Paperwork

VA Home Loan Paperwork Requirements

Introduction to VA Home Loan Paperwork Requirements

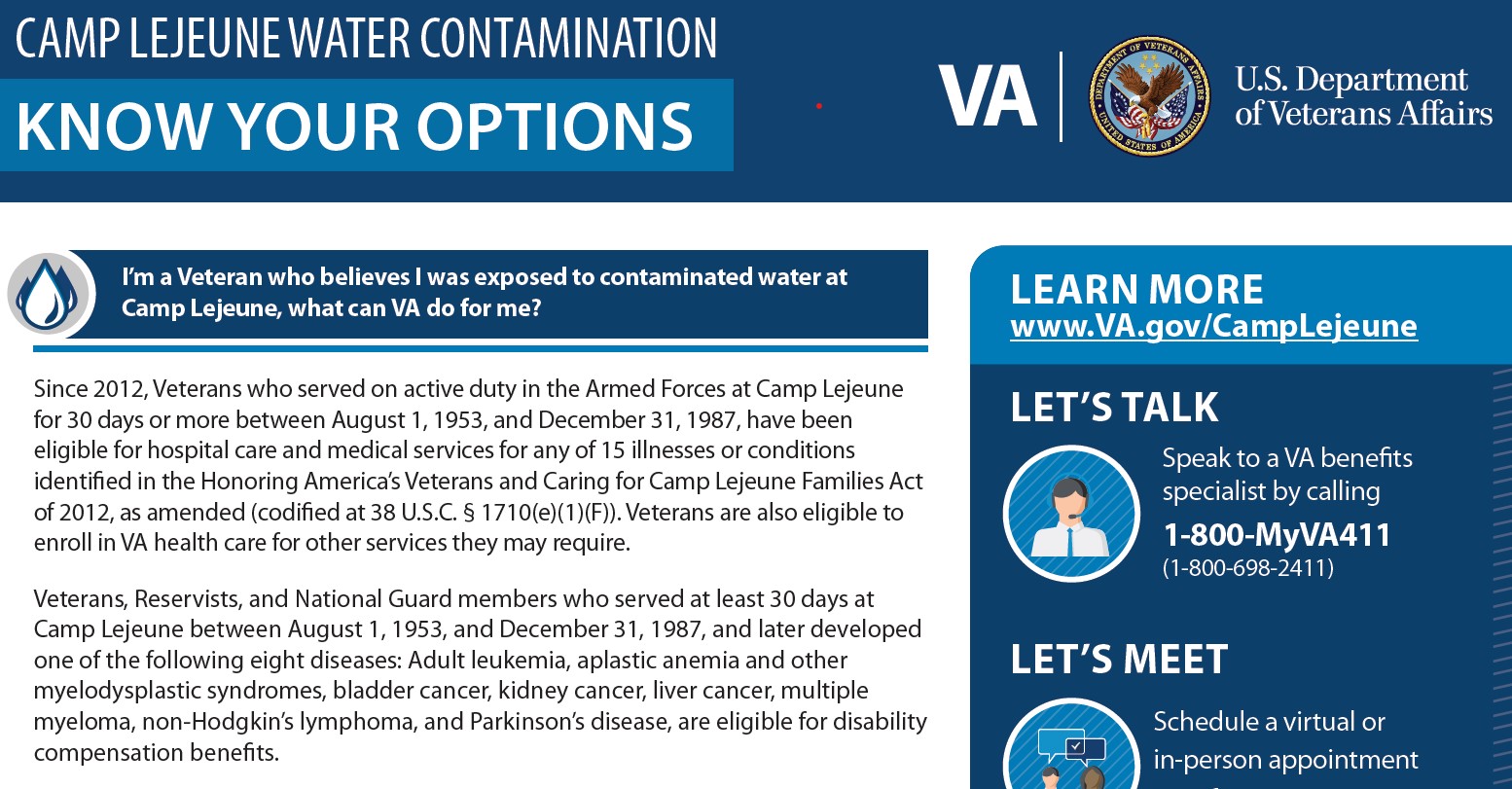

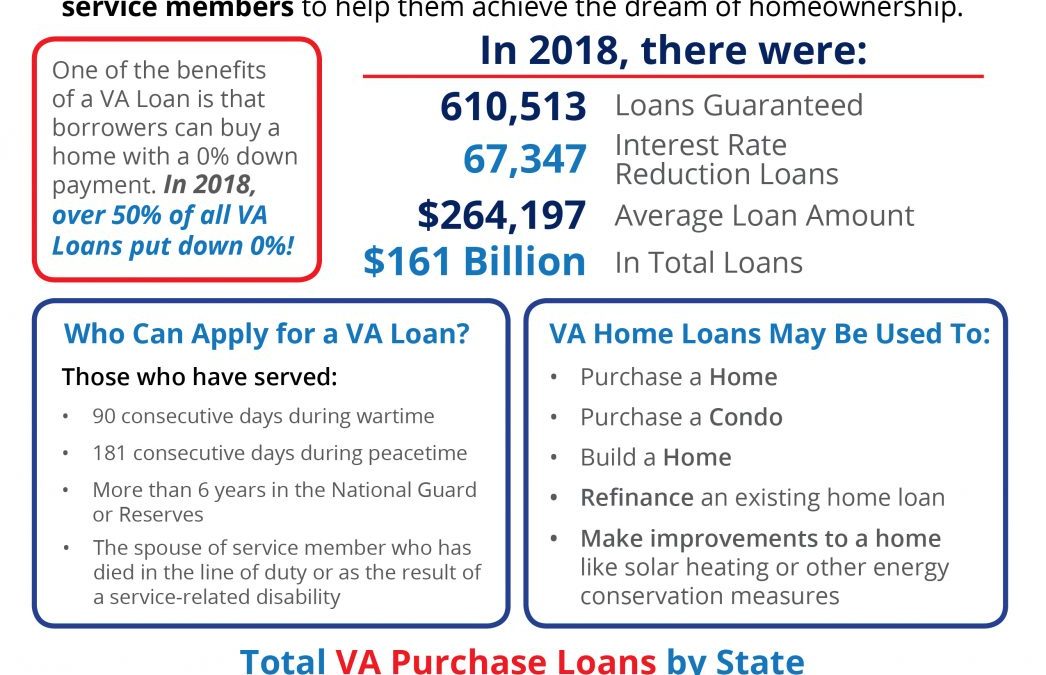

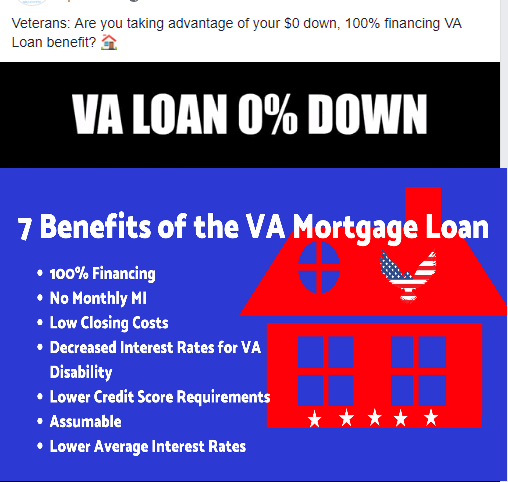

The VA home loan program is a valuable benefit for eligible veterans, active-duty personnel, and surviving spouses. However, navigating the paperwork requirements can be overwhelming. In this post, we will break down the necessary documents and steps to help you understand the VA home loan paperwork requirements.

Eligibility Requirements

To be eligible for a VA home loan, you must meet one of the following requirements: * Be an active-duty military personnel * Be a veteran * Be a member of the National Guard or Reserve * Be a surviving spouse of a veteran who died in service or as a result of a service-connected disability You will need to obtain a Certificate of Eligibility (COE) to prove your eligibility for a VA home loan.

