Paperwork

Mortgage Preapproval Paperwork Requirements

Introduction to Mortgage Preapproval

When considering purchasing a home, one of the first steps potential buyers should take is to get preapproved for a mortgage. Mortgage preapproval is a process where a lender reviews a buyer’s financial situation and provides a preliminary approval for a mortgage, stating the amount they are willing to lend. This step is crucial as it not only gives buyers an idea of how much they can afford but also makes their offer more attractive to sellers. To initiate this process, buyers must gather and submit various documents to their lender. Understanding what these paperwork requirements are can help streamline the preapproval process.

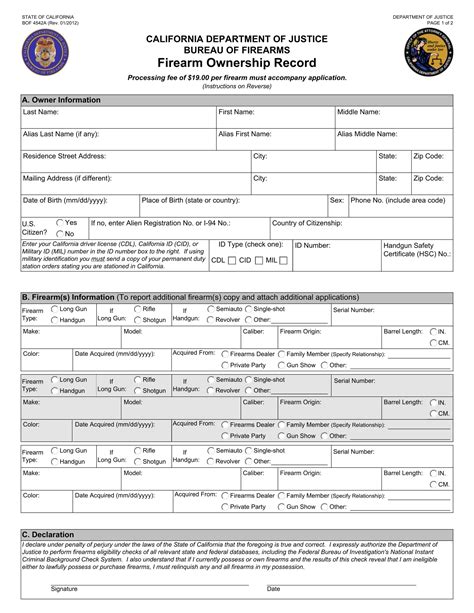

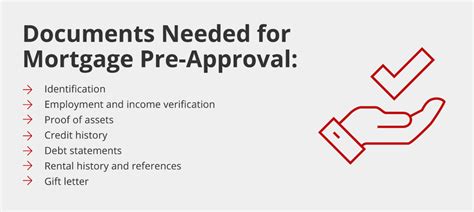

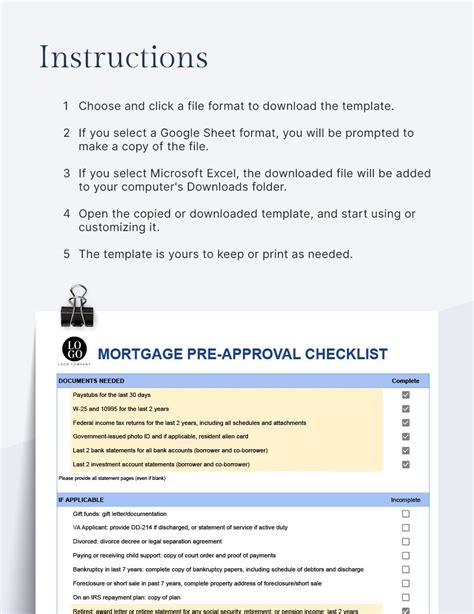

Required Documents for Mortgage Preapproval

The documents needed for mortgage preapproval can vary slightly depending on the lender and the buyer’s financial situation. However, there are several key documents that are commonly required. These include: - Identification Documents: A valid government-issued ID, such as a driver’s license or passport, is necessary to verify the buyer’s identity. - Income Documents: Buyers will need to provide proof of income, which can include pay stubs, W-2 forms, and potentially tax returns. For self-employed individuals, additional documentation like business tax returns and financial statements may be required. - Employment Verification: Lenders may contact the buyer’s employer to verify their employment status and income. - Bank Statements and Assets: Buyers need to show they have sufficient funds for the down payment and closing costs. This involves providing bank statements and other documents that detail their assets, such as investment accounts. - Credit Reports: While not typically submitted by the buyer, lenders will pull the buyer’s credit report to assess their creditworthiness. A good credit score can significantly improve the chances of preapproval and may result in better interest rates. - Debt Information: Documentation related to any outstanding debts, such as car loans, student loans, and credit card debt, is necessary to calculate the buyer’s debt-to-income ratio.

