Paperwork

Gifting Money Paperwork Requirements

Introduction to Gifting Money

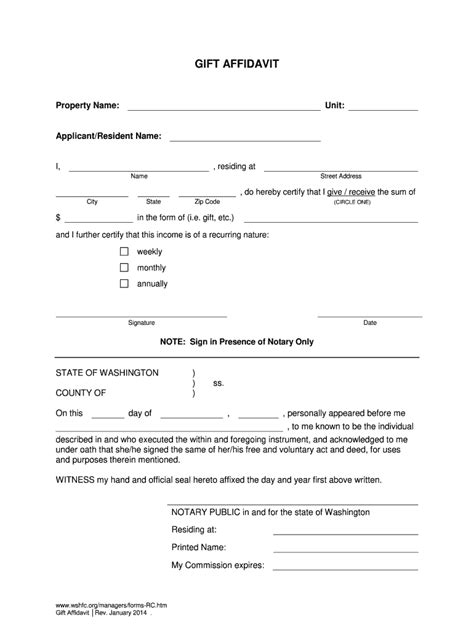

Gifting money to loved ones can be a thoughtful and generous act, but it’s essential to understand the paperwork requirements involved. Whether you’re giving a large sum to a family member or a small amount to a friend, there are certain rules and regulations you need to follow. In this article, we’ll explore the necessary paperwork for gifting money, including tax implications, gift tax returns, and other essential documents.

Understanding Gift Tax

The gift tax is a federal tax imposed on individuals who give money or assets to others. The tax is typically paid by the donor, not the recipient. The good news is that there are exemptions and exclusions that can help reduce or even eliminate the gift tax liability. For example, in the United States, you can give up to $16,000 per year to any individual without incurring gift tax. This amount is subject to change, so it’s crucial to check the current limits.

Gift Tax Returns

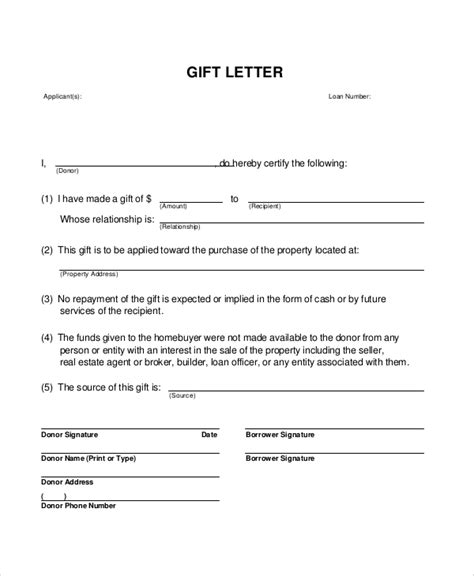

If you’re giving a large sum of money, you may need to file a gift tax return (Form 709) with the IRS. This form is used to report gifts that exceed the annual exclusion amount. Even if you don’t owe gift tax, you may still need to file a return to report the gift and claim any available exemptions. It’s essential to consult with a tax professional to determine if you need to file a gift tax return and to ensure you’re taking advantage of all available exemptions.

