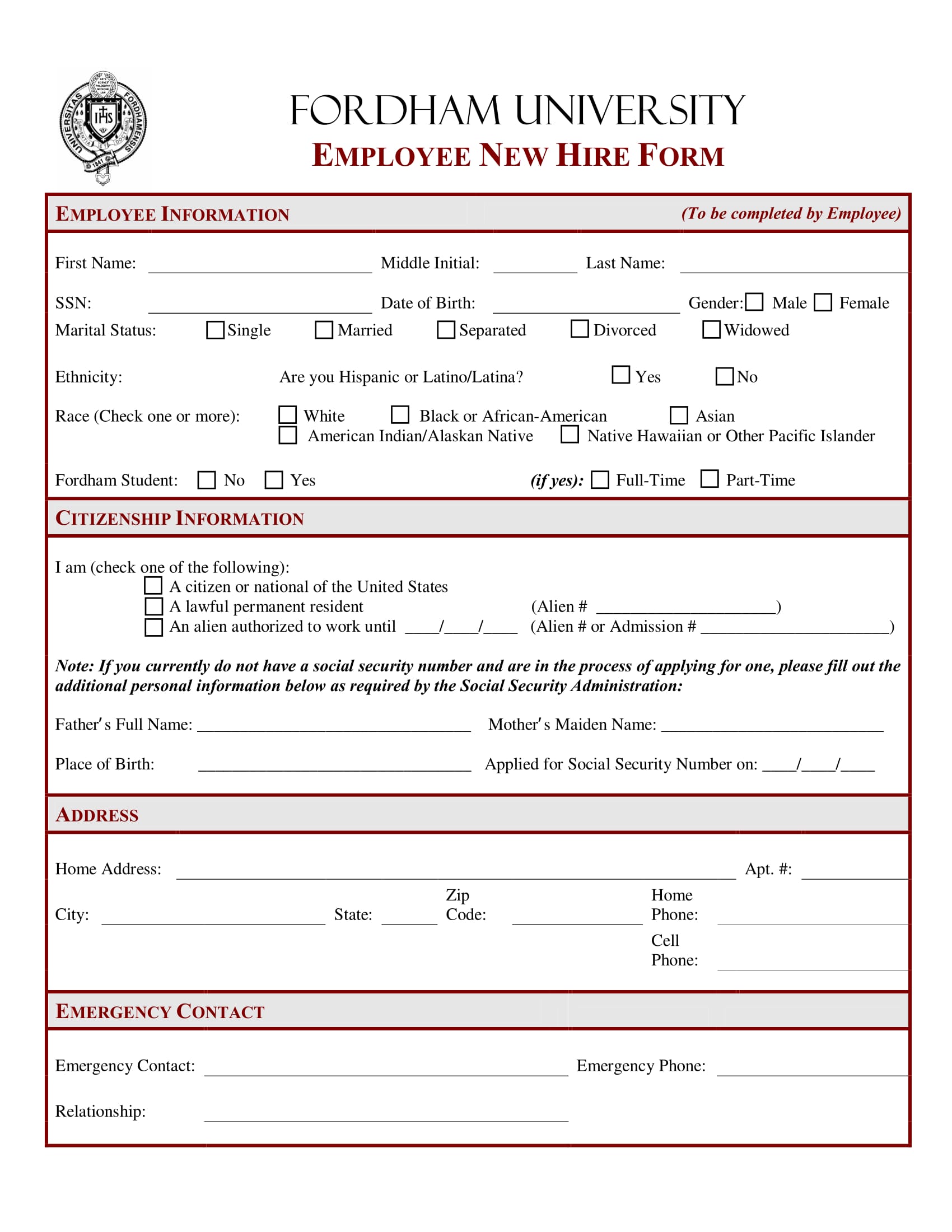

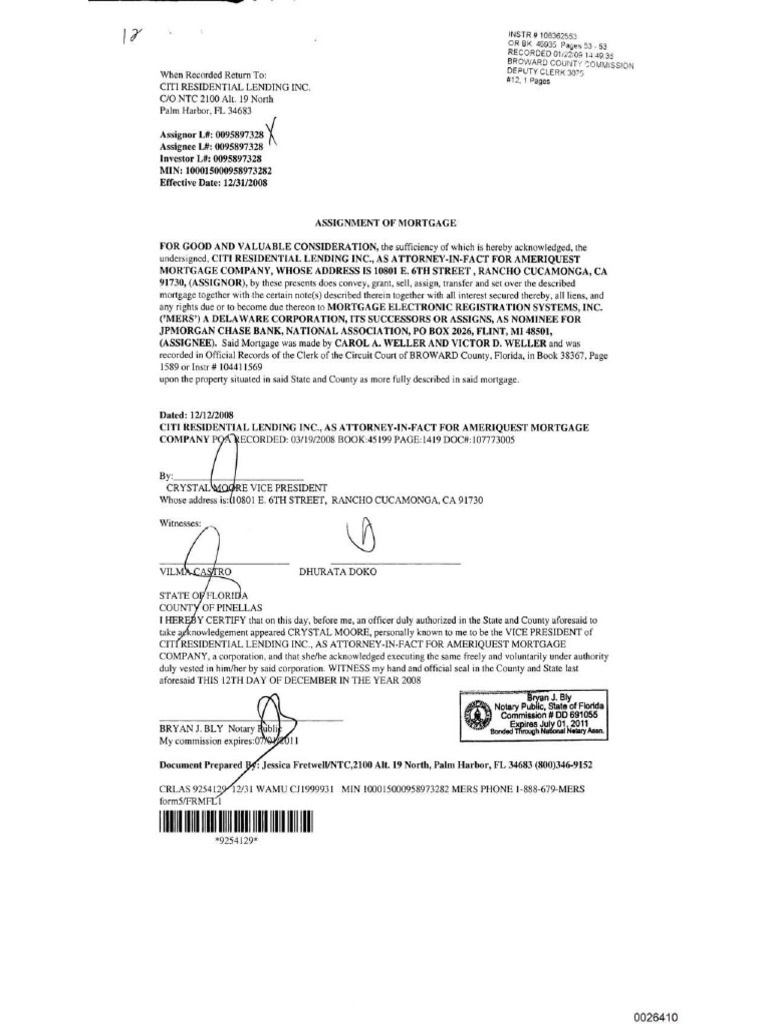

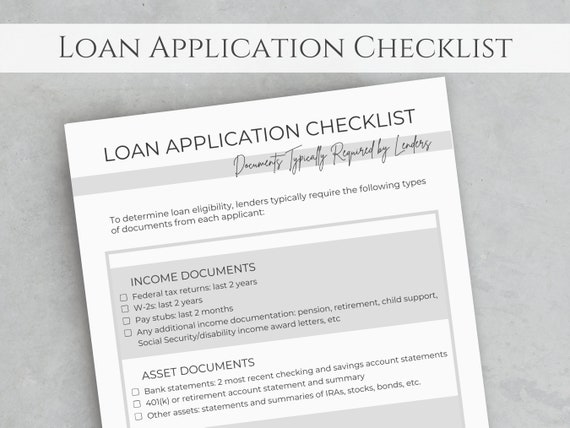

To successfully navigate the mortgage application process, it’s vital to understand the key documents required by lenders. These typically include: - Identification Documents: A valid government-issued ID, such as a driver’s license or passport, is necessary to verify your identity. - Income Verification: Pay stubs, W-2 forms, and tax returns are required to assess your income stability and ability to repay the loan. - Employment Verification: A letter from your employer confirming your employment status and income can be requested. - Asset Documentation: Bank statements, investment accounts, and retirement accounts are necessary to evaluate your financial assets and down payment capabilities. - Credit Reports: Lenders will obtain your credit reports to review your credit history and score, which significantly influences your loan eligibility and interest rate. - Property Information: Details about the property you’re purchasing, including its value and any outstanding liens, are crucial for the loan application.

Tips for Managing Mortgage Paperwork

Managing the mortgage paperwork efficiently can make a significant difference in the application process. Here are some tips to consider: - Stay Organized: Keep all your documents in one place, easily accessible, and ensure they are up-to-date. - Understand What’s Required: Familiarize yourself with the specific documents your lender needs to avoid unnecessary back-and-forth. - Act Promptly: Respond quickly to lender requests for additional information to keep the process moving. - Review Carefully: Before submitting your application, review all documents for accuracy and completeness.

Common Challenges and Solutions

