Paperwork

Hiring Paperwork Needed

Introduction to Hiring Paperwork

When it comes to hiring new employees, there are numerous steps that employers must take to ensure a smooth and compliant process. One of the most critical aspects of hiring is the paperwork involved. Hiring paperwork is essential for verifying the identity and eligibility of new hires, as well as for complying with various laws and regulations. In this article, we will delve into the world of hiring paperwork, exploring the different types of documents required, their importance, and the consequences of non-compliance.

Types of Hiring Paperwork

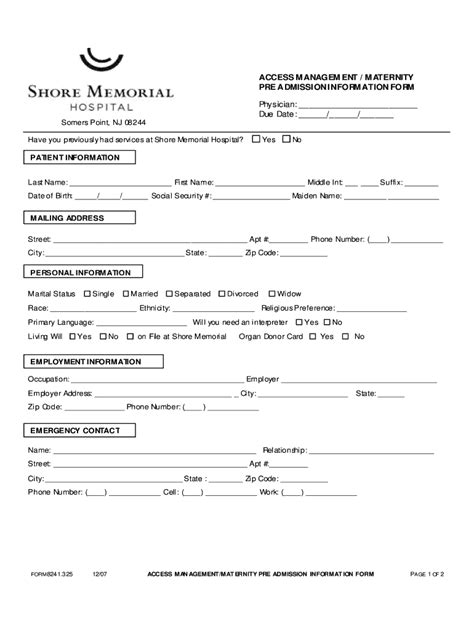

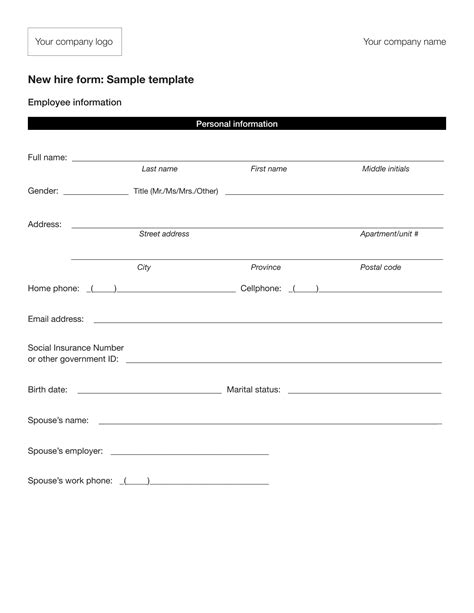

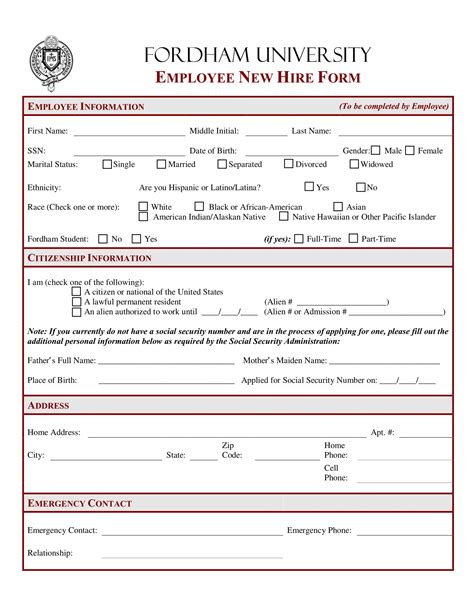

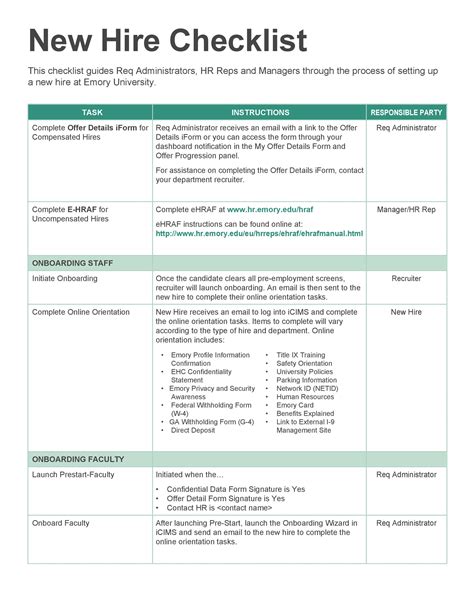

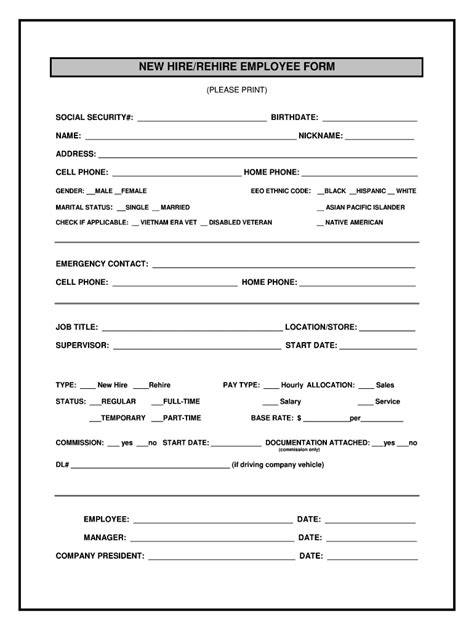

There are several types of hiring paperwork that employers must complete when hiring new employees. Some of the most common include: * W-4 forms: Used to determine the amount of federal income tax to withhold from an employee’s wages. * I-9 forms: Used to verify the identity and employment eligibility of new hires. * State tax forms: Used to determine the amount of state income tax to withhold from an employee’s wages. * Benefits enrollment forms: Used to enroll new hires in company-sponsored benefits, such as health insurance and 401(k) plans. * Employee contracts: Used to outline the terms and conditions of employment, including job duties, salary, and benefits.

Importance of Hiring Paperwork

Hiring paperwork is crucial for several reasons. Firstly, it helps to verify the identity and eligibility of new hires, reducing the risk of hiring unauthorized workers. Secondly, it ensures compliance with laws and regulations, such as tax laws and labor laws. Finally, it provides a paper trail in case of disputes or audits, helping to protect employers from potential liability.

Consequences of Non-Compliance