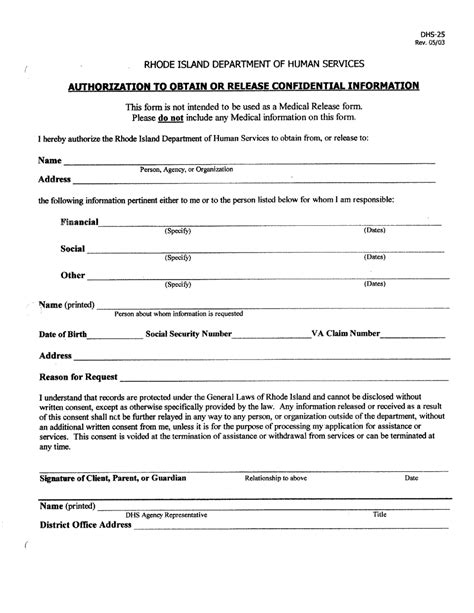

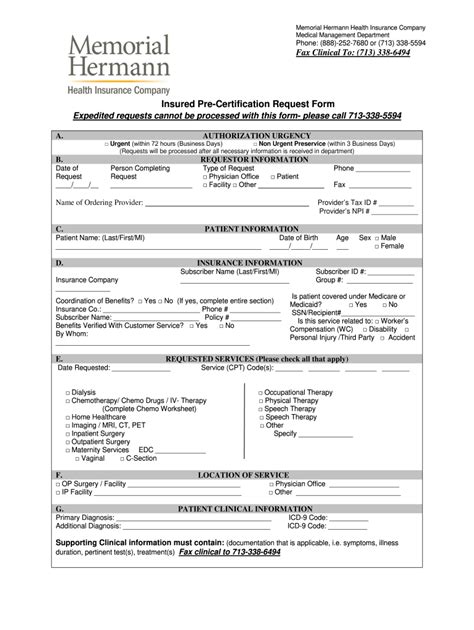

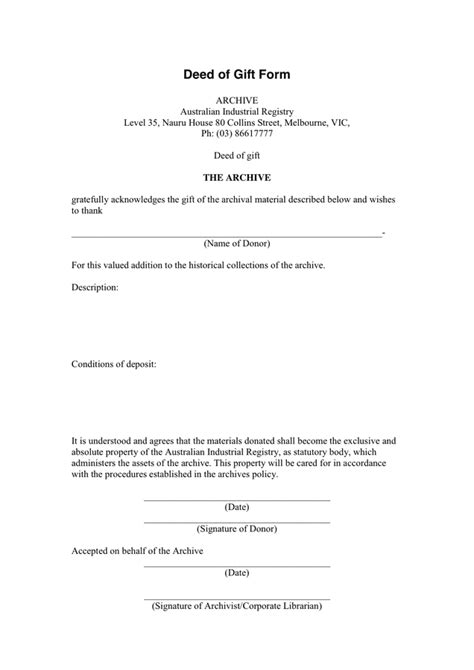

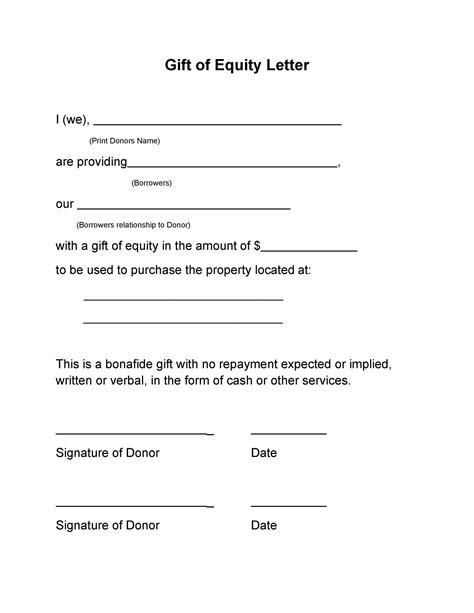

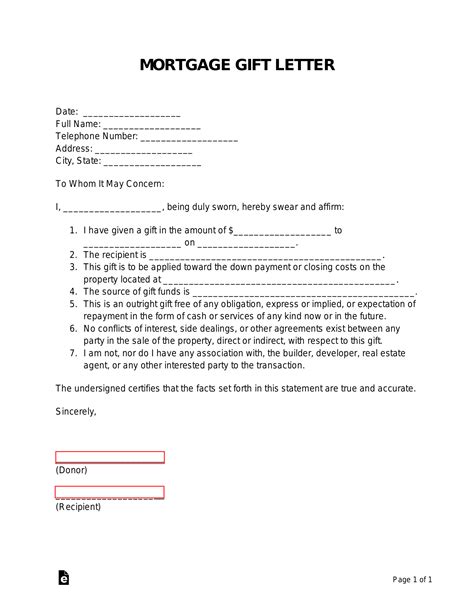

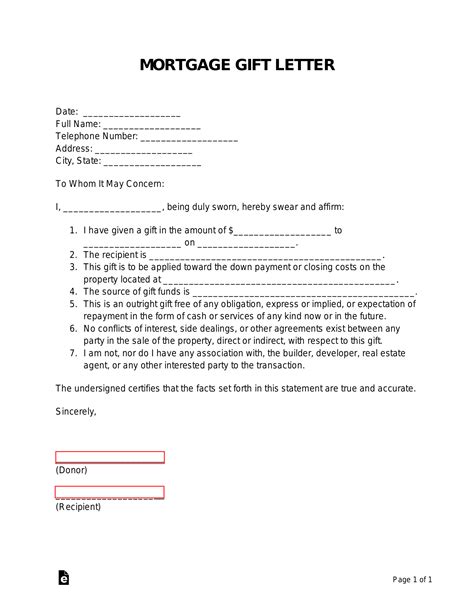

Other Paperwork Requirements

In addition to gift tax returns, there may be other paperwork requirements depending on the type of gift and the recipient. For example: * If you’re giving money to a minor, you may need to establish a custodial account or trust to manage the funds until the child reaches adulthood. * If you’re giving money to a non-US citizen, you may need to comply with foreign gift tax laws and report the gift to the IRS. * If you’re giving money to a charity, you may need to obtain a receipt or acknowledgement from the organization to claim a charitable deduction.

📝 Note: It's essential to keep accurate records of all gifts, including receipts, bank statements, and any other relevant documentation.