Despite thorough preparation, common challenges can arise during the mortgage application process. For instance, discrepancies in credit reports or issues with income verification can cause delays. To address these challenges: - Address Credit Issues: If you find errors in your credit report, dispute them promptly with the credit bureau. - Gather Additional Documentation: Be prepared to provide supplementary documents to clarify any inconsistencies in your application. - Communicate with Your Lender: Keep the lines of communication open with your lender to understand their requirements and the status of your application.

📝 Note: Maintaining open communication with your lender and being proactive in resolving any issues that arise can significantly reduce the stress associated with the mortgage application process.

Conclusion and Final Thoughts

In conclusion, navigating the world of mortgage paperwork requires careful preparation, attention to detail, and a thorough understanding of the application process. By being aware of the key mortgage paperwork requirements and following the tips outlined above, you can ensure a smoother journey to homeownership. Remember, each situation is unique, and what works for one individual may not work for another. Therefore, it’s crucial to stay flexible and adapt to any challenges that may arise during your mortgage application process.

What is the first step in the mortgage application process?

+

The first step typically involves pre-approval, where the lender reviews your creditworthiness and provides a preliminary approval for a specific loan amount.

What documents are usually required for a mortgage application?

+

Commonly required documents include identification, income verification (pay stubs, W-2 forms, tax returns), employment verification, asset documentation (bank statements, investment accounts), and credit reports.

How can I ensure a smooth mortgage application process?

+

Stay organized, understand what documents are required, act promptly on requests for additional information, and review your application carefully before submission. Open communication with your lender is also key to resolving any issues that may arise.