Business Checking Account Paperwork Needed

Introduction to Business Checking Accounts

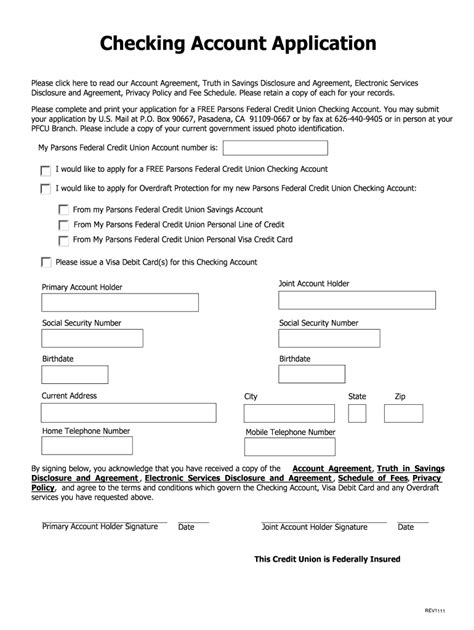

When it comes to managing the finances of a business, one of the most essential tools is a business checking account. This type of account allows businesses to keep their personal and business finances separate, making it easier to track expenses, manage cash flow, and prepare for tax season. However, before you can open a business checking account, you’ll need to gather the necessary paperwork. In this article, we’ll explore the documents you’ll need to get started.

Types of Businesses and Required Paperwork

The type of paperwork needed to open a business checking account varies depending on the structure of your business. Here are some common types of businesses and the documents they typically require: * Sole Proprietorship: As a sole proprietor, you’ll need to provide your business name, address, and social security number or tax identification number. * Partnership: Partnerships require a partnership agreement, which outlines the ownership and management structure of the business. You’ll also need to provide the names, addresses, and social security numbers or tax identification numbers of all partners. * Corporation: Corporations need to provide articles of incorporation, which include the business name, address, and purpose. You’ll also need to provide the names, addresses, and social security numbers or tax identification numbers of all corporate officers. * Limited Liability Company (LLC): LLCs require articles of organization, which include the business name, address, and purpose. You’ll also need to provide the names, addresses, and social security numbers or tax identification numbers of all members.

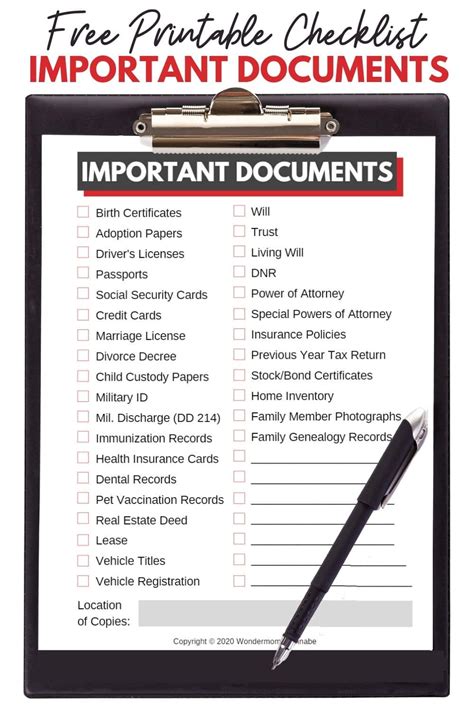

Additional Required Documents

In addition to the documents specific to your business type, you may also need to provide: * Business license: A copy of your business license, which is typically issued by the state or local government. * Employer Identification Number (EIN): An EIN is a unique identifier assigned to your business by the IRS. You can apply for an EIN online or by phone. * Resolving power: A document that authorizes certain individuals to act on behalf of the business, such as opening a bank account. * Identification: A valid form of identification, such as a driver’s license or passport, for all account signers.

Table of Required Documents

Here’s a summary of the documents you may need to open a business checking account:

| Business Type | Required Documents |

|---|---|

| Sole Proprietorship | Business name, address, social security number or tax identification number |

| Partnership | Partnership agreement, names, addresses, social security numbers or tax identification numbers of all partners |

| Corporation | Articles of incorporation, names, addresses, social security numbers or tax identification numbers of all corporate officers |

| Limited Liability Company (LLC) | Articles of organization, names, addresses, social security numbers or tax identification numbers of all members |

📝 Note: The specific documents required may vary depending on the bank and the state in which your business is located. It's always a good idea to check with the bank before applying for a business checking account.

Conclusion and Next Steps

In conclusion, opening a business checking account requires gathering various documents, including those specific to your business type and additional required documents. By understanding what paperwork is needed, you can ensure a smooth and efficient process. Once you’ve gathered all the necessary documents, you can apply for a business checking account and start managing your business finances with ease. Remember to always keep your business and personal finances separate to avoid any potential complications.

What is the purpose of a business checking account?

+

A business checking account allows businesses to keep their personal and business finances separate, making it easier to track expenses, manage cash flow, and prepare for tax season.

What documents are required to open a business checking account for a sole proprietorship?

+

To open a business checking account for a sole proprietorship, you’ll need to provide your business name, address, and social security number or tax identification number.

Can I use a personal checking account for my business?

+

No, it’s not recommended to use a personal checking account for your business. This can lead to complications when it comes to tracking expenses and managing cash flow, and may also affect your personal credit score.