Types of Gifts and Paperwork Requirements

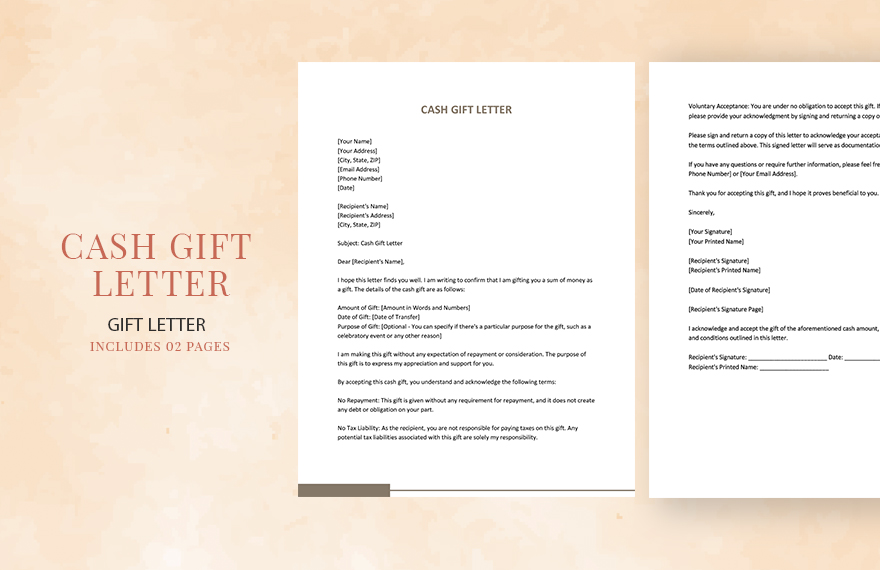

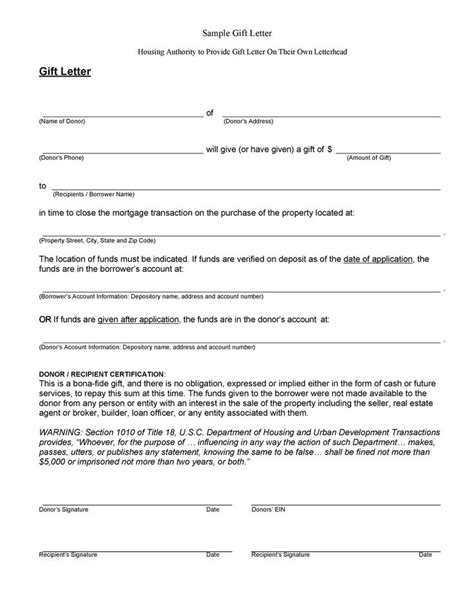

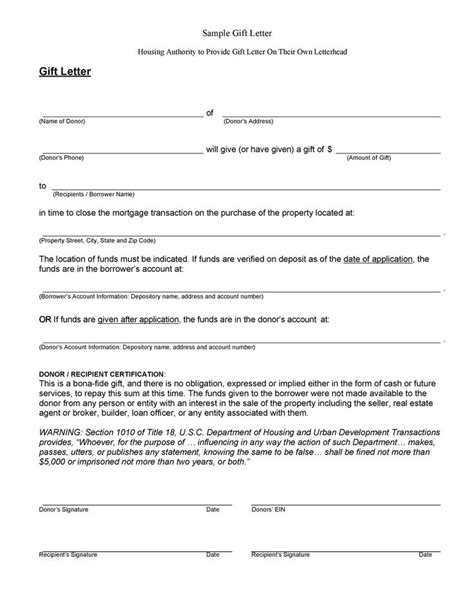

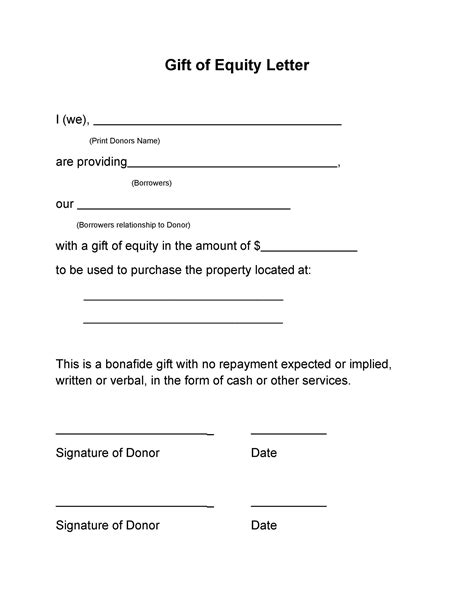

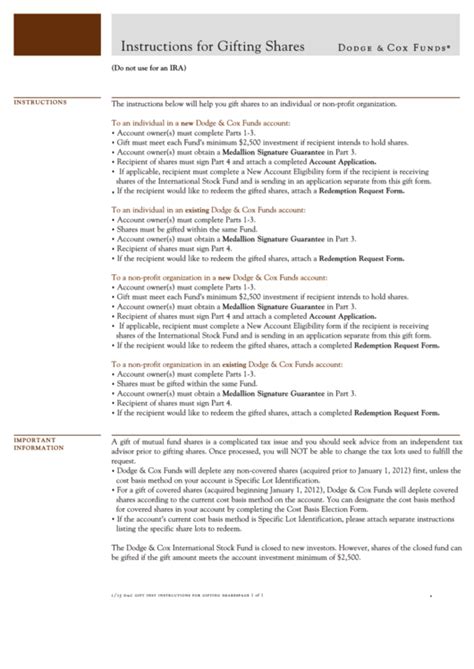

There are various types of gifts, each with its own set of paperwork requirements. Here are a few examples: * Cash gifts: These are the simplest type of gift, but you may still need to report them on a gift tax return if they exceed the annual exclusion amount. * Stock gifts: If you’re giving stocks or other securities, you’ll need to obtain a stock transfer form and comply with any applicable securities laws. * Real estate gifts: If you’re giving real estate, you’ll need to obtain a deed and comply with any applicable real estate laws.

| Type of Gift | Paperwork Requirements |

|---|---|

| Cash gifts | Gift tax return (Form 709), receipts, bank statements |

| Stock gifts | Stock transfer form, securities laws compliance |

| Real estate gifts | Deed, real estate laws compliance |

Conclusion and Final Thoughts

Gifting money can be a complex process, but understanding the paperwork requirements can help ensure a smooth and successful transfer. By following the guidelines outlined in this article, you can avoid potential pitfalls and make the most of your generous gesture. Remember to consult with a tax professional or attorney to ensure you’re complying with all applicable laws and regulations. With the right guidance, you can enjoy the benefits of gifting money while minimizing the hassle and stress associated with paperwork.

What is the annual exclusion amount for gift tax?

+

The annual exclusion amount for gift tax is $16,000 per year, per recipient. This amount is subject to change, so it’s essential to check the current limits.

Do I need to file a gift tax return if I give money to a charity?

+

No, you don’t need to file a gift tax return if you give money to a charity. However, you may need to obtain a receipt or acknowledgement from the organization to claim a charitable deduction.

What is a custodial account, and when is it required?

+

A custodial account is a type of account used to manage funds for a minor. It’s required when you give money to a minor, and the funds are managed by an adult until the child reaches adulthood.