Failure to complete hiring paperwork correctly can result in severe consequences, including: * Fines and penalties: For non-compliance with laws and regulations, such as tax laws and labor laws. * Lawsuits and settlements: For disputes or claims arising from incomplete or inaccurate paperwork. * Reputation damage: For failing to comply with laws and regulations, potentially damaging an employer’s reputation and brand.

📝 Note: Employers must ensure that all hiring paperwork is completed accurately and on time to avoid these consequences.

Best Practices for Managing Hiring Paperwork

To ensure a smooth and compliant hiring process, employers should follow these best practices: * Use electronic paperwork systems: To streamline the paperwork process and reduce errors. * Train HR staff: On the importance of hiring paperwork and how to complete it accurately. * Review and update paperwork regularly: To ensure compliance with changing laws and regulations. * Store paperwork securely: To protect sensitive employee information and maintain confidentiality.

| Type of Paperwork | Purpose | Consequences of Non-Compliance |

|---|---|---|

| W-4 forms | To determine federal income tax withholding | Fines and penalties for non-compliance |

| I-9 forms | To verify identity and employment eligibility | Fines and penalties for non-compliance |

| State tax forms | To determine state income tax withholding | Fines and penalties for non-compliance |

In the end, hiring paperwork is a critical aspect of the hiring process, and employers must ensure that it is completed accurately and on time. By following best practices and using electronic paperwork systems, employers can reduce errors, ensure compliance, and protect themselves from potential liability. The key to a successful hiring process is to prioritize paperwork, ensuring that all necessary documents are completed and stored securely. This approach will help employers to build a strong foundation for their workforce, while also maintaining compliance with laws and regulations.