Required Documents

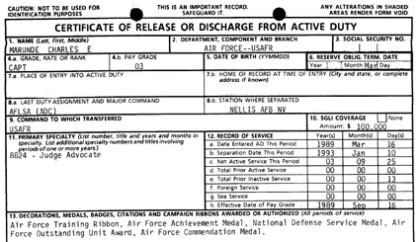

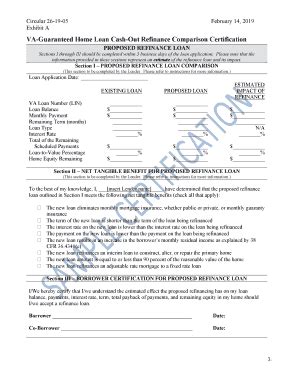

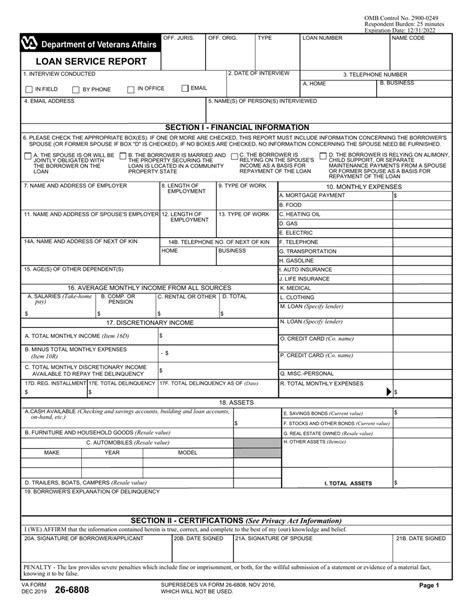

The following documents are typically required for a VA home loan: * Certificate of Eligibility (COE): This document confirms your eligibility for a VA home loan. * DD Form 214: This document is your discharge or separation papers from active duty. * VA Form 26-1880: This document is the request for a COE. * Identification: You will need to provide a valid government-issued ID, such as a driver’s license or passport. * Income and credit information: You will need to provide proof of income and creditworthiness, such as pay stubs, W-2 forms, and credit reports. * Appraisal report: A VA-approved appraiser will assess the value of the property to ensure it meets VA requirements.

VA Home Loan Application Process

The VA home loan application process typically involves the following steps: * Pre-approval: You will need to get pre-approved for a VA home loan by providing financial information to a lender. * Home selection: You will need to find a home that meets VA requirements and is eligible for a VA home loan. * Appraisal: A VA-approved appraiser will assess the value of the property. * Loan processing: The lender will process your loan application and order a credit report. * Loan approval: The lender will approve your loan application and issue a commitment letter. * Closing: You will sign the final loan documents and complete the purchase of the home.

📝 Note: The VA home loan application process may vary depending on the lender and the specific circumstances of the borrower.

VA Home Loan Paperwork Requirements for Self-Employed Borrowers

Self-employed borrowers may need to provide additional documentation, such as: * Tax returns: You will need to provide personal and business tax returns for the past two years. * Financial statements: You will need to provide a year-to-date profit and loss statement and a balance sheet. * Business license: You will need to provide a valid business license.

VA Home Loan Paperwork Requirements for Surviving Spouses

Surviving spouses may need to provide additional documentation, such as: * Death certificate: You will need to provide a copy of the veteran’s death certificate. * Marriage certificate: You will need to provide a copy of your marriage certificate. * DD Form 214: You will need to provide a copy of the veteran’s discharge or separation papers.

Conclusion

In summary, the VA home loan paperwork requirements can be complex, but understanding the necessary documents and steps can help you navigate the process. It’s essential to work with a knowledgeable lender and to carefully review all documents to ensure a smooth and successful transaction. By following these guidelines and providing the required documents, you can take advantage of the benefits of a VA home loan and achieve your dream of homeownership.

What is the minimum credit score required for a VA home loan?

+

While the VA does not have a minimum credit score requirement, lenders typically require a credit score of 620 or higher.

Can I use a VA home loan to purchase a condominium?

+

Yes, you can use a VA home loan to purchase a condominium, but the condominium complex must be approved by the VA.

How long does the VA home loan application process typically take?

+

The VA home loan application process typically takes 30-60 days, but can vary depending on the lender and the specific circumstances of the borrower.