Understanding the Preapproval Process

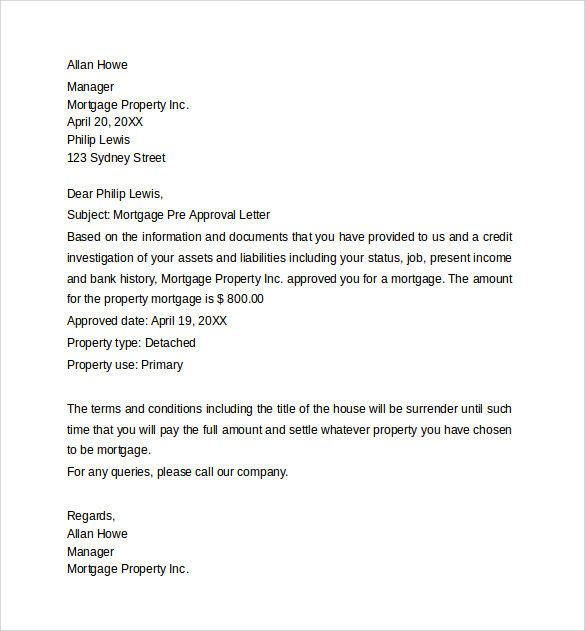

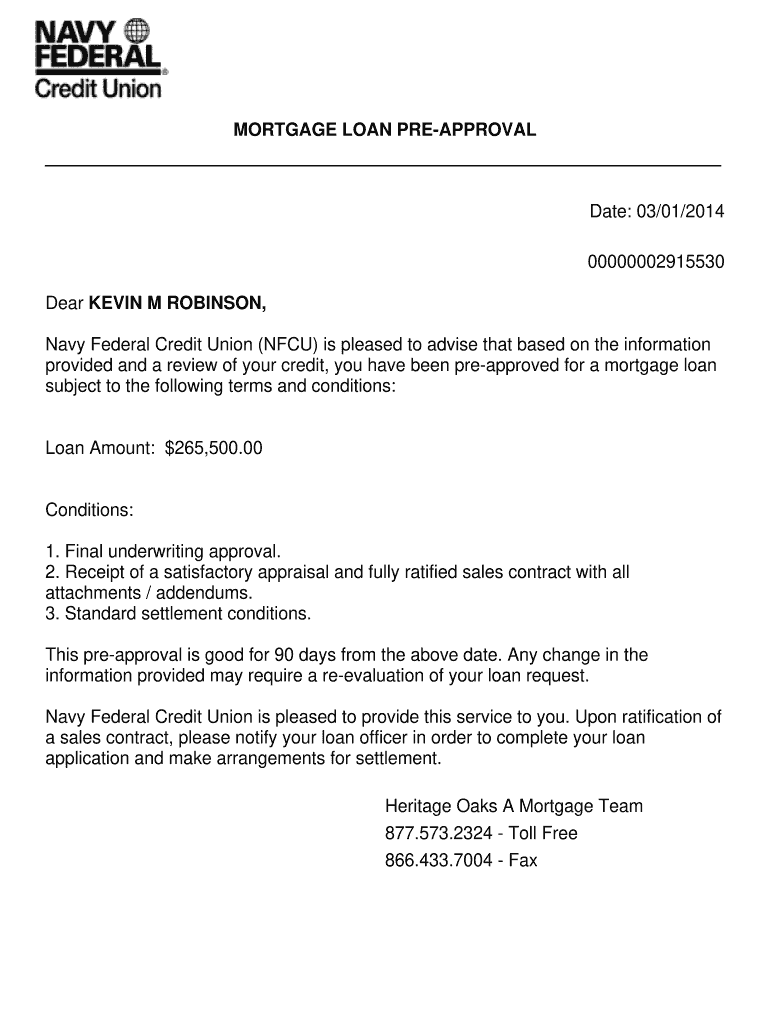

The preapproval process involves several steps: 1. Application: The buyer submits an application to the lender, providing basic financial information. 2. Review of Credit: The lender reviews the buyer’s credit report. 3. Verification of Income and Assets: The lender verifies the buyer’s income and assets through the documents provided. 4. Preapproval Letter: If approved, the lender issues a preapproval letter stating the approved loan amount and any conditions.

Benefits of Mortgage Preapproval

Mortgage preapproval offers several benefits to home buyers: - Clarifies Budget: It gives buyers a clear understanding of how much they can afford. - Strengthens Offer: Sellers are more likely to consider an offer from a preapproved buyer, as it indicates a higher likelihood of the sale going through. - Speeds Up Process: Having preapproval can expedite the final mortgage approval process once a home is chosen.

Challenges and Considerations

While preapproval is a valuable step in the home-buying process, there are challenges and considerations: - Credit Score Impact: Multiple credit inquiries can negatively affect credit scores. - Rate Locks: Preapproval typically doesn’t lock in an interest rate, which can fluctuate before the final approval. - Preapproval Expiration: Preapproval letters usually have an expiration date, after which the buyer may need to reapply.

📝 Note: It's essential for buyers to understand the terms of their preapproval and to ask questions if they are unsure about any part of the process.

Conclusion and Next Steps

In summary, getting preapproved for a mortgage is a critical step for potential home buyers. It involves gathering specific financial documents and undergoing a review process by a lender. Understanding the requirements and benefits of preapproval can make the home-buying process smoother and more successful. Buyers should carefully review their preapproval letter, consider their financial situation, and then start looking for homes within their approved budget. With preapproval in hand, buyers are better positioned to find and secure their dream home.

What is the typical duration of a mortgage preapproval?

+

Mortgage preapprovals are typically valid for 30 to 60 days, though this can vary by lender.

Can I get preapproved for a mortgage online?

+

Yes, many lenders offer online preapproval processes. Buyers can fill out applications and upload required documents through the lender’s website or portal.

Does preapproval guarantee a mortgage?

+

No, preapproval does not guarantee a mortgage. It is a preliminary approval based on initial financial review. The lender will conduct a more thorough review once a home is chosen and the buyer applies for the mortgage.